TIDMBBY

RNS Number : 6040Q

Balfour Beatty PLC

08 November 2012

News Release

8 November, 2012

BALFOUR BEATTY 2012 Q3 IMS

Balfour Beatty, the international infrastructure group,

announces its 2012 Q3 Interim Management Statement, covering the

period 30 June to 7 November 2012.

Trading

Our Professional Services, Support Services and Infrastructure

Investments businesses are demonstrating resilience and strength in

a challenging economic environment, performing well and in line

with our expectations.

In Construction Services, difficult trading conditions have

persisted in the period in our two major markets. US construction

markets remain depressed, and the performance of our UK

construction business is weaker than anticipated. Structural

problems in European Rail markets added to the challenges. We have

made good progress in implementing both phases of our cost

efficiency programme and that has been helpful in offsetting some

of the weakness.

As a result and based on the outturn for the third quarter,

profitability in 2012 will be slightly lower than expected at the

time of the half-year results although this will be somewhat offset

by a slightly lower effective tax rate. Furthermore, the conditions

that have led to a recent decline in the order book point to 2013

being a difficult year for Construction Services.

Operating performance

Order book

After a small decrease in the first half in the Construction

Services order book, we saw a more significant decline in the third

quarter. As a result, even though order intake in our other

businesses was stable, the Group order book closed at GBP14.4

billion at the end of September, down from GBP15.0 billion at the

end of June.

Professional Services

Professional Services has continued to perform well, benefitting

from its geographical diversity and the less cyclical nature of its

civil infrastructure work. The order book remained stable overall,

with small reductions in the UK and US offset by increases in the

rest of the world.

Revenue in the third quarter was in line with expectations, with

a decline in the UK being offset by modest growth in the US. We

made continued good progress in the rest of the world, particularly

in Qatar which is a new and growing market for our Professional

Services division. Last week our business in the North East of the

US was disrupted by the impact of Hurricane Sandy, although we do

not think it is likely to have a material impact on our financial

performance.

The division has maintained its focus on increasing utilisation

rates and combined with the successful completion of some large

projects in Asia Pacific, this is helping to improve profitability,

putting the division on track to achieve its medium-term margin

targets.

Construction Services

In the US construction market, the positive leading indicators

seen in the five months to March 2012 reversed, with the five

subsequent months showing negative indicators, pushing market

recovery further out than initially envisaged and keeping market

volumes at a depressed but stable level. In this environment, our

institutional building business has suffered from weak federal

demand and the general lack of larger complex projects where there

is greater opportunity to differentiate ourselves. In contrast, the

prospects for our civil infrastructure business remain positive

with some large design-build and PPP projects being tendered into

the market. Overall, our US construction business has performed in

line with our expectations, although the order book has

decreased.

In the UK, we are seeing further market deterioration. On the

one hand, the business is continuing to migrate towards smaller

contracts in a market with very few major projects. Approximately

half of our order book is now in our regional business, up from a

third a year ago. At the same time, the supply chain is suffering

which in turn, reduces our ability to negotiate terms that match

the worsening market conditions. The adverse impact of these recent

developments is expected to reduce profitability slightly this

year. Looking ahead, there is reduced visibility due to smaller

projects and shorter lead times, but in the absence of an immediate

improvement in these emerging market conditions, we expect further

decline in activity levels and pressure on margins into 2013.

We have continued to make progress in restructuring our

construction operations in both the UK and the US. The reduced

structural cost will, in part, offset the impact of volume and

margin pressure referred to above.

Our Rail construction business performed below expectations in

the third quarter. Activity levels in Italy and Spain have become

critically low. This, combined with the increasing commoditisation

of work in Germany and the UK, is expected to give rise to a

further adverse impact on profits of around GBP10 million in 2012.

We are currently undertaking a review of the operations across our

European rail business in the light of these structural

factors.

Cost efficiency update

Our cost efficiency programmes continued to make good progress.

Phase 1, which entails savings from indirect procurement and

combining transactional accounting and payroll in the UK in a

single Shared Service Centre in Newcastle, will reach its run-rate

savings of GBP30 million by the end of 2012.

Phase 2, the broader programme we announced in March 2012 with a

target of GBP50 million annual savings by 2015, is underway. The UK

Construction business has made significant progress in

restructuring its operations in the quarter. The new operating

structure, which will be in place by January 2013, combines six

operating companies into one, streamlining the number of locations

and creating a more efficient back office with 650 fewer employees.

These initiatives constitute the largest portion of the current

target savings. The new operating structure will also be more

flexible, agile and adaptable to change, should market conditions

require.

The US Construction business is in the process of reducing its

operating structure from five regions to three, with a significant

focus on leveraging resources across a broader geographic base.

Furthermore, Parsons Brinckerhoff has announced plans to move the

majority of its support functions from New York City to Lancaster,

Pennsylvania, which is expected to improve its cost effectiveness

from April 2013 onwards. The successful implementation of our

initiatives to date gives us confidence that we will achieve the

majority of the Phase 2 savings in 2013.

Support Services

Trading has been consistent with expectations in the period. The

order book was stable with an increase in the local authority

outsourcing contracts - including the North Tyneside business

services contract - offsetting the anticipated modest decline in

the Utilities (water and power) order book.

Revenue grew year on year in the third quarter; WorkPlace, our

facilities management business, and Utilities were particularly

good performers.

Profit performance has recovered from cost increases incurred in

the first half and the division is on track to meet our

expectations.

Infrastructure Investments

Performance has been resilient given the long-term and stable

characteristics of this business. In the period, we have been

working on bringing our preferred bidder positions in US military

housing to financial close. We are also diversifying the business

into new geographies such as Canada, the USA and Australia, and new

sectors such as energy-from-waste and biomass, while developing

investment models in addition to PFI and PPP.

A good example of diversification is the preferred bidder award

in August of University of Edinburgh's GBP110 million Holyrood

Postgraduate Student Accommodation and Outreach Centre project. The

50-year concession contract involves the design, build and

maintenance of student accommodation facilities for 1,160

postgraduate students, as well as an outreach centre which will

become the focal point for the University's community-based

teaching activities and continuous professional development

courses.

Financial position

Average net debt for the nine months to the end of September was

GBP15m. This reduction in cash is a reflection of further working

capital outflow in UK Construction and the delay in the anticipated

improvement in US Construction orders. While we still expect some

seasonal recovery in working capital by the year-end, a significant

change in the underlying position is unlikely.

Outlook

The construction market backdrop has become more difficult with

the continued absence of the larger complex projects coming to

market and a reduction in confidence in the US building market

following some encouraging signs earlier in the year. The impact of

these issues is evident in current performance and the reduction in

our order book which collectively point to 2013 being a difficult

year for Construction Services.

We have been managing our business on the basis that market

conditions would be tough, and this has been an effective strategy.

We will take further action, both operationally and strategically

where necessary, to mitigate any adverse impacts on our

business.

In the medium and long term, we are confident that our position

in infrastructure markets, our focus and competitive advantage in

the transportation, rail, power, water and mining verticals, and

our initiatives to access growing markets such as Australia,

Canada, Brazil and India will stand us in good stead as well as

making the business more robust.

ENDS

Conference call

Balfour Beatty will host a conference call for analysts and

investors at 8:00 (UK time). To join the call, please dial +44

(0)20 7784 1036 and quote confirmation code 1896430. A recording of

the call and its transcript will be posted on our website within 24

hours of the event.

Analyst/investor enquiries:

Basak Kotler

Balfour Beatty plc

Tel 020 7216 6924

Media enquiries:

Rebecca Salt

Balfour Beatty plc

Tel 020 7216 6865

This document contains forward-looking statements which have

been made in good faith based on the information available at the

time of its approval. It is believed that the expectations

reflected in these statements are reasonable, but they may be

affected by a number of risks and uncertainties that are inherent

in any forward-looking statement which could cause actual results

to differ materially from those currently anticipated.

Notes to Editors:

1. Balfour Beatty (www.balfourbeatty.com) is a world-class

infrastructure group with capabilities in professional

services, construction services, support services and

infrastructure investments.

We work in partnership with our customers principally

in the UK, continental Europe, the US, South-East Asia,

Australia and the Middle East, who value the highest

levels of quality, safety and technical expertise.

Key infrastructure markets include transportation (roads,

rail and airports); social infrastructure (education,

specialist healthcare, and various types of accommodation);

utilities (water, gas and power transmission and generation)

and commercial (offices, leisure and retail).

The Group delivers services essential to the development,

creation and care of these infrastructure assets including

project design, financing and management, engineering

and construction, and facilities management services.

Balfour Beatty employs 50,000 people around the world.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSEAPFXEDNAFFF

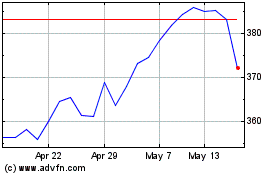

Balfour Beatty (LSE:BBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Balfour Beatty (LSE:BBY)

Historical Stock Chart

From Jan 2024 to Jan 2025