TIDMGFIN

RNS Number : 6725U

Gfinity PLC

27 November 2023

For immediate release

27 November 2023

Gfinity PLC

("Gfinity" or the "Company")

Disposal

The Board of Gfinity plc (AIM:GFIN) announces that the Company

has today disposed of its remaining 27.5 per cent. interest in

Athlos Game Technologies Limited ("Athlos"), its former proprietary

esports technology business, to Tourbillon Group UK Limited (the

"Disposal").

Background

Athlos was originally created by Gfinity as an extension to its

online platform and was used by the Esports Solutions Division, to

deliver online esports tournaments.

However, the Athlos division cost Gfinity approximately GBP2m

per year to operate which became unsustainable, given Gfinity's low

share price and poor market conditions. As previously announced in

June 2023, following a restructuring and refocus on digital media

and its significant position in the Gamer website industry, the

Company sold 72.5% of Athlos to Tourbillon Group UK Limited

("Tourbillon"). Liabilities associated with Athlos were assumed by

Tourbillon, with the buyer also providing initial working capital

to support the business. Gfinity retained a 27.5% shareholding in

Athlos and the consideration payable to Gfinity by Tourbillon was

GBP1.

Since the Disposal, Tourbillon has restructured Athlos, but the

Athlos business still remains substantially loss making and

requires ongoing funding from its shareholders, including Gfinity

from December. The Board of Gfinity estimate that its share of the

ongoing funding commitment is likely to amount to in excess of

GBP25,000 per month for the next year.

Following the restructuring earlier this year, Gfinity is

focusing its resources on its continuing digital media interests

and accordingly, Gfinity is unable fund any further investment into

a legacy business such as Athlos, even if the Board believed that

the potential long-term prospects for Athlos were positive.

Disposal

Accordingly, as Gfinity is both unwilling and unable to

recommence funding Athlos from December, the Board has agreed to

sell Gfinity's remaining 27.5 per cent. interest in Athlos to

Tourbillon for an immediate payment of GBP260,000 in cash. The cash

consideration, which will be used for investment in development of

Gfinity's digital media business and general working capital

purposes, significantly improves Gfinity's financial position and

establishes a stronger base to implement its new plans and reach a

turnaround position. Following the disposal, Gfinity will have no

further interest in or commitment to Athlos.

Related Party

As David Halley is the controlling shareholder and chief

executive of Tourbillon, the disposal is a related party

transaction pursuant to Rule 13 of the AIM Rules for Companies.

Accordingly, the Independent Directors (being the Board other than

David Halley) consider, having consulted with the Company's

Nominated Adviser, that the disposal is fair and reasonable insofar

as Gfinity's Shareholders are concerned. In particular, the

Independent Directors have taken into account that:

- In the current financial year ending 30 June 2024, Athlos is

estimated to require funding from Gfinity at the rate of in excess

of GBP25,000 per month.

- Gfinity is currently unable fund any such further investment

into a legacy business such as Athlos.

- In the absence of the sale, Gfinity would expect to be

significantly diluted in Athlos and would have no certainty that it

would be able to sell its remaining diluted interest for any

value.

- The proposed consideration values Athos at approximately

GBP0.95m, which represents a value multiple of approximately three

times revenue which the Independent Directors believe is in line

with market parameters for an early-stage tech company, with a

similar record and prospects.

Further AIM Disclosures

In the last published audited accounts for the year ended 30

June 2022, Athlos generated revenue of GBP0.3m, with a loss before

tax of GBP0.5m. If capitalised development expenditure were

expensed, the loss before tax would have been GBP1.2m. The assets

of Athlos as at December 2022 were GBP0.7 million.

As previously announced on 6 June 2023, in the year to December

2022, Athlos generated revenue of GBP0.4m, with a loss before tax

of GBP0.5m. If capitalised development expenditure were expensed,

the loss before tax would have been GBP1.2m. The assets of Athlos

as at December 2022 were GBP1.2m. In the 12 months to the end of

May 2023, Athlos absorbed GBP1.5m of Group cash. The financials as

at December 2022 were unaudited.

The sale to Tourbillon in June 2023 was completed before David

Halley either became a director of Gfinity or acquired an interest

in the Company.

Other Information

Further information on the Company including a copy of this

announcement is available from the Company's website:

www.gfinityplc.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR"). The person who arranged for the release of this

announcement on behalf of the Company was Neville Upton,

Chairman.

Enquiries:

Gfinity Plc Neville Upton ir@gfinity.net

Beaumont Cornish Limited Roland Cornish +44 (0)207 628 3369

Nominated Adviser and Michael Cornish www.beaumontcornish.co.uk

Broker

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's

Nominated Adviser and is authorised and regulated by the FCA.

Beaumont Cornish's responsibilities as the Company's Nominated

Adviser, including a responsibility to advise and guide the Company

on its responsibilities under the AIM Rules for Companies and AIM

Rules for Nominated Advisers, are owed solely to the London Stock

Exchange. Beaumont Cornish is not acting for and will not be

responsible to any other persons for providing protections afforded

to customers of Beaumont Cornish nor for advising them in relation

to the proposed arrangements described in this announcement or any

matter referred to in it.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISEANFKAFSDFFA

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

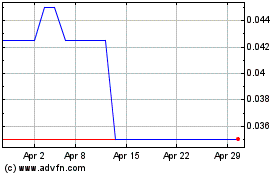

Gfinity (LSE:GFIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gfinity (LSE:GFIN)

Historical Stock Chart

From Dec 2023 to Dec 2024