TIDMEGY

RNS Number : 7075S

Vaalco Energy Inc

08 November 2023

VAALCO ENERGY, INC. ANNOUNCES

THIRD QUARTER 2023 RESULTS

HOUSTON - November 8, 2023 - VAALCO Energy, Inc. (NYSE: EGY,

LSE: EGY) ("VAALCO" or the "Company") today reported operational

and financial results for the third quarter of 2023.

Third Quarter 2023 Highlights and Key Items:

-- Achieved production of 18,844 net revenue interest ( "NRI") (1) barrels of oil equivalent

per day ( "BOEPD"), at the higher end of guidance, driven by operational uptime in Gabon and

continued drilling success in Egypt;

-- Working interest ("WI") (2) production of 24,430 BOEPD also at higher end of guidance

range;

-- Increased NRI sales to 1,812,000 barrels of oil equivalent ( "BOE"), or 19,700 BOEPD above

the midpoint of guidance;

-- Reported lifting of 600,000 gross barrels of oil in Gabon occurred in first week of October

2023;

-- Grew unrestricted cash by 124% to $103.4 million after paying out $6.7 million in dividends

in the quarter and completing $6.0 million in share buybacks;

-- Since inception of the $30 million share buyback program, VAALCO has purchased over $20

million in shares;

-- Continued to collect Egyptian receivables and have reduced accounts receivable by $17.7 million

in the third quarter, decreasing the outstanding current Egyptian accounts receivable to $18.8

million;

-- Reported Q3 2023 net income of $6.1 million ($0.06 per diluted share) and Adjusted Net Income

(3) of $7.5 million ($0.07 per diluted share); both were reduced by a non-cash tax adjustment

in Gabon of $5.3 million ($0.05 per diluted share) due to increased oil price quarter over

quarter related to untaken, in-kind tax barrels;

-- Grew Adjusted EBITDAX (3) by 9% to $71.4 million compared to Q2 2023 and funded $22.5 million

in capital expenditures from cash on hand and cash from operations during the third quarter

of 2023;

-- Delivering meaningful cash returns to shareholders with $36 million returned year to date,

representing about 41% of Free Cash Flow (3) available to shareholders; and

-- Announced quarterly cash dividend of $0.0625 per share of common stock to be paid on December

21, 2023.

(1) All NRI production rates are VAALCO's working interest volumes less royalty volumes, where

applicable

(2) All WI production rates and volumes are VAALCO 's working interest volumes

(3) Adjusted EBITDAX, Adjusted Net Income, Adjusted Working Capital and Free Cash Flow are Non-GAAP

financial measures and are described and reconciled to the closest GAAP measure in the attached

table under "Non-GAAP Financial Measures."

George Maxwell, VAALCO's Chief Executive Officer commented,

"Building a diversified portfolio of high performing assets has

been part of our strategic vision for the past two years. Our

continued outstanding results both operationally and financially

reinforce the success of this strategy and point to a very bright

future for VAALCO. Our 2023 capital program in Egypt and Canada has

exceeded expectations, and coupled with our solid operational

uptime in Gabon, has allowed us to deliver robust production rates.

We raised production and sales guidance after our first half 2023

results and our continued strong performance has carried into the

third quarter with both production and sales at the high end of our

guidance ranges. We have maintained a lower cost structure and have

reduced our capital run rate. All of these factors have contributed

to our Adjusted EBITDAX growth and cash flow generation allowing us

to return meaningful value to shareholders and grow our cash

position to over $100 million at September 30, 2023. In early

October, we also had another lifting in Gabon of about 600,000

gross barrels, which will further add to our healthy cash position.

We expect our ability to grow cash flow in the current commodity

price environment to continue through year-end. This robust cash

reserve will allow us to fund our 2024 capital program, continue to

return cash to shareholders through dividends and buybacks and

provides meaningful financial optionality for the future."

"Our strategic vision has proven highly successful, but it's our

employees' commitment to operational excellence and execution that

has helped VAALCO achieve record production and Adjusted EBITDAX w

hile growing cash flow and returning significant value to

shareholders. VAALCO is financially stronger, with more reserves

and production, than at any other time in our history and poised to

continue to grow in 2024 and beyond. We continue to have no bank

debt and a growing cash position that will allow us to fund 2024

capex projects across our portfolio. We remain committed to

accretively growing VAALCO both organically and through additional

inorganic opportunities. The diversity and strength of our assets

provide a solid foundation for sustainable growth and supports our

commitment to returning and growing value for our

shareholders."

Operational Update

Egypt

In Egypt, VAALCO continued to use the EDC-64 rig in the Eastern

Desert drilling campaign. The Company completed six wells in the

third quarter of 2023, five development wells K-80, K-84, K-85,

M-24, Arta-91 and one deep appraisal well EA-54. Drilling continues

on the EA-55 development well in the fourth quarter which will be

the last well of the 2023 campaign. Through operational

efficiencies, VAALCO is drilling an average of two wells per month

with the EDC-64 rig, nearly twice as fast as in 2022, and VAALCO

has drilled 18 wells this year, while also completing the Arta-77Hz

at the beginning of 2023. The 2023 firm and contingent work program

was drilled faster and cheaper compared to budget, adding to its

economic returns.

A summary of the Egyptian drilling campaign's impact during the

third quarter is presented below:

VAALCO Egypt Q3 Wells

Well Spud date Pay Zones Completion Interval IP-30 Rate BOPD

-------- ---------- ----------- ------------------- ----------- ---------- ---------------

K-80 7/1/2023 141.4 feet Asl-A, B, D and E Asl-E 16.4 feet 144

K-84 7/16/2023 98.8 feet Asl- D, E, F and G Asl-G 19.7 feet 158

K-85 7/31/2023 63.3 feet Asl- D, E, F and G Asl-E 9.8 feet 164

M-24 8/14/2023 70.2 feet Asl-A, B and D Asl-D 9.8 feet 120

Arta-91 9/1/2023 40 feet Red-bed/Nukhl Red-bed 20.0 feet 94

EA-54 9/12/2023 none Red-bed/Nukhl Abandoned none none

-------- ---------- ----------- ------------------- ----------- ---------- ---------------

The East Arta 54 appraisal well in Egypt was drilled and

abandoned during the period and subsequently, $1.2 million was

charged to exploration expense.

Canada

VAALCO drilled and completed two wells in the first quarter of

2023, consisting of a 1.5-mile lateral and a 3-mile lateral, which

were also required for land retention purposes. Both wells were

drilled and completed safely and cost effectively without incident.

The wells were tied in and equipped in April and early May with

overall cycle times that were significantly less than historical

cycle times. The wells began flowing in May and naturally flowed

through June. In early July, the pump and rods were run on both

wells. Both wells' production rates exceeded expectations, and the

Company is monitoring their long-term performance while evaluating

future drilling campaigns, with the intent of moving exclusively to

2.5 mile and 3-mile laterals to improve economics. This resulted in

record production levels reported for Canada in 2023. Additionally,

VAALCO is conducting a review of completions intensity for

potential future well completions and facility and pad optimization

which should improve production cycle times in the future.

Gabon

VAALCO completed its 2021/2022 drilling campaign in the fourth

quarter of 2022. The Company is currently evaluating locations and

planning for its next drilling campaign. Gabon production

performance in the nine months ended September 30, 2023 has been

strong and ahead of plan driven by improved operational uptime at

Etame. The cost savings from the new Floating, Storage and

Offloading vessel ("FSO") have been captured, as planned, but are

being offset by increased marine cost as a consequence of

inflationary (marine vessel supply rates, transportation, and

contractors) and industry supply chain pressures as well as higher

diesel costs due to the feed gas line being suspended due to a

leak. The gas line has been successfully fixed in October and the

FSO is now utilizing gas rather than diesel.

Environmental, Social and Governance

As part of the Company's commitment to environmental

stewardship, social awareness and good corporate governance, VAALCO

published its annual ESG report in April 2023. The report covers

VAALCO's ESG initiatives and related key performance indicators and

is available on VAALCO's web site, www.vaalco.com, under the

"Sustainability" tab. During 2022, the Company completed a

materiality study, led by its ESG Engineer with input from key

personnel across the organization with responsibility for engaging

with its key stakeholder groups. Working with an external

consultancy, VAALCO created an ESG materiality framework against

which it plotted material topics informed by the Global Reporting

Initiative and Sustainability Accounting Standards Board. Each of

these were assessed based upon the perceived level of risk to the

business and the level of management control in place.

Financial Update -Third Quarter of 2023

Reported net income of $6.1 million ($0.06 per diluted share)

for the third quarter of 2023 which was down modestly compared with

net income of $6.8 million ($0.06 per diluted share) in the second

quarter of 2023 and $6.9 million ($0.11 per diluted share) in the

third quarter of 2022. The decrease in earnings compared to the

second quarter of 2023 is mainly due to higher income tax expense,

losses on derivatives and well exploration costs, partially offset

by increased sales revenue and decreased depreciation. depletion

and amortization ("DD&A") expense. The decrease in earnings

compared to the third quarter of 2022 is primarily due to higher

sales revenue due to increased volumes more than offset by higher

production expense, higher DD&A expense, higher losses on

derivatives and higher income taxes.

Adjusted EBITDAX totaled $71.4 million in the third quarter of

2023, a 9% increase from $65.3 million in the second quarter of

2023, primarily due to higher revenues driven by higher sales and

commodity pricing. The increase in third quarter 2023 Adjusted

EBITDAX to $71.4 million compared with $42.4 million, generated in

the same period in 2022, is primarily due to increased revenue as a

result of the TransGlobe transaction which was partially offset by

lower commodity prices.

Quarterly Summary -

Sales and Net

Revenue

$ in thousands Three Months Ended September 30, 2023 Three Months Ended June 30, 2023

--------------------------------------- ----------------------------------------

Gabon Egypt Canada Total Gabon Egypt Canada Total

------- -------- ------- -------- -------- -------- ------- --------

Oil Sales $64,100 $ 88,748 $ 7,832 $160,680 $ 87,478 $ 50,201 $ 8,325 $146,004

NGL Sales - - $ 2,073 $ 2,073 - - $ 1,885 $ 1,885

Gas Sales - - $ 988 $ 988 - - $ 703 $ 703

------ ------- ------ ------- ------- ------- ------ -------

Gross Sales $64,100 $ 88,748 $10,893 $163,741 $ 87,478 $ 50,201 $10,913 $148,592

Selling Costs &

carried interest $ 1,378 $ (497) - $ 881 $ 2,212 $ (1) - $ 2,211

Royalties & taxes $(8,203) $(37,944) $(2,206) $(48,353) $(11,766) $(28,892) $ (905) $(41,563)

Net Revenue $57,275 $ 50,307 $ 8,687 $116,269 $ 77,924 $ 21,308 $10,008 $109,240

Oil Sales MMB

(working interest) 764 1,282 101 2,146 1,113 910 123 2,146

Average Oil Price

Received $ 83.92 $ 69.24 $ 77.89 $ 74.87 $ 78.62 $ 55.15 $ 67.76 $ 68.04

% Change Q3 2023

vs. Q2 2023 10%

Average Brent Price - - - $ 86.65 - - - $ 77.92

% Change Q3 2023

vs. Q2 2023 11%

Gas Sales MMCF

(working interest) - - 470 470 - - 442 442

Average Gas Price

Received - - $ 2.10 $ 2.10 - - $ 1.59 $ 1.59

% Change Q3 2023

vs. Q2 2023 32%

Average Aeco Price

($USD) - - - $ 1.89 - - - $ 1.68

% Change Q3 2023

vs. Q2 2023 13%

NGL Sales MMB

(working interest) - - 82 82 - - 78 78

Average Liquids

Price Received - - $ 25.27 $ 25.27 - - $ 24.04 $ 24.04

% Change Q3 2023 vs.

Q2 2023 5%

% Change Q3 % Change Q3

2023 vs. Q3 2023 vs. Q2

Revenue and Sales Q3 2023 Q3 2022 2022 Q2 2023 2023

---------- -------- ------------- ---------- -------------

Production (NRI

BOEPD) 18,844 9,157 106% 19,676 (4)%

Sales (NRI BOE) 1,812,000 731,000 148% 1,803,000 0%

Realized commodity

price ($/BOE) $ 63.41 $ 103.61 (39)% $ 59.37 7%

Commodity (Per BOE

including realized

commodity

derivatives) $ 63.38 $ 91.13 (30)% $ 59.34 7%

Total commodity

sales ($MM) $ 116.3 $ 78.1 49% $ 109.2 6%

VAALCO had net revenue increase by $7.0 million or 6% as total

NRI sales volumes of 1,812,000 BOE was slightly higher than Q2 2023

but rose 148% compared to 731,000 BOE for Q3 2022. Q3 2023 sales

were at the higher end of VAALCO's guidance. The Company expects

fourth quarter 2023 NRI sales to be between 19,800 and 22,000

BOEPD.

Q3 2023 realized pricing (net of royalties) was up 7% compared

to Q2 2023 but decreased 39% compared to Q3 2022.

Costs and % Change Q3 2023 % Change Q3 2023

Expenses Q3 2023 Q3 2022 vs. Q3 2022 Q2 2023 vs. Q2 2023

--------- --------- ---------------- --------- ----------------

Production

expense,

excluding

offshore

workovers and

stock comp ($MM) $ 39.9 $ 23.2 72% $ 38.8 3%

Production

expense,

excluding

offshore

workovers ($/BOE) $ 22.07 $ 31.79 (31)% $ 21.51 3%

Offshore workover

expense ($MM) $ (0.0) $ - -% $ (0.2) (88)%

Depreciation,

depletion and

amortization

($MM) $ 32.5 $ 9.0 262% $ 38.0 (14)%

Depreciation,

depletion and

amortization

($/BOE) $ 18.0 $ 12.26 46% $ 21.10 (15)%

General and

administrative

expense,

excluding

stock-based

compensation

($MM) $ 5.2 $ 2.0 159% $ 4.8 8%

General and

administrative

expense,

excluding

stock-based

compensation

($/BOE) $ 2.9 $ 2.74 4% $ 2.7 6%

Stock-based

compensation

expense ($MM) $ 1.0 $ - -% $ 0.6 67%

Current income tax

expense (benefit)

($MM) $ 2.1 $ (1.2) (275)% $ 12.4 (83)%

Deferred income

tax expense

(benefit) ($MM) $ (2.6) $ 24.0 (111)% $ (0.8) 225%

Total production expense (excluding offshore workovers and stock

compensation) of $39.9 million in Q3 2023 was higher compared to Q2

2023 and the same period in 2022. The increase in Q3 2023 expense

compared to Q2 2023 was driven primarily by higher costs related to

higher sales volumes. The increase in Q3 2023 compared to the Q3

2022 was primarily driven by increased expense associated with

higher sales and costs associated with the TransGlobe combination

as well as higher costs associated with boats, diesel and operating

costs. VAALCO has seen inflationary and industry supply chain

pressure on personnel and contractor costs.

Q3 2023 had no offshore workover expense. The negative $0.2

million in workover expenses in Q2 2023 was the result of a

reversal of accruals on completion and tie out of the workover

AFE's. There were no offshore workover expenses in Q3 2022.

Q3 2023 production expense per BOE, excluding offshore workover

costs remained low at $22.07 per BOE which was in line with Q2 2023

and down 31% compared to Q3 2022 due to higher sales, lower costs

in Etame associated with the FSO conversion and lower per BOE costs

from the Egyptian and Canadian assets.

DD&A expense for the Q3 2023, was $32.5 million which was

lower than $38.0 million in Q2 2023 and higher than $9.0 million in

Q3 2022. The decrease in Q3 2023 DD&A expense, compared to Q2

2023, is due to lower DD&A costs associated with Gabon due to a

lifting that occurred in early October 2023. The increase in Q3

2023 DD&A expense compared to Q3 2022 is due to higher

depletable costs associated with the FSO, the field reconfiguration

capital costs at Etame and the step-up in fair value of the

TransGlobe assets.

Q3 2023 included a $1.2 million expense related to the East Arta

54 appraisal well in Egypt that was abandoned during Q3 2023 and

subsequently expensed to Exploration Expense.

General and administrative ("G&A") expense, excluding

stock-based compensation, increased to $5.2 million in Q3 2023 from

$4.8 million in Q2 2023 and $2.0 million in Q3 2022. The increase

in general and administrative expenses is primarily due to higher

professional service fees, salaries and wages, and accounting and

legal fees. The Company has incurred one-time reorganization costs

in 2023 as it integrates the TransGlobe assets and eliminates

duplicate administrative costs. Q3 2023 G&A was within the

Company's guidance. The Company has made meaningful progress toward

reducing absolute G&A costs when compared against the combined

TransGlobe and VAALCO Q3 2022 costs.

Non-cash stock-based compensation expense was $1.0 million for

Q3 2023 compared to no expense for Q3 2022. Non-cash stock-based

compensation expense for Q2 2023 was $0.6 million.

Other income (expense), net, was an income of $0.2 million for

Q3 2023, compared to an expense of $7.7 million during Q2 2022 and

an expense of $0.5 million for Q2 2023. Other income (expense),

net, normally consists of foreign currency losses. For Q3 2022,

included in other (expense) income, net is $6.4 million of

transaction costs associated with the TransGlobe transaction.

Foreign income taxes for Gabon are settled by the government

taking their oil in-kind. Q3 2023 income tax expense was an expense

of $25.8 million and is comprised of current tax expense of $26.8

million and deferred tax benefit of $0.9 million. Due to the sharp

rise in oil prices subsequent to June 30, 2023, the repricing of

the government oil taken in kind in Gabon to market pricing from

June 30, 2023 to September 30, 2023 has resulted in higher than

expected accrued taxes of approximately $5.3 million. Q2 2023

income tax expense was an expense of $11.6 million. This was

comprised of $12.4 million of current tax expense and a deferred

tax benefit of $0.8 million. Q3 2022 income tax expense was an

expense of $22.8 million. This was comprised of $24.0 million of

deferred tax expense and a current tax benefit of $1.2 million. For

all periods, VAALCO's overall effective tax rate was impacted by

non-deductible items associated with derivative losses and

corporate expenses.

Financial Update - First Nine Months of 2023

Production for the first nine months of 2023 more than doubled

to 6,594 MBOE compared to 2,765 MBOE production in the first nine

months of 2022. The increase was driven by production from the

TransGlobe assets, as well as new wells from the 2021/2022 drilling

campaign in Gabon. The first nine months of 2023 saw sales volume

more than double to 4,839 MBbls net crude oil compared to 2,305

MBbls for the first nine months of 2022. Crude oil sales are a

function of the number and size of crude oil liftings in each

quarter and do not always coincide with volumes produced in any

given period.

The average realized crude oil price for the first nine months

of 2023 was $62.48 per barrel, representing a decrease of 43% from

$109.28 realized in the first nine months of 2022. This decrease in

crude oil price reflects the softening in commodity pricing over

the past year, as well as the incorporation of the TransGlobe

assets which include Canadian and Egyptian crude, natural gas, and

NGLs that have lower realized pricing than Gabon.

The Company reported net income for the nine months ended

September 30, 2023 of $16.4 million, which compares to $34.1

million for the same period of 2022. The decrease in net income for

the nine months ended September 30, 2023 compared to the same

period in 2022 was primarily due to higher production costs, higher

DD&A and lower oil prices partially offset by increased sales

volumes.

Year to Date

Summary - Sales and

Net Revenue

$ in thousands Nine Months Ended September 30, 2023 Nine Months Ended September 30, 2022

----------------------------------------- ------------------------------------

Gabon Egypt Canada Total Gabon Egypt Canada Total

-------- -------- ------- --------- -------- ----- ------ ----------

Oil Sales 194,179 193,570 22,811 410,560 289,290 - - 289,290

NGL Sales - - 6,421 6,421 - - - -

Gas Sales - - 2,649 2,649 - - - -

------- ------- ------ -------- ------- ----- ------ ---------

Gross Sales 194,179 193,570 31,881 419,630 289,290 - - 289,290

Selling Costs &

carried interest 3,590 (995) - 2,595 5,843 - - 5,843

Royalties & taxes (25,833) (86,176) (4,304) (116,313) (37,395) - - (37,395)

Net Revenue 171,936 106,399 27,577 305,912 257,738 - - 257,738

Oil Sales MMB

(working interest) 2,404 3,032 317 5,753 2,650 - - 2,650

Average Oil Price

Received $ 80.76 $ 63.85 $ 72.01 $ 71.36 $ 109.17 - - $ 109.17

% Change 2023 vs.

2022 -35%

Average Brent Price $ 81.99 $ 105.00

% Change 2023 vs.

2022 -22%

Gas Sales MMCF

(working interest) - - 1,327 1,327 - - - -

Average Gas Price

Received - - $ 2.00 $ 2.00 - - - -

% Change Q2 2023

vs. Q1 2023

NGL Sales MMB

(working interest) - - 237 237 - - - -

Average Liquids

Price Received - - $ 27.10 $ 27.10 - - - -

Capital Investments/Balance Sheet

For the first nine months of 2023, net capital expenditures

totaled $77.4 million on a cash basis and $63.3 million on an

accrual basis. These expenditures were primarily related to costs

associated with the development drilling programs in Egypt and

Canada. In the second quarter 2023 earnings release, VAALCO reduced

its planned capital budget for full year 2023 from a range of $70

to $90 million to $71 to $75 million, or nearly $10 million at the

mid-point of guidance. The increased efficiencies achieved in

drilling wells in Egypt and Canada contributed to VAALCO's reducing

its planned spending for 2023.

At the end of the third quarter of 2023, VAALCO had an

unrestricted cash balance of $103.4 million. Working capital at

September 30, 2023 was $51.3 million compared with $45.7 million at

June 30, 2023, while Adjusted Working Capital (3) at September 30,

2023 totaled $63.3 million. VAALCO continues to work with the

Egyptian General Petroleum Corporation on both collections and

offsets. In addition, with the completion of drilling in Canada and

Egypt, VAALCO expects to see a reduction in its outstanding

Accounts Payable and Accruals.

In mid-2022, VAALCO announced entry into a new credit agreement,

effective May 16, 2022, for a new five-year Reserve Based Lending

("RBL") facility with Glencore Energy UK Ltd. ("Glencore") that

includes an initial commitment of $50 million and is expandable up

to $100 million. The facility is currently secured by the Company's

assets in Gabon and matures in 2027. Key terms and covenants under

the new facility include Consolidated Total Net Debt to EBITDAX

(each term as defined in the RBL facility) for the trailing twelve

months of less than three times and requires VAALCO to maintain a

minimum consolidated cash and cash equivalents balance of $10

million. While VAALCO intends to fund its capital and shareholder

returns programs with internally generated funds, the facility

enhances future financial flexibility.

Cash Dividend Policy and Share Buyback Authorization

VAALCO paid a quarterly cash dividend of $0.0625 per share of

common stock for the third quarter of 2023 on September 22, 2023.

On November 7, 2023, the Company announced its next quarterly cash

dividend of $0.0625 per share of common stock for the fourth

quarter of 2023 ($0.25 annualized), to be paid on December 21, 2023

to stockholders of record at the close of business on November 24,

2023. VAALCO increased its per share dividend amount 92% beginning

with the second quarter of 2023 compared to the quarterly dividends

paid in 2022. Future declarations of quarterly dividends and the

establishment of future record and payment dates are subject to

approval by the VAALCO Board of Directors (the "Board").

On November 1, 2022, VAALCO announced that its newly expanded

Board formally ratified and approved the share buyback program that

was announced on August 8, 2022 in conjunction with the pending

business combination with TransGlobe. The Board also directed

management to implement a Rule 10b5-1 trading plan to facilitate

share purchases through open market purchases, privately negotiated

transactions, or otherwise in compliance with Rule 10b-18 under the

Securities Exchange Act of 1934. The plan provides for an aggregate

purchase of currently outstanding common stock up to $30 million.

Payment for shares repurchased under the program will be funded

using the Company's cash on hand and cash flow from operations.

The actual timing, number and value of shares repurchased under

the share buyback program will depend on a number of factors,

including constraints specified in any Rule 10b5-1 trading plans,

price, general business and market conditions, and alternative

investment opportunities. Under such a trading plan, the Company's

third-party broker, subject to Securities and Exchange Commission

regulations regarding certain price, market, volume and timing

constraints, has authority to purchase the Company's common stock

in accordance with the terms of the plan. The share buyback program

does not obligate the Company to acquire any specific number of

shares in any period, and may be expanded, extended, modified or

discontinued at any time.

Since inception of the buyback program in November 2022 through

November 3, 2023, VAALCO has repurchased $20.8 million in

shares.

Hedging

The Company continued to opportunistically hedge a portion of

its expected future production to lock in strong cash flow

generation to assist in funding its capital and shareholder returns

programs.

The following includes hedges remaining in place for the fourth

quarter of 2023 and new hedges that were entered into for 2024:

Average

Settlement Type of Monthly Weighted Average Put Weighted Average

Period Contract Index Volumes Price Call Price

-------------- -------------------- -------------------

(Bbls) (per Bbl) (per Bbl)

October 2023 -

December 2023 Collars Dated Brent 85,000 $ 65.00 $ 90.00

January 2024 -

March 2024 Collars Dated Brent 85,000 $ 65.00 $ 97.00

April 2024 -

June 2024 Collars Dated Brent 65,000 $ 65.00 $ 100.00

2023 Guidance:

The Company has provided fourth quarter 2023 guidance and

updated its full year 2023 guidance. Driven by continued strong

performance from the 2023 drilling program, production guidance for

both Egypt and Canada have been raised. Additionally, due to

operational excellence and continued focus on maintaining strong

uptime in the field, VAALCO has raised its Gabon full year

production guidance. The drilling, completions and facility

improvements seen in Egypt and Canada have also driven capital

costs lower and VAALCO has updated and lowered its full year

capital expenditure budget. All of the quarterly and annual

guidance is detailed in the tables below.

FY 2023 Gabon Egypt Canada

--------------- -------------- --------------- -------------

Production (BOEPD) WI 23,450 - 24,400 9,950 - 10,200 10,900 - 11,400 2,600 - 2,800

Production (BOEPD) NRI 18,300 - 18,900 8,600 - 8,800 7,500 - 7,700 2,200 - 2,400

Sales Volume (BOEPD) WI 23,050 - 24,000 9,550 - 9,800 10,900 - 11,400 2,600 - 2,800

Sales Volume (BOEPD) NRI 17,900 - 18,500 8,200 - 8,400 7,500 - 7,700 2,200 - 2,400

Production Expense (millions) WI & NRI $154.0 - $160.0

Production Expense per BOE WI $17.00 - $19.50

Production Expense per BOE NRI $22.00 - $25.00

Offshore Workovers (millions) WI & NRI $0 - $0

Cash G&A (millions) WI & NRI $18.0 - $21.0

CAPEX (millions) WI & NRI $71 - $75

DD&A ($/BO) NRI $20.0 - $22.00

Q4 2023 Gabon Egypt Canada

--------------- --------------- --------------- -------------

Production (BOEPD) WI 22,900 - 24,600 9,400 - 10,100 11,100 - 11,800 2,400 - 2,700

Production (BOEPD) NRI 17,600 - 19,400 8,100 - 8,800 7,600 - 8,300 1,900 - 2,300

Sales Volume (BOEPD) WI 25,300 - 27,600 11,800 - 13,100 11,100 - 11,800 2,400 - 2,700

Sales Volume (BOEPD) NRI 19,800 - 22,000 10,300 - 11,400 7,600 - 8,300 1,900 - 2,300

Production Expense (millions) WI & NRI $42.2 - $47.6

Production Expense per BOE WI $16.00 - $21.00

Production Expense per BOE NRI $21.00 - $26.50

Offshore Workovers (millions) WI & NRI $0 - $0

Cash G&A (millions) WI & NRI $4.0 - $6.0

CAPEX (millions) WI & NRI $9.5 - $12

DD&A ($/BO) NRI $20.0 - $22.0

Conference Call

As previously announced, the Company will hold a conference call

to discuss its third quarter 2023 financial and operating results

tomorrow, Wednesday, November 8, 2023, at 10:00 a.m. Central Time

(11:00 a.m. Eastern Time and 4:00 p.m. London Time). Interested

parties may participate by dialing (833) 685-0907. Parties in the

United Kingdom may participate toll-free by dialing 08082389064 and

other international parties may dial (412) 317-5741. Participants

should request to be joined to the "VAALCO Energy Third Quarter

2023 Conference Call." This call will also be webcast on VAALCO's

website at www.vaalco.com. An archived audio replay will be

available on VAALCO's website.

A "Q3 2023 Supplemental Information" investor deck will be

posted to VAALCO's web site prior to its conference call on

November 8, 2023 that includes additional financial and operational

information.

About VAALCO

VAALCO, founded in 1985 and incorporated under the laws of

Delaware, is a Houston, USA based, independent energy company with

production, development and exploration assets in Africa and

Canada.

Following its business combination with TransGlobe in October

2022, VAALCO owns a diverse portfolio of operated production,

development and exploration assets across Gabon, Egypt, Equatorial

Guinea and Canada.

For Further Information

VAALCO Energy, Inc. (General and Investor Enquiries) +00 1 713 623 0801

Website: www.vaalco.com

Al Petrie Advisors (US Investor Relations) +00 1 713 543 3422

Al Petrie / Chris Delange

Buchanan (UK Financial PR) +44 (0) 207 466 5000

Ben Romney / Barry Archer VAALCO@buchanan.uk.com

Forward Looking Statements

This press release includes "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the "Securities Act") and Section 21E of the Securities

Exchange Act of 1934, as amended, which are intended to be covered

by the safe harbors created by those laws and other applicable laws

and "forward-looking information" within the meaning of applicable

Canadian securities laws. Where a forward-looking statement

expresses or implies an expectation or belief as to future events

or results, such expectation or belief is expressed in good faith

and believed to have a reasonable basis. All statements other than

statements of historical fact may be forward-looking statements.

The words "anticipate," "believe," "estimate," "expect," "intend,"

"forecast," "outlook," "aim," "target," "will," "could," "should,"

"may," "likely," "plan" and "probably" or similar words may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements in this press release include, but are

not limited to, statements relating to (i) estimates of future

drilling, production, sales and costs of acquiring crude oil,

natural gas and natural gas liquids; (ii) the amount and timing of

stock buybacks, if any, under VAALCO's stock buyback program and

VAALCO's ability to enhance stockholder value through such plan;

(iii) expectations regarding future exploration and the

development, growth and potential of VAALCO's operations, project

pipeline and investments, and schedule and anticipated benefits to

be derived therefrom; (iv) expectations regarding future

acquisitions, investments or divestitures; (v) expectations of

future dividends, buybacks and other potential returns to

stockholders; (vi) expectations of future balance sheet strength;

(vii) expectations of future equity and enterprise value; and

(viii) VAALCO's ability to finalize documents and effectively

execute the POD for the Venus development in Block P.

Such forward-looking statements are subject to risks,

uncertainties and other factors, which could cause actual results

to differ materially from future results expressed, projected or

implied by the forward-looking statements. These risks and

uncertainties include, but are not limited to: risks relating to

any unforeseen liabilities of VAALCO or TransGlobe; the ability to

generate cash flows that, along with cash on hand, will be

sufficient to support operations and cash requirements; the impact

and costs of compliance with laws and regulations governing oil and

gas operations; the risks described under the caption "Risk

Factors" in VAALCO's 2022 Annual Report on Form 10-K filed with the

SEC on April 6, 2023.

Dividends beyond the fourth quarter of 2023 have not yet been

approved or declared by the Board of Directors for VAALCO. The

declaration and payment of future dividends and the terms of share

buybacks remains at the discretion of the Board and will be

determined based on VAALCO's financial results, balance sheet

strength, cash and liquidity requirements, future prospects, crude

oil and natural gas prices, and other factors deemed relevant by

the Board. The Board reserves all powers related to the declaration

and payment of dividends and the terms of share buybacks.

Consequently, in determining the dividend to be declared and paid

on VAALCO common stock or the terms of share buybacks, the Board

may revise or terminate the payment level or buyback terms at any

time without prior notice.

Inside Information

This announcement contains inside information as defined in

Regulation (EU) No. 596/2014 on market abuse which is part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

("MAR") and is made in accordance with the Company's obligations

under article 17 of MAR. The person responsible for arranging the

release of this announcement on behalf of VAALCO is Matthew Powers,

Corporate Secretary of VAALCO.

VAALCO ENERGY, INC AND SUBSIDIARIES

Consolidated Balance Sheets (Unaudited)

As of September 30, 2023 As of December 31, 2022

-------------------------- -------------------------

ASSETS (in thousands)

Current assets:

Cash and cash equivalents $ 103,353 $ 37,205

Restricted cash 111 222

Receivables:

Trade, net 22,788 52,147

Accounts with joint venture owners, net of

allowance for credit losses of $0.6 and $0.3

million,

respectively 1,635 15,830

Foreign income taxes receivable - 2,769

Other, net of allowance for credit losses of

$3.5 and $0.0 million, respectively 64,826 68,519

Crude oil inventory 9,287 3,335

Prepayments and other 16,115 20,070

--- --------------------- --- --------------------

Total current assets 218,115 200,097

--- --------------------- --- --------------------

Crude oil and natural gas properties, equipment and

other - successful efforts method, net 467,877 495,272

Other noncurrent assets:

Restricted cash 1,787 1,763

Value added tax and other receivables, net of

allowance of $9.9 million and $8.4 million,

respectively 9,462 7,150

Right of use operating lease assets 3,510 2,777

Right of use finance lease assets 87,971 90,698

Deferred tax assets 31,222 35,432

Abandonment funding 6,268 20,586

Other long-term assets 1,616 1,866

--- --------------------- --- --------------------

Total assets $ 827,828 $ 855,641

=== ===================== === ====================

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 43,924 $ 59,886

Accounts with joint venture owners 1,151 -

Accrued liabilities and other 76,470 91,392

Operating lease liabilities - current portion 3,539 2,314

Finance lease liabilities - current portion 7,810 7,811

Foreign income taxes payable 33,256 -

Current liabilities - discontinued operations 673 687

--- --------------------- --- --------------------

Total current liabilities 166,823 162,090

--- --------------------- --- --------------------

Asset retirement obligations 45,201 41,695

Operating lease liabilities - net of current portion 82 686

Finance lease liabilities - net of current portion 77,862 78,248

Deferred tax liabilities 76,120 81,223

Other long-term liabilities 17,369 25,594

--- --------------------- --- --------------------

Total liabilities 383,457 389,536

--- --------------------- --- --------------------

Commitments and contingencies

Shareholders' equity:

Preferred stock, $25 par value; 500,000 shares

authorized, none issued - -

Common stock, $0.10 par value; 160,000,000 shares

authorized, 121,341,251 and 119,482,680

shares issued, 105,714,499 and 107,852,857 shares

outstanding, respectively 12,134 11,948

Additional paid-in capital 356,424 353,606

Accumulated other comprehensive income 844 1,179

Less treasury stock, 15,626,752 and 11,629,823

shares, respectively, at cost (65,145) (47,652)

Retained earnings 140,114 147,024

--- --------------------- --- --------------------

Total shareholders' equity 444,371 466,105

--- --------------------- --- --------------------

Total liabilities and shareholders' equity $ 827,828 $ 855,641

=== ===================== === ====================

VAALCO ENERGY, INC AND SUBSIDIARIES

Consolidated Statements of Operations (Unaudited)

Three Months Ended Nine Months Ended

-------------------------------------------- -----------------------------

September 30, September 30, June 30, September 30, September

2023 2022 2023 2023 30, 2022

------------- -------------- ----------- -------------- ------------

(in thousands except per share amounts)

Revenues:

Crude oil,

natural gas and

natural gas

liquids sales $ 116,269 $ 78,097 $ 109,240 $ 305,912 $ 257,738

Operating costs

and expenses:

Production

expense 39,956 23,312 38,604 106,760 67,147

FPSO

Demobilization - 8,867 5,647 5,647 8,867

Exploration

expense 1,194 56 57 1,259 250

Depreciation,

depletion and

amortization 32,538 8,963 38,003 94,958 21,827

General and

administrative

expense 6,216 1,979 5,395 16,835 10,507

Credit losses

and other 822 1,020 680 2,437 2,083

--------- --- --------- ------- --- --------- --- -------

Total operating

costs and

expenses 80,726 44,197 88,386 227,896 110,681

Other operating

income

(expense), net 5 - (303) (298) (5)

--------- --- --------- ------- --- --------- --- -------

Operating income 35,548 33,900 20,551 77,718 147,052

--------- --- --------- ------- --- --------- --- -------

Other income

(expense):

Derivative

instruments

gain (loss),

net (2,320) 3,778 31 (2,268) (37,522)

Interest

expense, net (1,426) (234) (1,703) (5,375) (355)

Other income

(expense), net 183 (7,707) (537) (1,494) (10,514)

--------- --- --------- ------- --- --------- --- -------

Total other

income

(expense),

net (3,563) (4,163) (2,209) (9,137) (48,391)

--------- --- --------- ------- --- --------- --- -------

Income from

continuing

operations before

income taxes 31,985 29,737 18,342 68,581 98,661

Income tax expense

(benefit) 25,844 22,843 11,588 52,203 64,467

--------- --- --------- ------- --- --------- --- -------

Income from

continuing

operations 6,141 6,894 6,754 16,378 34,194

Loss from

discontinued

operations, net of

tax - (26) (2) (15) (58)

--------- --- --------- ------- --- --------- --- -------

Net income $ 6,141 $ 6,868 $ 6,752 $ 16,363 $ 34,136

========= === ========= ======= === ========= === =======

Other

comprehensive

income (loss)

Currency

translation

adjustments (2,216) - 2,006 (335) -

--------- --- --------- ------- --- --------- --- -------

Comprehensive

income $ 3,925 $ 6,868 $ 8,758 $ 16,028 $ 34,136

========= === ========= ======= === ========= === =======

Basic net income

(loss) per share:

Income (loss)

from continuing

operations $ 0.06 $ 0.12 $ 0.06 $ 0.15 $ 0.57

Loss from

discontinued

operations, net

of tax - - - - -

--------- --- --------- ------- --- --------- --- -------

Net income

(loss) per

share $ 0.06 $ 0.12 $ 0.06 $ 0.15 $ 0.57

========= === ========= ======= === ========= === =======

Basic weighted

average shares

outstanding 106,289 59,068 106,965 106,876 58,900

========= === ========= ======= === ========= === =======

Diluted net income

(loss) per share:

Income (loss)

from continuing

operations $ 0.06 $ 0.11 $ 0.06 $ 0.15 $ 0.57

Loss from

discontinued

operations, net

of tax - - - - -

--------- --- --------- ------- --- --------- --- -------

Net income

(loss) per

share $ 0.06 $ 0.11 $ 0.06 $ 0.15 $ 0.57

========= === ========= ======= === ========= === =======

Diluted weighted

average shares

outstanding 106,433 59,450 107,613 107,072 59,335

========= === ========= ======= === ========= === =======

VAALCO ENERGY, INC AND SUBSIDIARIES

Consolidated Statements of Cash Flows (Unaudited)

Nine Months Ended September 30,

-------------------------------------

2023 2022

----------------- --------------

(in thousands)

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 16,363 $ 34,136

Adjustments to reconcile net income to net cash provided by operating

activities:

Loss from discontinued operations, net of tax 15 58

Depreciation, depletion and amortization 94,958 21,827

Bargain purchase gain 1,412 -

Exploration Expense 1,194 -

Deferred taxes (2,305) 39,540

Unrealized foreign exchange loss 932 914

Stock-based compensation 2,332 2,300

Cash settlements paid on exercised stock appreciation rights (282) (805)

Derivative instruments (gain) loss, net 2,268 37,522

Cash settlements paid on matured derivative contracts, net (62) (42,683)

Cash settlements paid on asset retirement obligations (4,796) -

Credit losses and other 2,437 2,083

Other operating loss, net 317 5

Operational expenses associated with equipment and other 2,560 953

Change in operating assets and liabilities:

Trade receivables 29,364 5,683

Accounts with joint venture owners 15,090 (11,118)

Other receivables 694 (2,904)

Crude oil inventory (5,952) (2,661)

Prepayments and other 1,198 (1,120)

Value added tax and other receivables (3,719) (5,371)

Other long-term assets 2,942 (2,842)

Accounts payable (10,083) 4,129

Foreign income taxes receivable/payable 36,025 24,928

Accrued liabilities and other (11,076) 25,182

------------- -------------

Net cash provided by (used in) continuing operating

activities 171,826 129,756

------------- -------------

Net cash used in discontinued operating activities (15) (57)

------------- -------------

Net cash provided by (used in) operating activities 171,811 129,699

------------- -------------

CASH FLOWS FROM INVESTING ACTIVITIES:

Property and equipment expenditures (77,365) (103,853)

------------- -------------

Net cash provided by (used in) continuing investing

activities (77,365) (103,853)

Net cash used in discontinued investing activities - -

------------- -------------

Net cash provided by (used in) investing activities (77,365) (103,853)

------------- -------------

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from the issuances of common stock 593 257

Dividend distribution (20,153) (5,816)

Treasury shares (17,493) (788)

Deferred financing costs (83) (1,535)

Payments of finance lease (5,246) (193)

------------- -------------

Net cash provided by (used in) in continuing financing

activities (42,382) (8,075)

------------- -------------

Net cash used in discontinued financing activities - -

------------- -------------

Net cash provided by (used in) in financing activities (42,382) (8,075)

------------- -------------

Effects of exchange rate changes on cash (321) -

------------- -------------

NET CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH 51,743 17,771

CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD 59,776 72,314

------------- -------------

CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT OF PERIOD $ 111,519 $ 90,085

============= =============

VAALCO ENERGY, INC AND SUBSIDIARIES

Selected Financial and Operating Statistics

(Unaudited)

Three Months Ended Nine Months Ended

--------------------------------------------- ----------------------------

September 30, September 30, September 30, September 30,

2023 2022 June 30, 2023 2023 2022

-------------- -------------- ------------- ------------- -------------

NRI SALES DATA

Crude oil, natural

gas and natural gas

liquids sales (MBOE) 1,812 731 1,803 4,839 2,305

WI PRODUCTION DATA

Etame Crude oil

(MBbl) 911 968 934 2,787 2,765

Egypt Crude oil

(MBbl) 1,076 - 1,054 3,032 -

Canada Crude Oil

(MBbl) 101 - 123 317 -

Canada Natural Gas

(Mcf) 470 - 442 1,327 -

Canada Natural Gas

Liquid (Mbbl) 82 - 78 237 -

Canada Crude oil,

natural gas and

natural gas

liquids (MBOE) 261 - 275 775 -

--- --------- --- --------- --------- --------- --- --------

Total Crude

oil, natural

gas and

natural gas

liquids

production

(MBOE) 2,248 968 2,263 6,594 2,765

Gabon Average

daily production

volumes (BOEPD) 9,901 10,525 10,262 10,209 10,127

Egypt Average

daily production

volumes (BOEPD) 11,691 - 11,579 11,106 -

Canada Average

daily production

volumes (BOEPD) 2,835 - 3,021 2,838 -

--- --------- --- --------- --------- --------- --- --------

Average daily

production

volumes (BOEPD) 24,430 10,525 24,863 24,153 10,127

NRI PRODUCTION DATA

Etame Crude oil

(MBbl) 792 842 812 2,425 2,405

Egypt Crude oil

(MBbl) 732 - 726 2,074 -

Canada Crude Oil

(MBbl) 81 - 113 274.82 -

Canada Natural Gas

(Mcf) 376 - 406 1,150.85 -

Canada Natural Gas

Liquid (Mbbl) 66 - 72 205.52 -

Canada Crude oil,

natural gas and

natural gas liquids

(MBOE) 210 - 253 672 -

Total Crude oil,

natural gas and

natural gas liquids

production (MBOE) 1,734 842 1,791 5,172 2,405

Gabon Average

daily production

volumes (BOEPD) 8,609 9,157 8,923 8,883 8,810

Egypt Average

daily production

volumes (BOEPD) 7,957 - 7,978 7,598 -

Canada Average daily

production volumes

(BOEPD) 2,279 - 2,776 2,462 -

Average daily

production volumes

(BOEPD) 18,844 9,157 19,676 18,943 8,810

AVERAGE SALES

PRICES:

Crude oil, natural

gas and natural

gas liquids sales

(per BOE) - WI

basis $ 70.78 $ 104.25 $ 64.67 $ 67.40 $ 109.17

Crude oil, natural

gas and natural gas

liquids sales (per

BOE) - NRI basis $ 63.41 $ 103.61 $ 59.37 $ 62.48 $ 109.28

Crude oil, natural

gas and natural gas

liquids sales (Per

BOE including

realized commodity

derivatives) $ 63.38 $ 91.13 $ 59.34 $ 62.47 $ 90.76

COSTS AND EXPENSES

(Per BOE of sales):

Production expense $ 22.05 $ 31.89 $ 21.41 $ 22.06 $ 29.13

Production expense,

excluding offshore

workovers and stock

compensation* 22.04 31.79 21.51 22.32 29.10

Depreciation,

depletion and

amortization 17.96 12.26 21.08 19.62 9.47

General and

administrative

expense** 3.43 2.71 2.99 3.48 4.56

Property and

equipment

expenditures,

cash basis (in

thousands) $ 22,533 $ 43,575 $ 27,132 $ 77,365 $ 103,853

*Offshore workover costs excluded from the three months ended

September 30, 2023 and 2022 and June 30, 2023 are $0.0 million,

$0.0 million and $(0.2) million, respectively.

*Stock compensation associated with production expense excluded

from the three months ended September 30, 2023 and 2022 and June

30, 2023 are not material.

**General and administrative expenses include $0.57, $(0.03) and

$0.33 per barrel of oil related to stock-based compensation expense

in the three months ended September 30, 2023 and 2022 and June 30,

2023, respectively.

NON-GAAP FINANCIAL MEASURES

Management uses Adjusted Net Income to evaluate operating and

financial performance and believes the measure is useful to

investors because it eliminates the impact of certain non-cash

and/or other items that management does not consider to be

indicative of the Company's performance from period to period.

Management also believes this non-GAAP measure is useful to

investors to evaluate and compare the Company's operating and

financial performance across periods, as well as facilitating

comparisons to others in the Company's industry. Adjusted Net

Income is a non-GAAP financial measure and as used herein

represents net income before discontinued operations, impairment of

proved crude oil and natural gas properties, deferred income tax

expense, unrealized commodity derivative loss, gain on the Sasol

Acquisition and non-cash and other items.

Adjusted EBITDAX is a supplemental non-GAAP financial measure

used by VAALCO's management and by external users of the Company's

financial statements, such as industry analysts, lenders, rating

agencies, investors and others who follow the industry, as an

indicator of the Company's ability to internally fund exploration

and development activities and to service or incur additional debt.

Adjusted EBITDAX is a non-GAAP financial measure and as used herein

represents net income before discontinued operations, interest

income net, income tax expense, depletion, depreciation and

amortization, exploration expense, impairment of proved crude oil

and natural gas properties, non-cash and other items including

stock compensation expense, gain on the Sasol Acquisition and

unrealized commodity derivative loss.

Management uses Adjusted Working Capital as a transition tool to

assess the working capital position of the Company's continuing

operations excluding leasing obligations because it eliminates the

impact of discontinued operations as well as the impact of lease

liabilities. Under the lease accounting standards, lease

liabilities related to assets used in joint operations include both

the Company's share of expenditures as well as the share of lease

expenditures which its non-operator joint venture owners' will be

obligated to pay under joint operating agreements. Adjusted Working

Capital is a non-GAAP financial measure and as used herein

represents working capital excluding working capital attributable

to discontinued operations and current liabilities associated with

lease obligations.

Management uses Free Cash Flow to evaluate financial performance

and to determine the total amount of cash over a specified period

available to be used in connection with returning cash to

shareholders, and believes the measure is useful to investors

because it provides the total amount of net cash available for

returning cash to shareholders by adding cash generated from

operating activities, subtracting amounts used in financing and

investing activities, and adding back amounts used for dividend

payments and stock repurchases. Free Cash Flow is a non-GAAP

financial measure and as used herein represents net change in cash,

cash equivalents and restricted cash and adds the amounts paid

under dividend distributions and share repurchases over a specified

period.

Free Cash Flow has significant limitations, including that it

does not represent residual cash flows available for discretionary

purposes and should not be used as a substitute for cash flow

measures prepared in accordance with GAAP. Free Cash Flow should

not be considered as a substitute for cashflows from operating

activities before discontinued operations or any other liquidity

measure presented in accordance with GAAP. Free Cash Flow may vary

among other companies. Therefore, the Company's Free Cash Flow may

not be comparable to similarly titled measures used by other

companies.

Adjusted EBITDAX and Adjusted Net Income have significant

limitations, including that they do not reflect the Company's cash

requirements for capital expenditures, contractual commitments,

working capital or debt service. Adjusted EBITDAX, Adjusted Net

Income, Adjusted Working Capital and Free Cash Flow should not be

considered as substitutes for net income (loss), operating income

(loss), cash flows from operating activities or any other measure

of financial performance or liquidity presented in accordance with

GAAP. Adjusted EBITDAX and Adjusted Net Income exclude some, but

not all, items that affect net income (loss) and operating income

(loss) and these measures may vary among other companies.

Therefore, the Company's Adjusted EBITDAX, Adjusted Net Income,

Adjusted Working Capital and Free Cash Flow may not be comparable

to similarly titled measures used by other companies.

The tables below reconcile the most directly comparable GAAP

financial measures to Adjusted Net Income, Adjusted EBITDAX,

Adjusted Working Capital and Free Cash Flow.

VAALCO ENERGY, INC AND SUBSIDIARIES

Reconciliations of Non-GAAP Financial Measures

(Unaudited)

(in thousands)

Three Months Ended Nine Months Ended

--------------------------------------------- ----------------------------

Reconciliation of

Net Income to

Adjusted Net September 30, September 30, June 30, September 30, September

Income 2023 2022 2023 2023 30, 2022

-------------- -------------- ----------- -------------- ------------

Net income $ 6,141 $ 6,868 $ 6,752 $ 16,363 $ 34,136

Adjustment for

discrete items:

Discontinued

operations, net

of tax - 26 2 15 58

Unrealized

derivative

instruments

loss (gain) 2,321 (12,902) (35) 2,206 (5,161)

Arrangement

Costs - 6,424 - - 7,624

FPSO

demobilization - 8,867 5,647 5,647 8,867

Deferred income

tax expense

(benefit) (985) 24,008 (813) 673 39,539

Other operating

(income)

expense, net (5) - 303 298 5

--- --------- --- --------- ------- --- --------- --- -------

Adjusted Net Income $ 7,472 $ 33,291 $ 11,856 $ 25,202 $ 85,068

=== ========= === ========= ======= === ========= === =======

Diluted Adjusted

Net Income per

Share $ 0.07 $ 0.56 $ 0.11 $ 0.24 $ 1.43

=== ========= === ========= ======= === ========= === =======

Diluted weighted

average shares

outstanding (1) 106,433 59,450 107,613 107,072 59,335

=== ========= === ========= ======= === ========= === =======

(1) No adjustments to weighted average shares outstanding

Three Months Ended Nine Months Ended

--------------------------------------------- ----------------------------

Reconciliation of

Net Income to September 30, September 30, June 30, September 30, September

Adjusted EBITDAX 2023 2022 2023 2023 30, 2022

-------------- -------------- ----------- -------------- ------------

Net income $ 6,141 $ 6,868 $ 6,752 $ 16,363 $ 34,136

Add back:

Impact of

discontinued

operations - 26 2 15 58

Interest expense

(income), net 1,426 234 1,703 5,375 355

Income tax

expense

(benefit) 25,844 22,843 11,588 52,203 64,467

Depreciation,

depletion and

amortization 32,538 8,963 38,003 94,958 21,827

Exploration

expense 1,194 56 57 1,259 250

FPSO

demobilization - 8,867 5,647 5,647 8,867

Non-cash or

unusual items:

Stock-based

compensation 1,078 36 605 2,332 2,300

Unrealized

derivative

instruments

loss (gain) 2,321 (12,902) (35) 2,206 (5,161)

Arrangement

Costs - 6,424 - - 7,624

Other operating

(income)

expense, net (5) - 303 298 5

Credit losses

and other 822 1,020 680 2,437 2,083

--- --------- --- --------- ------- --- --------- --- -------

Adjusted EBITDAX $ 71,359 $ 42,435 $ 65,305 $ 183,093 $ 136,811

=== ========= === ========= ======= === ========= === =======

VAALCO ENERGY, INC AND SUBSIDIARIES

Reconciliations of Non-GAAP Financial Measures

(Unaudited)

(in thousands)

Reconciliation of Working Capital

to Adjusted Working Capital As of September 30, 2023 As of December 31, 2022 Change

--------------------------- ------------------------- -------

Current assets $ 218,115 $ 200,097 $18,018

Current liabilities (166,823) (162,090) (4,733)

--------------------- --- -------------------- ------

Working capital 51,292 38,007 13,285

Add: lease liabilities - current

portion 11,349 10,125 1,224

Add: current liabilities - discontinued

operations 673 687 (14)

--------------------- --- -------------------- ------

Adjusted Working Capital $ 63,314 $ 48,819 $14,495

=== ===================== === ==================== ======

Nine Months Ended September 30, 2023

---------------------------------------

Reconciliation of Free Cash Flow

Net cash provided by Operating activities $ 171,811

Net cash used in Investing activities (77,365)

Net cash used in Financing activities (42,382)

Effects of exchange rate changes on cash (321)

------ -------------------------------

Total net cash change 51,743

Add back shareholder cash out:

Dividends paid 20,153

Stock buyback 15,566

-------------------------------

Total cash returned to shareholders 35,719

Free Cash Flow $ 87,462

===== ===============================

Percent of Free Cash Flow returned to shareholders 41 %

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTFFFLILELDIIV

(END) Dow Jones Newswires

November 08, 2023 02:00 ET (07:00 GMT)

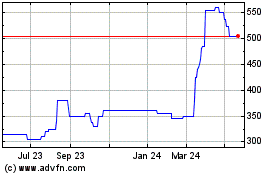

Vaalco Energy (LSE:EGY)

Historical Stock Chart

From Dec 2024 to Jan 2025

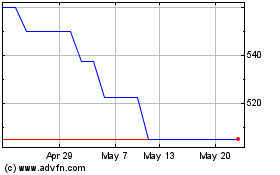

Vaalco Energy (LSE:EGY)

Historical Stock Chart

From Jan 2024 to Jan 2025