TIDMGMR

RNS Number : 0682M

Gaming Realms PLC

12 September 2023

12 September 2023

Gaming Realms plc

(the "Company" or the "Group")

Interim Results

Content licensing revenue grew 37% to GBP8.8m after 12

consecutive half years of growth

37% increase in Adjusted EBITDA(1) to GBP4.8m

Gaming Realms plc (AIM: GMR), the developer and licensor of

mobile focused gaming content, is pleased to announce its interim

results for the six months to 30 June 2023 (the "Period" or

"H1'23").

Financial highlights:

H1'23 H1'22 Change

GBPm GBPm %

----------------------------- ------ ------ --------

Revenue (Content licensing) 8.8 6.4 +37%

Revenue (Brand licensing) 1.0 0.3 +222%

Revenue (Social) 1.8 1.8 -2%

------ ------ --------

Total revenue 11.5 8.5 +36%

------ ------ --------

Adjusted EBITDA 4.8 3.5 +37%

Profit before tax 2.4 1.4 +74%

-- Total revenue grew 36% to GBP11.5m in H1'23 (H1'22: GBP8.5m)

-- Group Adjusted EBITDA grew 37% to GBP4.8m (H1'22: GBP3.5m),

representing a 41% Adjusted EBITDA margin (H1'22: 41%)

-- Total licensing revenues grew 46% to GBP9.8m (H1'22: GBP6.7m)

-- Content licensing revenue increased 37% to GBP8.8m (H1'22:

GBP6.4m) with an EBITDA margin of 54% (H1'22: 52%)

-- Brand licensing revenue increased 222% to GBP1.0m (H1'22: GBP0.3m)

-- Profit before tax increased 74% to GBP2.4m (H1'22: GBP1.4m)

-- Net cash at period end up 54% to GBP4.5m (Dec'22: GBP2.9m)

demonstrating the cash generative nature of the Group's business

model

Operational highlights:

-- Launched with 25 new partners globally, including Bet365 in

the UK, Betway, OLG (Provincial Lottery) and LeoVegas in Ontario

and Pokerstars in New Jersey

-- Submitted iGaming Supplier Licenses in British Columbia and

South Africa and the Company was granted its Swedish Gaming

Authority License

-- Secured brand licensing agreements for Tetris and TAITO's

SPACE INVADERS, both expected to launch in the second half of

2023

-- Gained ISO 27001 certification, an internationally recognised

standard for managing information security

-- Released 5 new games into the market, including Slingo

Cleopatra and Slingo Money Train. The Group now has 70 games in its

portfolio (Dec'22: 65 games, Jun'22: 61 games)

Post period-end:

-- Licensing revenue increased 20% in the two months post

period-end compared to the same period in 2022

-- Launched Slingo Originals content with Betclic in the Portuguese regulated market

-- Released Slingo Cosmic Clusters

(1) EBITDA is profit before interest, tax, depreciation and

amortisation expenses and is a non-GAAP measure. The Group uses

EBITDA to comment on its financial performance. The Group uses

EBITDA before share option and related charges (Adjusted EBITDA) to

comment on its financial performance above.

Outlook for FY23:

Gaming Realms has continued its growth through the first half of

2023, as the Company continues to execute on its core strategy of

developing and licensing games globally to market-leading brands

and operators delivering high margin revenues.

This Period has seen a record performance for the Group in terms

of revenue and EBITDA, driven by our core content licensing

business which has had 12 consecutive half years of growth.

This strong momentum is expected to continue into the second

half of the year, given the Group is still entering new markets and

releasing new games, having recently launched with Betclic in

Portugal and having applied for a licence to supply its games to

the South African market and to the Lottery in British

Columbia.

The European market continues to be the largest contributor to

content licensing revenues, having grown 38% in the Period when

compared to the same period in 2022, launching 5 new Slingo games

and adding 9 new partners.

Our revenues from North American content licensing have

increased 37%, with the region accounting for 45% of content

licensing revenue. New Jersey continues to be our leading market,

but Pennsylvania and Michigan are growing strongly as we launch

more games with new partners. As at 30 June 2023, we were live with

57 games in New Jersey across 20 partners, 18 games across 12

partners in Pennsylvania and 28 games across 12 partners in

Michigan.

In total we have launched with 25 partners in H1 2023. This

growth is supported by the launch of premium games, including

Slingo Cleopatra and Slingo Money Train. With the upcoming launch

of Slingo SPACE INVADERS and Tetris Slingo, we are confident of

further growth for the remainder of the year and the Board remains

comfortable with market expectations around FY23 financial

performance.

Commenting on the first half performance, Mark Segal, Chief

Executive Officer, said:

"We have delivered a strong first half performance as we have

grown our international licensing business with the launch of our

innovative Slingo content to a growing number of partners and

players.

"The Group has a strong pipeline of new business and the outlook

for the Group remains positive. We are seeing growth in our

existing partnerships coupled with new operator, product and market

launches, which gives us great confidence in terms of the longer

term prospects for the business."

An analyst briefing will be held virtually at 11.00 am today. To

attend, please contact Yellow Jersey at

gamingrealms@yellowjerseypr.com .

Enquiries

Gaming Realms plc

Michael Buckley, Executive Chairman

Mark Segal, CEO

Geoff Green, CFO 0845 123 3773

Peel Hunt LLP - NOMAD and Joint Broker

George Sellar

Andrew Clark

Lalit Bose 020 7418 8900

Investec Bank plc - Joint Broker

Bruce Garrow

Alex Wright

Ben Farrow 020 7597 5970

Yellow Jersey

Charles Goodwin

Annabelle Wills 07747 788 221

About Gaming Realms

G aming Realms creates and licenses innovative games for mobile,

with operations in the UK, U.S. and Canada. Through its unique IP

and brands, Gaming Realms is bringing together media, entertainment

and gaming assets in new game formats. The Gaming Realms management

team includes accomplished entrepreneurs and experienced executives

from a wide range of leading gaming and media companies.

Business review

The Group delivered overall revenue growth of 36% to GBP11.5m

(H1'22: GBP8.5m), driven by the Group's core content licensing

business.

The Group generated EBITDA of GBP4.5m (H1'22: GBP3.3m) and

GBP4.8m before share option and related charges (H1'22:

GBP3.5m).

The GBP1.2m increase in EBITDA generated compared with the prior

period has seen the Group record a profit before tax of GBP2.4m

(H1'22: GBP1.4m), an increase of GBP1.0m on the prior period.

Licensing

Licensing segment revenues increased 46% to GBP9.8m (H1'22:

GBP6.7m), which is broken down as:

-- Content licensing revenue growth of 37% to GBP8.8m (H1'22: GBP6.4m); and

-- Brand licensing revenue increased 222% to GBP1.0m (H1'22: GBP0.3m).

The segment delivered GBP5.7m EBITDA in the period, a 57%

overall uplift over the GBP3.6m in H1'22.

Content licensing

The core focus of the Group continues to be growing the content

licensing business by way of expanding into new regulated

territories, growing our unique Slingo games portfolio and

developing deep relationships with new and existing partners to

maximise value and engagement.

During the period under review, the Group went live with a

further 25 partners in existing markets within Europe and North

America. The Company was also granted its Swedish Gaming Authority

license, allowing the Company to continue to supply its games to

the Swedish market, and submitted license applications in both

British Columbia, Canada and South Africa.

An additional 5 new Slingo games were released to the market

during the period, bringing the Group's games portfolio to 70 games

at the period end (H1'22: 61 games).

Slingo is a unique genre of game in the market, which is driving

engagement with partners. It continues to prove highly popular with

both partners and players.

This resulted in a 37% increase in content licensing revenues to

GBP8.8m (H1'22: GBP6.4m). Total segmental expenses (excluding share

option and related charges) increased 34% to GBP4.0m (H1'22:

GBP3.0m), further demonstrating the operational leverage of the

content licensing business.

After the period end, the Group began distributing its content

in the Portuguese regulated market.

Brand licensing

Revenues from the Group's brand licensing activities, which are

non-core, increased to GBP1.0m (H1'22: GBP0.3m). This is a result

of two brand deals completed in the period, including a deal with

Entain to launch Slingo Bingo which went live in May 2023.

Social

Revenues in the Group's social publishing business reduced 2% to

GBP1.75m in the period (H1'22: GBP1.79m).

Marketing expenses of GBP0.3m (H1'22: GBP0.0m) have been

invested during the period aimed at increasing player numbers,

activity and revenues over a 12-month period. Management do not

expect this level of marketing investment to be repeated in the

second half of the year, as we expect revenues to be maintained.

Social remains a business where we can further monetise our Slingo

portfolio.

Excluding marketing expenses, segmental expenses increased 12%

to GBP1.2m (H1'22: GBP1.1m) as a result of further investment in

the development and operational team to support the Group's growth

plan.

Cashflow and balance sheet

The Group's cash balance at 30 June 2023 was GBP4.5m, an

increase of GBP1.6m from the GBP2.9m reported at 31 December

2022.

The current period increase in cash was largely driven by the

GBP3.9m cash inflow from operations, offset by GBP2.2m development

costs capitalised during the period and GBP0.1m acquisition of

tangible and intangible assets.

The Group remains debt free following the repayment of the

convertible loan with Gamesys Group in December 2022.

The Board continues to review the optimal use of the cash

balance.

The Group's net asset position at the period end was GBP20.5m

(31 December 2022: GBP17.9m).

Dividend

The Board of Directors are not proposing an interim dividend for

the Period as it continues to execute on its strategy and invest in

the growth of the business.

Consolidated statement of comprehensive income

for the 6 months ended 30 June 2023

6M 6M

30 June 30 June

2023 2022

Unaudited

Unaudited *

Note GBP GBP

------------------------------------------ ----- ------------------------ --------------------------

Revenue 2 11,543,255 8,507,887

Other income 63,147 -

Marketing expenses (437,398) (53,274)

Operating expenses (2,274,375) (1,780,497)

Administrative expenses (4,143,790) (3,194,016)

Share option and related charges 10 (246,056) (162,819)

EBITDA 2 4,504,783 3,317,281

----- ------------------------

Amortisation of intangible assets 6 (2,011,497) (1,737,493)

Depreciation of property, plant

and equipment 5 (135,044) (124,071)

Finance expense 3 (21,845) (117,769)

Finance income 3 15,873 13,038

------------------------------------------ ----- ------------------------ --------------------------

Profit before tax 2,352,270 1,350,986

Taxation credit 159,578 42,155

----- --------------------------

Profit for the period 2,511,848 1,393,141

------------------------------------------ ----- ------------------------ --------------------------

Other comprehensive income

Items that will or may be reclassified

to profit or loss:

Exchange (loss) / gain arising

on translation of foreign operations (95,724) 193,753

------------------------------------------ ----- ------------------------ --------------------------

Total other comprehensive income (95,724) 193,753

------------------------------------------ ----- ------------------------ --------------------------

Total comprehensive income 2,416,124 1,586,894

------------------------------------------ ----- ------------------------ --------------------------

Profit attributable to:

Owners of the parent 2,511,848 1,393,141

------------------------------------------ ----- ------------------------ --------------------------

Total comprehensive income attributable

to:

Owners of the parent 2,416,124 1,586,894

------------------------------------------ ----- ------------------------ --------------------------

Earnings per share Pence Pence

Basic 4 0.86 0.48

Diluted 4 0.84 0.47

------------------------------------------ ----- ------------------------ --------------------------

* Comparative numbers for the period ended 30 June 2022 have

been restated. See Note 1 for further details.

Consolidated statement of financial position

as at 30 June 2023

30 June 31 December

2023 2022

Unaudited Audited

Note GBP GBP

-------------------------------- ----- ------------- -------------

Non-current assets

Intangible assets 6 12,625,820 12,422,852

Property, plant and equipment 5 420,498 535,409

Deferred tax asset 871,255 287,407

Other assets 139,531 138,798

-------------------------------- ----- ------------- -------------

14,057,104 13,384,466

-------------------------------- ----- ------------- -------------

Current assets

Trade and other receivables 7 5,231,496 5,336,330

Cash and cash equivalents 4,490,232 2,922,775

-------------------------------- ----- ------------- -------------

9,721,728 8,259,105

-------------------------------- ----- ------------- -------------

Total assets 23,778,832 21,643,571

-------------------------------- ----- ------------- -------------

Current liabilities

Trade and other payables 8 2,738,282 3,270,319

Lease liabilities 125,848 217,731

-------------------------------- ----- ------------- -------------

2,864,130 3,488,050

-------------------------------- ----- ------------- -------------

Non-current liabilities

Deferred tax liability 238,246 75,592

Lease liabilities 126,752 167,680

-------------------------------- ----- ------------- -------------

364,998 243,272

-------------------------------- ----- ------------- -------------

Total liabilities 3,229,128 3,731,322

-------------------------------- ----- ------------- -------------

Net assets 20,549,704 17,912,249

-------------------------------- ----- ------------- -------------

Equity

Share capital 9 29,288,826 29,200,676

Share premium 87,670,735 87,653,774

Merger reserve (67,673,657) (67,673,657)

Foreign exchange reserve 1,453,977 1,549,701

Retained earnings (30,190,177) (32,818,245)

-------------------------------- ----- -------------

Total equity 20,549,704 17,912,249

-------------------------------- ----- ------------- -------------

Consolidated statement of cash flows

for the 6 months ended 30 June 2023

30 June 30 June

2023 2022

Unaudited Unaudited

Note GBP GBP

------------------------------------------- ------ ------------ ------------

Cash flows from operating activities

Profit for the period 2,511,848 1,393,141

Adjustments for:

Depreciation of property, plant and

equipment 5 135,044 124,071

Amortisation of intangible fixed assets 6 2,011,497 1,737,493

Finance income 3 (15,873) (13,038)

Finance expense 3 21,845 117,769

Income tax credit (159,578) (42,155)

Exchange differences (6,653) 5,413

Share based payment expense 10 116,220 253,775

Increase in trade and other receivables 119,974 (1,427,075)

Decrease in trade and other payables (215,605) (145,627)

Decrease in other assets - 11,848

------------------------------------------- ------ ------------ ------------

Net cash flows from operating activities

before taxation 4,518,719 2,015,615

------------------------------------------- ------ ------------ ------------

Net tax paid in the period (578,675) -

------------------------------------------- ------ ------------ ------------

Net cash flows from operating activities

before taxation 3,940,044 2,015,615

------------------------------------------- ------ ------------ ------------

Investing activities

Acquisition of property, plant and

equipment 5 (25,336) (99,376)

Acquisition of intangible assets 6 (83,763) (83,143)

Capitalised development costs 6 (2,204,419) (2,088,552)

------------------------------------------- ------ ------------ ------------

Net cash used in investing activities (2,313,518) (2,271,071)

------------------------------------------- ------ ------------ ------------

Financing activities

IFRS 16 lease payments (136,662) (103,282)

Issue of share capital on exercise

of options 9 105,111 13,332

Interest paid (13,866) (99,393)

------------------------------------------- ------ ------------ ------------

Net cash used in financing activities (45,417) (189,343)

------------------------------------------- ------ ------------ ------------

Net increase / (decrease) in cash

and cash equivalents 1,581,109 (444,799)

Cash and cash equivalents at beginning

of period 2,922,775 4,412,375

Exchange (loss) / gain on cash and

cash equivalents (13,652) 27,806

------------------------------------------- ------ ------------ ------------

Cash and cash equivalents at end of

period 4,490,232 3,995,382

------------------------------------------- ------ ------------ ------------

Consolidated statement of changes in equity

for the 6 months ended 30 June 2023

Foreign Total to

Merger Exchange Retained equity holders

Share capital Share premium reserve Reserve earnings of parents

GBP GBP GBP GBP GBP GBP

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

1 January 2022 28,970,262 87,370,856 (67,673,657) 1,418,269 (36,977,228) 13,108,502

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

Profit for the

period - - - - 1,393,141 1,393,141

Other comprehensive

income - - - 193,753 - 193,753

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

Total comprehensive

income

for the period - - - 193,753 1,393,141 1,586,894

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

Contributions by and

distributions

to owners

Share-based payment

on share

options (Note 10) - - - - 253,775 253,775

Exercise of options

(Note 9) 13,332 - - - 13,332

Conversion of loan 217,082 282,918 - - 106,000 606,000

30 June 2022

(unaudited) 29,200,676 87,653,774 (67,673,657) 1,612,022 (35,224,312) 15,568,503

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

1 January 2023 29,200,676 87,653,774 (67,673,657) 1,549,701 (32,818,245) 17,912,249

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

Profit for the

period - - - - 2,511,848 2,511,848

Other comprehensive

income - - - (95,724) - (95,724)

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

Total comprehensive

income

for the period - - - (95,724) 2,511,848 2,416,124

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

Contributions by and

distributions

to owners

Share-based payment

on share

options (Note 10) - - - - 116,220 116,220

Exercise of options

(Note 9) 88,150 16,961 - - - 105,111

30 June 2023

(unaudited) 29,288,826 87,670,735 (67,673,657) 1,453,977 (30,190,177) 20,549,704

---------------------- --------------- --------------- ------------- ----------- ------------- -----------------

Notes forming part of the consolidated financial statements

For the 6 months ended 30 June 2023

1. Accounting policies

General Information

Gaming Realms plc ("the Company") and its subsidiaries (together

"the Group").

The Company is admitted to trading on AIM of the London Stock

Exchange. It is incorporated and domiciled in the UK. The address

of its registered office is Two Valentine Place, London, SE1

8QH.

The results for the six months ended 30 June 2023 and 30 June

2022 are unaudited.

Basis of preparation

The financial information for the year ended 31 December 2022

included in these financial statements does not constitute the full

statutory accounts for that year. The Annual Report and Financial

Statements for 2022 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statement for 2022 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

This interim report, which has neither been audited nor reviewed

by independent auditors, was approved by the board of directors on

11 September 2023. The financial information in this interim report

has been prepared in accordance with UK adopted international

accounting standards. The accounting policies applied by the Group

in this financial information are the same as those applied by the

Group in its financial statements for the year ended 31 December

2022 and which will form the basis of the 2023 financial

statements.

The consolidated financial statements are presented in

Sterling.

Restatement of comparatives

The comparative results for the period ended 30 June 2022 have

been restated for the following items:

-- Management believes the presentation of hosting costs as an

operating expense rather than an administrative expense more

accurately reflects the function of the expense. Therefore

GBP601,196 of hosting costs incurred in the comparative period have

been reclassified from administrative expenses to operating

expenses. This reclassification has no impact on reported EBITDA or

profit after tax for the comparative period.

-- In the financial statements for the year ended 31 December

2022, the functional currency of a group company was changed,

effective 1 January 2022. This change was omitted from the 2022

interim financial statements, which have been restated to reflect

this change from 1 January 2022. The restatement has reduced the

total amortisation charge by GBP15,079 to GBP1,737,493, and reduced

the tax credit by GBP2,564 to GBP42,155. The overall impact is no

change to the previously reported EBITDA and an increase in the

reported profit after tax by GBP15,515 for the comparative

period.

Going concern

The Group meets its day-to-day working capital requirements from

the cash flows generated by its trading activities and its

available cash resources.

The Group prepares cash flow forecasts and re-forecasts at least

bi-annually as part of the business planning process.

The Directors have reviewed forecast cash flows for the period

to December 2025, and consider that the Group will have sufficient

cash resources available to meet its liabilities as they fall

due.

Accordingly, these financial statements have been prepared on

the basis of accounting principles applicable to a going concern,

which assumes that the Group will realise its assets and discharge

its liabilities in the normal course of business.

EBITDA

EBITDA is a non-GAAP company specific measure defined as profit

or loss before tax adjusted for finance income and expense,

depreciation and amortisation. EBITDA before share option and

related charges (Adjusted EBITDA) is considered to be a key

performance measure by the Directors as it serves as an indicator

of financial performance.

2. Segment information

The Board is the Group's chief operating decision-maker.

Management has determined the operating segments based on the

information reviewed by the Board for the purposes of allocating

resources and assessing performance.

The Group has two reportable segments.

-- Licensing - B2B brand and content licensing to partners in the US and Europe; and

-- Social publishing - provides B2C freemium games to the US.

Revenue

The Group has disaggregated revenue into various categories in

the following table which is intended to:

-- Depict how the nature, amount, timing and uncertainty of

revenue and cash flows are affected by economic date; and

-- Enable users to understand the relationship with revenue segment information provided below.

Social

Licensing publishing Other Total

H1 2023 revenue GBP GBP GBP GBP

-------------------------- ----------- ------------- ------- -----------

Primary geographical markets

UK, including Channel

Islands 531,124 - - 531,124

USA 3,978,599 1,754,604 - 5,733,203

Isle of Man 392,765 - - 392,765

Malta 1,736,619 - - 1,736,619

Gibraltar 2,483,391 - - 2,483,391

Rest of the World 666,153 - 666,153

-------------------------- ----------- ------------- ------- -----------

9,788,651 1,754,604 - 11,543,255

-------------------------- ----------- ------------- ------- -----------

Contract counterparties

Direct to consumers

(B2C) - 1,754,604 - 1,754,604

B2B 9,788,651 - - 9,788,651

-------------------------- ----------- ------------- ------- -----------

9,788,651 1,754,604 - 11,543,255

-------------------------- ----------- ------------- ------- -----------

Timing of transfer of goods

and services

Point in time 9,788,651 1,754,604 - 11,543,255

Over time - - - -

-------------------------- ----------- ------------- ------- -----------

9,788,651 1,754,604 - 11,543,255

-------------------------- ----------- ------------- ------- -----------

2. Segment information (continued)

Social

Licensing publishing Other Total

H1 2022 revenue GBP GBP GBP GBP

-------------------------- ----------- ------------- ------- ----------

Primary geographical

markets

UK, including Channel

Islands 411,529 - 11,000 422,529

USA 2,857,929 1,788,722 - 4,646,651

Isle of Man 359,662 - - 359,662

Malta 1,224,280 - - 1,224,280

Gibraltar 1,208,956 - - 1,208,956

Rest of the World 645,809 - - 645,809

-------------------------- ----------- ------------- ------- ----------

6,708,165 1,788,722 11,000 8,507,887

-------------------------- ----------- ------------- ------- ----------

Contract counterparties

Direct to consumers

(B2C) - 1,788,722 - 1,788,722

B2B 6,708,165 - 11,000 6,719,165

-------------------------- ----------- ------------- ------- ----------

6,708,165 1,788,722 11,000 8,507,887

-------------------------- ----------- ------------- ------- ----------

Timing of transfer of goods

and services

Point in time 6,708,165 1,788,722 11,000 8,507,887

Over time - - - -

-------------------------- ----------- ------------- ------- ----------

6,708,165 1,788,722 11,000 8,507,887

-------------------------- ----------- ------------- ------- ----------

EBITDA

Licensing Social publishing Head Office Total

H1 2023 GBP GBP GBP GBP

----------------- --------------------------- ------------------------------------------ --------------------------- ------------------------

Revenue 9,788,651 1,754,604 - 11,543,255

Other income - 63,147 - 63,147

Marketing

expense (55,826) (334,197) (47,375) (437,398)

Operating

expense (1,622,353) (652,022) - (2,274,375)

Administrative

expense (2,342,829) (582,910) (1,218,051) (4,143,790)

Share option (50,100) (5,499) (190,457) (246,056)

and

related charges

----------------- --------------------------- ------------------------------------------ --------------------------- ------------------------

EBITDA 5,717,543 243,123 (1,455,883) 4,504,783

----------------- --------------------------- ------------------------------------------ --------------------------- ------------------------

2. Segment information (continued)

Licensing Social publishing Head Office Total

H1 2022 GBP GBP GBP GBP

----------------- ------------------------- ------------------------------------------ --------------------------- -------------------------

Revenue 6,708,165 1,788,722 11,000 8,507,887

Marketing (13,081) (2,063) (38,130) (53,274)

expense

Operating

expense (1,161,910) (618,587) - (1,780,497)

Administrative

expense (1,815,916) (485,343) (892,757) (3,194,016)

Share option

and

related

charges (77,067) (855) (84,897) (162,819)

----------------- ------------------------- ------------------------------------------ --------------------------- -------------------------

EBITDA 3,640,191 681,874 (1,004,784) 3,317,281

----------------- ------------------------- ------------------------------------------ --------------------------- -------------------------

As per Note 1, the restatement of comparative results relating

to hosting fees has also been reflected in the segmental

information. In the licensing segment GBP440,153 has been

reclassified from administrative expenses to operating expenses, in

the social publishing segment the reclassification is

GBP161,043.

3. Finance income and expense

6M 6M

30 June 30 June

2023 2022

GBP GBP

---------------------------------------- ----------------------------- -----------------------------

Finance income

Interest received 733 -

Interest income on unwind of deferred

income 15,140 13,038

----------------------------------------- ----------------------------- -----------------------------

Total finance income 15,873 13,038

----------------------------------------- ----------------------------- -----------------------------

Finance expense

Bank interest paid 13,866 9,519

Effective interest on other creditor - 94,497

Interest expense on lease liability 7,979 13,753

----------------------------------------- ----------------------------- -----------------------------

Total finance expense 21,845 117,769

----------------------------------------- ----------------------------- -----------------------------

4. Earnings per share

Basic earnings per share is calculated by dividing the result

attributable to ordinary shareholders by the weighted average

number of shares in issue during the period. The calculation of

diluted EPS is based on the result attributable to ordinary

shareholders and weighted average number of ordinary shares

outstanding after adjustment for the effects of all dilutive

potential ordinary shares. The Group's potentially dilutive

securities consist of share options.

6M 6M

30 June 30 June

2023 2022

GBP GBP

------------------------------------------- ------------ ------------

Profit after tax attributable to the

owners of the parent Company 2,511,848 1,393,141

Number Number

------------------------------------------- ------------ ------------

Denominator - basic

Weighted average number of ordinary

shares 292,174,223 291,309,072

Denominator - diluted

Weighted average number of ordinary

shares 292,174,223 291,309,072

Weighted average number of option shares 8,092,887 7,442,107

------------------------------------------- ------------ ------------

Weighted average number of shares 300,267,111 298,751,179

------------------------------------------- ------------ ------------

Pence Pence

------------------------------------------- ------------ ------------

Basic earnings per share 0.86 0.48

Diluted earnings per share 0.84 0.47

------------------------------------------- ------------ ------------

5. Property, plant and equipment

Computers Office

ROU lease Leasehold and related furniture

assets improvements equipment and equipment Total

GBP GBP GBP GBP GBP

----------------------- ----------- --------------- -------------- ---------------- ----------

Cost

At 1 January 2023 835,973 63,113 436,667 68,231 1,403,984

Additions - - 24,261 1,075 25,336

Disposals (121,996) - - - (121,996)

Exchange differences (4,279) (160) (3,320) (1,046) (8,805)

At 30 June 2023 709,698 62,953 457,608 68,260 1,298,519

----------------------- ----------- --------------- -------------- ---------------- ----------

Accumulated deprecation and

impairment

At 1 January 2023 493,168 46,326 266,456 62,625 868,575

Depreciation charge 78,193 6,163 49,137 1,551 135,044

Disposals (121,996) - - - (121,996)

Exchange differences (210) (160) (2,251) (981) (3,602)

At 30 June 2023 449,155 52,329 313,342 63,195 878,021

----------------------- ----------- --------------- -------------- ---------------- ----------

Net book value

At 1 January 2023 342,805 16,787 170,211 5,606 535,409

----------------------- ----------- --------------- -------------- ---------------- ----------

At 30 June 2023 260,543 10,624 144,266 5,065 420,498

----------------------- ----------- --------------- -------------- ---------------- ----------

6. Intangible assets

Customer Development Domain Intellectual

Goodwill database Software costs Licenses names Property Total

GBP GBP GBP GBP GBP GBP GBP GBP

---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

Cost

At 1 January

2023 6,799,250 1,490,536 1,316,645 21,493,414 319,471 8,874 5,844,747 37,272,937

Additions - - 16,627 2,204,419 67,136 - - 2,288,182

Exchange

differences (54,383) - - (29,931) (392) - - (84,706)

At 30 June

2023 6,744,867 1,490,536 1,333,272 23,667,902 386,215 8,874 5,844,747 39,476,413

--------------- ---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

Accumulated amortisation

and impairment

At 1 January

2023 1,650,000 1,490,536 1,291,285 14,879,872 129,430 8,874 5,400,088 24,850,085

Amortisation

charge - - 20,483 1,559,222 66,249 - 365,543 2,011,497

Exchange

differences - - - (10,989) - - - (10,989)

At 30 June

2023 1,650,000 1,490,536 1,311,768 16,428,105 195,679 8,874 5,765,631 26,850,593

--------------- ---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

Net book

value

At 1 January

2023 5,149,250 - 25,360 6,613,542 190,041 - 444,659 12,422,852

--------------- ---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

At 30 June

2023 5,094,867 - 21,504 7,239,797 190,536 - 79,116 12,625,820

--------------- ---------- ----------- ---------- ------------- ---------- -------- -------------- -----------

7 . Trade and other receivables

30 June 31 December

2023 2022

GBP GBP

--------------------------------- ---------- ------------

Trade receivables 2,755,937 3,497,710

Other receivables 262,098 145,506

Tax and social security 550,878 280,912

Prepayments and accrued income 1,662,583 1,412,202

--------------------------------- ---------- ------------

5,231,496 5,336,330

--------------------------------- ---------- ------------

All amounts shown fall due for payment within one year.

8. Trade and other payables

30 June 31 December

2023 2022

GBP GBP

-------------------------- ---------- ------------

Trade payables 830,430 669,024

Other payables 146,835 118,777

Tax and social security 158,931 464,557

Accruals 1,602,086 2,017,961

-------------------------- ---------- ------------

2,738,282 3,270,319

-------------------------- ---------- ------------

The carrying value of trade and other payables classified as

financial liabilities measured at amortised cost approximates fair

value. All amounts shown fall due for payment within one year.

9. Share capital

30 June 30 June 31 December 31 December

2023 2023 2022 2022

Ordinary shares Number GBP Number GBP

Ordinary shares of 292,888,281 29,288,826 292,006,775 29,200,676

------------ ----------- ------------ ------------

10 pence each

--------------------- ------------ ----------- ------------ ------------

The issue of 881,506 ordinary shares relates to the exercise of

share options during the period. The increase in share capital of

GBP88,150 and share premium of GBP16,961, totalling GBP105,111 is

disclosed in the consolidated statement of changes in equity and

consolidated statement of cash flows.

10. Share based payments

The share option and related charges income statement expense

comprises:

6M 6M

30 June 2023 30 June 2022

GBP GBP

------------------------------------ -------------- --------------

IFRS 2 share-based payment charge 116,220 253,775

Direct taxes related to share

options 129,836 (90,956)

------------------------------------ -------------- --------------

246,056 162,819

------------------------------------ -------------- --------------

IFRS 2 (Share-based payments) requires that the fair value of

equity settled transactions are calculated and systematically

charged to the statement of comprehensive income over the vesting

period. The total fair value that was charged to the income

statement in the period in relation to equity-settled share-based

payments was GBP116,220 (H1'22: GBP253,775).

Where individual EMI thresholds are exceeded or when unapproved

share options are exercised by overseas employees, the Group is

subject to employer taxes payable on the taxable gain on exercise.

Since these taxes are directly related to outstanding share

options, the income statement charge has been included within share

option and related charges. The Group uses its closing share price

at the reporting date to calculate such taxes to accrue. The tax

related income statement charge for the period was GBP129,836

(H1'22: GBP90,956 credit).

11. Related party transactions

Jim Ryan is a Non-Executive Director of the Company and the CEO

of Pala Interactive, which has a real-money online casino and bingo

site in New Jersey, Pennsylvania and Ontario. During the period,

total license fees earned by the Group were $30,259 (H1'22:

$10,401) with $23,180 due at 30 June 2023 (30 June 2022: $940).

During the period the Group distributed its content to certain

North American partners via Pala's B2B platform distribution

network, with platform fees of $7,933 being incurred (H1'22: $108)

of which $3,243 was owed at 30 June 2023 (30 June 2022: $108).

During the period GBP90,000 (H1'22: GBP75,000) of consulting

fees were paid to Dawnglen Finance Limited, a company controlled by

Michael Buckley. No amounts were owed at 30 June 2023 (30 June

2022: GBPNil).

12. Post balance sheet events

On 2 August 2023 3,455,000 share options were granted to certain

Directors and employees of the Group. All of the options vest on 30

June 2026. All of the options have an exercise price of nil

pence.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKDBDABKDACD

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

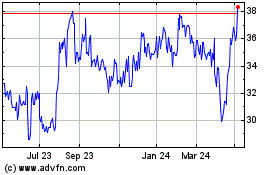

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

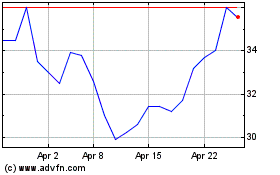

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Apr 2023 to Apr 2024