TIDMHAT

RNS Number : 3260V

H&T Group PLC

09 August 2022

9(th) August 2022

H&T Group PLC ("H&T" or "the Group" or "the

Company")

UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 June 2022

H&T Group plc (AIM:HAT), the UK's largest pawnbroker and a

leading retailer of high quality new and pre-owned jewellery and

watches, today announces its interim results for the six months

ended 30 June 2022 ("the period").

Highlights

-- Profit before tax of GBP6.7m (H1'2021: GBP4.7m) as the

continued momentum in our core pawnbroking business underpinned

a strong performance.

-- The pledge book grew 27% to GBP85.1m (December 2021:

GBP66.9m) with demand for pledge lending remaining at

record levels. Daily average lending volumes are more

than 40% above pre-pandemic norms.

-- Retail sales of GBP20.8m (H1'2021: GBP12.4m) reflects

an increasing demand for high quality new and pre-owned

jewellery and watches.

-- Net income from other services of GBP9.4m (H1'2021: GBP8.3m),

driven by buoyant gold purchasing, particularly during

the second quarter, and a doubling of foreign currency

revenues as international holiday travel returns. Revenue

from personal loans has reduced as the book reduces.

-- Net Asset Value of GBP139.1m (December 2021: GBP136.6m),

supported by assets of high intrinsic value.

-- Net Debt of GBP8.6m (December 2021: net cash GBP17.6m).

Cash balances and funding facilities have been deployed

primarily to fund the growing pledge book and increased

inventory.

-- Interim dividend increased to 5p per share (H1'2021:

4p), reflecting the Board's growing confidence in the

future prospects for the Group.

-- Acquired Swiss Time Services for a consideration of GBP4.3m,

inclusive of a net cash balance of GBP0.5m, on 1 July

2022. This acquisition is immediately earnings enhancing

and will bring watch repair and servicing expertise in-house,

supporting the Group's growing watch business.

Chris Gillespie, H&T chief executive, said:

"This year is the 125(th) anniversary of the founding of

H&T. We have a proud history and the growth we have seen in the

first half of this year has been very encouraging. We experienced

increasing momentum across our product set, customer base, and

geographical locations. This has continued into the second

half.

I am delighted that we recently concluded the acquisition of

Swiss Time Services, allowing the Group to add watch repair

services to its product offering, which aligns well with our

broader watch strategy. We look forward to the opportunities and

synergies this acquisition will bring to the Group.

We continue to invest, both in our store estate to take

advantage of the ongoing strong demand for our services, and the

opportunity to expand beyond our current footprint. We remain

focused on enhancing the Group's IT infrastructure and digital

capabilities. We have begun the roll out of the new Point of Sale

(POS) system in our stores, with full roll out expected to be

completed before the end of 2022.

The positive trading momentum which began in late in 2021 has

continued into 2022, with monthly demand for pledge lending

growing, consistent appetite for our new and pre-owned retail

products, and a strong rebound in gold purchase and foreign

currency sales. We anticipate that demand for our services will

continue to grow in the months ahead, and we are investing in scale

and capabilities, both operational and technological, in order to

take advantage of the opportunities ahead of us.

I am extremely proud of the H&T team, wherever they work

across the Group. They consistently deliver outstanding levels of

service to our customers. They are and will remain, critical to our

future success."

Financial Highlights 2022 2021 Change FY 2021

(GBPm unless stated) %

6 months ended 30

June

------------ ---------- -------

Reported Profit before GBP6.7m GBP4.7m 42.6% GBP7.9m

Tax

Reported Diluted

EPS (p) 13.1p 9.3p 40.9% 15.4p

Dividends per share 5p 4p 25% 12.0p

Net assets GBP139.1m GBP135.9m 2.4% GBP136.6m

Key Performance

Indicators

Net Pledge book GBP85.1m GBP50.2m 69.5% GBP66.9m

Net Pawnbroking revenue GBP22.9m GBP18.5m 23.8% GBP37.7m

Retail sales GBP20.8m GBP12.4m 67.7% GBP36.2m

online sales 14% 19% 14%

new jewellery sales 18% 13% 16%

gross margin 42% 54%* 46%

Number of stores 261 254 257

* Underlying margin excluding provisions

movements 46%

--------------------------------------------- ---------- ------- ----------

Enquiries

H&T Group plc

Chris Gillespie, Chief Executive +44(0)20 8225 2700

Diane Giddy, Chief Financial Officer

Shore Capital Ltd (Nominated Advisor and Broker) +44(0)20 7408

4090

Stephane Auton/Iain Sexton (Corporate Advisory)

Guy Wiehahn/Chloe Booker-Triolo (Corporate Broking)

Alma PR (Public Relations) +44(0)20 3405 0205

Sam Modlin

handt@almarpr.co.uk

Andy Bryant

Lily Soares Smith

INTERIM REPORT

Overview

The period under review has been one of continued momentum for

the Group, with growth seen across the entire product set, customer

base, and geographical locations. The Group delivered profit before

tax of GBP6.7m (H1'2021: GBP4.7m). The Pawnbroking and Retail

segments continue to be the major contributors to our performance,

supported by returning demand for gold purchasing and foreign

currency.

We opened four new stores in the first half, growing the number

of stores to 261. A further store opened in July with three more

opening in August, and further openings are planned for the

remainder of the year. We have also increased the pace of the

rolling refurbishment programme for our current store estate.

We are implementing a new POS system, which will dramatically

enhance customers' experience in store and is fundamental to the

investment in our digital capabilities. It provides a single

customer view across the product range and will enable customers to

interact with us more effectively across all channels. Roll out is

expected to be completed by the end of 2022.

Financial Results

The Group delivered profit before tax of GBP6.7m (H1'2021:

GBP4.7m).

The Pawnbroking and Retail segments continue to be the major

contributors to our performance, supported by returning demand for

gold purchasing and foreign currency. The growth in the pledge book

was the driver of a net increase in impairment charges as required

by IFRS 9, of GBP6.7m (H1'2021: GBP1.7m), which reduces reported

profits in the short term.

The Group's balance sheet remains strong with net assets of

GBP139.1m (December 2021: GBP136.6m). The balance sheet is

primarily underpinned by the inherent value, expressed at cost, of

precious metals - mainly gold and watches - both in the form of

collateral for the pledge book and in inventory.

Inventories increased to GBP36.1m (December 2021: GBP28.4m).

Retail stock holding in stores is broadly flat. The significant

increase in gold purchasing demand since April is the main

contributor to this short-term increase in stock holding, along

with higher quantities of pledged items released from the

pawnbroking book. We are addressing this by investing in increased

capacity at our processing centre, and in broadening contractual

relationships with smelters. We expect this increase in capacity to

result in inventory levels reducing in H2, with a subsequent

realisation of revenue and profit.

At 30 June 2022 the Group had net debt of GBP8.6m (December

2021: net cash GBP17.6m). Cash balances and funding facilities have

been deployed primarily to fund the growing pledge book and

increased inventory.

Direct and administration expenses increased to GBP40.3m

(H1'2021: GBP30.1m). Impairment charges expressed under IFRS9,

which are included in these expenses, were GBP5m higher than prior

year as a result of the significant increase in pledge balances.

Close cost control continues to be a priority at a time of rising

inflationary pressures. Employee related costs have increased by 7%

this year. We continue to negotiate improved leasehold occupancy

terms upon lease renewal, and the Group fixed its energy costs in

December 2021 until the end of 2023.

Review of Operations

Pawnbroking

Pledge lending is the Group's core business, contributing 39%

(H1'2021: 40%) to total revenue. Demand for pledge lending

continued to gather momentum during the first half of 2022, as

customers' increasing need to access small sums of short-term

credit comes at a time of reduced market supply following the

departure of several firms from the unsecured lending market.

Demand for lending has been growing consistently through the

period, and lending volumes are now more than 40% in excess of

pre-pandemic levels.

The pledge book grew by 27% in the period, to GBP85.1m (December

2021: GBP66.9m). As expected, the composition of the pledge book

has reverted to pre-pandemic norms across customer segments and

loan values. The recovery in demand for larger value loans began

later than smaller value, higher yielding loans and has now fully

returned.

Redemption rates remain above historic norms. However, more time

is required to determine any longer-term impact of changing

customer behaviour. During the second quarter of 2022 we have seen

an increased propensity of customers to repay their loans and

redeem their items more quickly, shortening average loan duration

to 98 days (December 2021: 107 days).

Net Revenue amounted to GBP22.9m (H1'2021: GBP18.5m) an increase

of 23.8% on prior year with an annualised risk adjusted margin of

61.4% (H1'2021: 73.6%). Interest margins before the impact of IFRS

impairment charge are moderating as expected, as the composition of

the pledge book has returned to a more normal distribution, along

with the impact of shortening duration.

The average pledge lending value remains below GBP400, albeit

the recovery in demand for larger loans has increased this average

relative to the prior year. The median lending value for the first

half of 2022 was GBP180 per loan (6 months to December 2021:

GBP170). Average Loan to Value has remained below 65%.

Pawnbroking summary

6 months ended 30 June 2022 2021 Change FY

GBP'm GBP'm % 2021

---------- --------- --------

Net pledge book - note 1 GBP85.1 GBP50.2 69.5% GBP66.9

Average net pledge book GBP77.1 GBP48.6 58.6% GBP53.7

Revenue GBP30.0 GBP20.9 43.5% GBP44.7

Impairment charge GBP7.2 GBP2.4 200.0% GBP7.5

Net revenue GBP22.9 GBP18.5 23.8% GBP37.3

Annualised Interest margin note

2 79.2% 87.1% 83.3%

Annualised risk adjusted margin

note 3 61.4% 73.6% 69.5%

--------------------------------------- ---------- --------- -------- --------

Notes:

1. Includes accrued interest and impairment

2. Revenue expressed on an annualised basis as a percentage

of the average net pledge book over the previous 12 months

3. Net revenue expressed on an annualised basis as a percentage

of the average net pledge book over the previous 12 months

------------------------------------------------------------------------ --------

Retail

H&T is a leading retailer of high quality pre-owned

jewellery and watches. We also offer customers an expanding range

of new jewellery items.

Retail sales for H1'2022 grew by 67.7% to GBP20.8m (H1'2021:

GBP12.4m), which generated profits of GBP8.7m (H1'2021: GBP6.7m).

Margins remain above historic levels at 42% (H1'2021 underlying

margin: 46%). The reduction year on year primarily reflects the

sales mix between new and pre-owned products.

Sales of pre-owned products represented 82% (H1'2021: 87%) of

total sales. Supply of some pre-owned jewellery categories has been

constrained during and immediately following the pandemic,

requiring us to source higher volumes of new jewellery. We expect

this to moderate as a result of the strong pawnbroking and gold

purchase performance.

Online sales continue to grow, representing 14% (H1'2021: 16%)

of total sales and generating income of GBP2.9m (H1'2021: GBP2.4m).

We were unable to offer retail products for sale in our stores for

much of the first half of 2021 due to pandemic-related trading

restrictions. The Group's strategic objective to improve our web

capabilities and our customer journey remains a priority.

Gold Purchasing, Scrap and Other Services

Other services include Gold Purchasing, Pawnbroking Scrap,

Foreign Currency (FX), Money Transfer, Cheque Cashing and Personal

Lending.

Combined net revenue generated from Gold Purchasing, Pawnbroking

Scrap, FX, Money Transfer and Cheque Cashing was up 74.5% to

GBP8.2m (H1'2021: GBP4.7m), before personal loans, a product which

is no longer offered, and which was a meaningful contributor in

prior periods.

Gold Purchasing: The prevailing gold price has a direct impact

on gold purchasing as it affects customer demand. The gold price

has been elevated since February 2022. The average gold price per

troy ounce during the period was GBP1,445 (H1'2021: GBP1,301) and

coupled with the impact of inflation on customers disposable

income, we have seen a significant increase in gold purchase

volumes in recent months. Some of this volume is yet to be

processed and is currently held in inventory.

Gold purchasing contributed net revenue of GBP2.8m (H1'2021:

GBP1.3m) on sales of GBP15.1m (H1'2021: GBP8.0m). The gross margin

also benefited from the higher gold price, rising to 19% (H1'2021:

16%).

Pawnbroking Scrap : The growing size of the pledge book has

increased the volume of items, if not sold at auctions, which

progresses to the scrapping process. Some of this volume is yet to

be processed and is currently held in inventory.

The gross value of pawnbroking scrap sales to June 2022 was

GBP7.1m (H1'2021: GBP5.2m) with gross margin of GBP1.4m (H1'2021:

GBP1.0m) up 40% on the prior year, with margins remaining

consistent at 19%.

Foreign Currency: With the return of international holiday

travel, transaction volumes have improved and are back close to

pre-pandemic levels. Gross profit grew by 160% to GBP2.6m (H1'2021:

GBP1m). We have identified this market as a growth opportunity for

the group

Money Transfer: Revenues remained flat at GBP0.8m (H1'2021:

GBP0.8m) on slightly higher transaction volumes. This activity is a

major driver of footfall to our stores.

Cheque Cashing: An increase in volumes, in part as a result of

recent government related cheque issuance, increased revenue earned

to GBP0.5m (H1'2021: GBP0.4m). Overall contribution remains modest

as the use of cheques in the UK economy is in long term

decline.

Personal Lending : Following the decision to cease all unsecured

lending in the first half of 2022, the unsecured loan book has

reduced to GBP1.8m (June 2021: GBP3.4m) as repayments were received

and impairment provisions released accordingly.

2022 Business Focus and Outlook

We believe that the Group has an opportunity for significant

growth in the medium term. This applies across our product

offering. Our focus is to ensure the Group is well positioned to

take advantage of these growth opportunities. Our priorities

are:

Store Estate

We believe that our stores, and our outstanding people, are and

will remain the heart of our business. There are opportunities to

expand the geographic coverage of our store network and we are

investing both in new store openings and in refreshing existing

stores. We opened four new stores in the first half of the year. A

further store was opened in July with three more opening in August.

This will bring the total number of stores to 265. We have a target

list of potential locations. Further openings are planned for the

remainder of the year and beyond, with the capital investment of a

new store being relatively modest.

Digital Strategy and Customer Journey

A new Point of Sale (POS) system, known as Evo, is being

deployed across the store network. Roll out will be completed in

the current year. This will revolutionise customers' experience in

stores whilst providing us with improved data and a single view of

the customer relationship across all products. This will support

more effective and better targeted marketing communications and

merchandising.

We will significantly improve and enhance our online presence.

We have started with the investor relations portal which has

recently been refreshed and the customer facing websites and our

social media presence are both in the process of being upgraded.

Our aim is to further modernise the functionality, and the look and

feel. We intend to make it easier for customers to do business with

us through the channel they choose.

Broadening our Business

On the 1(st) July 2022, the Group completed the acquisition of

Swiss Time Services Limited. This is an exciting opportunity for us

to bring watch expertise in house and broaden the range of services

we can offer to customers. Watches represent a growing part of the

business and a further growth opportunity. Watches currently

represent 14% of pledge lending and 15% of retail sales by value.

We believe by enhancing our capabilities in this area we can

further develop this line of business leading to improved

margins.

In 2019 the Group acquired a portfolio of over 70 stores and

pledge books, the integration of which has been very successful.

These stores are growing at a rate above that of the "mature" wider

estate, and the team has become very much a part of the H&T

family. We believe that further consolidation opportunities may

present themselves in future.

Macro-Economic Environment

We see the trading environment in the near term being positive

across the product range.

Pledge Book

We anticipate continued strong demand for our core pawnbroking

product as the impact of inflation on the consumer increases the

need for small sum, short term loans at a time when supply of

credit is more constrained than has been the case for many

years.

Retail

H&T is a leading retailer of high quality pre-owned

jewellery and watches. We also offer our customers an expanding

range of new jewellery items. Demand is expected to remain robust

for the remainder of the year, supported by the growing

attractiveness of buying pre-owned products and the environmental

and sustainability benefits this brings. Customers view these items

as representing good value for money, but also as a store of value

which can be sold or used as collateral for a future pledge loan if

their circumstances change.

Other

We expect increasing demand for foreign exchange services as

overseas travel continues to rebound. With increased focus and the

introduction of on-line options for customers, we consider this

market to be a growth opportunity for the Group.

Our Cost Base

Like all businesses, H&T is experiencing continued supply

chain pressures and the impact of inflation. We are mindful of the

impact of these economic factors on all our stakeholders. H&T

is primarily a fixed cost business and achieving operating

efficiencies will remain a key management focus while ensuring

capital is invested where appropriate and where attractive returns

can be achieved.

Dividend

The Board has approved an increased interim dividend of 5p (2021

interim: 4p), reflecting growing confidence in the future prospects

of the Group whilst adhering to the Group's stated dividend policy

of maintaining at least two times cover. The dividend will be paid

on 7 October 2022 to shareholders on the share register at the

close of business on 9 September 2022.

Interim Condensed Financial Statements

Unaudited Group Statement of Comprehensive Income

For the 6 months ended 30 June 2022

6 months 6 months 12 months

ended 30 ended 30 ended 31

June 2022 June 2021 December

Total Total 2021

Unaudited Unaudited Total

Continuing operations: Note GBP'000 GBP'000 GBP'000

Revenue 2 77,756 51,929 121,995

Cost of sales (30,070) (16,619) (45,640)

Gross profit 2 47,686 35,310 76,355

Other direct expenses (29,470) (21,190) (46,251)

* Impairment (included in the figure above) (6,703) (1,733) (6,012)

Administrative expenses (10,866) (8,917) (18,904)

Recurring operating profit 7,350 5,203 11,200

Non-recurring expenses - - (2,099)

Operating profit 7,350 5,203 9,101

Investment revenues - - 8

Finance costs 3 (631) (549) (1,247)

Profit before taxation 6,719 4,654 7,862

Tax charge on profit 4 (1,571) (1,015) (1,818)

Profit for the period and total

comprehensive income 5,148 3,639 6,044

Pence Pence Pence

Earnings per share from continuing

operations

Basic 5 13.15 9.29 15.43

Diluted 5 13.14 9.29 15.43

All profit for the period is attributable to equity

shareholders.

Unaudited Group Statement of Changes in Equity

For the 6 months ended 30 June 2022

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Note 2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Opening total equity 136,618 134,549 134,549

Total comprehensive income for the

period 5,148 3,639 6,044

Share option movement taken directly

to equity 481 120 11

Dividends paid 10 (3,133) (2,392) (3,986)

Closing total equity 139,114 135,916 136,618

Unaudited Group Balance Sheet

As at 30 June 2022

At 30 June At 30 June At 31 December

2022 2021 2021

Unaudited Unaudited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 19,341 19,330 19,330

Other intangible assets 3,630 2,229 1,892

Property, plant, and equipment 11,955 9,721 11,101

Right-of-use assets 16,973 18,311 17,400

Deferred tax assets 1,481 2,749 1,726

53,380 52,340 51,449

Current assets

Inventories 36,090 28,159 28,421

Trade and other receivables 90,522 55,951 72,449

Cash and bank balances 12,711 32,493 17,638

139,323 116,603 118,508

Total assets 192,703 168,943 169,957

Current liabilities

Borrowings 8 (6,343) - -

Trade and other payables (9,491) (10,266) (10,154)

Lease liabilities (5,768) (3,260) (3,191)

Current tax liability (1,094) (919) (375)

(22,696) (14,445) (13,720)

Net current assets 116,627 102,158 104,788

Non-current liabilities

Borrowings 8 (15,000) - -

Lease liabilities (12,530) (16,909) (15,792)

Long term provisions (3,363) (1,673) (3,827)

(30,893) (18,582) (19,619)

Total liabilities (53,589) (33,027) (33,339)

Net assets 139,114 135,916 136,618

Equity

Share capital 9 1,993 1,993 1,993

Share premium account 33,486 33,486 33,486

Employee Benefit Trust shares

reserve (23) (35) (35)

Retained earnings 103,658 100,472 101,174

Total equity attributable

to equity holders 139,114 135,916 136,618

Unaudited Group Cash Flow Statement

For the 6 months ended 30 June 2022

6 months 6 months 12 months

ended 30 ended 30 ended 31

June June December

2022 2021 2021

Unaudited Unaudited

Note GBP'000 GBP'000 GBP'000

Net cash (utilised) /generated from

operating activities 6 (15,563) 5,401 (3,035)

Investing activities

Interest received - - 8

Purchases of intangible assets (993) (155) (158)

Purchases of property, plant, and

equipment (4,547) (2,325) (5,231)

Acquisition of trade and assets of

businesses (47) - -

Acquisition of Right-of-use assets (1,987) (2,489) (4,081)

Net cash used in investing activities (7,574) (4,969) (9,462)

Financing activities

Dividends paid (3,133) (2,392) (3,986)

Increase in borrowings 15,000 - -

Increase in overdraft 6,343 - -

Debt restructuring costs - - (332)

Net cash generated / (used in) from

financing activities 18,210 (2,392) (4,318)

Net decrease in cash and cash equivalents (4,927) (1,960) (16,815)

Cash and cash equivalents at beginning

of the period 17,638 34,453 34,453

Cash and cash equivalents at end

of the period 12,711 32,493 17,638

Unaudited notes to the Condensed Interim Financial

Statements

For the 6 months ended 30 June 2022

1. Finance information and significant accounting policies

The interim financial statements of the group for the six months

ended 30 June 2022, which are unaudited, have been prepared in

accordance with the International Financial Reporting Standards

('IFRS') accounting policies adopted by the group and set out in

the annual report and accounts for the year ended 31 December 2021.

The group does not anticipate any change in these accounting

policies for the year ended 31 December 2022. As permitted, this

interim report has been prepared in accordance with the AIM rules

but not in accordance with IAS 34 "Interim financial reporting".

While the financial figures included in this preliminary interim

earnings announcement have been computed in accordance with IFRSs

applicable to interim periods, this announcement does not contain

sufficient information to constitute an interim financial report as

that term is defined in IFRS.

The financial information contained in the interim report also

does not constitute statutory accounts for the purposes of section

434 of the Companies Act 2006. The financial information for the

year ended 31 December 2021 is based on the statutory accounts for

the year ended 31 December 2021. The auditors reported on those

accounts: their report was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

Revenue recognition

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for goods

and services and interest income provided in the normal course of

business, net of discounts, VAT, and other sales-related taxes.

The Group recognises revenue from the following major

sources:

-- Pawnbroking, or Pawn Service Charge (PSC).

-- Retail jewellery sales.

-- Pawnbroking scrap and gold purchasing.

-- Personal loans interest income.

-- Income from other services and

-- Other income

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured.

Pawnbroking, or Pawn Service Charge (PSC)

PSC comprises contractual interest earned on pledge loans, plus

auction profit or loss, less any auction commissions payable and

less surplus payable to the customer. Revenue is recognised over

time in relation to the interest accrued by reference to the

principal outstanding and the effective interest rate applicable as

governed by IFRS 9.

Retail jewellery sales

Jewellery inventory is sourced from unredeemed pawn loans, newly

purchased items and inventory refurbished from the Group's gold

purchasing operation. For sales of goods to retail customers,

revenue is recognised when control of the goods has transferred,

being at the point the customer purchases the goods at the store.

Payment of the transaction price is due immediately at the point

the customer purchases the goods.

Under the Group's standard contract terms, customers have a

right of return within 30 days. Whilst stores were closed owing to

Covid-19 restrictions the returns policy was extended to cover a

period of 30 days after the store reopened. Additional flexibility

was offered during the year to allow customers to return items by

post rather than attend store. At the point of sale, a refund

liability and a corresponding adjustment to revenue is recognised

for those products expected to be returned. At the same time, the

Group has a right to recover the product when customers exercise

their right of return so consequently recognises a right to

returned goods asset and a corresponding adjustment to cost of

sales.

The Group uses its accumulated historical experience to estimate

the number of returns. It is considered highly probable that a

significant reversal in the cumulative revenue recognised will not

occur given the consistent and immaterial level of returns over

previous years; as a proportion of sales H1'2022 returns were 6%

(H1'2021: 6%)

Pawnbroking scrap and gold purchasing

Scrap revenue comprises proceeds from gold scrap sales. Revenue

is recognised when control of the goods has transferred, being at

the point the smelter purchases the relevant metals.

Other services

Other services comprise revenues from personal loan interest

income, third party cheque cashing, foreign exchange income,

buyback, Western Union, and other income. Commission receivable on

cheque cashing, foreign exchange income and other income is

recognised at the time of the transaction as this is when control

of the goods has transferred.

The Group recognises interest income arising on secured and

unsecured lending within trading revenue rather than investment

revenue on the basis that this represents most accurately the

business activities of the Group.

Other income

Government grants, including monies received under the

Coronavirus job retention scheme are recognised as other income

when there is reasonable assurance that the Group will comply with

the scheme conditions and the monies will be received. There are no

unfulfilled conditions and contingencies attaching to recognised

grants.

Gross profit

Gross profit is stated after charging inventory, pledge and

other services provisions and direct costs of inventory items sold

or scrapped in the year.

Other direct expenses

Other direct expenses comprise all expenses associated with the

operation of the various stores and collection centre of the Group,

including premises expenses, such as rent, rates, utilities and

insurance, all staff costs and staff related costs for the relevant

employees.

Inventories provisioning

Where necessary provision is made for obsolete, slow moving, and

damaged inventory or inventory shrinkage. The provision for

obsolete, slow moving, and damaged inventory represents the

difference between the cost of the inventory and its market value.

The inventory shrinkage provision is based on an estimate of the

inventory missing at the reporting date using historical shrinkage

experience.

2. Operating segments

Business segments

For reporting purposes, the Group is currently organised into

six segments - pawnbroking, gold purchasing, retail, pawnbroking

scrap, and other services.

The principal activities by segment are as follows:

Pawnbroking:

Pawnbroking is a loan secured against a collateral (the pledge).

In the case of the Group, over 99% of the collateral against which

amounts are lent comprises precious metals (predominantly gold),

diamonds and watches. The pawnbroking contract is a six-month

credit agreement bearing a monthly interest rate of between 1.99%

and 9.99%. The contract is governed by the terms of the Consumer

Credit Act 2008 (previously the Consumer Credit Act 2002). If the

customer does not redeem the goods by repaying the secured loan

before the end of the contract, the Group is required to dispose of

the goods either through public auctions if the value of the pledge

is over GBP75 (disposal proceeds being reported in this segment)

or, if the value of the pledge is GBP75 or under, through public

auctions or the retail or pawnbroking scrap activities of the

Group.

Purchasing:

Jewellery is bought direct from customers through all the

Group's stores. The transaction is simple with the store agreeing a

price with the customer and purchasing the goods for cash on the

spot. Gold purchasing revenues comprise proceeds from scrap sales

on goods sourced from the Group's purchasing operations.

Retail:

The Group's retail proposition is primarily gold, jewellery and

watches, and the majority of the retail sales are forfeited items

from the pawnbroking pledge book or refurbished items from the

Group's gold purchasing operations. The retail offering is

complemented with a small amount of new or second-hand jewellery

purchased from third parties by the Group.

Pawnbroking scrap:

Pawnbroking scrap comprises all other proceeds from gold scrap

sales of the Group's inventory assets other than those reported

within gold purchasing. The items are either damaged beyond repair,

are slow moving or surplus to the Group's requirements, and are

smelted and sold at the current gold spot price less a small

commission.

Other services:

This segment comprises:

-- Personal loans comprise income from the Group's unsecured

lending activities. Personal loan revenues are stated at amortised

cost after taking into consideration an assessment on a

forward-looking basis of expected credit losses.

-- Third party cheque encashment which is the provision of cash

in exchange for a cheque payable to our customer for a commission

fee based on the face value of the cheque.

-- The foreign exchange currency service where the Group earns a

margin when selling or buying foreign currencies.

-- Western Union commission earned on the Group's money transfer service.

Cheque cashing is subject to bad debt risk which is reflected in

the commissions and fees applied.

Segment information for these businesses is presented below:

Consolidated

for the

6 months

Other ended 30

Gold Pawnbroking Services Other June 2022

H1 2022 Pawnbroking purchasing Retail scrap Note 1 income

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 30,026 15,096 20,823 7,104 4,707 - 77,756

Total revenue 30,026 15,096 20,823 7,104 4,707 - 77,756

Gross profit 30,026 2,836 8,693 1,424 4,707 - 47,686

Impairment (7,161) - - - 458 - (6,703)

Segment

Contribution 22,865 2,836 8,693 1,424 5,165 - 40,983

Other direct expenses excluding impairment (22,767)

Administrative expenses (10,866)

Recurring operating profit 7,350

Non-recurring expenses -

Operating profit 7,350

Interest receivable -

Financing costs (631)

Profit before taxation 6,719

Tax charge on profit (1,571)

Profit for the period and total comprehensive

income 5,148

Consolidated

for the

Other Other 6 months

Gold Pawnbroking services Income ended 30

H1 2021 Pawnbroking purchasing Retail scrap Note 1 Note 2 June 2021

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 20,949 7,995 12,438 5,240 4,037 1,270 51,929

Total revenue 20,949 7,995 12,438 5,240 4,037 1,270 51,929

Gross profit 20,949 1,319 6,718 1,017 4,037 1,270 35,310

Impairment (2,414) - - - 681 - (1,733)

Segment

contribution 18,535 1,319 6,718 1,017 4,718 1,270 33,577

Other direct expenses excluding impairment (19,457)

Administrative expenses (8,917)

Recurring operating profit 5,203

Non-recurring expenses -

Operating profit 5,203

Financing costs (549)

Profit before taxation 4,654

Tax charge on profit (1,015)

Profit for the period and total comprehensive

income 3,639

For the

Other Other year ended

Full year Gold Pawnbroking services income 31 December

2021 Pawnbroking purchasing Retail scrap Note 1 Note 2 2021

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 44,742 20,445 36,227 11,008 8,302 1,271 121,995

Total revenue 44,742 20,445 36,227 11,008 8,302 1,271 121,995

Gross profit 44,742 3,382 16,640 2,018 8,302 1,271 76,355

Impairment (7,472) - - - 1,460 - (6,012)

Segment

contribution 37,270 3,382 16,640 2,018 9,762 1,271 70,343

Other direct expenses excluding impairment (40,239)

Administrative expenses (18,904)

Recurring operating profit 11,200

Non-recurring expenses (2,099)

Operating profit 9,101

Interest receivable 8

Financing costs (1,247)

Profit before taxation 7,862

Tax charge on profit (1,818)

Profit for the period and total comprehensive

income 6,044

Note 1: includes Personal Loan income

Note 2: includes 2021 income from Government Grants

Gross profit is stated after charging the direct costs of

inventory items sold or scrapped in the period. Other operating

expenses of the stores are included in other direct expenses. The

Group is unable to meaningfully allocate the other direct expenses

of operating the stores between segments as the activities are

conducted from the same stores, utilising the same assets and

staff. The Group is also unable to meaningfully allocate Group

administrative expenses, or financing costs or income between the

segments. Accordingly, the Group is unable to meaningfully disclose

an allocation of items included in the consolidated statement of

comprehensive income below gross profit, which represents the

reported segment results.

The Group does not apply any inter-segment charges when items

are transferred between the pawnbroking activity and the retail or

pawnbroking scrap activities.

3. Financing costs

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest on bank loans 111 (10) 102

Other interest - - 1

Interest expense on the

lease liability 416 501 950

Amortisation of debt issue

costs 104 58 194

Total interest expense 631 549 1,247

4. Tax charge on profit

The taxation charge for the 6 months ended 30 June 2022 has been

calculated by reference to the expected effective Corporation tax

and deferred tax rates for the full financial year to end on 31

December 2022. The underlying effective full year tax charge is

estimated to be 19% (six months ended 30 June 2021: 19%).

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

for the year attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the year.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the Group these

represent share options and conditional shares granted to employees

where the exercise price is less than the average market price of

the Company's ordinary shares during the year.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Unaudited Unaudited

6 months ended 30 6 months ended 30 12 months ended 31

June 2022 June 2021 December 2021

Earnings Weighted Per-share Earnings Weighted Per-share Earnings Weighted Per-share

GBP'000 average amount GBP'000 average amount GBP'000 average amount

number pence number pence number pence

of shares of shares of shares

Earnings

per share

-

basic 5,148 39,164,667 13.15 3,639 39,162,612 9.29 6,044 39,162,612 15.43

Effect of

dilutive

securities

Options - 6,889 (0.00) - - - - - -

Earnings

per share

diluted 5,148 39,171,556 13.14 3,639 39,162,612 9.29 6,044 39,162,612 15.43

6. Notes to the Cash Flow Statement

6 months 6 months 12 months

ended 30 ended 30 ended 31

June June December

2022 2021 2021

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Profit for the year 5,148 3,639 6,044

Adjustments for:

Investment revenues - - (8)

Financing costs 631 549 1,247

(Decrease)/Increase in provisions (463) 24 2,178

Income tax expense 1,571 1,015 1,818

Depreciation of property, plant and equipment 1,483 1,250 2,666

Depreciation of right-of-use assets 2,415 2,517 5,071

Amortisation of intangible assets 389 655 995

Right of use asset Impairment - - (179)

Share-based payment expense 262 134 55

Loss on disposal of property, plant and equipment 9 11 38

Loss on disposal of Right of use assets - - 3

Operating cash flows before movements in working

capital 11,445 9,794 19,928

Increase in inventories (7,653) (595) (857)

Decrease in other current assets - 1 1

Increase in receivables (18,024) (200) (15,574)

Decrease in payables (300) (917) (2,009)

Cash (utilised) / generated from operations (14,532) 8,083 1,489

Income taxes paid (400) (2,010) (3,349)

Interest paid on loan facility (215) (170) (225)

Interest paid on lease liability (416) (502) (950)

Net cash (utilised) / generated from operating

activities (15,563) 5,401 (3,035)

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with a maturity of

three months or less.

7. Earnings before interest, tax, depreciation and amortisation ("EBITDA")

EBITDA

EBITDA is a non IFRS9 measure and is defined as earnings before

interest, taxation, depreciation and amortisation. It is calculated

by adding back depreciation and amortisation to the operating

profit as follows:

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating profit 7,350 5,203 9,101

(i) Depreciation of the right-of-use assets 2,415 2,516 5,071

(ii) Depreciation and amortisation- other 1,872 1,905 3,660

(iii) Impairment of the right-of-use-assets - - (179)

EBITDA 11,637 9,624 17,653

The Board consider EBITDA to be a key performance measure as the

Group borrowing facility includes a number of loan covenants based

on it.

8. Borrowings

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Secured borrowing at amortised cost

Bank loans and overdrafts 6,342 - -

Total borrowings due for settlement within

one year 6,342 - -

Long term portion of bank loan 15,000 --

Amount due for settlement after more

than one year 15,000 --

9. Share capital

At At At

30 June 2022 30 June 2021 31 December

2021

Unaudited Unaudited Audited

Issued, authorised and fully

paid

(Ordinary Shares of GBP0.05

each)

GBP'000 Sterling 1,993 1,993 1,993

Number 39,864,077 39,864,077 39,864,077

The Group has one class of ordinary shares which carry no right

to fixed income.

10. Dividends

On 8 August 2022, the directors approved a 5 pence interim

dividend (30 June 2021: 4 pence) which equates to a dividend

payment of GBP1,958,000 (30 June 2021: GBP1,595,000). The dividend

will be paid on 7 October 2022 to shareholders on the share

register at the close of business on 9 September 2022 and has not

been provided for in the 2022 interim results. The shares will be

marked ex-dividend on 8 September 2022.

11. Post Balance sheet event

On 1 July 2022, the company acquired Swiss Time Services

Limited, a leading independent watch servicing and repair centre

for a total consideration of GBP4.3 million, inclusive of a net

cash balance of GBP0.5m which is subject to an adjustment

mechanism.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EANPPELLAEFA

(END) Dow Jones Newswires

August 09, 2022 02:00 ET (06:00 GMT)

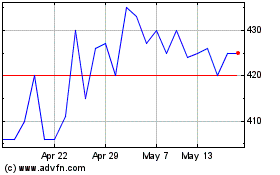

H&t (LSE:HAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

H&t (LSE:HAT)

Historical Stock Chart

From Feb 2024 to Feb 2025