TIDMFSTA

RNS Number : 4511T

Fuller,Smith&Turner PLC

15 November 2023

STRICTLY EMBARGOED

UNTIL 7AM WEDNESDAY 15 NOVEMBER 2023

FULLER, SMITH & TURNER P.L.C.

("Fuller's", the "Company", or the "Group")

Financial results for the 26 weeks to 30 September 2023

Strong progress as revenues and profits continue to rise

Financial and Operational Highlights

Unaudited Unaudited Audited

26 weeks 26 weeks ended 53 weeks

ended 24 September ended

30 September 1 April

2023 2022 2023

GBPm GBPm GBPm

---------------------------- ------------- -------------- ---------

Revenue and other income 188.8 168.9 336.6

EBITDA(1) 34.8 28.9 51.8

Adjusted profit before

tax(2) 14.5 9.8 12.7

Statutory profit before

tax 14.9 10.7 10.3

Basic earnings per share(3) 17.65p 13.13p 12.98p

Adjusted earnings per

share(3) 17.16p 12.48p 16.10p

Dividend per share 6.63p 4.68p 14.68p

Net debt excluding lease

liabilities(4) 129.4 129.2 132.8

---------------------------- ------------- -------------- ---------

All figures above are from continuing operations.

1 Earnings before interest, tax, depreciation, amortisation,

profit on disposal of property, plant and equipment, and separately

disclosed items.

2 Adjusted profit before tax is the profit before tax excluding separately disclosed items.

3 Per 40p 'A' or 'C' ordinary share. Basic EPS is calculated

using earnings attributable to equity shareholders after tax

including separately disclosed items. Adjusted EPS excludes

separately disclosed items.

4 Net debt excluding lease liabilities comprises cash and

short-term deposits, bank overdraft, bank loans, debenture stock

and preference shares.

Financial and Operational Highlights (cont)

-- Revenue up 12% to GBP188.8 million (H1 2023: GBP168.9

million), driven by strong performances across the estate

-- Like for like sales in H1 up 12.7%, demonstrating market

outperformance, substantially ahead of the industry's Coffer CGA

Business Tracker

-- Adjusted profit before tax increased by 48% to GBP14.5

million (H1 2023: GBP9.8 million) - demonstrating strong profit

conversion despite inflationary challenges

-- Net debt is at GBP129.4 million (H1 2023: GBP129.2 million)

with cash used to enhance the estate and finance shareholder

returns

-- Interim dividend increased in line with earnings to 6.63p (H1

2023: 4.68p), representing a 42% increase on last year

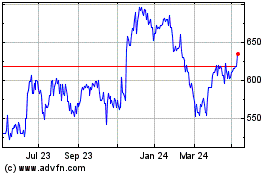

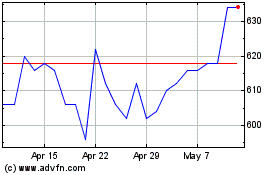

-- Completed buy back of one million 'A' shares at an average

price of 580p, and today announcing our intention to buyback an

additional one million 'A' shares.

Strategic Highlights

-- An excellent customer experience, resulting in like for like

sales growth across all areas during the first half

o Food sales up 15.5%

o Drink sales up 10.9%

o Accommodation sales up 13.4%

-- Continuing to invest for the long-term

o Enhancing the estate with GBP9.0 million capital

investment

o Significant pipeline of investments planned

o Increased investment in our people, including new leadership

training programme for all general managers

o Deployment of numerous ESG initiatives as part of our Life is

too good to waste programme

-- Effective proactive portfolio management with 21 of 23 pubs

earmarked for transfer from managed to tenanted completed -

remaining sites will complete imminently

-- Further strengthening of the Balance Sheet, with reduced

leverage, and headroom for acquisitions to drive long-term

growth.

Current Trading

-- Like for like sales for the 32 weeks to 11 November 2023 up 11.7%

-- Primed for a strong Christmas with bookings already 11% ahead of prior year.

Chief Executive Simon Emeny said:

"We have had a strong start to the year - delivering excellent

financial results and building a superb platform for future growth.

While there are still a number of macro-economic elements to

navigate, certain external factors are moving in our favour with

office workers continuing to return to their desks and the City

becoming a seven day operation with increased leisure spend at the

weekend.

"There has been a welcome return of major events. Customers are

increasingly seeking premium experiences when they are spending

their money, and we have the benefit of the lucrative international

tourist trade to come with inbound tourism still below pre-covid

levels.

"These factors play to our strengths which, combined with our

teams' operational excellence, have resulted in our like for like

sales rising 12.7% from the prior year - outperforming the market

and well ahead of the industry's Coffer CGA Business Tracker. There

is demonstrable momentum and positivity in the business, we have an

amazing group of dedicated team members, excellent leaders, and a

keen focus on continuing to grow profitable sales using all the

levers available to us.

"We have continued with our strong progress since the period

end, with like for like sales for the first 32 weeks of the year

growing by 11.7%. Trading in the City continues to grow and

although we cannot rule out further tube or train strikes, we are

looking forward to a good Christmas with bookings currently 11%

ahead of last year.

"Our capital investment programme for the year will see us

undertaking a number of large projects across the estate during the

remainder of this financial year, enhancing our iconic pubs and

hotels. We will also continue to invest in further development for

our exceptional team members including the roll out of a new online

training platform, to support our face to face learning, that will

increase engagement.

"Fuller's has a long-term vision, strong values and a clear

strategy - all underpinned by our predominately freehold estate of

iconic pubs in fantastic locations. While there is still a

challenging economic environment to navigate, we have had a strong

first half and with exciting plans in the pipeline, we are looking

forward to the second half of the year with confidence."

-Ends-

For further information, please contact:

Fuller, Smith & Turner P.L.C.

Simon Emeny, Chief Executive 020 8996 2000

Neil Smith, Finance Director 020 8996 2000

Georgina Wald, Corporate Comms Manager 020 8996 2198

Instinctif Partners

Justine Warren 020 7457 2010

Forthcoming dates in the financial calendar:

Interim dividend payment: 2 January 2024

Trading update: 25 January 2024

Full year results announcement FY 2024: 13 June 2024

AGM: 23 July 2024

Half year results announcement FY 2025: 14 November 2024

Notes to Editors:

Fuller, Smith & Turner PLC is the premium pubs and hotels

business that is famous for beautiful and inviting pubs with

delicious fresh food, a vibrant and interesting range of drinks,

and engaging service from passionate people. Our purpose in life is

to create experiences that nourish the soul. Fuller's has 183

managed businesses, with 1,015 boutique bedrooms, and 193 Tenanted

Inns. The Fuller's pub estate stretches from Brighton to Birmingham

and from Bristol to the Greenwich Peninsula, including 163

locations within the M25. Our Managed Pubs and Hotels include

Cotswold Inns & Hotels - seven stunning hotels in the

Cotswolds, and Bel & The Dragon - six exquisite modern English

inns located in the Home Counties. In summary, Fuller's is the home

of great pubs, outstanding hospitality and passionate people, where

everyone is welcome and leaves that little bit happier than they

arrived.

Photography is available from the Fuller's Press Office on 020

8996 2000 or by email at pr@fullers.co.uk .

This statement will be available on the Company's website,

www.fullers.co.uk . An accompanying presentation will be available

from 12 noon on 15 November 2023.

FULLER, SMITH & TURNER P.L.C.

FINANCIAL RESULTS FOR THE 26 WEEKSED 30 SEPTEMBER 2023

CHAIRMAN'S STATEMENT

I am very pleased to report that your Company has made excellent

progress in the first half of the year. While the cost-of-living

crisis, train strikes and conflict across the globe runs on,

Fuller's continues to focus on the long-term - delivering growing

sales and profits and investing in our people, our properties and a

constantly evolving customer offer.

I am delighted to see all our key metrics heading in the right

direction. Revenues have risen by 12%, adjusted profit before tax

is up by 48%, and in order to rebalance the interim dividend as a

proportion of the total dividend, we have increased the interim

dividend payment by 42%, which also brings it closer to

pre-pandemic levels. Simon Emeny and the Executive Team are showing

strong leadership and the business is delivering across its

strategic pillars.

While we are in great shape, the hospitality industry as a whole

still needs the support of Government. Forthcoming changes to

business rates, including an inflation-linked rise in the

all-important business rates multiplier, will hit the industry hard

and while well-funded companies like Fuller's have the bandwidth to

withstand (albeit reluctantly) these increases, many will not. I

urge this Government - and any future incumbent - to consider the

important role that pubs play in delivering jobs and tax revenues,

and their key role in local communities and society as a whole.

One of the highlights of the first half of this financial year

was the promotion of our People & Talent Director, Dawn Browne,

to the Main Board in July. This was in recognition of the

importance of people to our business, and I am pleased to say she

is already making an excellent contribution. In addition, her team

has undertaken a number of initiatives around leadership training,

diversity and inclusion, recruitment, development and retention -

with labour turnover rates improving significantly.

We are also making good inroads in hitting our Net Zero target

by 2030. With a large number of small changes we have already

substantially reduced our operational emissions - aided by

switching to renewable energy sources - and the accompanying

savings in energy have been most welcome. It is in all our

interests to operate in a way that reduces our impact on resources

and on the planet and I look forward to seeing this work develop

further.

Finally, I would like to thank the amazing team of people that

work at Fuller's for their contribution to these results. They are

an inspiration from the bar to the boardroom and it is their joie

de vivre that continues to deliver for our customers, for their

colleagues, and for our shareholders.

DIVID

The Board is pleased to announce an interim dividend of 6.63p

(H1 2023: 4.68p) per 40p 'A' and 'C' ordinary share and 0.663p (H1

2023: 0.468p) per 4p 'B' ordinary share. This will be paid on 2

January 2024 to shareholders on the share register as at 15

December 2023. This payment equates to 85% of the 2019 interim

payment and continues our return to a progressive dividend

policy.

Michael Turner

Chairman

14 November 2023

CHIEF EXECUTIVE'S REVIEW

OVERVIEW

We have had a strong start to the year - delivering excellent

financial results and building a superb platform for future growth.

While there are still a number of macro-economic elements to

navigate, certain external factors are moving in our favour with

office workers continuing to return to their desks and the City

becoming a seven day operation with increased leisure spend at the

weekend.

There has been a welcome return of major events. Customers are

increasingly seeking premium experiences when they are spending

their money, and we have the benefit of the lucrative international

tourist trade to come with inbound tourism still below pre-covid

levels.

These factors play to our strengths which, combined with our

teams' operational excellence, have resulted in our like for like

sales rising 12.7% from the prior year, outperforming the market

and well ahead of the industry's Coffer CGA Business Tracker. There

is demonstrable momentum and positivity in the business, we have an

amazing group of dedicated team members, excellent leaders, and a

keen focus on continuing to grow profitable sales using all the

levers available to us.

While growing sales will generate profits in the near term, we

continue to invest in our long-term strategy - delighting our

customers, inspiring our people, enhancing our estate through

investment, staying one step ahead by constantly evolving our

business and owning our impact. This strategy is driven by the

Executive Team and we are confident that its successful execution

will deliver sustainable growth for the future.

TRADING UPDATE

During the first half, we have ensured that everything we do,

every decision we make, and every training course we deliver has

the customer at its heart. Irrespective of location, we target a

discerning consumer - and pride ourselves on delivering delicious

food, a first-class range of drinks, beautiful bedrooms and

outstanding hospitality, promoted using data from our digital

systems. This delights our customers, keeps them coming back for

more and takes market share from our competitors.

Giving our customers reasons to visit

As well as expecting an excellent offer as outlined above, the

desire for a premium experience is clear and customers are often

looking for that extra something to entice them to the pub. The

range of events that we now offer across the estate ensures that

our customers have more reasons to visit than ever. These include

joint activations with our suppliers, cultural events that bring

theatre, opera and even panto to the pub, and an increased focus on

ensuring the pub is the best place to watch live sport outside of

the stadium.

We use all the tools available to us to promote these activities

including geo and demographic targeted digital marketing with

compelling content, regular communication to our database of 1.7

million engaged customers, and in-pub point of sale to

cross-promote future offers and events. We know this is working

with pre-booked revenue for the half year rising by 9%.

Strong growth across food, drink and accommodation

We have been delighted to see like for like sales growth across

all three main revenue streams - food, drink and accommodation.

Food like for like sales have risen by 15.5% and drink by 10.9%.

Accommodation like for like revenue is up 13.4%, while RevPAR has

risen by 15% and Average Room Rate has increased to GBP129 (H1

2023: GBP117).

While always delicious, the menu across our varied estate is

carefully targeted towards the local market - and we have a

customer-driven approach to menu design. I am delighted to see

innovative new dishes being rolled out including an exciting

children's menu and a new brunch offer that is opening up an

additional trading day part in a number of sites.

We aim to provide flexibility within a framework for our

kitchens, allowing creativity in our food team and exciting options

that are tailored for the site, the kitchen and our customers.

Dishes are designed through a collaborative process involving

chefs, managers, the food team and our suppliers, and are supported

by new photography and targeted digital and social marketing,

designed to tempt and tantalise the tastebuds of new and existing

customers.

We continue to leverage the benefits of our long-term supply

agreement with Asahi, while also working with a wide range of other

suppliers across all drink segments. Our tie up with Mirabeau

delivered a real boost to rosé wine sales over the summer, adding

an incremental GBP1m of revenue. We outperform the market in sales

of beer and cider and are category leaders in cask ale - a position

we are aiming to emulate in wine, premium spirits and cocktails,

and this will be an area of development in the second half of the

year.

Accommodation continues to perform well and the new booking

engine we rolled out across our Fuller's sites with rooms, Bel

& The Dragon and Cotswold Inns & Hotels is delivering

further benefits around upselling and driving direct bookings -

which have increased by 18.6% against the prior year.

Investing for the future in our pubs and people

We are very proud of our premium position in the marketplace and

during the period we have invested GBP7.4 million across 80 Managed

Pubs and Hotels. We also completed major schemes at The Sanctuary

House Hotel and The Admiralty, which were started in the last

financial year.

During the first half, we added six new bedrooms to The Counting

House in Cornhill. This fantastic scheme is realising benefits with

the rooms opening in early October and achieving occupancy levels

of 95%. Post period end, we acquired the freehold of The Crown in

Islington, a pub we have operated for many years.

We have several large and exciting investment schemes scheduled

for the second half of the year. These include projects at The

Alice Lisle in Ringwood, The Head of the River in Oxford, The Manor

at Moreton-in-Marsh, The Forester in Ealing - which was a recent

Tenanted to Managed transfer - The Rising Sun in the New Forest and

The Pilot at Greenwich. We look forward to updating on these

investments at the full year.

I could not be prouder of the amazing teams that work in our

pubs and we have increased our training budget by 25% to continue

to invest in them. In the first half, we have delivered 2,059

training days, recruited 88 new apprentices, and started the roll

out of a new leadership development programme for all general

managers across the business. It is always rewarding to be

recognised by your peers and we are delighted to be shortlisted in

three categories in the forthcoming BII NITA training awards.

Ultimately, the success of our activities around recruitment and

development is measured in happiness, engagement and retention.

Having just completed our latest Happiness Index employee survey,

we are very pleased to be reporting an increase in participation

rates, happiness and engagement scores for the second year running.

Even more pleasing is that labour turnover rates are now below

pre-pandemic levels.

Life is too good to waste

Across the business, we have made excellent progress during the

half year across our Life is too good to waste programme. We

continue to deliver for our corporate charity, Special Olympics

Great Britain, and have raised over GBP122,000 for this excellent

cause in the first half.

I am very pleased with the progress we have made around the

diversity, equity and inclusion agenda too. We launched our

Inclusion Action Plan, completed inclusive leadership development

for all senior leaders and operations managers and rolled out

menopause training that was accessible to all those in the

business.

We are making headway on our route to Net Zero by 2030 for Scope

1 and 2 emissions and have had our near-term science-based

emissions reduction target for Scope 1, 2 and 3 approved by the

Science Based Targets initiative. Our work in this area is

underpinned by new systems of measurement including smart meters

and energy dashboards in all our Managed Pubs and Hotels. We now

have 11 fully electric kitchens in place, we've increased the

amount of cooking oil recycling that takes place, progressed

refillable water solutions and added 30kW solar panels to the roof

of Pier House (our support centre office), as well as a raft of

other solutions.

While doing the right thing for the planet, we have also seen a

decrease in gas usage of 8.5% and a reduction in electricity

consumption of 5% in the period, on top of substantial reductions

last year. We have been recognised for the work undertaken in this

area with a BII Sustainability Award and a Green Tourism Award for

five Fuller's sites with rooms, and all seven Cotswold Inns &

Hotels sites.

TENANTED INNS

It has been an excellent first half for the Tenanted Inns

division, which has delivered revenues of GBP16.3 million and

profits of GBP6.9 million. We have completed the transfer of 21 of

the 23 sites earmarked to move from Managed to Tenanted and the

last two transfers are imminent. Moving these 23 sites to the

Tenanted model is expected to add GBP1 million of incremental

profit contribution.

We continue to undertake joint schemes with our Tenants, with

the Company investing GBP1.6 million across 23 sites in the first

half. We now have 54 tenanted pubs operating with turnover based

contracts - which allows us to share in non-beer revenues.

Finally, we have improved our Tenanted website, specifically

improving the listings of pubs to let, and moved to a new

recruitment system. These elements in tandem have freed up

additional resource in the Tenanted team which will allow us to

further support Tenants on turnover agreements to grow their

businesses which is, of course, mutually profitable.

FINANCIAL REVIEW

Group revenue and other income increased by 12% to GBP188.8

million (H1 2023: GBP168.9 million) and adjusted profit has

increased by 48% to GBP14.5 million (H1 2023: GBP9.8 million).

Managed Pubs and Hotels revenue increased by 12% with like for

like sales up by 12.7% compared with the prior year. Operating

profit in Managed Pubs and Hotels increased from GBP18.0 million to

GBP25.4 million with operating margin improving from 11.7% to 14.7%

despite the continued inflationary environment. This improvement in

operating margin is through a focus on sales growth and operational

excellence.

Tenanted Inns revenue improved by 8% to GBP16.3 million (H1

2023: GBP15.1 million) and EBITDA increased to GBP8.3 million (H1

2023: GBP7.8 million). EBITDA margin slightly declined from 51.7%

to 50.9% largely due to one-off costs associated with the transfer

of sites from Managed Pubs and Hotels to Tenanted Inns.

The Group has unsecured banking facilities of GBP200 million,

split between a revolving credit facility of GBP110 million and a

term loan of GBP90 million. During the period, the Group agreed

with its lenders to extend these facilities for a further year

through to May 2027. The Group also has GBP26 million of

debentures, GBP6 million of which is due for repayment in December

2023 and will be repaid out of the Group's current facilities. The

Group's undrawn committed facilities at 30 September 2023 were

GBP86.5 million, with a further GBP10.2 million of cash held on the

balance sheet.

Net debt (excluding leases) was at GBP129.4 million (H1 2023:

GBP129.2 million) and was down GBP3.4 million from net debt at year

end. The Group has delivered on its capital allocation framework

through investment in the estate and returns to shareholders. A

total of GBP9.0 million was invested in the existing estate in the

period, a dividend of GBP6.1 million was paid to shareholders, and

GBP3.5 million was used for share buybacks as part of a one million

share buyback programme which completed in November.

The Group has continued to strengthen its Balance Sheet during

the period with a ratio of net debt to pro forma EBITDA reducing to

2.6 times (down from 3.0 times at year end) and significant

headroom on its facilities. This will be further boosted with the

sale of The Mad Hatter, Southwark, in July 2024 which will realise

GBP20 million in value.

Adjusted finance cost increased to GBP6.9 million (H1 2023:

GBP5.8 million) with average cost of borrowing increasing from 5.4%

to 7.6% due to the increase in Bank of England base rates. The

Group has a zero-premium cap and collar over GBP60 million of the

term facility. This instrument is in place for a three-year period

to September 2025 to hedge some of the variability in interest

rates. The Group sold a floor of 310bps and bought a cap of 500bps

which has given some protection from the Bank of England rate since

it increased to 525bps on 3 August 2023.

Separately disclosed items before tax were a credit of GBP0.4

million (H1 2023: GBP0.9 million credit) which principally consists

of a release of a VAT provision of GBP1.1 million on settlement of

a claim, GBP0.4m credit received as part settlement of an ongoing

legal claim, and GBP0.4 million interest credit on the Group's

pension surplus. Net of this is an impairment charge of GBP1.5

million recognised in relation to the write down of three

properties and one right-of-use asset to their recoverable

value.

Tax has been provided at an effective rate before separately

disclosed items of 28.3% (H1 2023: 21.4%). The increase in the

effective tax rate is mainly due to the increase in the corporation

tax from 19% to 25% which came into effect in April 2023. The main

driver of the increase in effective tax rate on adjusted profits

over the standard rate of tax is a result of non-deductible

depreciation on assets that do not qualify for capital allowances.

Disclosure on tax is set out in note 5.

The net impact of these items results in the basic earnings per

share increasing by 4.52p to 17.65p (H1 2023: 13.13p) and adjusted

earnings per share increasing by 4.68p to 17.16p (H1 2023:

12.48p).

The growth in earnings per share has enabled the Group to

declare an interim dividend of 6.63p (H1 2023: 4.68p), which is an

increase of 42% on last year, in line with the 38% increase in

adjusted earnings per share. In addition to the dividend, the Group

announced in July 2023 the intent to repurchase one million 'A'

ordinary shares, which it has just recently completed. Today, the

Group has announced its intention to buyback an additional one

million 'A' ordinary shares.

The surplus on the defined benefit pension schemes has decreased

by GBP1.5 million from the year end and is now showing an

accounting surplus of GBP13.1 million (1 April 2023: surplus

GBP14.6 million, 24 September 2022: surplus GBP20.4 million). This

is predominately as a result of a decrease in the fair value of

scheme assets from GBP113.4 million to GBP103.8 million. The

present value of the scheme liabilities also decreased due to an

increase in the discount rate from 4.75% to 5.60%. As the Group has

an unconditional right to refund under the pension trust deed, an

asset has been recognised at 30 September 2023.

CURRENT TRADING AND OUTLOOK

We have continued with our strong progress since the period end,

with like for like sales for the first 32 weeks of the year growing

by 11.7%. Trading in the City continues to grow and although we

cannot rule out further tube or train strikes, we are looking

forward to a good Christmas with bookings currently 11% ahead of

last year.

Our capital investment programme for the year will see us

undertaking a number of large projects across the estate during the

remainder of this financial year, enhancing our iconic pubs and

hotels. We will also continue to invest in further development for

our exceptional team members including the roll out of a new online

training platform, to support our face to face learning, that will

increase engagement.

Fuller's is a great company with a superb team of dedicated

people at all levels. We have a long-term vision, strong values and

a clear strategy and all of this is underpinned by our

predominately freehold estate of iconic pubs in fantastic

locations.

While there is still a challenging economic environment to

navigate, we have had a strong first half. With exciting plans in

the pipeline, we are looking forward to the second half of the year

with confidence.

Simon Emeny

Chief Executive

14 November 2023

Fuller, Smith & Turner P.L.C.

Condensed Group Income Statement

For the 26 weeks ended 30 September 2023

Audited - 53 weeks

Unaudited - 26 weeks ended Unaudited - 26 weeks ended ended

30 September 2023 24 September 2022 1 April 2023

--------------------------------------- --------------------------------------------------- -----------------------

Before Before Before

separately Separately separately Separately separately Separately

disclosed disclosed disclosed disclosed disclosed disclosed

items items Total items items Total items items Total

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------ ---- ---------- ------------------ ------- ---------- ------------------ ------- ---------- -------------- -------

Revenue 2 188.8 - 188.8 168.9 - 168.9 336.6 - 336.6

Operating

costs 3 (167.4) - (167.4) (153.3) (3.2) (156.5) (311.5) (14.2) (325.7)

------------ ---- ---------- ------------------ ------- ---------- ------------------ ------- ---------- -------------- -------

Operating

profit 21.4 - 21.4 15.6 (3.2) 12.4 25.1 (14.2) 10.9

Profit on

disposal of

properties 3 - - - - 4.4 4.4 - 11.8 11.8

Finance

costs 4 (6.9) 0.4 (6.5) (5.8) (0.3) (6.1) (12.4) - (12.4)

------------ ---- ---------- ------------------ ------- ---------- ------------------ -------

Profit

before tax 14.5 0.4 14.9 9.8 0.9 10.7 12.7 (2.4) 10.3

Tax 5 (4.1) (0.1) (4.2) (2.1) (0.5) (2.6) (2.9) 0.5 (2.4)

------------ ---- ---------- ------------------ ------- ---------- ------------------ ------- ---------- -------------- -------

Profit for

the

period/year 10.4 0.3 10.7 7.7 0.4 8.1 9.8 (1.9) 7.9

------------ ---- ---------- ------------------ ------- ---------- ------------------ ------- ---------- -------------- -------

Fuller, Smith & Turner P.L.C.

Condensed Group Income Statement (continued)

For the 26 weeks ended 30 September 2023

Unaudited - 26 weeks ended Unaudited - 26 weeks ended Audited - 53 weeks ended

30 September 2023 24 September 2022 1 April 2023

------------------------ ---- ---------------------------- ---------------------------- --------------------------

Note Adjusted Statutory Adjusted Statutory Adjusted Statutory

------------------------ ---- -------------- ------------ -------------- ------------ --------------- ---------

Earnings per share per

40p 'A' and 'C' ordinary

share Pence Pence Pence Pence Pence Pence

------------------------ ---- -------------- ------------ -------------- ------------ --------------- ---------

Basic 6 17.16 17.65 12.48 13.13 16.10 12.98

Diluted 6 17.14 17.63 12.42 13.07 16.07 12.96

Earnings per share per

4p 'B' ordinary share

------------------------ ---- -------------- ------------ -------------- ------------ --------------- ---------

Basic 6 1.72 1.77 1.25 1.31 1.61 1.30

Diluted 6 1.71 1.76 1.24 1.31 1.61 1.30

------------------------ ---- -------------- ------------ -------------- ------------ --------------- ---------

Fuller, Smith & Turner P.L.C.

Condensed Group Statement of Comprehensive Income

For the 26 weeks ended 30 September 2023

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 53 weeks ended

30 September 2023 24 September 2022 1 April 2023

GBPm GBPm GBPm

Note

---------------------------------------------------- ---- ------------------- ------------------- ----------------

Profit for the period/year 10.7 8.1 7.9

---------------------------------------------------- ---- ------------------- ------------------- ----------------

Items that may be reclassified to profit or loss

Net gains on valuation of financial assets and

liabilities 0.4 1.2 0.1

Tax related to items that may be reclassified to

profit or loss 5 (0.1) (0.3) -

---------------------------------------------------- ---- ------------------- ------------------- ----------------

Items that will not be reclassified to profit or

loss

Net actuarial (losses)/gains on pension schemes 11 (3.1) 4.8 (2.5)

Tax related to items that will not be reclassified

to profit or loss 5 0.8 (1.2) 0.6

---------------------------------------------------- ---- ------------------- ------------------- ----------------

Other comprehensive (expense)/income for the

period/year, net of tax (2.0) 4.5 (1.8)

---------------------------------------------------- ---- ------------------- ------------------- ----------------

Total comprehensive income for the period/year, net

of tax 8.7 12.6 6.1

---------------------------------------------------- ---- ------------------- ------------------- ----------------

Fuller, Smith & Turner P.L.C.

Condensed Group Balance Sheet

30 September 2023

Audited

Unaudited Unaudited At

At At 1 April

30 September 2023 24 September 2022 2023

Note GBPm GBPm GBPm

----------------------------------- ---- ------------------ ------------------ ---------

Non-current assets

Intangible assets 28.7 29.3 29.0

Property, plant and equipment 8 580.5 591.8 583.3

Investment properties 1.5 1.6 1.5

Other financial assets 0.5 1.0 0.1

Right-of-use assets 62.8 69.2 66.4

Retirement benefit obligations 11 14.5 22.0 16.1

----------------------------------- ---- ------------------ ------------------ ---------

Total non-current assets 688.5 714.9 696.4

----------------------------------- ---- ------------------ ------------------ ---------

Current assets

Inventories 4.0 4.3 4.2

Trade and other receivables 10.3 17.9 10.2

Current tax receivable - 0.1 0.7

Cash and short-term deposits 10 10.2 20.4 14.1

Total current assets 24.5 42.7 29.2

----------------------------------- ---- ------------------ ------------------ ---------

Assets classified as held for sale 9 7.0 8.3 7.0

----------------------------------- ---- ------------------ ------------------ ---------

Total assets 720.0 765.9 732.6

----------------------------------- ---- ------------------ ------------------ ---------

Current liabilities

Trade and other payables (49.3) (63.1) (54.6)

Current tax payable (0.5) - -

Provisions (0.5) (0.5) (0.5)

Borrowings 10 (6.0) - (6.0)

Lease liabilities 10 (4.8) (6.0) (4.8)

Total current liabilities (61.1) (69.6) (65.9)

----------------------------------- ---- ------------------ ------------------ ---------

Non-current liabilities

Borrowings 10 (133.6) (149.6) (140.9)

Lease liabilities 10 (64.0) (71.6) (67.0)

Retirement benefit obligations 11 (1.4) (1.6) (1.5)

Deferred tax liabilities (17.1) (16.4) (14.7)

Total non-current liabilities (216.1) (239.2) (224.1)

----------------------------------- ---- ------------------ ------------------ ---------

Net assets 442.8 457.1 442.6

----------------------------------- ---- ------------------ ------------------ ---------

Fuller, Smith & Turner P.L.C .

Condensed Group Balance Sheet (continued)

30 September 2023

Unaudited Unaudited Audited

At At At

30 September 24 September 1 April

2023 2022 2023

GBPm GBPm GBPm

---------------------- -------------- ------------- ---------

Capital and reserves

Share capital 25.4 25.4 25.4

Share premium account 53.2 53.2 53.2

Capital redemption

reserve 3.7 3.7 3.7

Own shares (24.8) (16.6) (21.3)

Hedging reserve 0.3 0.8 -

Retained earnings 385.0 390.6 381.6

----------------------- -------------- ------------- ---------

Total equity 442.8 457.1 442.6

----------------------- -------------- ------------- ---------

Fuller, Smith & Turner P.L.C.

Condensed Group Statement of Changes in Equity

For the 26 weeks ended 30 September 2023

Share Capital

Share premium redemption Own Hedging Retained

capital account reserve shares reserve earnings Total

Unaudited - 26 weeks ended 30 September 2023 GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------------------------- -------- -------- ----------- --------- -------- --------- -------

At 1 April 2023 25.4 53.2 3.7 (21.3) - 381.6 442.6

-------------------------------------------- -------- -------- ----------- --------- -------- --------- -------

Profit for the period - - - - - 10.7 10.7

Other comprehensive expense for the period - - - - 0.3 (2.3) (2.0)

-------------------------------------------- -------- -------- ----------- --------- -------- --------- -------

Total comprehensive income for the period - - - - 0.3 8.4 8.7

Dividends (note 7) - - - - - (6.1) (6.1)

Shares purchased to be held in ESOT or as

treasury - - - (3.5) - - (3.5)

Share-based payment charges - - - - - 1.1 1.1

At 30 September 2023 25.4 53.2 3.7 (24.8) 0.3 385.0 442.8

-------------------------------------------- -------- -------- ----------- --------- -------- --------- -------

Unaudited - 26 weeks ended 24 September 2022

-------------------------------------------- -------- -------- ----------- --------- -------- --------- -------

At 26 March 2022 25.4 53.2 3.7 (16.6) (0.1) 383.6 449.2

-------------------------------------------- -------- -------- ----------- --------- -------- --------- -------

Profit for the period - - - - - 8.1 8.1

Other comprehensive income for the period - - - - 0. 9 3.6 4.5

-------------------------------------------- -------- -------- ----------- --------- -------- --------- -------

Total comprehensive income for the period - - - - 0. 9 11.7 12.6

Dividends (note 7) - - - - - (4.6) (4.6)

Share-based payment charges - - - - - 0.1 0.1

Tax charged directly to equity (note 5) - - - - - (0.2) (0.2)

At 24 September 2022 25.4 53.2 3.7 (16. 6 ) 0. 8 390.6 457 .1

-------------------------------------------- -------- -------- ----------- --------- -------- --------- -------

Fuller, Smith & Turner P.L.C.

Condensed Group Statement of Changes in Equity

For the 26 weeks ended 30 September 2023

Share Capital

Share premium redemption Own Hedging Retained

capital account reserve shares reserve earnings Total

Audited - 53 weeks ended 1 April 2023 GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------------------------- -------- -------- ----------- --------- -------- ----------- ---------

At 26 March 2022 25.4 53 .2 3.7 (16.6) ( 0. 1) 383.6 449.2

---------------------------------------- -------- -------- ----------- --------- -------- ----------- ---------

Profit for the year - - - - - 7.9 7. 9

Other comprehensive expense for the year - - - - 0. 1 (1.9) (1.8)

---------------------------------------- -------- -------- ----------- --------- -------- ----------- ---------

Total comprehensive income for the

period - - - - 0. 1 6.0 6.1

Shares purchased to be held in ESOT or

as treasury - - - (4.8) - - (4.8)

Shares released from ESOT and treasury - - - 0.1 - - 0.1

Dividends (note 7) - - - - - ( 7 .4) ( 7 .4)

Share-based payment credits - - - - - (0.4) (0.4)

Tax charged directly to equity (note 5) - - - - - (0.2) ( 0. 2)

At 1 April 2023 25.4 53.2 3.7 ( 21.3 ) - 381.6 442.6

---------------------------------------- -------- -------- ----------- --------- -------- ----------- ---------

Fuller, Smith & Turner P.L.C.

Condensed Group Cash Flow Statement

For the 26 weeks ended 30 September 2023

Audited

Unaudited Unaudited 53 weeks ended

26 weeks ended 26 weeks ended 1 April

30 September 2023 24 September 2022 2023

Note GBPm GBPm GBPm

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Profit before tax 14.9 10.7 10.3

Net finance costs before separately disclosed items 4 6.9 5.8 12.4

Separately disclosed items 3 (0.4) (0.9) 2.4

Depreciation and amortisation 2 13.4 13.3 26.7

------------------------------------------------------ ---- ------------------ ------------------ ----------------

34.8 28.9 51.8

Difference between pension charge and cash paid (1.2) (1.1) (2.3)

Share-based payment charges 1.1 0.2 (0.4)

Change in trade and other receivables (1.0) (7.4) 2.5

Change in inventories 0.2 (0.7) (0.6)

Change in trade and other payables (3.4) 5.6 (3.0)

Cash impact of operating separately disclosed items 3 1.2 (0.3) (0.5)

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Cash generated from operations 31 .7 25.2 47.5

Tax received - - -

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Cash generated from operating activities 31.7 25.2 47.5

----------------

Cash flow from investing activities

Purchase of property, plant and equipment (9.0) (14.9) (30.7)

Sale of property, plant and equipment, investment

property and assets held for sale 0.1 6.7 16.0

------------------------------------------------------ ---- ------------------ ------------------

Net cash outflow from investing activities (8.9) (8.2) (14.7)

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Cash flow from financing activities

Purchase of own shares (3.5) - (4.8)

Receipts on release of own shares to option schemes - - 0.1

Interest paid (5.1) (3.9) (8.7)

Preference dividends paid (0.1) (0.1) (0.1)

Equity dividends paid (6.1) (4.6) (7.4)

(Repayment)/drawdown of bank loans (7.0) 3.0 -

Payment of loan arrangement fees (0.4) (1.5) (1.5)

Surrender of leases 10 - (0.4) (2.1)

Principal elements of lease payments 10 (4.5) (4.7) (9.8)

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Net cash outflow from financing activities (26.7) (12.2) (34.3)

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Net movement in cash and cash equivalents 10 (3.9) 4.8 (1.5)

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Cash and cash equivalents at the start of the period 14.1 15.6 15.6

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Cash and cash equivalents at the end of the

period/year 10 10.2 20.4 14.1

------------------------------------------------------ ---- ------------------ ------------------ ----------------

Fuller, Smith & Turner P.L.C.

Notes to the Condensed Financial Statements

For the 26 weeks ended 30 September 2023

1. Half Year Report

Basis of Preparation

The half year financial statements for the 26 weeks ended 30

September 2023 have been prepared in accordance with the Disclosure

and Transparency Rules ("DTRs") of the Financial Conduct Authority

and with International Accounting Standard ("IAS") 34, Interim

Financial Reporting and should be read in conjunction with the

Annual Report and Financial Statements for the 53 weeks ended 1

April 2023.

The half year financial statements do not constitute full

accounts as defined by Section 434 of the Companies Act 2006. The

figures for the 53 weeks ended 1 April 2023 are derived from the

published statutory accounts. Full accounts for the 53 weeks ended

1 April 2023, including an unqualified auditor's report which did

not make any statement under Section 498 of the Companies Act 2006,

have been delivered to the Registrar of Companies.

The Directors have adopted the going concern basis in preparing

these accounts after assessing the Group's principal risks, which

are predominately the uncertainty over the UK economy and the cost

pressures impacting the UK from food inflation, rising staff costs

and utility prices and, in turn, the effect the cost-of-living

crisis is having on consumer spending. The Directors are confident

that the Group has sufficient liquidity to withstand these ongoing

challenges for the 12-month going concern assessment period to

November 2024 (the 'going concern period').

The continued uncertainty over the UK economy makes it difficult

to forecast the future financial performance and cash flows of the

Group. When assessing the ability of the Group to continue as a

going concern, the Directors have considered the Group's financing

arrangements, the pattern of trading in the first half of the

financial year, the possibility of further trading disruptions

caused by the tube and train strikes and the principal risks and

uncertainties as disclosed in the Group's latest Annual Report.

At 30 September 2023, the Group had a strong Balance Sheet with

92% of the estate being freehold properties along with available

headroom on undrawn facilities of GBP86.5 million and GBP10.2

million of cash resulting in net debt (excluding leases) of

GBP129.4 million. The Group has unsecured banking facilities of

GBP200 million, split between a revolving credit facility of GBP110

million and a term loan of GBP90 million. Under the facilities

agreement, the covenant suite (tested quarterly) consists of net

debt to adjusted EBITDA (leverage) and adjusted EBITDA to net

finance charges.

During the period, the Group agreed with its lenders to extend

these facilities for a further year through to May 2027. The Group

also has GBP26 million of debentures of which GBP6 million is due

for repayment in December 2023 and will be repaid out of the

Group's current facilities.

The Group has modelled financial projections for the going

concern period based upon two scenarios, the base case and the

severe but plausible ('downside case'). The base case is the Board

approved forecast for FY 2024 as well as the first eight months of

the FY 2025 plan which forms part of the Board approved three-year

plan. The base case assumes that costs will be impacted

predominately by the cost inflation currently seen. It also assumes

as a result of the continued cost of living challenges there will

be some impact on consumer confidence and hence volumes. Under this

scenario there would be liquidity headroom and all covenants would

be complied with for the duration of the going concern period.

The Group has also modelled a downside scenario whereby sales in

the Managed Division drop by c.4% from that assumed in the base

case and inflation continues at an even higher rate than in the

base case. The model still assumes that investment in the estate

will remain at the same levels as the base, that no further

disposals of properties will happen, and there is no reduction in

overhead spend. These are all mitigating factors that the Group has

in its control. Under this scenario the Group will still have

sufficient resources and headroom on its covenants throughout the

assessment period.

Given the uncertainties surrounding the UK economy, the Group

has also performed a reverse stress test to assess at which point

the Group would breach its covenants or not have sufficient

liquidity in the assessment period. The reduction in sales or

increase in costs to breach the covenant is thought to be too

remote that those scenarios are therefore considered

implausible.

The Directors have concluded that in both the base and downside

scenarios, the Group has sufficient debt facilities to finance

operations for the going concern assessment period and it would not

be in breach of any of its covenants and that the combination of

adverse events that would trigger a covenant breach are highly

unlikely at the current time.

After due consideration of the matters set out above, the

Directors are satisfied that there is a reasonable expectation that

the Group has adequate resources to continue in operational

existence for the going concern assessment period to November

2024.

The half year financial statements were approved by the

Directors on 14 November 2023.

New Accounting Standards

The accounting policies adopted in the preparation of the half

year financial statements are consistent with those followed in the

preparation of the Group's annual consolidated financial statements

for the 53 weeks ended 1 April 2023. The Group has not early

adopted any standard, interpretation or amendment that has been

issued but is not yet effective.

Taxation

Taxes on income in the interim periods are accrued using the tax

rate that is expected to be applicable to total annual earnings for

the full year in each tax jurisdiction based on substantively

enacted or enacted tax rates at the interim date.

2. Segmental Analysis

Managed

Pubs Tenanted

Unaudited - 26 weeks ended and Hotels Inns Unallocated(1) Total

30 September 2023 GBPm GBPm GBPm GBPm

Revenue

---------------------------------------- ------------ -------- -------------- -----

Sales of goods and services 151.9 11.8 - 163.7

Accommodation income 19.8 - - 19.8

---------------------------------------- ------------ -------- -------------- -----

Total revenue from contracts

with customers 171.7 11.8 - 183.5

Rental income 0.8 4.5 - 5.3

---------------------------------------- ------------ -------- -------------- -----

Revenue 172.5 16.3 - 188.8

---------------------------------------- ------------ -------- -------------- -----

Segment result 25.4 6.9 (10.9) 21.4

Operating separately disclosed

items -

---------------------------------------- ------------ -------- -------------- -----

Operating profit 21.4

Net finance costs (6.5)

---------------------------------------- ------------ -------- -------------- -----

Profit before tax 14.9

---------------------------------------- ------------ -------- -------------- -----

Other segment information

Additions: property, plant and

equipment 6.4 1.7 0.1 8.2

Depreciation and amortisation 11.7 1.4 0.3 13.4

Impairment of property and right-of-use

assets 1.3 0.2 - 1.5

EBITDA 37.1 8.3 (10.6) 34.8

---------------------------------------- ------------ -------- -------------- -----

Managed

Pubs Tenanted

Unaudited - 26 weeks ended and Hotels Inns Unallocated(1) Total

24 September 2022 GBPm GBPm GBPm GBPm

Revenue

---------------------------------------- ------------ -------- -------------- -----

Sales of goods and services 135.2 10.8 - 146.0

Accommodation income 17.8 - - 17.8

---------------------------------------- ------------ -------- -------------- -----

Total revenue from contracts

with customers 153.0 10.8 - 163.8

Rental income 0.8 4.3 - 5.1

---------------------------------------- ------------ -------- -------------- -----

Revenue 153.8 15.1 - 168.9

---------------------------------------- ------------ -------- -------------- -----

Segment result 18.0 6.8 (9.2) 15.6

Operating separately disclosed

items (3.2)

---------------------------------------- ------------ -------- -------------- -----

Operating profit 12.4

Profit on disposal of properties 4.4

Net finance costs (6.1)

---------------------------------------- ------------ -------- -------------- -----

Profit before tax 10.7

---------------------------------------- ------------ -------- -------------- -----

Other segment information

Additions: property, plant and

equipment 12.9 2.0 0.1 15.0

Depreciation and amortisation 12.0 1.0 0.3 13.3

Impairment of property 2.7 - - 2.7

EBITDA 30.0 7.8 (8.9) 28.9

---------------------------------------- ------------ -------- -------------- -----

2. Segmental Analysis (continued)

Managed

Pubs Tenanted

Audited - 53 weeks ended and Hotels Inns Unallocated(1) Total

1 April 2023 GBPm GBPm GBPm GBPm

Revenue

------------------------------------- ----------- -------- -------------- --------

Sale of goods and services 271.6 21.2 - 292.8

Accommodation income 33.7 - - 33.7

------------------------------------- ----------- -------- -------------- --------

Total revenue from contracts

with customers 305.3 21.2 - 326.5

Rental income 1.5 8.6 - 10.1

------------------------------------- ----------- -------- -------------- --------

Revenue 306.8 29.8 - 336.6

------------------------------------- ----------- -------- -------------- --------

Segment result 30.0 13.2 (18.1) 25.1

Operating separately disclosed

items (14.2)

------------------------------------- ----------- -------- -------------- --------

Operating Profit 10.9

Profit on disposal of properties 11.8

Net finance costs (12.4)

------------------------------------- ----------- -------- -------------- --------

Profit before tax 10.3

------------------------------------- ----------- -------- -------------- --------

Other segment information

Additions: property, plant and

equipment 25.2 4.7 0.1 30.0

Depreciation and amortisation 23.4 2.3 1.0 26.7

Impairment of property, right-of-use

assets and goodwill 12.5 1.8 - 14.3

EBITDA 53.4 15.5 (17.1) 51.8

------------------------------------- ----------- -------- -------------- ------

1 Unallocated expenses represent primarily the salary and costs of central teams and management.

3. Separately Disclosed Items

Audited

Unaudited Unaudited 53 weeks ended

26 weeks ended 26 weeks ended 1 April

30 September 2023 24 September 2022 2023

GBPm GBPm GBPm

----------------------------------------------------------- ------------------- ------------------ ----------------

Amounts included in operating profit:

Reorganisation costs - (0.5) (0.5)

Impairment of properties, right-of-use assets and

intangible assets (1.5) (2.7) (14.3)

Insurance claim 0.4 - (0.2)

VAT provision release 1.1 - 0.8

Total separately disclosed items included in operating

profit - (3.2) (14.2)

Profit on disposal of properties - 4.4 11.8

Separately disclosed finance costs:

Finance credit on net pension surplus (note 11) 0.4 0.2 0.5

Finance charge on the write down of arrangement fees - (0.5) (0.5)

Total separately disclosed finance costs 0.4 (0. 3 ) -

----------------------------------------------------------- ------------------- ------------------ ----------------

Total separately disclosed items before tax 0.4 0. 9 (2.4)

----------------------------------------------------------- ------------------- ------------------ ----------------

Separately disclosed tax:

Profit on disposal of properties - (0.7) (1.0)

Change in tax rates - - 0.5

Other items (0.1) 0.2 1.0

----------------------------------------------------------- ------------------- ------------------ ----------------

Total separately disclosed tax (0.1) (0.5) 0.5

----------------------------------------------------------- ------------------- ------------------ ----------------

Total separately disclosed items 0.3 0.4 (1.9)

----------------------------------------------------------- ------------------- ------------------ ----------------

The impairment charge of GBP1.5 million (24 September 2022:

GBP2.7 million, 1 April 2023: GBP14.3 million) relates to the write

down of three properties and one right-of-use asset to their

recoverable value.

The insurance claim of GBP0.4 million relates to the part

settlement of a legal claim that the Group has brought against its

insurers in relation to the pandemic. The matter is still ongoing.

In the prior year ending 1 April 2023, GBP0.2m is the write off of

property, plant and equipment net of insurance monies claimed.

The VAT provision release relates to the unwind of a provision

on the settlement of a VAT claim.

The cash impact of operating separately disclosed items before

tax for the 26 weeks ended 30 September 2023 was GBP1.2 million

cash inflow (24 September 2022: GBP0.3 million cash outflow, 1

April 2023: GBP0.5 million cash outflow).

4. Finance Costs

Audited

Unaudited Unaudited 53 weeks ended

26 weeks ended 26 weeks ended 1 April

30 September 2023 24 September 2022 2023

GBPm GBPm GBPm

----------------------------------------------------------- ------------------- ------------------ ----------------

Finance costs

Interest income from financial assets 0.1 - 0.2

Interest expense arising on:

Financial liabilities at amortised cost - loans and

debentures (5.5) (4.2) (9.6)

Financial liabilities at amortised cost - preference shares (0.1) (0.1) (0.1)

Financial liabilities at amortised cost - lease liabilities (1.4) (1.5) (2.9)

----------------------------------------------------------- ------------------- ------------------ ----------------

Total finance costs before separately disclosed items (6.9) (5.8) (12.4)

Finance credit on net pension liabilities (note 11) 0.4 0.2 0.5

Finance charge on the write down of arrangement fees - (0.5) (0.5)

Total finance costs (6.5) (6.1) (12.4)

----------------------------------------------------------- ------------------- ------------------ ----------------

5. Taxation

Audited

Unaudited Unaudited 53 weeks ended

26 weeks ended 26 weeks ended 1 April

30 September 2023 24 September 2022 2023

GBPm GBPm GBPm

--------------------------------------------------- ------------------- ------------------ ----------------

Tax on profit on ordinary activities

Current income tax:

Current tax on profit for the period 1.2 0.5 -

Adjustment for current tax on prior periods - - -

--------------------------------------------------- ------------------- ------------------ ----------------

Total current income tax 1.2 0.5 -

--------------------------------------------------- ------------------- ------------------ ----------------

Deferred tax:

Origination and reversal of temporary differences 3.1 2.0 3.6

Adjustments for deferred tax on prior periods (0.1) 0.1 (1.2)

Total deferred tax 3.0 2.1 2.4

--------------------------------------------------- ------------------- ------------------ ----------------

Total tax charged in the Income Statement 4.2 2.6 2.4

--------------------------------------------------- ------------------- ------------------ ----------------

Analysed as:

Before separately disclosed items 4.1 2.1 2.9

Separately disclosed items 0.1 0.5 (0.5)

--------------------------------------------------- ------------------- ------------------ ----------------

Total tax charged in the Income Statement 4.2 2.6 2.4

--------------------------------------------------- ------------------- ------------------ ----------------

Tax relating to items (credited)/charged to the

Statement of Comprehensive Income

Deferred tax:

Valuation gains on financial assets and liabilities 0.1 0.3 -

Net actuarial (losses)/gains on pension scheme (0.8) 1.2 (0.6)

--------------------------------------------------- ------------------- ------------------ ----------------

Tax (credit)/charge included in the Statement of

Comprehensive Income (0.7) 1.5 (0.6)

--------------------------------------------------- ------------------- ------------------ ----------------

Tax relating to items charged directly to equity

Deferred tax:

Share-based payments - 0.2 0.2

Tax charge included in the Statement of Changes in

Equity - 0.2 0.2

--------------------------------------------------- ------------------- ------------------ ----------------

The taxation charge is calculated by applying the Directors'

best estimate of the annual effective tax rate to the profit for

the period/year.

6. Earnings Per Share

Audited

Unaudited Unaudited 53 weeks ended

26 weeks ended 26 weeks ended 1 April

30 September 2023 24 September 2022 2023

Continuing operations GBPm GBPm GBPm

------------------------------------------------------ ------------------ ------------------ ---------------

Profit attributable to equity shareholders 10.7 8.1 7.9

Separately disclosed items net of tax (0.3) (0.4) 1.9

------------------------------------------------------ ------------------ ------------------ ---------------

Adjusted earnings attributable to equity shareholders 10.4 7.7 9.8

------------------------------------------------------ ------------------ ------------------ ---------------

Number Number Number

------------------------------- ---------- ---------- ----------

Weighted average share capital 60,610,000 61,712,000 60,875,000

Dilutive outstanding options

and share awards 70,000 275,000 90,000

------------------------------- ---------- ---------- ----------

Diluted weighted average share

capital 60,680,000 61,987,000 60,965,000

------------------------------- ---------- ---------- ----------

40p 'A' and 'C' ordinary

share Pence Pence Pence

---------------------------- ----- ----- -----

Basic earnings per share 17.65 13.13 12.98

Diluted earnings per share 17.63 13.07 12.96

Adjusted earnings per share 17.16 12.48 16.10

Diluted adjusted earnings

per share 17.14 12.42 16.07

---------------------------- ----- ----- -----

4p 'B' ordinary share Pence Pence Pence

---------------------------- ----- ----- -----

Basic earnings per share 1.77 1.31 1.30

Diluted earnings per share 1.76 1.31 1.30

Adjusted earnings per share 1.72 1.25 1.61

Diluted adjusted earnings

per share 1.71 1.24 1.61

---------------------------- ----- ----- -----

For the purposes of calculating the number of shares to be used

above, 'B' shares have been treated as one-tenth of an 'A' or 'C'

share. The earnings per share calculation is based on earnings from

continuing operations and on the weighted average ordinary share

capital which excludes shares held by trusts relating to employee

share options and shares held in treasury of 2,843,217 (24

September 2022: 1,741,713, 1 April 2023: 2,134,152).

Diluted earnings per share is calculated using the same earnings

figure as for basic earnings per share, divided by the weighted

average number of ordinary shares outstanding during the period

plus the weighted average number of ordinary shares that would be

issued on the conversion of all the dilutive potential ordinary

shares into ordinary shares.

Adjusted earnings per share is calculated on profit after tax

excluding separately disclosed items and on the same weighted

average ordinary share capital as for the basic and diluted

earnings per share. An adjusted earnings per share measure has been

included as the Directors consider that this measure better

reflects the underlying earnings of the Group.

7. Dividends

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

30 September 24 September 1 April

2023 2022 2023

GBPm GBPm GBPm

----------------------------------- ------------- ------------- ---------

Declared and paid during the

period

Interim paid in the period for

2023 - - 2.8

Final dividend paid in the period

for 2022 - 4.6 4.6

Final dividend paid in period

for 2023 6.1 - -

Equity dividends paid 6.1 4.6 7.4

----------------------------------- ------------- ------------- ---------

Dividends on cumulative preference

shares (note 4) 0.1 0.1 0.1

----------------------------------- ------------- ------------- ---------

Pence Pence Pence

----------------------------------- ------------- ------------- ---------

Dividends per 40p 'A' and 'C'

ordinary share

declared in respect of the period

Interim 6.63 4.68 4.68

Final - - 10.00

----------------------------------- ------------- ------------- ---------

6.63 4.68 14.68

----------------------------------- ------------- ------------- ---------

The pence figures above are for the 40p 'A' ordinary shares and

40p 'C' ordinary shares. The 4p 'B' ordinary shares carry dividend

rights of one-tenth of those applicable to the 40p 'A' ordinary

shares. Own shares held in the employee share trusts do not qualify

for dividends as the Trustees have waived their rights. Dividends

are also not paid on own shares held as treasury shares.

The Directors have declared an interim dividend for the 40p 'A'

ordinary shares and 40p 'C' ordinary shares of 6.63p (2023: 4.68p)

and 0.663p (2023: 0.468p) for the 4p 'B' ordinary shares.

8. Property, Plant and Equipment

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

30 September 24 September 1 April

2023 2022 2023

GBPm GBPm GBPm

--------------------------------------- ------------- ------------- ---------

Net book value at start of period/year 583.3 592.7 592.7

Additions 8.2 15.0 30.0

Disposals (0.2) - (1.2)

Impairment loss net of reversals (1.1) (2.7) (13.4)

Transfers to assets classified

as held for sale - (3.9) (5.7)

Depreciation provided during

the period (9.7) (9.3) (19.1)

Net book value at end of period/year 580.5 591.8 583.3

--------------------------------------- ------------- ------------- ---------

During the 26 weeks ended 30 September 2023, the Group

recognised a charge of GBP1.1 million (24 September 2022: GBP2.7

million, 1 April 2023 : GBP13.4 million) in respect of the write

down in value of its properties to their recoverable value.

The Group considers each trading outlet to be a cash generating

unit ("CGU") and each CGU is reviewed at each reporting date for

indicators of impairment. In assessing whether an asset has been

impaired, the carrying amount of the CGU is compared to its

recoverable amount. The recoverable amount is the higher of its

fair value less costs to sell ("FVLCS") and its value in use.

The Group uses a range of methods for estimating FVLCS which

include applying a market multiple to the CGU EBITDA and, for

leasehold sites, present value techniques using a discounted cash

flow method.

For the purposes of estimating the value in use of CGUs,

management have used a discounted cash flow approach. The

calculations use cash flow projections based on the following plans

covering a four-year period.

The key assumptions used by management are:

-- A long-term growth rate of 2.0% (1 April 2023: 2.0%) was used

for cash flows subsequent to the four-year approved budget/forecast

period.

-- An EBITDA multiple is estimated based on a normalised trading

basis and market data obtained from external sources. This resulted

in an average multiple of 10.5x (freehold 11.8x) on the Managed

estate and 10.9x on the Tenanted estate.

-- The discount rate is based on the Group's weighted average

cost of capital, which is used across all CGUs due to their similar

characteristics. The pre-tax discount rate is 10.5% (1 April 2023:

10.3%).

Impairments are recognised where the property valuation is also

lower than the CGU's carrying value for those determined to be at

risk of impairment. This is measured as the difference between the

carrying value and the higher of FVLCS and its value in use. Where

the property valuation exceeds the carrying value, no impairment is

required.

8. Property, Plant and Equipment (continued)

The value in use calculations are sensitive to the assumptions

used. The Directors consider a movement of 1.5% in the discount

rate and 0.5% in the growth rate to be reasonable with reference to

current market yield curves and the current economic conditions.

The additional impairment/(reversal) is set out as follows:

GBPm

Increase discount rate by 1.5% 19.2

-------

Decrease discount rate by 1.5% (15.9)

-------

Increase growth rate by 0.5% (4.8)

-------

Decrease growth rate by 0.5% 5.2

-------

The additional CGUs that would need to be considered for

impairment would have their FVLCS determined in order to conclude

on whether an impairment is required. A general decrease in

property values across the portfolio would have a similar effect to

that set out above i.e. any reduction in property values would lead

to assets being at risk of impairment. In the current year, a

decrease of 5% in the FVLCS would have led to an additional

impairment of GBP2.8 million for the CGUs where recoverable amount

has been assessed on FVLCS.

9. Assets held for sale

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

30 September 24 September 1 April

2023 2022 2023

GBPm GBPm GBPm

----------------------------------- ------------- ------------- ---------

Assets held for sale at the start

of the period/year 7.0 5.4 5.4

Assets disposed of during the year - (1.0) (3.7)

Assets transferred from property,

plant and equipment - 3.9 5.7

Impairment of assets - - (0.4)

----------------------------------- ------------- ------------- ---------

Assets held for sale at the end of

the period/year 7.0 8.3 7.0

----------------------------------- ------------- ------------- ---------

10. Analysis of Net Debt

At At

1 April Cash Non 30 September

Unaudited - 26 weeks 2023 flows cash(1) 2023

ended 30 September 2023 GBPm GBPm GBPm GBPm

---------------------------- -------- ------ -------- -------------

Cash and cash equivalents:

Cash and short-term

deposits 14.1 (3.9) - 10.2

---------------------------- -------- ------ -------- -------------

14.1 (3.9) - 10.2

---------------------------- -------- ------ -------- -------------

Financial liabilities

Lease liabilities (71.8) 4.5 (1.5) (68.8)

(71.8) 4.5 (1.5) (68.8)

Debt:

Bank loans(2) (119.4) 7.4 (0.1) (112.1)

Debenture stock (25.9) - - (25.9)

Preference shares (1.6) - - (1.6)

Total borrowings (146.9) 7.4 (0.1) (139.6)

----------------------------- -------- ------ -------- -------------

Net debt (204.6) 8.0 (1.6) (198.2)

----------------------------- -------- ------ -------- -------------

As of 30 September 2023, the Group has agreed a one-year

extension of its GBP200m unsecured facility from 27 May 2026 to 27

May 2027.

At At

Unaudited - 26 weeks 26 March Cash Non 24 September

ended 24 September 2022 flows cash(1) 2022

2022 GBPm GBPm GBPm GBPm

--------------------------- --------- ------ -------- -------------

Cash and cash equivalents:

Cash and short-term

deposits 15.6 4.8 - 20.4

--------------------------- --------- ------ -------- -------------

15.6 4.8 - 20.4

--------------------------- --------- ------ -------- -------------

Financial liabilities

Lease liabilities (80.7) 5.1 (2.0) (77.6)

(80.7) 5.1 (2.0) (77.6)

Debt:

Bank loans(2) (120.0) (1.5) (0.6) (122.1)

Debenture stock (25.9) - - (25.9)

Preference shares (1.6) - - (1.6)

--------------------------- --------- ------ -------- -------------

Total borrowings (147.5) (1.5) (0.6) (149.6)

--------------------------- --------- ------ -------- -------------

Net debt (212.6) 8.4 (2.6) (206.8)

--------------------------- --------- ------ -------- -------------

10. Analysis of Net Debt (continued)

At At

26 March Cash Non 1 April

Audited - 53 weeks 2022 flows cash(1) 2023

ended 1 April 2023 GBPm GBPm GBPm GBPm

--------------------------- --------- ------ -------- --------

Cash and cash equivalents:

Cash and short-term

deposits 15.6 (1.5) - 14.1

--------------------------- --------- ------ -------- --------

15.6 (1.5) - 14.1

--------------------------- --------- ------ -------- --------

Financial liabilities

Lease liabilities (80.7) 11.9 (3.0) (71.8)

(80.7) 11.9 (3.0) (71.8)

Debt:

Bank loans(2) (120.0) 1.5 (0.9) (119.4)

Debenture stock (25.9) - - (25.9)

Preference shares (1.6) - - (1.6)

--------------------------- --------- ------ -------- --------

Total borrowings (147.5) 1.5 (0.9) (146.9)

--------------------------- --------- ------ -------- --------

Net debt (212.6) 11.9 (3.9) (204.6)

--------------------------- --------- ------ -------- --------

1 Non-cash movements relate to the amortisation of arrangement

fees, arrangement fees accrued and movement in lease

liabilities.

2 Bank loans are net of arrangement fees and cashflows include the payment of arrangement fees.

11. Retirement Benefit Obligations

Unaudited Unaudited Audited

The amount included in the Balance At At At

Sheet arising from the Group's 30 September 24 September 1 April

obligations in respect of its 2023 2022 2023

defined benefit retirement plan GBPm GBPm GBPm

------------------------------------ ------------- ------------- --------

Fair value of Scheme assets 103.8 114.2 113.4

Present value of Scheme liabilities (90.7) (93.8) (98.8)

------------------------------------ ------------- ------------- --------

Surplus in the Scheme 13.1 20.4 14.6

------------------------------------ ------------- ------------- --------

The net position of the defined benefit retirement plan for the

26 weeks ended 30 September 2023 shows a surplus of GBP13.1

million. In accordance with IFRIC 14, the Group is able to

recognise an asset as it has an unconditional right to a refund of

any surplus in the event of the plan winding down.

Included within the total present value of Group and Company

Scheme liabilities of

GBP90.7 million (24 September 2022: GBP93.8 million, 1 April

2023: GBP98.8 million) are liabilities of

GBP1.4 million (24 September 2022: GBP1.6 million, 1 April 2023:

GBP1.5 million) which are entirely

unfunded. These have been shown separately on the Balance Sheet

as there is no right to offset the

assets of the funded Scheme against the unfunded Scheme.

Key financial assumptions used

in the valuation

of the Scheme

-------------------------------- ----------- --------- ---------

Rate of increase in pensions

in payment 3.25% 3.65% 3.20%

Discount rate 5.60% 5.20% 4.75%

Inflation assumption - RPI 3.25% 3.70% 3.20%

Inflation assumption - CPI (pre 2.35%/3.25% 2.8%/3.7% 2.3%/3.2%

2030/post 2030)

-------------------------------- ----------- --------- ---------

Mortality Assumptions

The mortality assumptions used in the valuation of the Scheme as

at 30 September 2023 are as set out in the financial statements for

the 53 weeks ended 1 April 2023.

Unaudited Unaudited Audited

At At At

30 September 24 September 1 April

2023 2022 2023

Assets in the Scheme GBPm GBPm GBPm

------------------------------ ------------- ------------- --------

Corporate bonds 43.5 19.8 56.4

Index linked debt instruments 30.4 18.6 28.7

Overseas equities 6.9 31.1 6.6

Alternatives 19.7 41.6 19.0

Cash 1.1 0.6 0.3

Annuities 2.2 2.5 2.4