Acquisition of Spot & Company of Manhattan

11 August 2008 - 4:30PM

UK Regulatory

RNS Number : 0324B

First Artist Corporation PLC

11 August 2008

Date: 11 August 2008

On behalf of: First Artist Corporation plc

For immediate release

FIRST ARTIST CORPORATION PLC

('First Artist' or 'the Company' or 'the Group')

Acquisition of Spot and Company of Manhattan, Inc

Suspension of Shares

Update on Dewynters Group

First Artist Corporation plc (AIM: FAN) the media, events and entertainment group, is delighted to announce that it has agreed the

acquisition of Spot and Company of Manhattan, Inc ("SpotCo").

This transaction constitutes a reverse takeover under the AIM Rules. The Company expects its securities to be suspended by the LSE until

such time that an admission document in respect of the enlarged entity is published.

The maximum consideration payable for SpotCo is US$18.86 million, to be satisfied in cash. The initial consideration comprises the

payment of $5.5 million, which will be followed by three guaranteed payments of $1.5 million over the next three years. Deferred

consideration will be also be payable over the next three years dependent on the achievement by SpotCo of certain financial performance

targets.

SpotCo is a leading US-based live entertainment advertising agency and is a natural strategic fit with Dewynters Limited ("Dewynters")

the Company's full-service agency which provides marketing, design, advertising, promotions, digital media services, publishing and

merchandising to the UK entertainment industry, together with signage and front of house display expertise through its subsidiary, Newman

Displays. Dewynters also has a merchandising operation in the US. Dewynters has pioneered a wealth of innovative campaigns including The

Phantom of the Opera, Cats and Les Miserables, and more recently Mamma Mia!, The Lion King, We Will Rock You, Wicked, Joseph And His Amazing

Technicolor Dreamcoat, The Sound of Music, The Lord of the Rings and Equus.

First Artist announced in July that it had ended discussions in respect of the potential disposal of Dewynters following two unsolicited

approaches earlier this year. It is the opinion of the Board that shareholders' interests will best be served by the retention of Dewynters

and the complementary acquisition of SpotCo, which will give the Group a dominant position in live entertainment advertising in the world's

two most important markets: London's West End and New York's Broadway. The two agencies have collaborated on numerous worldwide campaigns

in the past decade - for example, the musical Chicago, which reached 28 countries - and in joining forces will create new synergies by

extending the global expertise and experience they can offer clients. Each company will also continue to work independently with other

agencies and clients under their own identities.

SpotCo

SpotCo was founded in 1997 by Drew Hodges, its President and Chief Executive Officer, who is remaining with the business, together with

his executive team.

The agency is known for creating innovatively conceived, strategically inspired and elegantly designed campaigns which both attract

attention and deliver results.

SpotCo was credited with breathing new life into Broadway advertising with its first theatre campaign - a contemporary photomontage for

the musical Rent. Today, it is a live entertainment advertising agency whose work at any given time spans around half the shows on

Broadway. The agency is currently working on DreamWorks Theatrical's first musical, Shrek; the stage adaptation of 9 to 5; with Universal's

Working Title on the acclaimed Billy Elliot, already a box-office hit in Britain and Australia; on a stage adaptation of the film Priscilla

Queen of the Desert (in collaboration with Dewynters in London); and a revival of West Side Story. Beyond Broadway, SpotCo has worked on

Cirque du Soleil's Zumanity and Avenue Q in Las Vegas, and as shows go on tour, its campaigns appear worldwide from Las Vegas to London,

Melbourne to Moscow.

Demonstrating the calibre of the shows the agency attracts, over the last decade SpotCo's clients have won numerous Tony awards and an

impressive six Pulitzer Prizes.

In addition to its theatre specialisation, SpotCo's work spans film and cable television, publishing and music. The agency employs

around 55 staff at its offices on Seventh Avenue, New York.

In the financial year ended 31 December 2007, unaudited accounts show SpotCo had turnover of $39.3 million and profit before tax of

$0.60 million. Net assets of SpotCo at 31 December 2007 amounted to $2.87 million. Following the acquisition of SpotCo, the Board is

confident that the profits of both Dewynters and SpotCo will be significantly enhanced by the collaboration between the two companies.

Financing the acquisition

The acquisition of SpotCo has been funded through a new committed banking facility totalling �16.428 million, provided by Allied Irish

Bank, whose support the Company continues to enjoy.

The Company has agreed to acquire the whole of the issued share capital of SpotCo for up to $18.86 million (subject to adjustment by

reference to its net asset value as at 31 October 2008). The initial consideration is $5.5 million in cash. This is followed by three

guaranteed cash payments of $1.5 million on the first three anniversaries of the completion date. If the EBITDA exceeds certain thresholds

on each of the three anniversaries of the completion balance sheet date the following applies:

Profit Threshold Deferred Consideration

Year 1 $1.25m - $1.75m $10 cash for every $10 of EBITDA within the

threshold

over $1.75m $20 cash for every $10 of EBITDA above the

threshold

Year 2 $1.50m - $2.00m $10 cash for every $10 of EBITDA within the

threshold

over $2.00m $20 cash for every $10 of EBITDA above the

threshold

Year 3 $1.75m - $2.25m $10 cash for every $10 of EBITDA within the

threshold

over $2.25m $20 cash for every $10 of EBITDA above the

threshold

The annual deferred cash payments in respect of any one year are limited to $2.5 million with any excess cash consideration due being

carried forward to the ensuing year and then continuing to roll over subject to the maximum annual payment of $2.5 million. In order to

exceed the maximum deferred consideration, EBITDA for the three years post completion must total $9.8 million.

While the acquisition will have the effect of increasing Group debt, the profitability required to trigger the deferred consideration

has the effect of improving the interest cover ratio.

Commenting on the acquisition, Jon Smith, Chief Executive of First Artist, said:

"Over the last decade Drew Hodges and his team, through their creativity and talent, their understanding of contemporary branding and

imagery, and their involvement in productions from the earliest stages, have grown SpotCo into one of Broadway's foremost entertainment

advertising agencies. We are delighted that SpotCo will join the First Artist Group where, working alongside Dewynters, there will be

significant opportunities to enhance our services to clients and increase our presence on both sides of the Atlantic. In addition, we are

particularly pleased to confirm that Anthony Pye-Jeary, the Managing Director of Dewynters, will be extending his service agreement.

First Artist remains committed to its vision to become the UK's leading integrated media, events and entertainment group and the

acquisition of SpotCo demonstrates our commitment to this strategy. We look forward to providing all our clients with the most comprehensive

range of services available and our shareholders with enhanced shareholder value".

Anthony Pye-Jeary, Managing Director of Dewynters said:

"This is a thrilling opportunity for us all and I am delighted that we are joining forces with such a creative and strategically

forward-thinking team. Our clients will now benefit from a whole new direction in global thinking for both their existing and future

productions".

Drew Hodges, President and CEO of SpotCo said:

"Live entertainment marketing and brand development is becoming increasingly international, demanding highly innovative solutions to

entice many different audiences. Working with Dewynters, we can both produce even more groundbreaking work, and grow the dynamic creative

spirit our teams are known for, whilst creating a consistency of image in any market, all of which benefits our clients tremendously".

First Artist Corporation plc www.firstartist.com

Jon Smith, Chief Executive tel: 020 7993 0000

Julianne Coutts, Company Secretary

Daniel Stewart & Company plc tel: 020 7776 6550

Nominated Adviser and Broker www.danielstewart.co.uk

Lindsay Mair/Stewart Dick

Redleaf Communications firstartist@redleafpr.com

Emma Kane / Samantha Robbins Tel: 020 7822 0200

Notes to Editors:

First Artist Corporation plc was admitted to AIM in 2002.

First Artist's group companies are among the leading brands in their fields under the following categories:

Media - entertainment advertising, marketing, design, promotions, digital media, merchandising, signage and front of house displays for

the West End, Broadway and Las Vegas via the Dewynters and Newman Displays brands. Strategic sponsorship consulting via Sponsorship

Consulting, and sponsorship rights marketing through First Rights.

Events - offers a broad range of events such as conferences, company activity days, venue finding, delegate management and client events

for private and public sector clients such as the Training & Development Agency, under its Finishing Touch business.

Entertainment/Sport - representation of media personalities and football players/clubs across the UK, Europe and the US by First Artist

Management, First Artist Entertainment, Promosport and First Artist Scandinavia, together with wealth management through the Independent

Financial Advisory firm, Optimal Wealth Management.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQEAKPFFAAPEEE

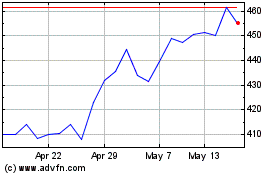

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

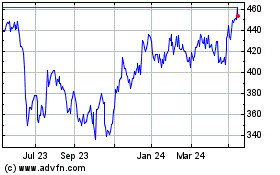

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024