TIDMBOOT

RNS Number : 8302M

Boot(Henry) PLC

19 September 2023

19 September 2023

HENRY BOOT PLC

('Henry Boot', the 'Company' or the 'Group')

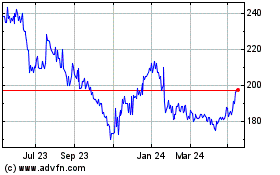

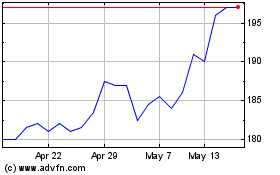

Ticker: BOOT.L: Main market premium listing: FTSE: Real Estate

Investment and Services.

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

A resilient operational performance driven by land promotion

disposals and property development completions, despite economic

headwinds

Henry Boot PLC, a Company engaged in land promotion, property

investment and development, and construction, announces its

unaudited interim results for the six months ended 30 June

2023.

Tim Roberts, Chief Executive Officer, commented:

"The first half of the year has seen our markets slow as

interest rates have continued to rise, but, as these results show,

our focus on prime strategic sites, high quality development and

premium homes has provided us with a degree of resilience. This has

helped us to report a very respectable underlying profit before tax

of GBP23.3m, an increase in NAV of 3%, plus the confidence to grow

our interim dividend by 10%.

Whilst uncertainty in our markets has increased, we believe we

have enough momentum to carry us through the year, although the

outlook for 2024 for the time being is not so clear. However, we

have conviction in our three markets which are driven by structural

trends and I am pleased to report that we remain on track to hit

our strategic growth and return targets over the medium term."

Financial highlights

-- 24.5% increase in revenue to GBP179.8m (June 2022: GBP144.4m)

driven by land disposals and housing completions

-- Underlying profit before tax(1) of GBP23.3m (June 2022:

GBP37.8m) or GBP25.0m (June 2022: GBP38.8m) on a statutory basis,

supported by the resilient performance of residential land sales

and industrial development activity

-- ROCE(2) of 6.3% (June 2022: 10.1%), expected to be around the

lower end of our medium-term target of 10%-15% by the year-end

-- NAV(3) per share is up by 2.6% to 303p (December 2022: 295p),

due to robust operational performance. Excluding the defined

benefit pension scheme surplus, the NAV per share showed an

underlying increase of 2.9% to 298p (December 2022: 291p)

-- Strong balance sheet, with net debt(4) of GBP70.8m (December

2022: GBP48.6m) reflecting continued investment in committed

developments and a decision to limit further acquisitions. Gearing

remains within our optimal stated range of 10%-20% at 17.5%

(December 2022: 12.3%)

-- EPS of 14.0p (June 2022: 24.1p); Interim dividend of 2.93p

declared (June 2022: 2.66p), an increase of 10%, reflecting the

Group's resilient operational performance and progressive dividend

policy

Operational highlights

-- GBP129.3m of property sales led by our land promotion,

development and housebuilding businesses, despite weakening

markets. Only GBP3.9m of acquisitions. GBP22.1m of investment in

our high quality committed development programme where costs are

98% fixed

-- Land promotion

o 1,900 plots sold (June 2022: 3,447), increased profit per plot

to GBP11,400 (December 2022: GBP6,066) due to significant sale at

Tonbridge, offsetting the volume reduction

o The total land bank has grown to 97,095 plots (December 2022:

95,704 plots)

o 8,335 plots with planning permission (December 2022: 9,431),

all held at cost

-- Property investment & development

o High quality committed development programme of GBP186m, with

52% pre-sold or pre-let

o c.700,000 sq ft of Industrial & Logistics development

underway (HB share: GBP96m GDV)

o GBP1.5bn development pipeline (HB share GBP1.26bn GDV), 62% of

which is focused on Industrial & Logistics markets, where

occupier demand remains robust

o The investment portfolio value increased to GBP112m (December

2022: GBP106m). Total return of 3.3% continues to be ahead of the

CBRE index for the six months to June 2023

o GBP11.1m post H1 23 investment sales, including Banner Cross

Hall our Head Office, at a combined 19% above book value

o Stonebridge Homes during H1 sold 99 units (30 June 2022: 39

units) and at the end of August has secured 97% of its annual sales

target of 250 units for 2023, with a total owned and controlled

land bank at 997 plots (December 2022: 1,094 plots) keeping us on

track to scale up this business

-- Construction

o The construction segment achieved turnover of GBP56.2m (June

2022: GBP66.5m) in a challenging market

o Henry Boot Construction remains focused on delivering its

current projects with 72% of its 2023 target order book secured

following delays in bringing activity to site as customers proceed

cautiously

-- Responsible Business

o Making good progress against our Responsible Business Strategy

targets set in January 2022, with the launch of our Health and

Wellbeing programme and continued progress in achieving our GHG

emissions target to support reaching NZC by 2030

NOTES:

(1) Underlying profit before tax is an alternative performance

measure (APM) and is defined as profit before tax excluding

revaluation movements on completed investment properties.

Revaluation movement on completed investment properties includes

gains of GBP1.4m (2022: GBP1.0m gain) on wholly owned completed

investment property and gains of GBP0.3m (2022: GBP0.6m gains) on

completed investment property held in joint ventures. This APM

provides the users with a measure that excludes specific external

factors beyond management's controls and reflects the Group's

underlying results. This measure is used in the business in

appraising senior management performance

(2) Return on Capital Employed (ROCE) is an APM and is defined

as operating profit/ average of total assets less current

liabilities (excluding DB pension surplus) at the opening and

closing balance sheet dates

(3) Net Asset Value (NAV) per share is an APM and is defined

using the statutory measures net assets/ordinary share capital

(4) Net (debt)/cash is an APM and is reconciled to statutory

measures in note 14

For further information, please contact:

Enquiries:

Henry Boot PLC

Tim Roberts, Chief Executive Officer

Darren Littlewood, Chief Financial Officer

Daniel Boot, Group Communications Manager

Tel: 0114 255 5444

www.henryboot.co.uk

Numis Securities Limited

Joint Corporate Broker

Ben Stoop/Will Rance

Tel: 0207 260 1000

Peel Hunt LLP

Joint Corporate Broker

Ed Allsopp/Charles Batten

Tel: 0207 418 8900

FTI Consulting

Financial PR

Giles Barrie/Richard Sunderland

Tel: 020 3727 1000

henryboot@fticonsulting.com

A webcast for analysts and investors will be held at 9.30am

today and presentation slides will be available to download via

www.henryboot.co.uk . Details for the live dial-in facility and

webcast are as follows:

Participants (UK): Tel: +44 (0) 33 0551 0200

Password: Henry Boot

Webcast link: https://stream.brrmedia.co.uk/broadcast/64b59edbedb1b705b3cdcddd

About Henry Boot PLC

Henry Boot PLC (BOOT.L) was established over 135 years ago and

is one of the UK's leading and long-standing property investment

and development, land promotion and construction companies. Based

in Sheffield, the Group is comprised of the following three

segments:

Land Promotion:

Hallam Land Management Limited

Property Investment and Development:

HBD (Henry Boot Developments Limited), Stonebridge Homes

Limited

Construction:

Henry Boot Construction Limited , Banner Plant Limited , Road

Link (A69) Limited

The Group possess a high-quality strategic land portfolio, an

enviable reputation in the property development market backed by a

substantial investment property portfolio and an expanding, jointly

owned, housebuilding business. It has a construction specialism in

both the public and private sectors, a long-standing plant hire

business, and generates strong cash flows from its PFI contract

through Road Link (A69) Limited.

www.henryboot.co.uk

CEO Review

Henry Boot traded in line with the Board's expectations over the

half year, achieving an underlying profit before tax of GBP23.3m

(June 2022: GBP37.8m), or GBP25.0m (June 2022: GBP38.8m) on a

statutory basis. Our expectations for the full year remain in line

with market consensus*. The Group's balance sheet remains strong,

with NAV per share increasing by 2.6% to 303p (Dec 2022: 295p), or

by 2.9% to 298p (Dec 2022: 291p) excluding the defined benefit

pension scheme surplus. Whilst the first half of the year has been

impacted by continued economic uncertainty, principally as a result

of persistent inflation and rising interest rates, we have

delivered a resilient performance, completing GBP129.3m of sales

within our land promotion, development and housebuilding

businesses. Acquisitions have only been GBP3.9m.

According to JLL, in H1 23 the volume of UK commercial property

transactions has slowed markedly to GBP14.2bn, down 53% on the same

period in 2022. Much of the reduction has been driven by fewer

large deals with demand remaining more resilient in those sectors

benefiting from rental growth such as Industrial & Logistics

(I&L) and build to rent (BtR), both are sectors that we focus

on. House prices have been more resilient than many commentators

predicted having reduced by 1.2% during the six months to June

according to Nationwide and are now 5.3% below the peak in August

2022. Reductions in the price of new homes have generally been

smaller than this. Whilst strategic land sale volumes have reduced

housebuilders continue to selectively acquire land, with an

emphasis on sites in prime locations which remains a focal point

for our land promotion business. In support of this, we currently

have nine sites under offer to housebuilders.

With this backdrop in mind, we have had a good six months,

supported by the resilience of our three long-term markets,

I&L, Residential and Urban Development. In the half-year:

-- Hallam Land Management (HLM) disposed of 1,900 plots (June

2022: 3,447 plots). Although plots sold in the period has

decreased, we have increased profit per plot to GBP11,400 (December

2022: GBP6,066), offsetting the volume reduction. This was due to a

significant and very profitable freehold sale at Tonbridge, which

has shown an ungeared internal rate of return of 27% p.a. HLM

continue to receive selective bids for its land, especially on

smaller prime sites from national and regional housebuilders. The

total land bank has grown to 97,095 plots (December 2022: 95,704

plots), of which 8,335 plots have planning permission.

-- HBD completed on a total Gross Development Value (GDV) of

GBP70m (HBD share) - of which 100% has been pre-let/ pre-sold with

a committed development programme of GBP186m GDV (HBD share) - 52%

of which is pre-let or pre-sold. The part which is not pre-let/

pre-sold comprises three high quality schemes; Island our NZC

office scheme in the heart of Manchester; Setl which offers premium

apartments in the Jewellery Quarter in the centre of Birmingham

and; Momentum an NZC I&L scheme in Rainham serving Greater

London. All three complete at various times in 2024 and we continue

to expect good customer interest. To replenish the committed

development programme, we have a number of I&L schemes which we

are looking to commit to providing we can appropriately manage risk

through pre-letting or forward sales.

-- Stonebridge Homes (SH) secured 88% of its 250-unit sales

target for this year during H1 23, achieving a slightly reduced

sales rate of 0.48 houses per week per outlet, alongside a firm

average selling price of GBP499,000. Post half-year, we have

secured a further 21 units, achieving a sales rate of 0.52 houses

per week per outlet in the months from July to August. This takes

us to 97% secured for the year. Despite a slower market, price

against budget has up to the end of August been running at plus

0.8%. We believe this is due to the high quality of our homes and

the prime locations of our sites.

-- Henry Boot Construction (HBC) has experienced challenging

trading conditions with industry wide supply constraints and

subcontractor and material availability issues giving rise to

delays and budget challenges on two of its largest projects - the

GBP47m BtR residential scheme Kangaroo Works in Sheffield and Block

H, the GBP42m urban development scheme also in Sheffield. The

GBP47m Cocoa Works, York, remains on time and budget.

Despite low economic growth and slowing markets, we have

maintained our strategic ambition to grow and are still looking to

invest into prime opportunities. Rightly, we have been cautious

during H1 23 towards acquisitions, with our main focus on

investment in building out HBD's committed development programme.

Investment in this area totals GBP22.1m, with a further GBP3.9m

made on land purchases for both HLM and SH's land bank.

We have also continued to invest in other strategic objectives

that support our long-term ambitions. For our people, we have

launched a refreshed reward strategy which offers more clarity on

career progression and remuneration, and we continue to invest in

modernising both digital and technology capabilities and our

marketing and customer relationship functions.

An example of this, is our imminent head office relocation to

the Isaac's Building in Sheffield city centre. The building offers

strong ESG credentials and will provide our people with a more open

and collaborative workspace. In regard to Banner Cross Hall, our

current head office, after receiving strong interest, we have

completed the sale of the building, retaining a short-term lease on

the premises until we relocate. The buyer intends to refurbish the

Hall primarily into serviced office space.

Overall, these investments have resulted in our gearing

increasing to 17.5%, which is still within our stated optimal range

of 10%-20%. Whilst the Group's GBP105m banking facility runs until

January 2025 we have already had positive conversations with our

existing lenders about its renewal and expect to agree terms during

Q4 23, with an aim to have renewed facilities in place in Q2

24.

*Market expectations being the average of current analyst

consensus of GBP37.8m profit before tax, comprising three forecasts

from Numis, Peel Hunt and Panmure Gordon.

Dividend

The Board has declared an interim dividend of 2.93p (June 2022:

2.66p), an increase of 10%, which reflects our progressive dividend

policy. This will be paid on 13 October 2023 to shareholders on the

register at the close of business on 29 September 2023.

Strategy

The Group set a medium-term strategy in 2021 to grow the size of

the business by increasing capital employed by 40% focusing on its

three key markets: I&L, Residential and Urban Development,

whilst maintaining ROCE within a 10-15% range. Since setting this

strategy, we have successfully grown our capital employed by 13% to

GBP413m. Good progress has been made against our stated medium-term

targets as set out below:

Measure Medium term H1 23 Performance Progress

target

Capital employed To over GBP500m GBP413m as at On track to grow

30 June 2023 capital employed

to over GBP500m

-------------------- --------------------- ---------------------------

Return on average 10-15% pa 6.3% in H1 23 We maintain our

capital employed aim to be within

the target range

for FY23

-------------------- --------------------- ---------------------------

Land promotion c.3,500 pa 1,900 plots in The running five

plot sales H1 23 year average has

increased to 3,175

plots pa. So, we

remain on track

to achieve our medium-term

target.

-------------------- --------------------- ---------------------------

Development Our share c.GBP200m Our share: GBP70m We are on course

completions pa in H1 23, with to carry on growing

committed programme our completed developments

of GBP186m for to GBP200m pa as

2023 we look to draw

down on our future

pipeline of GBP1.26bn.

-------------------- --------------------- ---------------------------

Grow investment To around GBP150m GBP112m as at Value increased

portfolio 30 June 2023 primarily due to

retained I&L developments.

We have made accretive

tactical sales and

will be patient

building the portfolio

back up to its target.

-------------------- --------------------- ---------------------------

Stonebridge Up to 600 units 99 homes completed Already looking

Homes sales pa in H1 23, out to expand our annual

of a delivery target in 2024,

target of 250 in line with overall

homes strategic objective

of 600 units.

-------------------- --------------------- ---------------------------

Construction Minimum of 65% 18% at H1 23 Difficult market

order book secured for the following for 2024 conditions impacting

year order book for 2024.

In response, the

opportunity pipeline

has been refocused,

with GBP85m PCSA's

in progress.

-------------------- --------------------- ---------------------------

Responsible Business

We launched our Responsible Business Strategy in January 2022,

with our primary aim to be NZC by 2030 with respect to Scopes 1

& 2. I am pleased with the progress we have made so far against

our 2025 objectives and targets. Our strategy is guided by three

principal objectives:

-- To further embed ESG factors into commercial decision making

so that the business adapts, ensuring long-term sustainability and

value creation for the Group's stakeholders.

-- To empower and engage our people to deliver long term

meaningful change and impact for the communities and environments

Henry Boot works in.

-- To focus on issues deemed to be most significant and material

to the business and hold ourselves accountable by reporting

regularly on progress.

18-month performance against our 2025 target

Our People Performance Our Places Performance

Develop and deliver The Health and Contribute GBP1,000,000 We contributed

a Group-wide Wellbeing Strategy of financial (financial and

Health and Wellbeing and Programme (and equivalent) equivalent value

Strategy was launched to value to our of) over GBP400,000

the Group in February charitable partners to our charitable

2023 with a range and community

of resources, partners.

activities and

guidance delivered

throughout 2023.

---------------------------- -------------------------- ------------------------

Increase gender We have made progress, Contribute 7,500 More than 3,500

representation with female representation volunteering volunteering

in the business, across our workforce hours to a range hours have been

aiming for 30% increasing to of community, delivered.

of our team and 27% (2022: 26%). charity, and

line managers education projects

being female

---------------------------- -------------------------- ------------------------

Our Planet Performance Our Partners Performance

---------------------------- -------------------------- ------------------------

Reduce Scope Total direct GHG Pay all of our The Living Wage

1 and 2 GHG emissions emissions (Scopes suppliers the Foundation has

by over 20% to 1 and 2) in 2022 real living wage been engaged

support reaching were 2,930 tonnes and secure accreditation and a review

NZC by 2030 which equates with the Living is currently

to a 12% reduction Wage Foundation being undertaken

from the 2019 of the requirements

baseline. Remain to secure membership.

on course to achieve

the decarbonisation

trajectory.

---------------------------- -------------------------- ------------------------

Reduce consumption Sustainability Collaborate with We continue to

of avoidable audits completed all our partners engage with membership

plastic by 50% and a reduction to reduce our organisations

action plan is environmental (including Yorkshire

in development. impact Climate Action

Coalition and

the UK Green

Building Council)

and our supply

chain to share

knowledge and

best practice.

---------------------------- -------------------------- ------------------------

The Group is also committed to ensuring that all the properties

within the investment portfolio have a minimum EPC rating of 'C'.

Currently 73% (December 2022: 70%) of these properties have a

rating of 'C' or higher, of which 45% (December 2022: 39%) of the

total portfolio are rated 'A-B'. The majority of the remaining 27%

of the portfolio that are currently below a 'C' rating, have

redevelopment potential with a target range of 'A' or 'B'.

Outlook

There is no doubt that the rapid increase in short term rates is

slowing the economy, reducing customer demand across our markets,

and putting pressure, not least due to the funding costs, on the

viability of residential and commercial schemes. As its designed to

do, tighter monetary policy is curbing cost pressures, and we have

seen the rate of inflation come down throughout the Group with the

prospect of more to come by the year end giving us a degree of

confidence in being able to achieve our current year ambitions.

Henry Boot is not immune to these pressures, but its focus on high

quality real estate and customer care affords us some

resilience:

-- HLM promotes high quality, significant sites, with the

majority in the South of England, and c.24,000 plots around the

golden growth triangle demarked by London, Cambridge and Oxford.

Whilst uncertainty around the timing of disposals has increased

over the short-term we have no doubt that the structural demand for

homes in the UK will continue to outstrip supply and that these

sites will be in demand from housebuilders.

-- HBD delivers institutional quality development in and around

the major regional cities and the main road networks, offering high

ESG credentials. 64% of its speculative committed development is

NZC. The majority of our pipeline is industrial where structural

occupier demand endures.

-- SH builds premium homes, in affluent locations, and over the

year whilst it's been harder work to sell, as mortgage rates and

uncertainty have increased, sales rates have remained resilient. By

the end of August, in effect, 97% of this year's target has been

sold and we have increased overall volume by 43%, in line with our

ambition to scale up this business.

Our balance sheet offers the same quality and resilience, with

development and land promotion opportunities held at the lower of

cost or value whilst gearing is managed over the cycle at between

10-20%. Our NAV has shown consistent growth through cycles. This

allows us to invest in opportunities, such as land, both to promote

in the medium term and to build houses as we scale up SH. It also

allows us to build out our high quality committed development

programme.

We have confidence in the long-term fundamentals of our market,

supported by our people and their skillsets, plus the financial

resources to meet the business's strategic growth and return

ambitions.

Business Review

Land Promotion

HLM had a good first half, achieving an operating profit of

GBP17.0m (June 2022: GBP17.2m) from selling 1,900 plots (June 2022:

3,447 plots). Although the number of plots sold in the year has

decreased, average gross profit per plot increased to GBP11,400

(December 2022: GBP6,066) due primarily to a significant freehold

sale of land at Tonbridge, Kent, offsetting the volume

reduction.

UK greenfield land values decreased by 2.8% in the six months to

June 2023 according to Savills Research. Transactions slowed

significantly relative to the same period in 2022, with downward

pressures on land values reflecting many housebuilders more modest

new build sales rates. However, with 17% fewer homes granted

planning consent in H1 23 compared to the same period in 2022, the

reduction in land supply coming forward has resulted in selective

demand for prime deliverable sites.

HLM's land bank has grown to 97,095 plots (December 2022: 95,704

plots), of which 8,335 plots (December 2022: 9,431 plots) have

planning permission (or Resolution to Grant subject to S106). The

decrease in plots with planning permission reflects the continued

delays in the planning system due to a growing number of

complexities. One such complexity is the emerging Draft National

Planning Guidance, which looks to be slowing down local authority

development plan making and planning application determination with

58 development plans having been withdrawn or paused since the

December 2022 announcements. Notwithstanding this, HLM has gained

planning permission on 804 plots over H1 23, which is a significant

increase from the 435 plots granted in 2022. During the period,

there were 689 plots submitted for planning, taking the total plots

awaiting determination to 12,182 (December 2022: 12,297 plots).

HLM's land bank remains well positioned to benefit from the

delays and complexities in the planning system due to the high

levels of stock both with planning and awaiting determination, and

the team's specialist skill set and its strategically placed

regional coverage. Despite the challenges, the number of plots in

the portfolio continues to increase, giving us confidence in the

medium term that our stock levels with planning will return to

similar levels seen in previous years.

There is significant latent value in the Group's strategic land

portfolio, which is held as inventory at the lower of cost or net

realisable value. As such, no uplift in value is recognised within

our accounts relating to any of the 8,335 plots with planning, and

any increase in value created from securing planning permission

will only be recognised on disposal.

Residential Land Plots

With permission In planning Future Total

b/f granted sold c/f

------- -------- -------- -------

2023 9,431 804 (1,900) 8,335 12,182 76,578 97,095

------- -------- -------- ------- ------------ ------- -------

2022 12,865 435 (3,869) 9,431 12,297 73,976 95,704

2021 15,421 452 (3,008) 12,865 11,259 68,543 92,667

2020 14,713 2,708 (2,000) 15,421 8,312 64,337 88,070

2019 16,489 1,651 (3,427) 14,713 10,665 51,766 77,144

------- -------- -------- ------- ------------ ------- -------

-- In relation to significant schemes:

o At Tonbridge, Kent, we concluded an agreement for the sale of

125 plots to national housebuilder Cala Homes. The site was

originally contracted under option in 2004, with the freehold

subsequently purchased by HLM in 2021. The scheme includes

additional community benefits such as new cycle and pedestrian

links to a local railway station and a contribution to improved

public transport infrastructure. The sale will complete in two

phases across 2023 (81 plots) and 2024 (44 plots). The final

completion will result in an ungeared internal rate of return of

27% p.a in 2024.

o At Pickford Gate, Coventry (formerly known as Eastern Green),

a 2,400 plot site, a 250 plot sale concluded to the Vistry Group in

April. Marketing will commence for the next tranche in September,

which will comprise up to 1,000 plots.

o At Swindon, the 2,000-plot site with outline consent that is

being promoted through an option agreement jointly held with Taylor

Wimpey (TW), as previously reported, terms for acquisition were

nearly settled with the landowners, but stalled due to the market

disruption in Q4 2022. Alongside TW, HLM is now working to exchange

on the purchase later this year, with completion expected to fall

into 2024.

Property Investment and Development

Property Investment and Development, which includes HBD and

Stonebridge Homes, delivered a combined operating profit of GBP8.5m

(June 2022: GBP19.6m).

According to the CBRE Monthly Index, commercial property values

declined by 0.4% in the six months to June 2023. Industrial

property was the best performing sector with values up 1.4% during

the first half of the year ahead of retail up 1.0%, whilst offices

declined by 3.5%. The rate of yield expansion has slowed during

2023 following the significant capital value correction in the

second half of 2022. Industrial continues to deliver the highest

rental growth at 3.2% in six months to June 2023. Whilst take up

has slowed from record levels during the pandemic, occupier demand

is proving resilient due to the longer-term structural drivers and

limited supply of high-quality space. At the same time the outlook

for BtR remains positive with rental growth for multifamily assets

of 8.2% in the year to March 2023 according to CBRE driven by

continued strong demand and a lack of available units.

HBD completed on two developments with a total GDV of GBP70m

(HBD share), with 100% of these either sold or let:

-- Completed on a GBP54m (GDV) I&L scheme, Power Park,

located on the former Imperial Tobacco plant in Nottingham. The

426,000 sq ft scheme, comprising seven units, was pre-sold to

Oxenwood Logistics Fund, on a forward funding basis in 2021. Each

of the seven units meet BREEAM "Very Good" standards.

-- Completed an 85,000 sq. ft. building at the 83-acre

Butterfield Business Park in Luton, Bedfordshire. The GBP16m (GDV)

unit was pre-let to Shoal Group, an electrical component supplier,

and has been retained within the investment portfolio.

The committed development programme now totals a GDV of GBP341m

(HBD share: GBP186m GDV) of which 52% is currently pre-let or

pre-sold, with 98% of the development costs fixed.

2023 Committed Programme

GDV HBD Share of GDV Commercial Residential Size

Scheme (GBPm) (GBPm) ('000 sq ft) (Units) Status Completion

------------------- -------- ------------------- -------------- ----------------- ------------------ -----------

Industrial

Rainham, Momentum 120 24 380 - Speculative Q1 24

Southend, Ipeco2

and Cama, 20 20 156 - Pre-Sold Q1 24

Walsall, SPARK

Remediation 37 37 - - Forward funded Q2 24

Preston, East DPD Pre-let and

& DHL 30 15 150 - forward funded Q4 23

207 96 686 -

-------- ------------------- -------------- -----------------

Urban Residential

Birmingham, Setl 32 32 - 102 Speculative Q1 24

York, TDT 22 22 54 - Pre-sold Q3 23

Aberdeen, Bridge

of Don 12 1 - TBC Under-offer Q2 24

Aberdeen, Pre-sold and DM

Cloverhill 2 2 - 500 fee Q4 23

-------- ------------------- -------------- -----------------

68 57 54 602

-------- ------------------- -------------- -----------------

Urban Commercial

Manchester, Island 66 33 91 - Speculative Q3 24

Total for the Year 341 186 831 602

------------------- -------- ------------------- -------------- -----------------

% sold or pre-let

(incl Island) 36% 52%

Within the committed programme there is currently nearly 700,000

sq ft of I&L space (HBD share: GBP96m GDV), a total of 602

urban residential units (HBD share: GBP57m GDV) and 91,000 sq ft of

commercial space (HBD share: GBP33m GDV). In this regard:

-- Two freehold Design and Build transactions, at HBDs 52 acre

I&L scheme in Southend, Essex, have been added and agreed at a

total price of GBP20m and a combined c.156,000 sq ft of warehouse

space. A 129,000 sq ft headquarters facility will be developed for

Ipeco Holdings, the world leader in aircraft seating. CAMA Asset

Store, specialists in sustainable storage for the creative

industries, will take occupation of a 27,600 sq ft warehouse

facility with ancillary office accommodation.

-- SETL, the 102 premium apartment scheme in Birmingham, is on

track to complete in Q1 24 and marketing of selective apartments

will start shortly with the remainder to be sold post PC during

2024. Although the market has slowed, the aim is to achieve sales

in line with our stated GBP32m GDV.

-- At Momentum, Rainham (in an 80:20 JV with Barings) a 380,000

sq ft speculative I&L development targeting NZC serving Greater

London, is ahead of building schedule and is now targeting

completion in Q1 24. Marketing of the scheme is underway and is

attracting encouraging occupier interest.

-- HBD and Greater Manchester Pension Fund are working in a

50:50 JV to deliver 91,000 sq ft of NZC offices within Manchester

City Centre. Island will include 12,500 sq ft of amenity areas

including social, meeting and event spaces and a communal roof

terrace. The scheme is on track to be completed in Q3 24 and is

again generating occupier interest.

-- Post half-year, HBD has completed The Disabilities Trust,

York (HBD share: GBP22m GDV), a 54,000 sq ft scheme with state of

the art care facilities. The building is low carbon and has

achieved BREEAM 'Excellent' rating. This is the fourth phase of our

highly successful Chocolate Works development, in York.

-- HBD are looking to replenish the programme by committing to

further schemes such as the development of I&L schemes at

Walsall Spark, Roman Way, Preston and Welwyn, subject to demand and

viability.

HBD's total development pipeline has been maintained at a GDV of

GBP1.5bn (HBD share: GBP1.26bn GDV). All of these opportunities sit

within the Company's three key markets of I&L (62%), Urban

Commercial (21%) and Urban Residential (17%). Significant schemes

include:

-- At Golden Valley, Cheltenham, HBD continues preparations to

submit a planning application for the first phase of the scheme

(HBD share: GBP50m GDV), with the council signing off the Funding

Agreement in Q3 2023. The scheme comprises a mixed-use campus

clustered around 150,000 sq ft of innovation space.

-- At Neighbourhood, Birmingham (HBD share: GBP140m GDV), after

securing planning approval for a 414-unit BtR development, HBD are

continuing preparatory works but have delayed seeking funding until

the new year.

The total value of the investment portfolio (including share of

properties held in JVs) has increased to GBP112m (December 2022:

GBP106m). Following the significant repricing of UK commercial real

estate in Q4 2022, capital values have stabilised in the first six

months of 2023 with an underlying valuation increase of 0.8% for

the investment portfolio, principally as a result of the growth in

rental values for I&L assets with the equivalent yield

unchanged at 6.2%. The total property return of 3.3% for the six

months to June 2023, was ahead of the return from the CBRE UK

Monthly Index (2.5%). During the period occupancy increased to 89%

(December 2022: 88%) with the weighted average unexpired lease term

now 10.6 years (8.9 years to first break).

Post half year, the Group has also completed four sales of

smaller assets for a total of GBP11.1m including Banner Cross Hall,

at an average 19% premium to December 2022 valuation.

The UK housing market remained subdued during H1 23 as homebuyer

demand continued to be impacted by higher mortgage rates. According

to Nationwide UK house prices decreased by 1.2% during the six

months to June and are now 5.3% below the August 2022 peak. Whilst

higher mortgage rates are suppressing activity with monthly housing

transactions around 15% below pre-pandemic levels unemployment is

expected to remain low by historic standards which should provide

some support to house prices.

Against this backdrop demand for housing has remained resilient,

with pricing remaining firm, leaving SH still on track to meet its

annual sales target having secured 88% (144 private/77 social) of

its 2023 delivery target of 250 units at 30 June. The average

selling price for private units to 30 June is GBP499k (June 2022:

GBP512k) alongside an average sales rate of 0.48 (June 2022: 0.6)

units per week per outlet, for private houses (PH), in line with

target. Sales prices achieved were 1.2% above budget whilst build

cost inflation has started to moderate, reducing from c.10% in 2022

to 8% currently. Negotiations with suppliers and subcontractors are

ongoing and are likely to lead to further falls in cost

inflation.

Post H1 23, SH have secured an additional 21 units (PH) taking

them to 97% (164 private/78 social) secured for the year, meaning

only a further eight units (PH) need to be secured between 1

September and the end of October to achieve its annual sales

target. The year to date sales rate achieved to the end of August

was 0.49 houses per week per outlet.

SH total owned and controlled land bank comprises 997 plots

(June 2022: 1,164) of which 775 plots have detailed or outline

planning and has 2.21 years supply based on a one-year rolling

forward sales forecast for land with planning or 2.38 years for its

full land bank. SH have a number of sites where terms are agreed in

order to grow its land bank in line with stated scale up plans.

However, the business is being patient in negotiations, in light of

the slowing house sales market and the more subdued land

market.

The strategic objective of growing the business to achieve 600

completions per annum over the medium term remains on track.

Construction

Trading in the Group's construction segment has been below

expectations in H1 23, achieving an operating profit of GBP4.4m

(2022: GBP6.3m).

UK construction activity slowed during the first half of 2023,

with monthly output increasing by 1.0% following the strong

increase of 6.2% in 2022. All new work decreased by 2.1% with the

most significant reduction of 6.7% for private housing.

Construction output in June 2023 was 7.3% above the February 2020

pre-CV-19 level.

HBC is trading below management's expectations, having

experienced difficult operating conditions in line with the UK

construction market. The slowdown in UK construction has resulted

in HBC securing only 72% of its turnover for 2023 (94% of its costs

have fixed price orders placed or contractual inflation clauses)

and has experienced several delays on Pre-Construction Services

Agreements (PCSAs). However, there is a healthy pipeline of

opportunities that HBC is actively pursuing, with a target of

GBP85m PCSA's across urban development and residential

opportunities.

Despite both schemes suffering delays, subcontractor and

material availability issues, the Kangaroo Works, a GBP47m BtR

scheme, completed in August 2023, with the Heart of the City,

Sheffield Block H, a GBP42m urban development scheme, due to

complete in phases between August and October 2023. The Cocoa

Works, a GBP47m residential development in York, remains on time

and to budget.

Banner Plant is trading slightly below expectations, seeing a

slight reduction in demand in line with the wider slowdown in

construction activity. The business has refocused on core hire

products and cost management. Road Link is performing in line with

management expectations.

FINANCIAL REVIEW

Consolidated statement of comprehensive income

Group revenue for the period increased by 24.5% to GBP179.8m (30

June 2022: GBP144.4m) as the Land Promotion business completed

additional freehold sales and Stonebridge continued to grow

completions, achieving 99 unit sales in H1 (30 June 2022: 39 unit

sales). The Group continued to generate strong revenues from

property development activity and construction work during the

period.

Gross profit was slightly below that of the prior period at

GBP40.8m (30 June 2022: GBP43.9m) and shows the ongoing resilience

of the Group despite challenging market conditions. Other income of

GBP4.8m relates to a legal settlement on a property development

contract completed in 2016. Administrative expenses (excluding

pension costs) increased by GBP2.2m (30 June 2022: increased

GBP2.5m) reflecting the current and future growth ambitions of the

business, and includes investment in our people, systems, marketing

and ESG.

Fair value of investment properties increased by GBP0.6m (30

June 2022: increase GBP3.4m) with Group assets continuing to

outperform the CBRE index. Profits on sale of investment properties

were GBP0.1m (30 June 2022: GBPnil). The Group's share of profit

from joint ventures and associates was GBP0.2m (30 June 2022:

GBP10.4m), including investment property valuation gains of GBP0.3m

(30 June 2022: GBP0.6m), the prior year included an individually

significant disposal of a residential site in Aberdeen.

Property revaluation gains/(loss) H1 23 H1 22 2022

GBP'm GBP'm GBP'm

----------------------------------------------------- ------- ------- -------

Wholly owned investment property:

- Completed investment property 1.4 1.0 (7.3)

- Investment property in the course of construction (0.8) 2.4 2.4

----------------------------------------------------- ------- ------- -------

0.6 3.4 (4.9)

Joint ventures and associates:

- Completed investment property 0.3 0.6 (3.2)

- Investment property in the course of construction - - -

----------------------------------------------------- ------- ------- -------

0.3 0.6 (3.2)

----------------------------------------------------- ------- ------- -------

0.9 4.0 (8.2)

----------------------------------------------------- ------- ------- -------

This results in a 34% reduction in operating profit to GBP25.7m

(30 June 2022: GBP39.1m) which generated an underlying profit

before tax(1) of GBP23.3m or GBP25.0m on a statutory basis (30 June

2022: GBP37.8m underlying or GBP38.8m statutory), which remains a

robust result given current market conditions. Earnings per share

followed, reducing to 14.0p (30 June 2022: 24.1p).

Return on capital employed

Lower operating profits in the period resulted in a decreased

return on capital employed (ROCE) of 6.3% over a six-month period

(30 June 2022: 10.1%). Over a 12-month period we continue to

believe a target return of 10-15% is appropriate for our current

operating model, although in current market conditions we would

expect to be at the lower end of this range.

Finance and gearing

Financing costs were GBP2.5m (30 June 2022: GBP0.9m) reflecting

the impact of rising interest rates on borrowings. This is

partially offset by finance income of GBP1.8m (30 June 2022:

GBP0.5m) as an element of financing costs are recovered through our

joint venture arrangements.

At 30 June 2023, net debt was GBP70.8m (31 December 2022:

GBP48.6m). This reflects an increase in deferred land sale receipts

as well as continued investment in strategic land, property

development and our growing housebuilder.

Gearing levels have increased to 17.5% (31 December 2022: 12.3%)

and remain within our preferred operating range of 10%-20%. We

remain selective on new investments in an uncertain market but

ready to react to any compelling opportunities that might

arise.

Cash flows

Operating cash inflows before movements in working capital were

GBP22.0m (30 June 2022: GBP23.4m).

Working capital requirements have increased as a result of land

transactions on deferred payment terms and from investment in

inventory, resulting in working capital outflows of GBP15.8m (30

June 2022: GBP22.9m outflow) which, in turn, meant that operations

generated funds of GBP6.1m (30 June 2022: GBP0.5m). After interest

paid of GBP1.9m (30 June 2022: GBP0.5m) and tax paid of GBP0.9m (30

June 2022: GBP1.0m) net cash inflows from operating activities were

GBP3.3m (30 June 2022: GBP1.1m outflows).

Including expenditure on investment properties of GBP7.0m (30

June 2022: GBP0.3m) and advances to joint ventures and associates

of GBP6.8m (30 June 2022: GBP2.1m), net cash outflows from

investing activities were GBP12.3m (30 June 2022: GBP7.8m

inflow).

The final dividend on ordinary shares for 2022 increased by 10%

to GBP5.3m (30 June 2022: GBP4.8m).

Statement of financial position

Total non-current assets were GBP206.1m (31 December 2022:

GBP183.3m). Significant movements arose as follows:

- a GBP5.5m increase in right of use assets (30 June 2022:

GBP0.3m decrease) due to investment in plant acquired on hire

purchase and a lease on the Group's new head office;

- a GBP5.6m increase (30 June 2022: decrease GBP3.4m) in the

value of investment properties, being subsequent capital

expenditure of GBP7.0m (30 June 2022: GBPnil), transfers from

inventory GBPnil (30 June 2022: GBP4.5m) a revaluation gain of

GBP0.6m (30 June 2022: gain of GBP3.4m), disposals of GBP1.0m (30

June 2022: GBPnil), and transfers to assets held for sale of

GBP1.0m (30 June 2022: GBP11.1m);

- Investments in joint ventures and associates increased by

GBP0.2m to GBP10.2m (31 December 2022: GBP10.0m), being profits

generated of GBP0.2m;

- an increase in non-current trade receivables of GBP14.6m (30

June 2022: GBP1.3m decrease) following a number of strategic land

sales made on deferred terms;

- The pension scheme asset has increased GBP1.9m to GBP8.1m (31

December 2022: GBP6.2m) largely due to the effect of the increasing

liabilities discount rate offset by asset returns during the

period; and a deferred tax asset which remains consistent at

GBP0.2m (30 June 2022: GBP3.1m decrease).

Current assets were GBP8.9m higher at GBP404.0m (31 December

2022: GBP395.0m) resulting from:

- an uplift in inventories to GBP297.7m (31 December 2022:

GBP291.8m) due to growth in housebuilding inventory;

- lower trade and other receivables of GBP65.2m (31 December 2022: GBP66.6m);

- cash and cash equivalents which were GBP3.1m higher at

GBP20.5m (31 December 2022: GBP17.4m) due to current cash

requirements and timing on loan repayments; and

- assets held for sale of GBP3.1m (31 December 2022: GBPnil)

which relates to two property assets, one in Southend and a second

being the Group's Head Office building in Sheffield (as the Group

prepares to relocate to Sheffield City Centre in Q4).

Total liabilities rose to GBP204.7m (31 December 2022:

GBP156.6m) with the most significant changes arising from:

- trade and other payables, including contract liabilities,

decreased GBP8.5m to GBP95.9m (31 December 2022: GBP104.4m);

and,

- borrowings, including lease liabilities, increased to GBP91.3m

(31 December 2022: GBP66.0m) as the Group continues to invest in

operational assets and transact on deferred payment terms.

Retained earnings increased net assets to GBP405.4m (31 December

2022: GBP394.3m) with the net asset value per share increasing by

2.6% to 303p (31 December 2022: 295p), an underlying increase of

2.9% to 298p (Dec 2022: 291p) when excluding the defined benefit

pension scheme surplus net of tax liability.

NOTES:

(1) Underlying profit before tax is an alternative performance

measure (APM) and is defined as profit before tax excluding

revaluation movements on completed investment properties.

Revaluation movement on completed investment properties includes

gains of GBP1.4m (2022: GBP1.0m gain) on wholly owned completed

investment property and gains of GBP0.3m (2022: GBP0.6m gains) on

completed investment property held in joint ventures. This APM

provides the users with a measure that excludes specific external

factors beyond management's controls and reflects the Group's

underlying results. This measure is used in the business in

appraising senior management performance.

(2) Return on Capital Employed (ROCE) is an APM and is defined

as operating profit/ average of total assets less current

liabilities (excluding DB pension surplus) at the opening and

closing balance sheet dates

(3) Net Asset Value (NAV) per share is an APM and is defined

using the statutory measures net assets/ordinary share capital

(4) Net (debt)/cash is an APM and is reconciled to statutory

measures in note 14

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

for the half year ended 30 June 2023

Half year Half year Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------------------------- --------- --------- -----------

Revenue 179,756 144,414 341,419

Cost of sales (138,909) (100,528) (259,829)

---------------------------------------------------- --------- --------- -----------

Gross profit 40,847 43,886 81,590

Other income 4,800 - -

Administrative expenses (20,831) (18,596) (40,455)

24,816 25,290 41,135

Increase/(decrease) in fair value of investment

properties 595 3,443 (4,921)

Profit on sale of investment properties 86 16 646

Loss on sale of assets held for sale - - (149)

Profit on disposal of joint ventures - - 667

Share of profit of joint ventures and associates 188 10,376 9,079

Operating profit 25,685 39,125 46,457

Finance income 1,769 535 1,641

Finance costs (2,495) (883) (2,503)

Profit before tax 24,959 38,777 45,595

Tax (5,805) (6,071) (7,725)

---------------------------------------------------- --------- --------- -----------

Profit for the period from continuing operations 19,154 32,706 37,870

---------------------------------------------------- --------- --------- -----------

Other comprehensive (expense)/income not being reclassified

to profit or loss in subsequent periods:

Revaluation of Group occupied property (86) - 315

Deferred tax on property revaluations 15 - (23)

Actuarial (loss)/gain on defined benefit pension

scheme (2,049) 18,842 14,994

Deferred tax on actuarial loss/(gain) 512 (4,710) (3,749)

Total other comprehensive (expense)/income not

being reclassified to profit or loss in subsequent

periods (1,608) 14,132 11,537

---------------------------------------------------- --------- --------- -----------

Total comprehensive income/(expense) for the period 17,546 46,838 49,407

---------------------------------------------------- --------- --------- -----------

Profit for the period attributable to:

Owners of the Parent Company 18,661 32,065 33,319

Non-controlling interests 493 641 4,551

---------------------------------------------------- --------- --------- -----------

19,154 32,706 37,870

---------------------------------------------------- --------- --------- -----------

Total comprehensive income attributable to:

Owners of the Parent Company 17,053 46,197 44,856

Non-controlling interests 493 641 4,551

---------------------------------------------------- --------- --------- -----------

17,546 46,838 49,407

---------------------------------------------------- --------- --------- -----------

Basic earnings per ordinary share for the profit

attributable

to owners of the Parent Company during the period 14.0p 24.1p 25.0p

---------------------------------------------------- --------- --------- -----------

Diluted earnings per ordinary share for the profit

attributable

to owners of the Parent Company during the period 13.7p 23.7p 24.6p

---------------------------------------------------- --------- --------- -----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (UNAUDITED)

as at 30 June 2023

30 June 30 June 31 December

2022

2023 Restated(1) 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------------------------- --------- ------------ -----------

Assets

Non-current assets

Intangible assets 2,552 3,321 2,933

Property, plant and equipment 24,210 27,975 28,766

Right of use assets 6,476 1,290 997

Investment properties 102,716 100,740 97,116

Investment in joint ventures and associates 10,178 15,581 9,990

Retirement benefit asset 8,108 8,361 6,188

Trade and other receivables 51,648 34,827 37,029

Deferred tax assets 249 332 249

---------------------------------------------------- --------- ------------ -----------

206,137 192,427 183,268

---------------------------------------------------- --------- ------------ -----------

Current assets

Inventories 297,664 252,894 291,778

Contract assets 17,421 12,761 19,257

Trade and other receivables 65,207 74,296 66,601

Cash and cash equivalents 20,538 21,526 17,401

Assets classified as held for sale 3,142 11,137 -

403,972 372,614 395,037

---------------------------------------------------- --------- ------------ -----------

Liabilities

Current liabilities

Trade and other payables 90,243 82,250 95,827

Contract liabilities 1,468 7,730 4,006

Current tax liabilities 7,664 2,876 3,793

Borrowings 85,000 60,000 65,000

Lease liabilities 1,539 559 426

Provisions 2,836 4,511 4,003

---------------------------------------------------- --------- ------------ -----------

188,750 157,926 173,055

---------------------------------------------------- --------- ------------ -----------

Net current assets 215,222 214,688 221,982

---------------------------------------------------- --------- ------------ -----------

Non-current liabilities

Trade and other payables 4,235 2,571 4,568

Lease liabilities 4,770 791 607

Deferred tax liability 4,878 6,573 4,401

Provisions 2,057 855 1,385

---------------------------------------------------- --------- ------------ -----------

15,940 10,790 10,961

---------------------------------------------------- --------- ------------ -----------

Net assets 405,419 396,325 394,289

---------------------------------------------------- --------- ------------ -----------

Equity

Share capital 13,798 13,747 13,763

Property revaluation reserve 2,281 2,060 2,352

Retained earnings 378,213 370,229 365,692

Other reserves 8,246 7,139 7,482

Cost of shares held by ESOP trust (966) (966) (967)

---------------------------------------------------- --------- ------------ -----------

Equity attributable to owners of the Parent Company 401,572 392,209 388,322

Non-controlling interests 3,847 4,116 5,967

---------------------------------------------------- --------- ------------ -----------

Total equity 405,419 396,325 394,289

---------------------------------------------------- --------- ------------ -----------

(1) See 'Prior year restatements' for further details in the

'Basis of preparation and accounting policies'

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

for the half year ended 30 June 2023

Attributable to owners of the Parent

Company

-----------------------------------------------------------

Cost

of

shares

Property held Non-

Share revaluation Retained Other by ESOP controlling Total

capital reserve earnings reserves trust Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------- ----------- -------- -------- ------- ------- ----------- -------

At 1 January 2022 13,732 2,060 328,348 6,744 (1,044) 349,840 5,446 355,286

---------------------------- -------- ----------- -------- -------- ------- ------- ----------- -------

Profit for the period - - 32,065 - - 32,065 641 32,706

Other comprehensive income - - 14,132 - - 14,132 - 14,132

---------------------------- -------- ----------- -------- -------- ------- ------- ----------- -------

Total comprehensive income - - 46,197 - - 46,197 641 46,838

---------------------------- -------- ----------- -------- -------- ------- ------- ----------- -------

Equity dividends - - (4,833) - - (4,833) (1,971) (6,804)

Proceeds from shares issued 15 - - 395 - 410 - 410

Share-based payments - - 517 - 78 595 - 595

---------------------------- -------- ----------- -------- -------- ------- ------- ----------- -------

15 - (4,316) 395 78 (3,828) (1,971) (5,799)

---------------------------- -------- ----------- -------- -------- ------- ------- ----------- -------

At 30 June 2022 (unaudited) 13,747 2,060 370,229 7,139 (966) 392,209 4,116 396,325

---------------------------- -------- ----------- -------- -------- ------- ------- ----------- -------

At 1 January 2022 13,732 2,060 328,348 6,744 (1,044) 349,840 5,446 355,286

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

Profit for the year - - 33,319 - - 33,319 4,551 37,870

Other comprehensive income - 292 11,245 - - 11,537 - 11,537

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

Total comprehensive income - 292 44,564 - - 44,856 4,551 49,407

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

Equity dividends - - (8,383) - - (8,383) (4,030) (12,413)

Proceeds from shares issued 31 - - 738 - 769 - 769

Share-based payments - - 1,163 - 77 1,240 - 1,240

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

31 - (7,220) 738 77 (6,374) (4,030) (10,404)

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

At 31 December 2022 (audited) 13,763 2,352 365,692 7,482 (967) 388,322 5,967 394,289

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

Profit for the period - - 18,661 - - 18,661 493 19,154

Other comprehensive expense - (71) (1,537) - - (1,608) - (1,608)

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

Total comprehensive income/(expense) - (71) 17,124 - - 17,053 493 17,546

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

Equity dividends - - (5,347) - - (5,347) (2,613) (7,960)

Proceeds from shares issued 35 - - 764 - 799 - 799

Share-based payments - - 744 - 1 745 - 745

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

35 - (4,603) 764 1 (3,803) (2,613) (6,416)

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

At 30 June 2023 (unaudited) 13,798 2,281 378,213 8,246 (966) 401,572 3,847 405,419

------------------------------------- ------ ----- ------- ----- ------- ------- ------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

for the half year ended 30 June 2023

Half year Half year Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------------------------- --------- --------- -----------

Cash flows from operating activities

Cash generated from operations 6,140 518 (16,549)

Interest paid (1,949) (549) (1,829)

Tax paid (930) (1,030) (2,918)

----------------------------------------------------------- --------- --------- -----------

Net cash flows from operating activities 3,261 (1,061) (21,296)

----------------------------------------------------------- --------- --------- -----------

Cash flows from investing activities

Purchase of property, plant and equipment (926) (335) (971)

Purchase of investment property (6,975) 283 (9,301)

Purchase of investment in associate - - (2,112)

Proceeds on disposal of property, plant and equipment

(excluding assets held for hire) 21 184 10,987

Proceeds on disposal of assets held for hire - - 270

Proceeds on disposal of investment properties 1,013 - 8,146

Repayment of loans from joint ventures and associates - 2,483 10,904

Advances to joint ventures and associates (6,752) (2,101) (8,560)

Proceeds on disposal of investment in joint ventures - - 6,873

Distributions received from joint ventures and

associates - 6,960 7,160

Interest received 1,299 372 1,153

Net cash flows from investing activities (12,320) 7,846 24,549

----------------------------------------------------------- --------- --------- -----------

Cash flows from financing activities

Proceeds from shares issued 801 410 769

Movement in payables from joint ventures and associates 4 358 355

Decrease in borrowings (15,000) (30,000) (70,000)

Increase in borrowings 35,000 40,000 85,000

Principal element of lease payments (648) (339) (679)

Dividends

paid - ordinary shares (5,336) (4,822) (8,362)

- non-controlling interests (2,614) (1,971) (4,030)

- preference shares (11) (11) (21)

---------------------------------------------------------- --------- --------- -----------

Net cash flows from financing activities 12,196 3,625 3,032

----------------------------------------------------------- --------- --------- -----------

Net increase in cash and cash equivalents 3,137 10,410 6,285

Net cash and cash equivalents at beginning of period 17,401 11,116 11,116

----------------------------------------------------------- --------- --------- -----------

Net cash and cash equivalents at end of period 20,538 21,526 17,401

----------------------------------------------------------- --------- --------- -----------

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

for the half year ended 30 June 2023

1. GENERAL INFORMATION

The Company is a public limited company, listed on the London

Stock Exchange and incorporated and domiciled in the United

Kingdom. The address of its registered office is Banner Cross Hall,

Ecclesall Road South, Sheffield, United Kingdom, S11 9PD.

The financial information set out above does not comprise

statutory accounts within the meaning of Section 434 of the

Companies Act 2006 and is neither audited nor reviewed. The

Financial Statements for the year ended 31 December 2022, which

were prepared in accordance with UK-adopted International

Accounting Standards, have been reported on by the Group's auditors

and delivered to the Registrar of Companies. The Independent

Auditors' Report was unqualified and did not contain any statement

under Section 498 of the Companies Act 2006.

2. Basis of preparation and accounting policies

The half-yearly financial information has been prepared in

accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority and with UK adopted International

Accounting Standard IAS 34 'Interim Financial Reporting'.

The half-yearly financial information has been prepared using

the same accounting policies and methods of computation as compared

with the annual Financial Statements for the year ended 31 December

2022.

A number of other standards, amendments and interpretations

became effective from 1 January 2023, which do not have a material

impact on the Group's financial statements or accounting

policies.

Prior year restatements

Amounts owed by joint ventures and associates

Amounts owed by joint ventures and associates have been restated

for the period ended 30 June 2022. The Group previously recognised

amounts owed by joint ventures and associates as being entirely due

within one year on the basis these amounts were repayable on

demand. Following a review of the Group's historic practice and

future plans not to call on all intercompany receivables in the

short term, GBP22,824,000 of amounts owed by joint ventures and

associates at 30 June 2022 have been reclassified to non-current in

line with IAS 1. There is no impact on the Consolidated Statement

of Comprehensive Income, Statement of Changes in Equity or

Statement of Cash Flows.

Government loans

The Group's borrowings and trade receivables have been restated

for the period ended 30 June 2022. The Group previously recognised

a government loan payable to the Homes and Communities Agency (HCA)

amounting to GBP2,941,000 and a corresponding trade receivable from

the related housebuilder. Following legal guidance on the nature of

the agreement it has been concluded that the Group has no residual

obligation to the HCA in respect of the loan which is payable

directly by the related housebuilder and therefore no rights to

receive a corresponding trade receivable from the related

housebuilder. This has resulted in previously reported borrowings

reducing by GBP2,941,000 and trade receivables decreasing by the

same. There is no impact on the Consolidated Statement of

Comprehensive Income, Statement of Changes in Equity or Statement

of Cash Flows.

Going Concern

The Group meets its day-to-day working capital requirements

through a secured loan facility. The facility was renewed on 23

January 2020, at a level of GBP75m, for a period of three years and

extended by one year in January 2021 and a further year in January

2022 taking the facility renewal to 23 January 2025 on the same

terms as the existing agreement. The facility includes an accordion

to increase the facility by up to GBP30m, which was called on by

the Group on 9 October 2022, increasing the overall facility to

GBP105m.

The Directors have considered the Group's principal risk areas,

including the risk of continued economic slowdown, that they

consider material to the assessment of going concern.

The Directors have prepared forecasts to 31 December 2024

covering a base case and severe downside scenario.

Having conducted significant stress testing at the year-end they

have further considered the outcome of our half year position and

their latest forecasts, whilst taking into account the current

trading conditions, the markets in which the Group's businesses

operate and associated credit risks together with the available

committed banking facilities and the potential mitigations that can

be taken, to protect operating profits and cash flows.

The severe downside scenario considered includes short-term

curtailment in transactional activity and percentage reductions in

other activities mirroring recent downturn experiences. This is

followed by a short to medium-term recovery, coupled with the

ability to manage future expenditure as described in the 2022

Annual Report.

As reported in the 2022 Annual Report, the most sensitive

covenant in our facilities relates to the ratio of EBIT (Earnings

Before Interest and Tax) on a 12-month rolling basis to senior

facility finance costs. Our downside modelling, which reflects a

near 50% reduction in revenue and near 67% reduction in profit

before tax from our base case for 2023, demonstrates significant

headroom over this covenant throughout the forecast period to the

end of December 2024.

Their review supports the view that the Group will have adequate

resources, liquidity and available bank facilities to continue in

operational existence for the foreseeable future. Accordingly, they

continue to adopt the going concern basis of accounting in

preparing the half-yearly financial information.

Estimates and Judgements

The preparation of half-yearly financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expense. Actual results

may differ from these estimates.

In preparing these half-yearly financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the Consolidated Financial

Statements for the year ended 31 December 2022.

Goodwill

Goodwill is subjected to an impairment test at the reporting

date or when there has been an indication that the goodwill should

be impaired, any loss is recognised immediately through the

Consolidated Statement of Comprehensive Income and is not

subsequently reversed.

3. Segment information

For the purpose of the Board making strategic decisions, the

Group is currently organised into three operating segments:

Property Investment and Development; Land Promotion; and

Construction. Group overheads are not a reportable segment;

however, information about them is considered by the Board in

conjunction with the reportable segments.

Operations are carried out entirely within the United

Kingdom.

Inter-segment sales are charged at prevailing market prices.

The accounting policies of the reportable segments are the same

as the Group's accounting policies as detailed above.

Segment profit represents the profit earned by each segment

before tax and is consistent with the measure reported to the

Group's Board for the purpose of resource allocation and assessment

of segment performance.

Half year ended 30 June 2023 Unaudited

-----------------------------------------------------------------------

Property

investment

and Land Group

development promotion Construction overheads Eliminations Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ----------- --------- ------------ --------- ------------ --------

Revenue

External sales 71,517 52,645 55,594 - - 179,756

Inter-segment sales 144 - 585 156 (885) -

--------------------------------- ----------- --------- ------------ --------- ------------ --------

Total revenue 71,661 52,645 56,179 156 (885) 179,756

--------------------------------- ----------- --------- ------------ --------- ------------ --------

Gross profit/(loss) 11,117 21,143 8,467 134 (14) 40,847

Other income 4,800 - - - - 4,800

Administrative expenses (8,297) (4,168) (4,087) (4,293) 14 (20,831)

Other operating income/(expense) 872 (3) - - - 869

--------------------------------- ----------- --------- ------------ --------- ------------ --------

Operating profit/(loss) 8,492 16,972 4,380 (4,159) - 25,685

Finance income 4,219 529 229 140 (3,348) 1,769

Finance costs (2,455) (263) (217) (2,163) 2,603 (2,495)

Profit/(loss) before

tax 10,256 17,238 4,392 (6,182) (745) 24,959

Tax (2,338) (4,076) (1,098) 1,707 - (5,805)

--------------------------------- ----------- --------- ------------ --------- ------------ --------

Profit/(loss) for the

period 7,918 13,162 3,294 (4,475) (745) 19,154

--------------------------------- ----------- --------- ------------ --------- ------------ --------

Half year ended 30 June 2022 Unaudited

-----------------------------------------------------------------------

Property

investment

and Land Group

development promotion Construction overheads Eliminations Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ----------- --------- ------------ --------- ------------ --------

Revenue

External sales 56,837 24,741 62,836 - - 144,414

Inter-segment sales 145 - 3,685 214 (4,044) -

------------------------ ----------- --------- ------------ --------- ------------ --------

Total revenue 56,982 24,741 66,521 214 (4,044) 144,414

------------------------ ----------- --------- ------------ --------- ------------ --------

Gross profit/(loss) 13,042 20,409 10,368 85 (18) 43,886

Administrative expenses (7,233) (3,250) (4,040) (4,091) 18 (18,596)

Other operating income 13,835 - - - - 13,835

------------------------ ----------- --------- ------------ --------- ------------ --------

Operating profit/(loss) 19,644 17,159 6,328 (4,006) - 39,125

Finance income 724 310 482 5 (986) 535

Finance costs (740) (77) (190) (1,074) 1,198 (883)

Profit/(loss) before

tax 19,628 17,392 6,620 (5,075) 212 38,777

Tax (1,904) (3,304) (1,717) 854 - (6,071)

------------------------ ----------- --------- ------------ --------- ------------ --------

Profit/(loss) for the

period 17,724 14,088 4,903 (4,221) 212 32,706

------------------------ ----------- --------- ------------ --------- ------------ --------

Year ended 31 December 2022 Audited

-----------------------------------------------------------------------

Property

investment

and Land Group

development promotion Construction overheads Eliminations Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ----------- --------- ------------ --------- ------------ --------

Revenue

External sales 168,990 43,820 128,609 - - 341,419

Inter-segment sales 290 - 4,453 386 (5,129) -

------------------------ ----------- --------- ------------ --------- ------------ --------

Total revenue 169,280 43,820 133,062 386 (5,129) 341,419

------------------------ ----------- --------- ------------ --------- ------------ --------

Gross profit/(loss) 36,488 24,320 20,720 99 (37) 81,590

Administrative expenses (16,142) (6,971) (8,636) (8,743) 37 (40,455)

Other operating income 5,322 - - - - 5,322

------------------------ ----------- --------- ------------ --------- ------------ --------

Operating profit/(loss) 25,668 17,349 12,084 (8,644) - 46,457

Finance income 4,015 744 1,507 26,576 (31,201) 1,641

Finance costs (2,226) (213) (374) (3,373) 3,683 (2,503)

Profit/(loss) before

tax 27,457 17,880 13,217 14,559 (27,518) 45,595

Tax (3,411) (3,451) (2,771) 1,908 - (7,725)

------------------------ ----------- --------- ------------ --------- ------------ --------

Profit/(loss) for the

year 24,046 14,429 10,446 16,467 (27,518) 37,870

------------------------ ----------- --------- ------------ --------- ------------ --------

30 June 30 June 31 December

2022

2023 Restated(1) 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------ --------- ------------ -----------

Segment assets

Property investment and development 375,023 336,185 355,491

Land promotion 152,251 139,678 149,598

Construction 48,116 55,395 45,766

Group overheads 5,826 3,564 3,612

------------------------------------ --------- ------------ -----------

581,216 534,822 554,467

Unallocated assets

Retirement benefit assets 8,108 8,361 6,188

Deferred tax assets 249 332 249

Cash and cash equivalents 20,536 21,526 17,401

------------------------------------ --------- ------------ -----------

Total assets 610,109 565,041 578,305

------------------------------------ --------- ------------ -----------

Segment liabilities