Response to BPB Document

15 September 2005 - 2:00AM

UK Regulatory

RNS Number:2752R

Compagnie de Saint-Gobain

14 September 2005

Not for release, publication or distribution, in whole or in part, in, into or

from Australia, Canada or Japan

14 September 2005

Compagnie de Saint-Gobain

Cash Offer for BPB plc

Response to BPB's document

Compagnie de Saint-Gobain ("Saint-Gobain") notes that BPB plc ("BPB") has today

issued its formal defence document and has the following comments to make:

* Although the document contains considerable detail, Saint-Gobain was aware

of the key elements

* The document contains a profit forecast, which takes earnings per share

from a consensus of 44p per share1 immediately before the offer period to 47p

per share2 for the year to 31 March 2006, before taking into account the

impact of the proposed return of capital

* BPB's view that it should trade on a P/E multiple as high as 14.3x is very

surprising

* The peer group used by BPB to arrive at this multiple includes US

companies that have historically traded at substantially higher P/E multiples

to European companies. Saint-Gobain does not believe that the methodology

used by BPB is valid and believes a more appropriate current year P/E

multiple would be considerably lower

In summary, Saint-Gobain continues to believe that its offer of 720p per share

takes into account the quality and growth of BPB's business. The document

contains no information that suggests that BPB deserves a re-rating and indeed

validates Saint-Gobain's view that 720p per share fully and fairly values BPB.

Enquiries

Saint-Gobain (for analysts and investors)

Florence Triou-Teixeira, Head of IR Tel: +33 1 47 62 45 19

Alexandre Etuy, Deputy Head of IR Tel: +33 1 47 62 37 15

BNP Paribas (joint financial adviser to Saint-Gobain)

Thierry Dormeuil Tel: +33 1 42 98 12 34

Oliver Ellingham Tel: +44 20 7595 2000

UBS Investment Bank (joint financial adviser and broker to Saint-Gobain)

Charles-Henri Le Bret Tel: +33 1 48 88 30 30

Liam Beere Tel: +44 20 7567 8000

Brunswick (PR adviser to Saint-Gobain)

John Sunnucks Tel: +44 20 7404 5959

Sophie Fitton Tel: +44 20 7404 5959

Notes

1. Consensus immediately prior to the offer period is comprised of forecasts

from ABN Amro, Citigroup, CSFB, Deutsche Bank, DrKW, Merrill Lynch, Morgan

Stanley and Teather & Greenwood

2. Underlying pro forma earnings and EPS (diluted) of 50p less pro forma impact

assuming a capital return on 1 April 2005 of 3p

Copies of the Offer Document and the Form of Acceptance are available for

collection (during normal business hours) from Capita Registrars at PO Box 166,

The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TH.

Further information on Saint-Gobain is available on Saint-Gobain's website

www.saint-gobain.com.

Terms used in this announcement shall have the meaning given to them in the

Offer Document.

The Offer in the United States is made solely by the Offeror and neither BNP

Paribas, UBS nor any of their respective affiliates is making the Offer into the

United States.

The Saint-Gobain Directors and the Offeror Directors accept responsibility for

the information contained in this announcement. To the best of the knowledge and

belief of the Saint-Gobain Directors and the Offeror Directors (who have taken

all reasonable care to ensure that such is the case), the information contained

in this announcement for which they are responsible is in accordance with the

facts and does not omit anything likely to affect the import of such

information.

BNP Paribas and UBS are acting exclusively for Saint-Gobain and the Offeror in

connection with the Offer and no one else, and will not be responsible to anyone

other than Saint-Gobain and the Offeror for providing the protections afforded

to respective clients of BNP Paribas and UBS nor for providing advice in

relation to the Offer or any other matter referred to herein.

This announcement does not constitute an offer to sell or an invitation to

purchase any securities or the solicitation of an offer to buy any securities.

This information is provided by RNS

The company news service from the London Stock Exchange

END

RSPSFAFILSISEIU

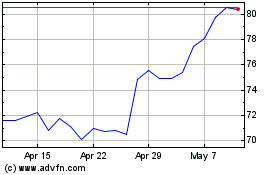

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Oct 2024 to Nov 2024

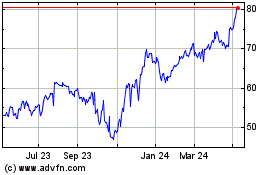

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Nov 2023 to Nov 2024