TIDMBA.

RNS Number : 3757K

BAE SYSTEMS PLC

05 May 2022

5 May 2022

BAE Systems plc - Annual General Meeting and Market Update

BAE Systems plc will hold its Annual General Meeting today at

11.00 a.m. in Farnborough, Hampshire, UK. At the meeting, Chairman,

Sir Roger Carr, and Chief Executive, Charles Woodburn, will comment

on the performance of the Group in 2021, as detailed in the results

announcement published on 24 February 2022.

The results of voting at the Annual General Meeting will be

announced later today.

Additionally, BAE Systems plc provides the following update on

trading year to date.

Charles Woodburn, BAE Systems Chief Executive , said:

"Trading in the first quarter has been in line with expectations

with strong order intake and good operational performance being

maintained.

"Looking forward, our diverse portfolio, together with our focus

on programme execution, cash generation and efficiencies, are

helping us to navigate the challenging operating environment in the

near term, while positioning us well for sustained top line and

margin growth in the coming years, alongside accelerating our ESG

agenda. Additionally, we see opportunities to further enhance the

medium- term outlook as our customers address the elevated threat

environment."

Guidance

The Group's full year 2022 guidance across all metrics is

unchanged from that provided at the Preliminary announcement on 24

February 2022.

-- Sales +2-4% (2021: GBP21,310m)

-- Underlying EBIT +4-6% (2021: GBP2,205m)

-- Underlying EPS +4-6% (2021: 47.8p)

-- 2022 Free Cash Flow (FCF) >GBP1bn

-- Cumulative FCF 2022-2024 >GBP4bn

-- Guidance is provided on the basis of an exchange rate of $1.38:GBP1 for the year

Should the current dollar rate persist, this will be a tailwind

to earnings with sensitivity to EPS being around 1 pence for every

5 cent movement.

Operational update

Overall programme execution has been good across all sectors in

the year to date. There remain ongoing pressures on our supply

chains, delivery lead times and people resourcing across our

operations. Consistent with our guidance we continue to mitigate

the major financial impacts. In many cases, we benefit from

long-term programme positions and incumbencies with more stable

forward visibility for long-lead items allowing us to continue to

actively manage supplier lead times against demand

requirements.

Order flow

We continue to expect a strong year of order intake and order

flow to date has been positive especially on our long-term

programmes.

Orders received are predominantly long cycle in nature which

will support our growth expectations into the coming years.

Additionally, there is a pipeline of opportunities across all

sectors to enhance the growth outlook, as we look to support our

key customers and allies in addressing the heightened threat

environment.

Notable new and strategically important awards received this

year include:

Sector Contract

Electronic F-35 Lightning II EW systems

Systems

---------------------------------------------------------

Electronic M-Code Global Positioning System modules

Systems

---------------------------------------------------------

Electronic Airborne High Frequency Radio Modernisation programme

Systems

---------------------------------------------------------

Electronic Electric drive systems for new zero-emission capable

Systems hybrid transit buses in Philadelphia

---------------------------------------------------------

Platform & Amphibious Combat Vehicle programme Lot 2 full rate

Services production

---------------------------------------------------------

Platform & USS Essex and USS Mustin ship repair and maintenance

Services

---------------------------------------------------------

Platform & 7-year support, sustainment & readiness for Norwegian

Services CV90s

---------------------------------------------------------

Air 11-year contract for support to the UK's Royal Air Force

Hawk fleet

---------------------------------------------------------

Air MBDA order flow from Rafale exports

---------------------------------------------------------

Cyber and Intel US Navy Naval Air Warfare Center Webster Outlying Field

support

---------------------------------------------------------

Cyber and Intel Lifecycle management and sustainment of the US Navy's

C5ISR systems

---------------------------------------------------------

Defence spending outlook in our key markets

Our geographic diversity positions us strongly as many of the

countries in which we operate have announced or are making plans to

increase spending to counter the elevated and evolving threat

environment on multiple fronts.

In the US, the spending outlook is positive. The Fiscal Year

2022 Omnibus Appropriations bill was signed into law on 9 March.

This FY22 budget of $743bn maintains funding support for many of

our key programmes: combat vehicles; F-35 and other electronic

warfare programmes; and precision weapon systems. The President's

Fiscal Year 2023 Budget Request includes $773bn for the Department

of Defense and the business remains well aligned to the current US

National Defense Strategy readiness and modernisation priorities of

the US military services. We expect continued alignment with the

2022 National Defense Strategy release.

In the UK, the Defence Command Paper renewed commitments to our

major long-term programmes in complex warship, submarine and combat

aircraft design and build, allowing for long-term investment in

these key sovereign capabilities, as well as strong support for the

cyber domain. The opportunity pipeline is positive with domestic,

export and collaboration opportunities identified and we have the

capabilities to support our UK customer in its space ambitions.

In Europe, the significant step up in German defence expenditure

is important for long-term defence funding. We see other nations

increasing or likely to increase their defence budgets to address

the threat environment and for NATO countries to move to, and even

beyond, their 2% of GDP commitments. We remain well placed through

our positions on Eurofighter Typhoon, our shareholding in MBDA, our

BAE Systems Hägglunds and Bofors businesses based in Sweden,

through US Foreign Military Sales and we are pursuing a number of

significant opportunities in the region.

Our portfolio is well positioned to benefit from increased

defence spending in Asia Pacific through our Australia business,

which is already set to grow significantly due to our contracted

positions and through export opportunities from our UK, US and

Australian business to the region. The AUKUS announcement is

strategically significant, and a clear example of how nations are

looking to co-ordinate capabilities in multi domain operations to

address the threat environment. As the largest defence provider in

the UK and Australia and a top 10 prime contractor to the US DoD,

we are well positioned to support our government customers in these

nations as discussions progress.

In the Middle East, our longstanding relationships at government

and company levels, continued regional instability and the nature

of our long-term contracts, mean we expect defence and security to

remain a priority. The renewal of certain existing long-term

support contracts is tracking in line with expectations and we

continue to progress a number of opportunities with existing

customers.

Portfolio and sector re-alignment

As disclosed in the Annual Report and reflecting the changes in

operational reporting lines effective from the beginning of the

year, the BAE Systems Australia business will transition from being

reported in the Air segment to the Maritime segment. Additionally,

the Group has established a new Digital Intelligence business,

bringing together the non-US digital and data capabilities to

further strengthen how we deliver these services and capabilities

to our customers. Digital Intelligence will report within the Cyber

& Intelligence segment.

The re-presented 2021 sales performance to reflect these changes

is detailed below. There is no change to the guidance ranges

following this segmental representation.

Year ended 31 December As reported Reclassification Re-presented

2021 GBPm GBPm GBPm

Electronic Systems 4,491 - 4,491

------------ ----------------- -------------

Platforms & Services 3,395 - 3,395

------------ ----------------- -------------

Air 8,321 (872) 7,449

------------ ----------------- -------------

Maritime 3,416 753 4,169

------------ ----------------- -------------

Cyber & Intelligence 1,752 171 1,923

------------ ----------------- -------------

HQ/intra-group (65) (52) (117)

------------ ----------------- -------------

Group Sales 21,310 - 21,310

------------ ----------------- -------------

In March, we completed the acquisition of Bohemia Interactive

Simulations (BISim), a leading developer of advanced military

simulation and training software. BISim expands our modelling and

simulation capabilities to meet growing global demand for agile

military training that helps to protect military personnel and

reduce the environmental impacts of live training, while supporting

the carbon net zero ambitions of our customers and ourselves.

ESG

It is important to recognise the defence industry's contribution

to security and prosperity and that BAE Systems is a responsible,

government-backed, strictly regulated and ethically-led defence and

security company.

Global events have more than ever demonstrated the need for

strong defence and security in the face of aggression by nation

states. The defence industry and we at BAE Systems provide critical

capabilities and support to our governments and their allies to

fulfill their primary obligations to keep their citizens safe, as

well as providing important positive economic and societal

contributions from the provision of sustainable high-quality and

well-paid jobs.

Additionally, we continue to advance our capabilities in

sustainable technologies with a number of electric-hybrid contracts

won in the period. We are harnessing our expertise in energy

management systems and flight controls to support the development

of electric propulsion systems for future flight, with GE Aviation

selecting us to provide energy management solutions for NASA's

hybrid electric technology demonstrator programme.

The progress we are making on our sustainability agenda has been

reflected in an improvement in ratings from a number of providers,

and we have maintained our AA leader class rating with MSCI.

Board

As previously announced, Dame Carolyn Fairbairn and Ian Tyler

will be standing down from their roles as Non-Executive Directors

at today's Annual General Meeting (AGM). Nicole Piasecki will

succeed Ian Tyler as Chair of the Remuneration Committee with

effect from the close of the AGM.

Final dividend

The 2021 final dividend of 15.2 pence per share will be paid,

subject to shareholder approval, on 1 June 2022.

Investor engagement

We will host a capital markets event in October with a focus on

the Digital Intelligence business, technology advancements and an

update on our ESG agenda.

2022 Interim results

BAE Systems will announce its interim results for the half year

ending 30 June 2022 on 28 July 2022.

For further information please contact:

Investors Media

Martin Cooper, Kristina Anderson,

Investor Relations Director Director, Media Relations

Telephone: +44 (0)1252 383455 Telephone: +44 (0) 7540 628673

Email: investors@baesystems.com Email: Kristina.anderson@baesystems.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKQBQCBKDPPK

(END) Dow Jones Newswires

May 05, 2022 02:01 ET (06:01 GMT)

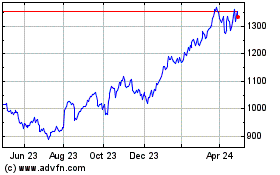

Bae Systems (LSE:BA.)

Historical Stock Chart

From Mar 2024 to Apr 2024

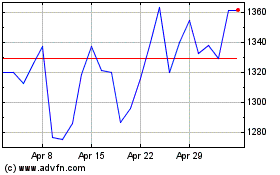

Bae Systems (LSE:BA.)

Historical Stock Chart

From Apr 2023 to Apr 2024