TIDMDIGI

RNS Number : 6234W

Digital Marketing Group PLC

23 November 2010

Date: 23 November 2010

On behalf of: Digital Marketing Group plc ("DMG", "the Company"

or "the Group")

Embargoed: 0700hrs

Digital Marketing Group plc

Interim Results 2010/2011

Digital Marketing Group plc (AIM: DIGI), the UK's largest

digital marketing agency, today announced its interim results for

the six months ended 30 September 2010.

Performance Highlights

-- Gross profits GBP17.90m (2009: GBP17.44m)

-- EBITDA before share based payments GBP2.47m (2009:

GBP3.63m)

-- Profit before tax ("PBT") before amortisation and share based

payment charges GBP1.95m (2009: GBP2.93m)

-- Profit after tax GBP0.32m (2009: GBP0.14m)

-- Net debt GBP6.07m (GBP7.26m 31 March 2010); undrawn banking

facilities of GBP3.28 million

-- Adjusted basic earnings per share 1.57 pence (2009: 3.20

pence)

-- Basic earnings per share 0.42 pence (2009: 0.20 pence)

Commenting on the results, Stephen Davidson, Chairman of Digital

Marketing Group plc, said: "We continue to operate in a difficult

and uncertain market place however we have still produced positive

results with an increase in profit after tax and reduced debt."

Ben Langdon, Chief Executive of Digital Marketing Group plc,

added: "The results for the six months are reflective of a mixed

performance. Our ecommerce division delivered exceptional growth in

profits of 28% yr/yr. Voice marketing also delivered strong levels

of new business and achieved significant growth in both gross

profits and PBT yr/yr. Conversely, our data services division

continues to underperform."

"We have reduced the number of office locations in our marketing

agency division and this will show positive results through

efficiency and resource allocation for the benefit of clients."

"We are in a strong position to take advantage of recoveries

within our market and should also continue to see organic growth

within our ecommerce division."

Enquiries:

Digital Marketing Group plc

Ben Langdon, Chief Executive

Keith Sadler, Group Finance Director

finnCap

Tom Jenkins/Sarah Wharry 020 7600 1658

INTERIM RESULTS

Our profit before tax for the six months ended 30 September 2010

was GBP0.6 million compared to GBP0.7 million for the six months

ended 30 September 2009 and our profit after tax, as a result of a

reduced tax charge, increased from GBP0.1 million to GBP0.3

million. Gross profits increased from GBP17.4 million to GBP17.9

million.

The performance from our ecommerce division has continued to

produce excellent results. Gross profit has increased by 68% and

profit before tax has increased by 28%. This reflects a movement in

the retail sector to establish business critical systems for their

online offering. Our team are strategically placed to take

advantage of this shift. They are a Tier 1 IBM reseller for IBM's

global leading ecommerce platform, Websphere.

As I stated in the annual report and accounts, recovery in our

DMG pillar and in particular our data services division is linked

to the speed of recovery in financial services and we have still to

see any signs of improvement in this sector. In addition,

continuing delays in client decisions within our marketing agency

division has meant our new business conversion has not been as we

had anticipated.

During the period we received partial settlement on a

contractual obligation from a client who has gone into liquidation,

amounting to GBP0.9 million, which has been disclosed within other

income.

Operating expenses increased as a result of the increase in

staff costs within our ecommerce business in order to deliver the

successful increase in its revenues. We have consolidated the 20:20

agency business around our largest office based in Newbury,

Berkshire, which has resulted in the closure of the Bristol office

and the relocation of a number of staff from our Swindon office.

This will mean a more efficient process and allocation of resource

to client assignments.

Net debt has been reduced by GBP1.2 million in the six months to

30 September 2010 to GBP6.1 million. The cost of financing this

debt has fallen from GBP375,000 for the six months ended 30

September 2009 to GBP256,000 for the six months under review.

Recent client wins include Royal Bank of Scotland, Promethean,

Homeserve Weight Watchers and Informa World.

Outlook

There is still uncertainty within our market sector which is

delaying our return to significant growth. We are managing our cost

base robustly to ensure it is appropriate for the business but are

mindful of the fact that we need to invest to protect the assets

that we have. We expect to produce profitable operating results

above those reported in the first six months.

Ben Langdon

Chief Executive

22 November 2010

Consolidated Interim Statement of Comprehensive Income

(unaudited)

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2010 2009 2010

Note GBP'000 GBP'000 GBP'000

Revenue 4 22,494 24,701 48,464

Direct costs (4,596) (7,260) (13,004)

----------- ----------- ---------

Gross profit 17,898 17,441 35,460

Other operating income 856 1,133 1,709

Amortisation (967) (956) (1,938)

Operating expenses (16,937) (16,555) (36,108)

----------- ----------- ---------

Operating profit/(loss) 850 1,063 (877)

----------- ----------- ---------

Finance income 1 2 2

Finance costs (257) (377) (534)

----------- ----------- ---------

Net financing costs (256) (375) (532)

----------- ----------- ---------

Profit/(loss) before tax 594 688 (1,409)

Tax expense 5 (279) (552) (576)

----------- ----------- ---------

Profit/(loss) for the period

attributable to equity holders

of the parent 315 136 (1,985)

Other comprehensive income:

Cash flow hedging

Current year gains 53 57 65

----------- ----------- ---------

Total comprehensive income 368 193 (1,920)

----------- ----------- ---------

Earnings per ordinary share 6

- basic 0.42p 0.20p (2.88)p

- diluted 0.41p 0.18p (2.88)p

----------- ----------- ---------

Consolidated interim balance sheet (unaudited)

30 Sept 30 Sept 31 March

2010 2009 2010

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 1,759 1,816 1,752

Goodwill 44,330 46,973 45,653

Other intangible assets 13,387 15,435 14,272

--------- --------- ---------

59,476 64,224 61,677

--------- --------- ---------

Current assets

Inventories 210 154 212

Trade and other receivables 10,693 9,226 11,832

Cash and cash equivalents 9,239 11,421 7,399

--------- --------- ---------

20,142 20,801 19,443

--------- --------- ---------

Total assets 79,618 85,025 81,120

--------- --------- ---------

Liabilities

Current liabilities

Bank overdraft 7 (8,364) (9,783) (6,443)

Other interest bearing loans

and borrowings 7 (6,673) (1,691) (1,691)

Financial derivatives 8 (363) (424) (416)

Trade and other payables (9,954) (11,929) (12,741)

Tax payable (574) (1,518) (254)

Provisions (59) (58) (187)

--------- --------- ---------

(25,987) (25,403) (21,732)

--------- --------- ---------

Non-current liabilities

Other interest bearing loans

and borrowings 7 (275) (5,966) (6,522)

Deferred tax liabilities (3,868) (4,396) (4,133)

--------- --------- ---------

(4,143) (10,362) (10,655)

--------- --------- ---------

Total liabilities (30,130) (35,765) (32,387)

--------- --------- ---------

Net assets 49,488 49,260 48,733

--------- --------- ---------

Equity

Capital and reserves attributable

to equity holders of the

company

Share capital 34,050 33,689 34,026

Share premium account 6,608 6,608 6,608

Hedging reserve (363) (424) (416)

Capital redemption reserve 125 125 125

Share option reserve 395 5,810 419

Retained earnings 8,673 3,452 7,971

--------- --------- ---------

Total equity 49,488 49,260 48,733

--------- --------- ---------

Consolidated interim cash flow statement (unaudited)

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2010 2009 2010

Note GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Profit for the period 315 136 (1,985)

Adjustment for:

Depreciation, amortisation

and impairment 1,232 1,282 6,299

Loss on disposal of property,

plant and equipment - - 28

Movement in provision (128) - 40

Financial income (1) (2) (2)

Financial expenses 257 377 534

Share based payment expense 387 1,288 2,874

Tax expense 279 552 576

Decrease/(increase) in trade

and other receivables 1,114 1,509 (1,034)

Decrease/(increase) in

inventories 2 42 (16)

(Decrease) in trade and

other payables (1,477) (3,553) (2,543)

----------- ----------- ---------

Cash generated from operations 1,980 1,631 4,771

Interest received 1 2 2

Interest paid (207) (272) (482)

Tax paid (212) (826) (2,355)

----------- ----------- ---------

Net cash flow from operating

activities 1,562 535 1,936

----------- ----------- ---------

Cash flows from investing

activities

Proceeds from the sale of

property, plant and equipment - 3 4

Acquisitions of subsidiaries,

net of cash acquired - 7 (1,632)

Payment of contingent

consideration for prior year

acquisitions - (278) (600)

Addition of intangible assets (82) (275) (694)

Acquisition of property,

plant and equipment (272) (87) (301)

----------- ----------- ---------

Net cash outflow from investing

activities (354) (630) (3,223)

----------- ----------- ---------

Cash flows from financing

activities

Proceeds from new loan and

draw down of bank facilities - - 600

Repayment of borrowings (1,289) (1,688) (1,778)

Net cash outflow from financing

activities (1,289) (1,688) (1,178)

----------- ----------- ---------

Net decrease in cash, cash

equivalents and bank overdrafts (81) (1,783) (2,465)

Cash and cash equivalents

at beginning of period 956 3,421 3,421

----------- ----------- ---------

Cash and cash equivalents

at end of period 875 1,638 956

----------- ----------- ---------

Cash and cash equivalents

comprise:

Cash at bank and in hand 9,239 11,421 7,399

Bank overdrafts 7 (8,364) (9,783) (6,443)

----------- ----------- ---------

Cash and cash equivalents

at end of period 875 1,638 956

----------- ----------- ---------

Consolidated interim statement of changes in equity

(unaudited)

Share Capital Share

Share premium Hedging redemption option Retained Total

capital account reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

April 2009 33,689 6,608 (481) 125 5,810 2,028 47,779

-------- -------- -------- ----------- -------- --------- --------

Credit in

respect of

share based

payments - - - - - 1,288 1,288

Transactions

with owners - - - - - 1,288 1,288

-------- -------- -------- ----------- -------- --------- --------

Profit for the

period - - - - - 136 136

Other

comprehensive

income:

Cash flow

hedges - - 57 - - - 57

Total

comprehensive

income for

the period - - 57 - - 136 193

-------- -------- -------- ----------- -------- --------- --------

Balance at 30

September

2009 33,689 6,608 (424) 125 5,810 3,452 49,260

-------- -------- -------- ----------- -------- --------- --------

Allotment of

5p ordinary

shares 337 - - - (337) - -

Credit in

respect of

share based

payments - - - - - 1,586 1,586

Transfer to

share option

reserve - - - - (5,054) 5,054 -

Transactions

with owners 337 - - - (5,391) 6,640 1,586

-------- -------- -------- ----------- -------- --------- --------

Loss for the

period - - - - - (2,121) (2,121)

Other

comprehensive

income:

Cash flow

hedges - - 8 - - - 8

Total

comprehensive

income for

the period - - 8 - - (2,121) (2,113)

-------- -------- -------- ----------- -------- --------- --------

Balance at 31

March 2010 34,026 6,608 (416) 125 419 7,971 48,733

-------- -------- -------- ----------- -------- --------- --------

Allotment of

5p ordinary

shares 24 - - - (24) - -

Credit in

respect of

share based

payments - - - - - 387 387

Transactions

with owners 24 - - - (24) 387 387

-------- -------- -------- ----------- -------- --------- --------

Profit for the

period - - - - - 315 315

Other

comprehensive

income:

Cash flow

hedges - - 53 - - - 53

Total

comprehensive

income for

the period - - 53 - - 315 368

-------- -------- -------- ----------- -------- --------- --------

Balance at 30

September

2010 34,050 6,608 (363) 125 395 8,673 49,488

-------- -------- -------- ----------- -------- --------- --------

1. General Information

Digital Marketing Group plc (the "Company") is incorporated and

domiciled in the United Kingdom. The Company is listed on the AIM

market of the London Stock Exchange. The registered address is

30-33 Minories, Tower Hill, London, EC3N 1DD.

The interim financial information was approved for issue on 22

November 2010.

2. Basis of preparation

The consolidated interim financial statements for the six months

ended 30 September 2010 have been prepared in accordance with

applicable accounting standards and under the historical cost

convention except for certain financial instruments that are

carried at fair value.

The financial information for the year ended 31 March 2010 set

out in this interim report does not constitute statutory accounts

as defined in Section 434 of the Companies Act 2006. The Group's

statutory financial statements for the year ended 31 March 2010

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain statements under Section 498 (2) or Section 498 (3) of the

Companies Act 2006.

The consolidated interim financial information should be read in

conjunction with the annual financial statements for the year ended

31 March 2010, which have been prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union.

3. Accounting policies

Except as described below, the principal accounting policies of

Digital Marketing Group plc and its subsidiaries ("the Group") are

consistent with those set out in the Group's 2010 annual report and

financial statements.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The following new standards and amendments to standards are

mandatory for the first time for the financial year beginning 1

April 2010.

-- IAS 27 Consolidated and Separate Financial Statements

(Revised 2008) (effective 1 July 2009).

-- Amendment to IAS 39 Financial Instruments: Recognition and

Measurement - Eligible Hedged Items (effective 1 July 2009).

-- Group Cash-settled Share-based Payment Transactions -

Amendment to IFRS 2 (effective 1 January 2010).

-- IFRIC 17 Distributions of Non-cash Assets to Owners

(effective 1 July 2009).

-- IFRIC 18 Transfers of Assets from Customers (effective

prospectively for transfers on or after 1 July 2009).

-- Amendment to IAS 32 Classification of Rights Issues

(effective 1 February 2010).

4. Segment information (unaudited)

The chief operating decision-maker has been identified as the

Group Chief Executive. The Group Chief Executive reviews the

Group's internal reporting in order to assess performance and

allocate resources. Management has determined the operating

segments based on these reports. 20:20 provide full agency services

for clients on digital platforms together with ecommerce services.

DMG provide digital direct marketing, data and data related

services and voice services to clients.

The Group Chief Executive assesses the performance of the

operating segments based on gross profit and operating profit

before interest and tax.

Total assets exclude intangible assets, cash and external

borrowings which have not been allocated to operating segments.

No single client accounts for more than 10% of Group revenue.

All the Group's activities are carried out within the UK.

Six months ended 30

September 2010

20:20 DMG Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 15,113 7,845 (464) 22,494

Direct costs (4,192) (868) 464 (4,596)

----------- --------- ------------ ---------

Gross profit 10,921 6,977 - 17,898

Other operating income 3 853 - 856

Operating expenses excluding

depreciation, amortisation

and charges for share

based payments (9,055) (6,729) (501) (16,285)

----------- --------- ------------ ---------

Operating profit before

depreciation, amortisation

and charges for share

based payments 1,869 1,101 (501) 2,469

Depreciation (126) (138) (1) (265)

Amortisation (521) (446) - (967)

Charges for share based

payments (102) (70) (215) (387)

----------- --------- ------------ ---------

Operating profit 1,120 447 (717) 850

----------- --------- ------------

Finance income 1

Finance costs (257)

---------

Profit before tax 594

Tax expense (279)

---------

Profit for the period 315

---------

Six months ended 30

September 2009

20:20 DMG Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 14,377 10,594 (270) 24,701

Direct costs (6,463) (1,034) 237 (7,260)

-------- -------- ------------ ---------

Gross profit 7,914 9,560 (33) 17,441

Other operating income 5 1,128 - 1,133

Operating expenses excluding

depreciation, amortisation

and charges for share

based payments (6,557) (7,798) (586) (14,941)

-------- -------- ------------ ---------

Operating profit before

depreciation, amortisation

and charges for share

based payments 1,362 2,890 (619) 3,633

Depreciation (108) (206) (12) (326)

Amortisation (505) (451) - (956)

Charges for share based

payments 30 (274) (1,044) (1,288)

-------- -------- ------------ ---------

Operating profit 779 1,959 (1,675) 1,063

-------- -------- ------------

Finance income 2

Finance costs (377)

---------

Profit before tax 688

Tax expense (552)

---------

Profit for the period 136

---------

Year ended 31 March

2010

20:20 DMG Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 27,832 21,322 (690) 48,464

Direct costs (11,382) (2,160) 538 (13,004)

--------- --------- ------------ ---------

Gross profit 16,450 19,162 (152) 35,460

Other operating income 7 1,702 - 1,709

Operating expenses excluding

depreciation, amortisation

and charges for share

based payments (12,572) (15,511) (739) (28,822)

--------- --------- ------------ ---------

Operating profit before

depreciation, amortisation

and charges for share

based payments 3,885 5,353 (891) 8,347

Depreciation (204) (345) (25) (574)

Amortisation (1,010) (928) - (1,938)

Impairment (2,519) (1,254) (14) (3,787)

Charges for share based

payments (22) (1,381) (1,522) (2,925)

--------- --------- ------------ ---------

Operating profit 130 1,445 (2,452) (877)

--------- --------- ------------

Finance income 2

Finance costs (534)

---------

Loss before tax (1,409)

Tax expense (576)

---------

Loss for the period (1,985)

---------

Total assets 20:20 DMG Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000

30 September 2010 35,810 26,800 17,008 79,618

31 March 2010 35,175 27,707 18,238 81,120

30 September 2009 31,535 32,759 20,731 85,025

-------- -------- ------------ --------

5. Tax expense (unaudited)

A reconciliation of the charge that would result from applying

the standard UK corporation tax rate to profit before tax to the

tax charge is given below.

Year

Six months ended Six months ended ended

30 Sept 2010 30 Sept 2009 31 March 2010

GBP'000 GBP'000 GBP'000

Recognised in the

consolidated statement

of comprehensive

income:

Current year tax 544 870 1,134

Origination and

reversal of temporary

differences (265) (318) (558)

----------------- ----------------- --------------

Total tax charge 279 552 576

----------------- ----------------- --------------

Profit /(loss) before

tax 594 688 (1,409)

----------------- ----------------- --------------

Tax charge thereon at

UK corporation tax

rate of 28% (2009:

28%) 166 193 (395)

Effects of:

Non-deductible expenses - - 94

Impairment of goodwill - - 892

Share based payment

charges 108 361 804

Schedule 23 deductions - - (805)

Depreciation for period

in excess of capital

allowances - 28 -

Other 5 (67) (68)

Prior year adjustment - 37 54

----------------- ----------------- --------------

Total tax charge 279 552 576

6. Earnings per share (unaudited)

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2010 2009 2010

Pence per Pence per Pence per

share share share

Basic 0.42p 0.20p (2.88)p

Diluted 0.41p 0.18p (2.88)p

------------ ------------ ----------

Earnings per share have been calculated by dividing the profit

attributable to shareholders by the weighted average number of

ordinary shares in issue during the period. The calculations of

basic and diluted earnings per share are:

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2010 2009 2010

GBP'000 GBP'000 GBP'000

Profit/(loss) for the period

attributable to shareholders 315 136 (1,985)

----------- ----------- ----------

Weighted average number of Number Number Number

ordinary shares in issue: '000 '000 '000

Basic 74,237 67,378 69,010

Adjustment for share options,

warrants and contingent shares 3,149 7,001 6,935

----------- ----------- ----------

Diluted 77,386 74,379 75,945

----------- ----------- ----------

Adjusted earnings per share

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2010 2009 2010

Pence per Pence per Pence per

share share share

Basic adjusted earnings per 1.57 3.20p 8.77p

share

Diluted adjusted earnings 1.50 2.90p 7.97p

per share

----------- ----------- ----------

Adjusted earnings per share have been calculated by dividing the

profit attributable to shareholders before amortisation, impairment

and charges for share based payments by the weighted average number

of ordinary shares in issue during the period. The numbers used in

calculating the basic and diluted adjusted earnings per share are

reconciled below:

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2010 2009 2010

GBP'000 GBP'000 GBP'000

Profit/(loss) before tax 315 688 (1,409)

Amortisation 967 956 1,938

Impairment of carrying value

of goodwill and intangibles - - 3,787

Charges for share based payments 425 1,383 2,874

----------- ----------- ---------

Adjusted profit attributable

to shareholders 1,707 3,027 7,190

Current period tax charge (544) (870) (1,134)

----------- ----------- ---------

1,163 2,157 6,056

----------- ----------- ---------

7. Bank overdraft, borrowings and loans (unaudited)

30 Sept 30 Sept 31 March

2010 2009 2010

Summary GBP'000 GBP'000 GBP'000

Bank overdraft 8,364 9,783 6,443

Borrowings, undiscounted

cash flows 6,948 7,657 8,213

-------- -------- ---------

15,312 17,440 14,656

-------- -------- ---------

Borrowings are repayable

as follows:

Within 1 year

Bank overdraft 8,364 9,783 6,443

Borrowings 6,822 1,848 1,865

-------- -------- ---------

Total due within 1 year 15,186 11,631 8,308

Less future interest (149) (157) (174)

-------- -------- ---------

Total due within 1 year 15,037 11,474 8,134

-------- -------- ---------

In more than 1 year but not

more than 2 years 276 1,812 6,596

In more than 2 years but

not more than 3 years - 4,284 -

Total due in more than 1

year 276 6,096 6,596

Less future interest (1) (130) (74)

-------- -------- ---------

Total due in more than 1

year 275 5,966 6,522

-------- -------- ---------

Average interest rates at

the balance sheet date were: % % %

Overdraft 2.75 5.00 2.75

Term loan 2.04 1.85 1.96

Term loan 2.54 3.35 2.46

Revolving credit facility 2.35 2.32 2.33

-------- -------- ---------

As the loans are at variable market rates their carrying amount

is equivalent to their fair value.

In 2007 the Group purchased an interest rate swap of 6.19% for

the period 2007 to 2012 for GBP4.0 million of its borrowings.

The borrowing facilities available to the Group at 30 September

2010 was GBP10.36 million (2009: GBP11.13 million) and, taking into

account cash balances within the Group, there was GBP3.28 million

(2009: GBP3.28 million) of available borrowing facilities.

A composite accounting system is set up with the Group's

bankers, which allows debit balances on overdraft to be offset

across the Group with credit balances.

Cash at

Reconciliation of net bank and

debt in hand Overdraft Borrowings Net debt

GBP'000 GBP'000 GBP'000 GBP'000

30 September 2010 9,239 (8,364) (6,948) (6,073)

31 March 2010 7,399 (6,443) (8,213) (7,257)

30 September 2009 11,421 (9,783) (7,657) (6,019)

---------- ---------- ----------- ---------

8. Financial derivatives (unaudited)

30 Sept 30 Sept 31 March

2010 2009 2010

GBP'000 GBP'000 GBP'000

Interest rate swap 363 424 416

-------- -------- ---------

In 2007 the Group purchased an interest rate swap of 6.19% for

the period 2007 to 2012 for GBP4.0 million of its borrowings. This

swap is designated a hedge of the interest expense relating to the

Group loans. The contract was marked to market at 30 September 2010

and was a net liability of GBP363,000 (2009: GBP424,000).

9. Provisions (unaudited)

30 Sept 30 Sept 31 March

2010 2009 2010

GBP'000 GBP'000 GBP'000

At the beginning of the period 187 147 147

Additional provisions for

restructuring - - 187

Utilised during the year (128) (89) (147)

-------- -------- ---------

At the end of the period 59 58 187

-------- -------- ---------

Provisions relate to leases in the Group where the commercial

benefit has either ceased or will cease before the normal expiry

period.

10. Share capital (unaudited)

Authorised:

45p deferred shares 5p ordinary shares

GBP'000 GBP'000

Authorised share capital

at 31 March 2010 and

30 September 2010 45,000 10,000

Allotted, issued and fully paid

45p deferred 5p ordinary

shares shares

Number Number GBP'000

Issued share capital

at 31 March 2010 67,378,520 74,121,505 34,026

Allotment of 5p ordinary

shares - 483,494 24

--------------- -------------- ----------

At 30 September 2010 67,378,520 74,604,999 34,050

--------------- -------------- ----------

The shares issued in the period were as a result of the exercise

of share options by employees and directors.

11. Related party transactions (unaudited)

There were no significant changes in the nature and size of

related party transactions for the period from those disclosed in

the Annual Report for the year ended 31 March 2010.

INDEPENDENT REVIEW REPORT TO DIGITAL MARKETING GROUP PLC

Introduction

We have been engaged by the company to review the interim

financial information in the interim report for the six months

ended 30 September 2010 which comprises the consolidated interim

statement of comprehensive income, the consolidated interim balance

sheet, the consolidated interim cash flow statement and the

consolidated interim statement of changes in equity and the related

notes 1 to 11. We have read the other information contained in the

interim financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the interim

financial information.

This report is made solely to the company in accordance with

guidance contained in ISRE (UK and Ireland) 2410, "Review of

Interim Financial Information performed by the Independent Auditor

of the Entity". Our review work has been undertaken so that we

might state to the company those matters we are required to state

to them in a review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company, for our review work, for this

report, or for the conclusion we have formed.

Directors' responsibilities

The interim report is the responsibility of, and has been

approved by, the directors. The AIM rules of the London Stock

Exchange require that the accounting policies and presentation

applied to the interim financial information are consistent with

those which will be adopted in the annual accounts having regard to

the accounting standards applicable for such accounts.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The interim financial information in the interim

report has been prepared in accordance with the basis of

preparation in note 2.

Our responsibility

Our responsibility is to express to the company a conclusion on

the interim financial information in the interim report based on

our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial information in the

interim report for the six months ended 30 September 2010 is not

prepared, in all material respects, in accordance with the basis of

accounting described in note 2.

Grant Thornton UK LLP

Chartered Accountants

Sheffield

22 November 2010

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGGMCGUPUGMP

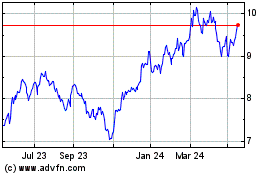

Gblbalfaccusd (LSE:DIGI)

Historical Stock Chart

From Jan 2025 to Feb 2025

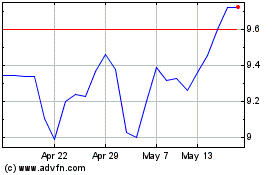

Gblbalfaccusd (LSE:DIGI)

Historical Stock Chart

From Feb 2024 to Feb 2025