TIDMDPP

RNS Number : 5896N

DP Poland PLC

26 September 2023

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

DP Poland plc

("DP Poland", the "Group" or the "Company")

Interim Results for the Period Ended 30 June 2023 and Trading

Update

DP Poland, the operator of Domino's pizza stores and restaurants

across Poland and Croatia, is pleased to announce its unaudited

results for the six months ended 30 June 2023.

Unaudited Financial Information

Currency: GBP000 H1 2023 H1 2022 % change

Group System Sales 21,386 17,098 25.1%

-------- -------- ---------

Group Revenue 20,960 16,575 26.5%

-------- -------- ---------

EBITDA* 1,051 388 171.2%

-------- -------- ---------

EBITDA*(Pre-IFRS

16) (720) (1,130) 36.3%

-------- -------- ---------

EBITDA margin

% 5.02% 2.34%

-------- -------- ---------

Loss for the period (1,592) (2,200) 27.6%

-------- -------- ---------

* excluding non-cash items, non-recurring items and store

pre-opening expenses

Financial highlights

-- Overall Group revenue increased by 26.5% to GBP21.0m (H1

2022: GBP16.6m), including Croatia.

-- Poland revenue increased by 21.0% to GBP20.1m (H1 2022: GBP16.6m)

-- Group system sales were up 25.1% to GBP21.4m including Croatia (H1 2022: GBP17.1m)

-- Poland system sales increased by 14.9% to PLN 108.1m (H1 2022: PLN 94.1m)

o Strong Poland LFL revenue growth of 18.0% in H1 2023 compared

to H1 2022 driven by increased order count (11.3%) and average

ticket price (5.8%)

o Growth of delivery and non-delivery Poland LFL System Sales of

15.8% and 22.6%, respectively, compared to prior period

-- Group EBITDA increased by 171.2% to GBP1.1m (H1 2022: GBP0.4m)

-- Group loss before tax improved from GBP(2.2)m for H1 2022 to GBP(1.6)m for H1 2023

-- Cash at bank of GBP2.7m as at 30 June 2023 (GBP1.7m as at 30 June 2022)

Operational highlights

-- The Group operated 116 stores at the end of June 2023,

including 112 Domino's Pizza stores across Poland and 4 across

Croatia

-- One new store was opened in Poland and one in Croatia in the

first half of 2023. At the same time, four ex-Dominium stores have

been upgraded to Domino's standards and two stores were closed as

part of the store network optimisation plan

-- Average delivery times reduced by 13.0% in H1 2023 (vs H1

2022), resulting in improved Net Promoter Scores and customer

satisfaction

-- Further development of digital capabilities

-- Mitigating actions were taken in H1 to reduce the impact of

inflationary pressures particularly in food and energy which have

now begun to ease, however, labour inflationary pressures have

remained

Nils Gornall, CEO, commented:

"H1 2023 saw the company move into positive store EBITDA and I

am confident that we can build on this in the second half of the

year. Delivery times are coming down, which are driving improved

customer satisfaction and increased orders which are now regularly

exceeding 700 orders per store per week. Driving order count higher

is our prime objective in the second half as this is a key driver

of consistent and improved profitability.

The results we have achieved position the Company firmly for

ongoing market share expansion. This growth will be fueled by

continued operational excellence, enhancing our digital solutions

for customer orders and internal processes, and maintaining an

unwavering commitment to our customer value proposition. We

anticipate that these efforts will lead to the creation of new

sales records for the Company, and continued improvement in

EBITDA".

Post period end trading update

Polish trading remains strong with double digit sales and order

count LFL growth. In July and August, Polish LFL sales grew by

10.6% and 17.3%, respectively, compared to 2022, with the growth

split evenly between sales channels. Performance in the first half

of September has so far been strong.

In the year to August 2023, the Polish market has seen

double-digit revenue growth compared to 2022:

-- 16.9% increase in LFL System Sales

o 18.9% LFL non-delivery revenue growth

o 15.7% LFL delivery revenue growth

-- 12.3% increase in total System Sales, despite a reduction of 8 store locations vs 2022

The Croatian market has been impacted by inflationary pressures

and consumers enjoying the summer on the coast where we are not

currently present. This resulted in LFL sales growth in July and

August of (14,0%) and 0.1%, respectively, compared to 2022.

Overall, the addition of one new store resulted in system sales

growth of 10.9% and 25.5% in July and August, respectively, versus

the prior year.

In the year to August 2023, Croatia grew system sales 35.9% and

LFL sales 4.4% with the prospects for September and the rest of the

year looking encouraging.

We expect to deliver a solid performance for the Group in Q3 and

to be in line with expectations for Q4. In the coming months, we

expect to open another two stores in Poland and one store in

Croatia, further improve our cost position through additional cost

saving initiatives and driving market share.

Investor Presentation

The Company is pleased to announce that Nils Gornall and Edward

Kacyrz will provide a live presentation relating to the Interim

Results via Investor Meet Company on 27th Sep 2023 at 3:00pm

BST.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet DP POLAND PLC via:

https://www.investormeetcompany.com/dp-poland-plc/register-investor

Investors who already follow DP Poland plc on the Investor Meet

Company platform will automatically be invited.

Enquiries:

DP Poland plc

Nils Gornall, CEO

Tel: +44 (0) 20 3393 6954

Email: ir@dppoland.com

Singer Capital Markets (Nominated Adviser and Broker)

Shaun Dobson

Tel: +44 (0) 20 7496 3000

Notes for editors

About DP Poland plc

DP Poland, has the exclusive right to develop, operate and

sub-franchise Domino's Pizza stores in Poland and Croatia. The

group operates 116 stores and restaurants throughout cities and

towns in Poland and Croatia.

Chief Executive Officer's Review

After twelve months of leading DP Poland plc, it is a great

pleasure to share with you insights to visibly improving

performance of the Company, which prove that the proposed

transformation strategy for the Company is working, despite

challenging market conditions, predominantly related to

inflationary pressures visible in food, labour and utility

cost.

I feel confident that current results and Company setup build

strong foundations for further Company growth. Supported by an

energised team, we will enter into the second stage of our

transformation plan, concentrating on further company expansion and

transition towards a franchisee model, which allows us to

capitalise on the opportunity to grow market share and sales

volumes under our High-Volume Mentality.

Store performance

The Company has seen strong top line performance in the first

six months of 2023, recording 18.0% and 10.2% LFL system sales

growth in Poland and Croatia, respectively, compared to the prior

year. At the same time, Company total system sales grew by more

than 25% year-on-year, driven by the third store opening in Croatia

and store network optimization in Poland. The sales growth vs.

prior year was achieved through a combination of (i) 11.3% growth

in order count in Poland; (ii) continued simultaneous dynamic

growth in both delivery and non-delivery channels, and (iii)

improved product quality and reduced delivery times in both

markets.

In Poland, a Q1'23 TV campaign targeting the carry-out offering

helped deliver a 22.6% year-on-year growth, and delivery sales

continued growing at double-digits, delivering a 15.8% year-on-year

growth.

In Croatia, the transition of the Croatian currency from the

Kuna to the Euro at the beginning of 2023 contributed to weaker

sales in January, whilst also impacting higher inflation. However,

the market returned to strong double-digit LFL sales growth from

February, delivering 10.2% year-on-year growth in H1 and average

weekly order count per store exceeded 1,100, which sets an

aspirational benchmark for the Polish market.

Value for money

In the current trading environment, our focus on providing the

consumer with the best value-for-money is essential for building

market share and, thus, our strong value message together with

delivery promise is key to success.

We aim to attract and retain new consumers with a strong

pipeline of promotions, new pizzas and sides to increase frequency

of purchase. We started the year with the compelling offer for

carry-out and delivery, medium pizzas for 19.99PLN and 24.99PLN,

respectively. This drew new customers to Domino's, a key factor in

the ongoing sales momentum we've experienced this year. In the

second quarter, we focused on product quality and our menu offering

by upgrading recipes with additional ingredients, launching new

menus purely dedicated for the dine-in channel as well as

implementing one-topping pizzas with the entry price points at

17.99PLN for a medium pizza. Our promotions have proved successful

with consumers and the changes made in the portfolio mix have

started contributing positively to the Company performance.

In H1 2023 we continued to improve on the pizza delivery

process, adding eBikes and rejuvenating our scooter fleet , which

allowed us to substantially shorten our delivery times by 13%

year-on-year to around 25 minutes. As a direct result of these

initiatives, we have seen an improving Net Promoter Score. Although

our delivery times are already at the European average for Dominos

stores in the coming year we are introducing GPS technologies to

improve driver route planning to further reduce delivery times to

22 minutes.

Input cost inflation and mitigating action

High inflation in labour, energy and food costs over the last

two years has had an adverse implication on the restaurant sector

in the region. In Q2 2023, high inflation in energy and food have

started to abate, however, labour rates are still under

inflationary pressures.

In the first half of the year, we have worked hard to mitigate

against these inflationary pressures through renegotiating supply

chain contracts and reducing distribution costs to our stores.

Additionally, we have improved labour efficiency by implementing

the 'Tanda' scheduling system across our entire store network,

which resulted in visible labour costs reduction and allowed us to

remain competitive on our pizza prices. These actions have made our

Company much more resistant to economic fluctuations and put us in

a strong position to grow market share.

We expect to further improve our cost position in the second

half of the year through additional cost saving initiatives.

Digital

In the past six months, we've witnessed a substantial leap in

our digital capabilities. The Company has focused on further

development of the mobile app and improvements in the webpage

layout to enhance the consumer experience at every touchpoint with

Domino's. This has resulted in a faster ordering process and higher

basket values. Overall sales growth through the mobile app almost

quadrupled year-on-year and app downloads have doubled.

Additionally, customers' consents for text messages have grown 20%

and consents for email marketing have grown 44%. Digital orders now

account for 89% of all delivery orders and we are well on our way

to our 90% target. Towards the end of the year, we plan to launch a

dine-in self-ordering solution via mobile app and trial

self-ordering kiosks for carry-out and dine-in customers.

At the beginning of 2023 we upgraded our ERP system bringing us

closer towards a paperless organisation. This change has been

followed with the introduction of a digital approval process (Q2

2023), and in the coming months will be supplemented with automatic

bookings and cash reconciliation processes - all for the purpose of

simplified and integrated accounting and controlling.

Outlook

We have made a strong start to the second half of the year and

expect to see a continued improvement in profitability as we grow

our sales. We are confident that the drive for order growth and

network expansion is the key to success and will soon bring us to a

pre-IFRS 16 positive EBITDA.

The improvement of business profitability and positive cash flow

is the prime goal for the entire team. Demonstrating consistently

profitable stores will enable us to move to the second stage of

planned transformation and accelerate the growth of our stores'

portfolio using the franchise model to become the market leader in

Poland over the next 3-5 years with 250+ stores.

FINANCIAL STATEMENTS

Group Income Statement

for 6 months to 30.06.2023

Unaudited Unaudited Audited

6 months 6 months Year to

to 30.06.2023 to 30.06.2022 31.12.2022

Notes GBP GBP GBP

Revenue 2 20,959,825 16,575,350 35,694,098

Direct Costs (16,345,959) (13,529,067) (28,312,921)

Selling, general and administrative

expenses - excluding:

store pre-opening expenses, depreciation,

amortisation and share based payments (3,562,483) (2,658,585) (5,687,720)

Group adjusted EBITDA - excluding

non-cash items, non-recurring items

and store pre-opening expenses 1,051,383 387,698 1,693,457

Store pre-opening

expenses - (32,894) (37,584)

Other non-cash and non-recurring

items 191,282 23,035 (500,971)

Depreciation and amortisation (2,406,520) (2,079,335) (4,336,210)

Share based payments

(1) (198,483) - (137,748)

Foreign exchange gains /

(losses) 290,825 276,382 17,406

Finance income 13,199 11,648 257,984

Finance costs (499,865) (786,469) (1,258,850)

Loss before taxation (1,558,179) (2,199,935) (4,302,516)

------ --------------- --------------- -------------

Taxation (2) 3 (33,806) - (57,429)

Loss for the period (1,591,985) (2,199,935) (4,359,945)

------ --------------- ---------------

Loss per share Basic 4 (0.22 p) (0.38 p) (0.67 p)

Diluted 4 (0.22 p) (0.38 p) (0.67 p)

(1, 2) - share based payments and taxation for 6 months to

30.06.2022 have not been included into Group income statement due

to the amount being immaterial

All the loss for the year is attributable to the owners of the

Parent Company.

Group Statement

of comprehensive income

for 6 months to 30.06.2023

Unaudited Unaudited Audited

6 months 6 months Year

to 30.06.2023 to 30.06.2022 to 31.12.2022

GBP GBP GBP

------------------------------------------ --------------- --------------- ---------------

Loss for the period (1,591,985) (2,199,935) (4,359,945)

Currency translation differences (192,317) 11,380 (333,785)

--------------------------------------------

Other comprehensive expense for the

period, net of tax to be reclassified

to profit or loss in subsequent periods (192,317) 11,380 (333,785)

-------------------------------------------- --------------- ---------------

Total comprehensive income for the

period (1,784,302) (2,188,555) (4,693,730)

-------------------------------------------- --------------- --------------- ---------------

All of the comprehensive expense for the year is attributable to

the owners of the Parent Company.

Group Balance Sheet

on 30 June 2023

Unaudited Unaudited Audited

30.06.2023 30.06.2022 31.12.2022

GBP GBP GBP

------------------------------- ------------- ------------- -------------

Non-current assets

Goodwill 15,179,109 15,016,129 15,111,002

Intangible assets 3,528,313 1,969,417 3,714,479

Property, plant and equipment 6,669,521 5,915,292 6,645,301

Leases - right of

use assets 6,678,007 7,512,357 6,472,965

Trade and other

receivables 848,060 800,448 822,042

--------------------------------- ------------- ------------- -------------

32,903,010 31,213,643 32,765,789

Current assets

Inventories 852,198 522,300 982,110

Trade and other receivables 2,017,944 1,354,550 1,966,987

Cash and cash equivalents 2,715,746 1,730,716 4,110,322

--------------------------------- ------------- ------------- -------------

5,585,888 3,607,566 7,059,419

Total assets 38,488,898 34,821,209 39,825,208

--------------------------------- ------------- ------------- -------------

Current liabilities

Trade and other payables (5,341,623) (5,415,603) (5,343,028)

Lease liabilities (2,990,580) (2,813,656) (2,834,336)

--------------------------------- ------------- ------------- -------------

(8,332,203) (8,229,259) (8,177,364)

Non-current liabilities

Lease liabilities (5,771,073) (6,107,204) (5,666,835)

Deferred tax (313,703) (213,982) (276,099)

Borrowings (6,715,686) (6,217,469) (6,763,297)

--------------------------------- ------------- ------------- -------------

(12,800,462) (12,538,655) (12,706,231)

Total liabilities (21,132,665) (20,767,914) (20,883,595)

--------------------------------- ------------- ------------- -------------

Net assets 17,356,233 14,053,295 18,941,613

--------------------------------- ------------- ------------- -------------

Equity

Called up share capital 3,562,409 3,102,293 3,561,969

Share premium account 46,925,141 42,593,641 46,925,141

Capital reserve -

own shares (48,163) (48,163) (48,163)

Retained earnings (22,843,714) (19,427,950) (21,450,212)

Merger relief reserve 23,676,117 21,282,500 23,676,117

Reverse Takeover

reserve (33,460,406) (33,460,406) (33,460,406)

Currency translation

reserve (455,151) 11,380 (262,834)

-------------------------------- ------------- ------------- -------------

Total equity 17,356,233 14,053,295 18,941,613

--------------------------------- ------------- ------------- -------------

Group Statement of Cash Flows

for 6 months to 30.06.2023

Unaudited Unaudited Audited

6 months 6 months Year

to 30.06.2023 to 30.06.2022 to 31.12.2022

GBP GBP GBP

-------------------------------------- --------------- --------------- ---------------

Cash flows from operating

activities

Loss before taxation for

the period (1,558,179) (2,199,935) (4,302,516)

Adjustments for:

Finance income (13,199) (11,648) (257,984)

Finance costs 499,865 786,470 1,258,850

Foreign exchange movements (891,037) 150,204 (144,025)

Depreciation, amortisation

and impairment 2,406,520 2,079,335 4,336,210

Loss on fixed asset

disposal (529) 5,563 136,974

VAT refund - interests - - 231,476

Dismantling provision - - 20,466

Share based payments expense 198,483 - 137,748

--------------------------------------- --------------- --------------- ---------------

Operating cash flows before movement

in working capital 641,924 809,989 1,417,199

Decrease / (increase) in

inventories 129,912 285,332 (314,212)

Decrease / (increase) in trade

and other receivables (76,975) (79,915) (748,711)

Increase / (decrease) in trade

and other payables (1,405) 94,096 359,363

---------------------------------------- --------------- --------------- ---------------

Cash generated from operations 693,456 1,109,502 713,639

Taxation payable - - -

Net cash generated from

operations 693,456 1,109,502 713,639

Cash flows from investing

activities

Payments to acquire software (161,007) (32,856) (241,032)

Payments to acquire property,

plant and equipment (605,693) (453,236) (1,072,811)

Payments to acquire intangible

fixed assets (65,646) (19,721) (62,831)

Proceeds from disposal of property

plant and equipment 23,474 37,349 46,063

Interest received on sub-franchisee

loans 8,651 27,020 16,767

Interest received on short-term - 8,048 -

deposits

Cash flows of acquiring a

subsidiary - - (2,241,534)

Net cash (used in) investing

activities (800,221) (433,396) (3,555,378)

Cash flows from financing

activities

Net proceeds from issue of ordinary

share capital 440 - 7,231,341

Repayment of lease

liabilities (926,962) (1,313,525) (2,068,948)

Repayment of borrowings - - (163,539)

Interest paid on lease liabilities (305,924) (347,824) (665,084)

--------------------------------------- --------------- --------------- ---------------

Net cash from/(used in) financing

activities (1,232,446) (1,661,349) 4,333,770

Net increase / (decrease)

in cash (1,339,211) (985,243) 1,492,031

Exchange differences on cash

balances (55,365) 14,313 (83,355)

Cash and cash equivalents at

beginning of period 4,110,322 2,701,646 2,701,646

Cash and cash equivalents at

end of period 2,715,746 1,730,716 4,110,322

---------------------------------------- --------------- --------------- ---------------

Group Statement of Changes in Equity

for 6 months to 30.06.2023

Share Currency Capital Reverse Merger

reserve

Share premium Retained translation - Takeover Relief

own

capital account earnings reserve shares reserve reserve Total

GBP GBP GBP GBP GBP GBP GBP GBP

--------------- ---------- ----------- ------------- ------------ --------- ------------- ----------- ------------

At 30 June

2022 3,102,293 42,593,641 (19,427,950) 11,380 (48,163) (33,460,406) 21,282,500 14,053,295

Translation

difference - - - (275,484) - - - (275,484)

Loss for the

period - - (2,160,010) - - - - (2,160,010)

Total

comprehensive

income for

the year - - (2,160,010) (275,484) - - - (2,435,494)

Shares issued

(net

of expenses) 459,676 4,331,500 - - - - 2,393,617 7,184,793

Share based

payments - - 137,748 - - - - 137,748

Transactions

with

owners in

their

capacity as

owners 459,676 4,331,500 137,748 - - - 2,393,617 7,322,541

At 31 December

2022 3,561,969 46,925,141 (21,450,212) (262,834) (48,163) (33,460,406) 23,676,117 18,941,613

--------------- ---------- ----------- ------------- ------------ --------- ------------- ----------- ------------

Translation

difference - - - (192,317) - - - (192,317)

Loss for the

period - - (1,591,985) - - - - (1,591,985)

Total

comprehensive

income for

the year - - (1,591,985) (192,317) - - - (1,784,302)

Shares issued

(net

of expenses) 440 - - - - - - 440

Share based

payments - - 198,483 - - - - 198,483

Transactions

with

owners in

their

capacity as

owners 440 - 198,483 - - - - 198,923

At 30 June

2023 3,562,409 46,925,141 (22,843,714) (455,151) (48,163) (33,460,406) 23,676,117 17,356,233

--------------- ---------- ----------- ------------- ------------ --------- ------------- ----------- ------------

Notes to the Financial Statements

for 6 months to 30.06.2023

1 Basis of preparation

These condensed interim financial statements are unaudited and

do not constitute statutory accounts within the meaning of the

Companies Act 2006. These condensed interim financial statements

have been prepared in accordance with IAS 34 'Interim Financial

Reporting' and were approved on behalf of the Board by the Chairman

David Wild.

The accounting policies and methods of computation applied in

these condensed interim financial statements are consistent with

those applied in the Group's most recent annual financial

statements for the year ended 31 December 2022.

The financial statements for the year ended 31 December 2022,

which were prepared in accordance with UK-adopted international

accounting standards, IFRIC Interpretations and the Companies Act

2006 have been delivered to the Registrar of Companies. The

auditors' opinion on those financial statements was unqualified and

did not contain a statement made under s498(2) or (3) of the

Companies Act 2006.

Copies of these condensed interim financial statements and the

Group's most recent annual financial statements are available on

request by writing to the Company Secretary at our registered

office DP Poland plc, One Chamberlain Square, Birmingham, B3 3AX,

United Kingdom, or from our website www.dppoland.com .

2 Revenue

Unaudited Unaudited Audited

6 months 6 months Year to

to 30.06.2023 to 30.06.2022 31.12.2022

GBP GBP GBP

--------------- --------------- --------------- ------------

Core revenue 20,959,825 16,575,350 35,693,133

Other revenue - - 965

20,959,825 16,575,350 - 35,694,098

--------------- --------------- --------------- ------------

Core revenues are ongoing revenues including sales to the public

from corporate stores, sales of materials and services to

sub-franchisees, royalties received from sub-franchisees and rents

received from sub-franchisees. Other revenues are non-recurring

transactions such as the sale of stores, fittings and equipment to

sub-franchisees.

3 Taxation

Unaudited Unaudited Audited

6 months 6 months Year to

to 30.06.2023 to 30.06.2022 31.12.2022

GBP GBP GBP

--------------------------------- --------------- --------------- ------------

Current tax - -

Deferred tax charge relating to

the origination and reversal

of temporary differences 33,806 - 57,429

-

Total tax charge in income

statement 33,806 - 57,429

---------------------------------- --------------- --------------- ------------

4 Earnings per ordinary share

The loss per ordinary share has been calculated as follows:

Unaudited Unaudited Audited

6 months 6 months Year to

to 30.06.2023 to 30.06.2022 31.12.2022

GBP GBP GBP

----------------------------------- --------------- --------------- ------------

Profit / (loss)

after tax (GBP) (1,591,985) (2,199,935) (4,359,945)

Weighted average number of shares

in issue (excluding EBT held

shares) 710,642,415 578,123,216 653,776,085

Basic and diluted earnings per

share (pence) (0.22 p) (0.38 p) (0.67 p)

-------------------------------------- --------------- --------------- ------------

The weighted average number of shares for the period excludes

those shares in the Company held by the employee benefit trust. At

30 June 2023 the basic and diluted loss per share is the same,

because the vesting of share awards would reduce the loss per share

and is, therefore, anti-dilutive.

5 Principal risks and uncertainties

The principal risks and uncertainties facing the Group are

disclosed in the Group's financial statements for the year ended 31

December 2022, available from www.dppoland.com and remain

unchanged.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DELFLXKLLBBL

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

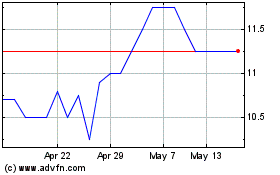

Dp Poland (LSE:DPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dp Poland (LSE:DPP)

Historical Stock Chart

From Apr 2023 to Apr 2024