TIDMOSI

RNS Number : 2247A

Osirium Technologies PLC

22 September 2022

The information contained within this announcement is deemed by

the Company to constitute inside information for the purposes of

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310.

22 September 2022

Osirium Technologies plc

("Osirium", the "Group" or the "Company")

Interim Results

Osirium Technologies plc (AIM: OSI), a leading vendor of

cloud-based cybersecurity and IT automation software, announces its

unaudited interim results for the six months ended 30 June

2022.

Financial highlights

-- Total recognised revenue up 23% to GBP0.91 million (1H

2021: GBP0.74 million), a record for the Group

-- Total bookings increased by 30% to GBP1.18 million (1H

2021: GBP0.91 million), also a record for the Group, reflecting

the success of the Group's continued customer acquisition

strategy, alongside larger average contract values

-- Annualised Recurring Revenue (ARR) at GBP1.61 million,

an increase of 29% over the past 12 months (June 2021:

GBP1.25 million)

-- Deferred revenue increased 14% to GBP1.91 million (1H

2021: GBP1.68 million)

-- Operating loss of GBP1.63 million (1H 2021: GBP1.52 million)

-- Cash balance at 30 June 2022 of GBP0.27 million (30 June:

GBP1.74 million), increasing to GBP0.68 million at 17

September 2022

Operational highlights

-- Growth in the size of the Group's average contract value,

as Information Technology spend recovers post-COVID, in

combination with a growing need for privileged security

-- Privileged Process Automation ("PPA") and Privileged Endpoint

Management ("PEM") now contributing materially to bookings

growth alongside Privileged Access Management ("PAM"),

providing an exciting opportunity for cross-selling and

up-selling, and contributing to 8% of June 2022 ARR

-- Continued customer acquisition across a range of sectors,

with notable wins in healthcare, higher education and

financial services

-- International expansion driven by the Group's channel

partner network, with first wins in the USA and Finland

-- GBP1 million fundraise in February to drive sales and

marketing efforts

Post period highlights

-- Significant GBP0.5 million three-year contract extension

with global asset manager, representing c. 30% of the

total bookings achieved by the Group for the financial

year ended 31 December 2021

-- The Group secured its second largest initial contract

and this was achieved in the Higher Education sector

-- Three-year contract extension with existing Privileged

Access Management customer with 2,600 licences, for a

total value of over GBP0.29 million, secured in September

-- Cash balance at 17 September 2022 of GBP0.68 million (prior

to the cash receipt due from the GBP0.29 million contract

extension announced on 17 September 2022 and noted above)

David Guyatt, CEO of Osirium, commented:

"We have continued our positive direction of travel in the

current financial year, achieving record bookings and revenue for

the Group alongside a sustained momentum in customer acquisition

across our target sectors.

"Operationally, we have strengthened our sales and marketing arm

through continued partnerships as well as for our direct sales arm

through the additional funds raised earlier in 2022. Alongside

this, we have driven further revenues through the emergence of our

PPA and PEM products alongside PAM.

"As privileged security solutions emerge as an essential

component of IT security, we continue to grow our sales pipeline

with new and existing customers. Alongside this, we remain vigilant

around the Group's costs with a clear focus towards reaching cash

flow breakeven. The Group will continue to take steps to

rationalise its cost base without compromising our sales and

marketing momentum. We are very pleased with the continued trading

momentum in the second half of the financial year to date and look

forward to the rest of the year with confidence."

Contacts

Osirium Technologies plc Tel: +44 (0)1183 242 444

David Guyatt, CEO

Rupert Hutton, CFO

Allenby Capital Limited (Nominated adviser and broker) Tel: +44 (0)20 3328 5656

James Reeve / George Payne (Corporate Finance)

Tony Quirke (Sales and Corporate Broking)

Alma PR (Financial PR adviser) Tel: +44 (0)20 3405 0205

Hilary Buchanan osirium@almapr.co.uk

Kieran Breheny

Will Ellis Hancock

About Osirium

Osirium Technologies plc (AIM: OSI) is a leading UK-based

cybersecurity software vendor delivering Privileged Access

Management (PAM), Privileged Endpoint Management (PEM) and Osirium

Automation solutions that are uniquely simple to deploy and

maintain.

With privileged credentials involved in over 80% of security

breaches, customers rely on Osirium PAM's innovative technology to

secure their critical infrastructure by controlling 3(rd) party

access, protecting against insider threats, and demonstrating

rigorous compliance. Osirium Automation delivers time and cost

savings by automating complex, multi-system processes securely,

allowing them to be delegated to Help Desk engineers or end-users

freeing specialist IT resources. The Osirium PEM solution balances

security and productivity by removing risky local administrator

rights from users while at the same time allowing escalated

privileges for specific applications.

Founded in 2008 with its headquarters in Reading, UK, the Group

was admitted to trading on AIM in April 2016.

For further information, please visit www.osirium.com .

Chief Executive Officer's Review

Overview

H1 2022 has been a period of significant progress for Osirium,

in which a number of growth milestones have been achieved. The

Group's strong performance in the first half of the financial year

reflects a rebound in economic conditions following the impact of

Covid-19 and accelerating momentum as our end markets increase

their focus on cyber security strategies. As a result, we are

delighted to report the Company's best-ever H1 for bookings at

GBP1.18 million, with revenue and deferred revenue also at record

levels for the Group.

As initially reported in the trading update on 8 July 2022,

Annualised Recurring Revenue ("ARR") is a key industry measurement

of the size of a SaaS Company's subscription revenue, and the Group

has decided to adopt this as a key performance indicator going

forward. For June 2022, the Group's ARR was GBP1.61 million, an

increase of 11% since the start of the year (December 2021: GBP1.45

million) and 29% over the past 12 months (June 2021: GBP1.25

million), providing visibility of future revenue.

The financial growth in the period is underpinned by growing

momentum across all aspects of the business - more customer

acquisition, new partners, a growing prospect pipeline and further

innovation. The Group continued to grow its share in core sectors

such as healthcare and higher education, as well as achieving wins

in new geographies and sectors. Importantly, in combination with

this continued customer acquisition, we are now observing a greater

average contract value for these new contracts, driving the

bookings and revenue growth during the first half of the financial

year.

A core driver of sales has been accelerated take-up of

Privileged Process Automation (PPA) and Privileged Endpoint

Management (PEM) products alongside the Group's core Privileged

Access Management (PAM) solution. This not only serves as an

important way to initiate discussions with new customers, but also

represents an exciting opportunity for upselling and cross-selling

to existing customers.

In February 2022, we announced a GBP1 million fundraise (gross)

primarily to drive our sales and marketing functions. In addition

to product R&D, the Group has invested these funds to build

capacity to support the scaling up of the business. The benefits of

these investments are now clearly filtering through to the level of

interest we are currently witnessing in our sales pipeline. We

would like to reiterate our thanks to shareholders for their

support. As announced earlier in the year, the Board considers that

the Company will be required to raise additional capital during the

second half of 2022.

Managing costs remains one of the most important priorities for

the business, and the growth in revenue experienced during the

period is steadily bringing forward the cash flow breakeven point.

Alongside this, the Group is actively supplementing this progress

and shareholder support through measures that are delivering

material cost savings within the business without affecting our

ability to continue to grow our bookings.

So far in H2 2022, we have seen a continuation of the growing

sales pipeline and the larger volumes of contracted revenue seen in

H1. As a result, the Board remains confident in meeting revenue

expectations for FY22.

Market

Privileged security continues to be a necessity for companies

around the world as the risk of malicious cyber and ransomware

attacks remains prevalent.

One trend of note is the increasing price and higher criteria

needed to attain cybersecurity insurance. According to the Global

Insurance Market Index from Marsh & McLennan, in Q2 2022,

cyber-insurance prices increased 79% year-on-year in the USA,

reflecting the increased cost of failure in this area. Privileged

security is quickly becoming an essential product for cybersecurity

insurance and, in some geographies, is seen as a necessary

component for such insurance, as noted in our July contact win with

a UK university. The University bought a three-year PAM

subscription, worth c. GBP140,000, as PAM was a key prerequisite

for its cybersecurity insurance provider, before any deal was

agreed.

Alongside this driver, we are seeing increased awareness of the

benefits of privileged protection. The Group's product portfolio

has been purposely built from the ground up to blend powerful

functionality with simple deployment - a key aspect of the Group's

differentiation. This is gaining increased brand value and

appreciation within the core mid-market space. More than ever, we

are seeing a familiarity with privileged security among IT

professionals.

Consolidation in the privileged security market has continued,

presenting an opportunity for the Group to displace these larger,

often more cumbersome providers of privileged security. The ability

for our clients to roll out and implement our technologies in a

cost-effective manner, thereby rapidly securing their IT systems,

remains a key driver in generating and securing new business.

Product suite

Osirium's product suite consists of its well-established

Privileged Access Management solution (PAM), and its more recently

introduced Privileged Process Automation (PPA) and Privileged

Endpoint Management (PEM) solutions.

A key development during the period is the significant growth of

PPA and PEM as add-ons, as well as some customers now selecting

these services as standalone products, driving further customer

acquisition as well as creating another touchpoint for

cross-selling and up-selling our services.

Importantly, Osirium's three privileged security products have

always formed part of the Group's initial roadmap and have been

engineered to be fully complementary and integrated in a simplified

arrangement. The Directors believe that while other businesses have

acquired products to build out their suite, Osirium's products have

been built in line with its original vision, meaning they work

seamlessly together, unlike our competitors.

During the period, the Group was pleased to announce its first

contract in which the PPA order was significantly larger than the

PAM component, demonstrating the Group's growing capabilities

around the provision of a complete toolkit of privileged protection

solutions. A number of contracts have since been signed involving

both PPA and PEM as significant elements of the contract.

10% of the Company's customers now have more than one Osirium

product under contract, including a contract expansion with a major

UK provider of telephony and broadband services, who is now our

first customer to utilise all three Osirium privileged security

products.

Growth strategy

Osirium's growth strategy is built around three key strategic

areas: commitment to innovation,

customer focus and market expansion.

Commitment to innovation - unlocking incremental value

creation

The Group is committed to ensuring its product suite remains a

cutting-edge, best-in-class option for existing and prospective

customers. As PAM should be at the heart of all IT operations and

cyber security strategies, ease of use and availability become

critical. The Group continues to invest in simplifying privileged

access to vital IT systems ensuring the tool is used. Recent

innovations in the PAM client, used by admins to access their

devices, have focused on streamlining that access so that they can

get on with their work more efficiently. For assured availability

of the PAM service, Osirium has been investing in innovative

architectures to ensure continued service, even if a PAM server

becomes unavailable, for example, due to a hardware failure.

Importantly, this is delivered in a way customers can plan their

future growth without the need for complex or expensive external

dependencies.

The addition of automation, which protects what users do with

their privileged access, is still a unique differentiator. Osirium

Research(1) showed that the main inhibitors to delegating IT

operations are security and compliance risks. Automation addresses

those concerns, and customers are adopting Osirium PPA to allow

tasks that used to need multiple expert admins to delegate those

tasks to end-users safely. For example, the NHS Midlands and

Lancashire Commissioning Support Unit has deployed automation to

enable GP surgeries to take on common account management tasks. And

a major telecommunications provider has integrated PPA with their

HR system to ensure accounts are created and removed automatically,

ensuring the HR system is the "source of truth" and users don't

have access to any systems they shouldn't.

Removing local admin rights from end-user laptops and

workstations is a goal for an increasing number of organisations as

it's seen as a principal defence mechanism against ransomware and

malware attacks. Osirium PEM is a good fit with its focus on that

specific risk, rather than a bundled suite of endpoint management

tools, and, with its policy-based approach, reduces the workload on

IT teams.

(1)

https://www.osirium.com/news/lack-of-effective-automation-leads-to-compliance-risks-and-costs

Customer focus - providing foundations for land-and-expand

opportunity

While Osirium continues to be differentiated among its peers

through its simplicity of delivery and ease of deployment, the

combined usage of our range of products demonstrates more value to

customers. For instance, the Group's telecommunications provider

customer has highlighted this combined usage means it is easier to

deal with Osirium than a larger organisation with many point

solutions based outside the UK. The stickiness of the Group's

product suite and the cross-sale opportunity created by the appeal

of its technologies, was further evidenced by the post-period

contract signed by an existing customer that provides IT services

to local government in the UK. Engagement with customers and

targeted marketing campaigns are in place to further address this

opportunity.

The Group achieved a 98% customer SaaS contract retention rate

by customer number in the half, and it has established further

dedicated customer success resources to maintain these consistently

high renewal levels.

Osirium also continues to focus on enhancing the experience for

its existing customers through initiatives such as the Osirium

Customer Network, an informal forum for meeting and introducing

customers to each other for sharing best practices with

Osirium.

Market expansion - opening new opportunities for growth through

direct and partner channels

Following on from the NHS wins the Group experienced in 2021, we

have not only added to this number, but a number of the NHS Trusts

signed up in the previous financial year have now expanded their

existing licenses The Group has also successfully demonstrated its

land-and-expand strategy by initiating the sale of the Group's

add-on PPA and PEM products to some healthcare customers. Key new

wins in this sector during the period include a contract with

Midlands and Lancashire Commissioning Support Unit for the Group's

PPA and PAM solutions. Healthcare remains a strong source of

business for the Group, and we remain focused on winning new

prospects alongside expanding our licenses with existing customers.

As announced in April 2022, this was particularly significant as a

result of this being the Group's first customer win where the PPA

order was significantly larger than the PAM element.

The higher education sector remains another focus market for the

Group, and we are pleased to report a number of key wins during the

period including a new PAM contract worth c. GBP140,000 for a

three-year subscription with a UK university, as announced in

July.

In the financial services sector, our customer base continues to

grow, and we achieved our first contract win in the US with a

global investment bank headquartered in New York for our PAM

solution. Post-period, we were also delighted to announce a

significant three-year contract extension with a global asset

manager for PAM, as well as a 12-month extension on the use of the

Group's PPA solution, worth in total c. GBP0.5m.

Sales to new customers are driven by the Group's sales team

(direct sales) alongside its channel partner network. As a result

of our excellent customer service levels and best-in-class product

offering, we maintain strong relationships with existing customers

who are frequently willing to act as reference points when

contacted by potential customers from the same sector.

Direct

The Group has also invested in its sales and marketing function

during the period following the fundraising announced in February

2022, and we are now delivering sales and marketing campaigns that

have a greater sophistication and scope. Physical tradeshows and

other events have started to return. Attendances are below

pre-pandemic levels but recovering quickly, and attendees are more

motivated to have meaningful meetings with vendors, which has led

to new opportunities in the pipeline. Digital marketing remains an

important tool, and as a result of these investments, we are now

generating more activity through our online channels than ever

before. We have extended our work with specialist agencies to

enhance our in-house online lead-generation activities.

Partner and reseller network expansion

Osirium's partner channel network consists of software

distributors and resellers based across five continents. This

network has emerged as a critical tool for customer acquisition

with around 7% of the Group's sales now taking place through this

channel. Having partnered with software distribution firm Prianto

at the end of 2021, the Group has achieved a number of the period's

significant wins through this partnership. During the period, the

Group has expanded this network to include further resellers in

Sweden and South Africa.

Osirium has benefitted significantly from the global reach

provided by its network, enabling sales in geographies beyond the

scope of the Group's direct sales arm. As a result of this network,

the Group has signed contract wins in two new geographies, the USA

and Finland, during the first half of 2022.

Importantly, recognising the substantial market opportunity,

some of the Group's resellers have elected to invest dedicated

resources into product demonstrations, proof of concepts and

selling Osirium's products. This hugely increases Osirium's sales

capacity.

Current trading and outlook

We are delighted to report continued momentum into the second

half, underpinned by the significant contract extensions we

announced in August and September 2022. This trend is expected to

continue for the remainder of the year.

We approach the current period with three core strategic

priorities: growing our bookings and revenue, proactively managing

costs, and continuing our excellent rate of customer acquisition.

With a more sophisticated sales and marketing function, a

significantly expanded customer base to up-sell and cross-sell

into, and a growing demand for privileged security globally, we

remain very positive about the continued scaling of the business to

meet demand.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months Year to

to to

30-Jun-22 30-Jun-21 31-Dec-21

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

CONTINUING OPERATIONS

Revenue 909,577 736,711 1,474,504

Other operating income 2 13 13

Administrative expenses (2,535,240) (2,256,279) (4,705,350)

------------ ------------ ------------

OPERATING LOSS (1,625,661) (1,519,555) (3,230,833)

Finance costs (107,395) (91,863) (197,030)

Finance income - - -

------------ ------------ ------------

LOSS BEFORE TAX (1,733,056) (1,611,418) (3,427,863)

Income tax credit 315,774 292,326 594,562

------------ ------------ ------------

LOSS FOR THE PERIOD ATTRIBUTABLE

TO THE OWNERS OF OSIRIUM

TECHNOLOGIES PLC (1,417,282) (1,319,092) (2,833,301)

============ ============ ============

Loss per share from continuing

operations:

Basic and diluted loss per

share 5p 5p 11p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30-Jun-22 30-Jun-21 31-Dec-21

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible assets 3,721,569 3,521,843 3,557,310

Property, plant & equipment 68,790 81,284 79,588

Right-of-use asset 211,598 36,798 12,266

------------- ------------- -------------

4,001,957 3,639,925 3,649,164

CURRENT ASSETS

Trade and other receivables 1,236,390 1,155,804 1,082,260

Cash and cash equivalents 273,218 1,737,223 383,854

------------- ------------- -------------

1,509,608 2,893,027 1,466,114

------------- ------------- -------------

TOTAL ASSETS 5,511,565 6,532,952 5,115,278

============= ============= =============

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 2,786,811 2,153,854 2,158,450

Lease liability 19,125 40,276 15,765

------------- ------------- -------------

2,805,936 2,194,130 2,174,215

============= ============= =============

NON-CURRENT LIABILITIES

Lease liability 212,084 - -

Convertible loan notes 2,816,678 2,599,431 2,708,886

------------- ------------- -------------

3,028,762 2,599,431 2,708,886

------------- ------------- -------------

TOTAL LIABILITIES 5,834,698 4,793,561 4,883,101

============= ============= =============

EQUITY

SHAREHOLDERS EQUITY

Called up share capital 604,377 293,820 293,820

Share premium 13,006,740 12,462,317 12,462,319

Share option reserve 372,529 358,541 365,535

Convertible note reserve 394,830 394,830 394,830

Merger reserve 4,008,592 4,008,592 4,008,592

Retained earnings (18,710,201) (15,778,710) (17,292,919)

------------- ------------- -------------

TOTAL EQUITY ATTRIBUTABLE

TO THE

OWNERS OF OSRIRIUM TECHNOLOGIES

PLC (323,133) 1,739,390 232,177

------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 5,511,565 6,532,952 5,115,278

============= ============= =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Called Share Convertible

up

share Share Merger option note Retained Total

capital premium reserve reserve reserve earnings equity

GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January

2021 194,956 10,635,500 4,008,592 351,547 394,830 (14,459,618) 1,125,807

Changes in

equity

Total

comprehensive

loss - - - - - (1,319,092) (1,319,092)

-------- ----------- ---------- -------- ------------ ------------- ------------

Balance at 30

June 2021

(unaudited) 194,956 10,635,500 4,008,592 351,547 394,830 (15,778,710) (193,285)

======== =========== ========== ======== ============ ============= ============

Balance at 1

January

2021 194,956 10,635,500 4,008,592 351,547 394,830 (14,459,618) 1,125,807

Changes in

equity

Total

comprehensive

loss - - - - - (2,833,301) (2,833,301)

Issue of share

capital 98,864 1,826,818 - - - - 1,925,682

Share option

charge - - - 13,988 - - 13,988

-------- ----------- ---------- -------- ------------ ------------- ------------

Balance at 31

December

2021 (audited) 293,820 12,462,318 4,008,592 365,535 394,830 (17,292,919) 232,176

======== =========== ========== ======== ============ ============= ============

Balance at 1

January

2022 293,820 12,462,318 4,008,592 365,535 394,830 (17,292,919) 232,176

Changes in

equity

Total

comprehensive

loss - - - - - (1,417,282) (1,417,282)

Share option

charge - - - 6,994 - - 6,994

Issue of share

capital 310,557 689,443 - - - - 1,000,000

Issue costs - (145,021) - - - - (145,021)

-------- ----------- ---------- -------- ------------ ------------- ------------

Balance at 30

June 2022

(unaudited) 604,377 13,006,740 4,008,592 372,529 394,830 (18,710,201) (323,133)

======== =========== ========== ======== ============ ============= ============

CONSOLIDATED STATEMENT OF CASHFLOW

6 months 6 months Year

ended ended ended

30-Jun-22 30-Jun-21 31-Dec-21

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cashflows from operating activities

Cash used in operations (602,944) (728,996) (1,695,291)

Interest paid - -

Tax received 603,232 - 591,436

------------ ------------ ------------

Net cash generated from/(used

in) operating activities 288 (728,996) (1,103,855)

------------ ------------ ------------

Cash flows from investing activities

Purchase of intangible fixed

assets (945,808) (904,088) (1,837,104)

Purchase of tangible fixed assets (10,524) (12,155) (37,469)

Sale of tangible fixed assets - 167 208

Interest received 2 - -

------------ ------------ ------------

Net cash used in investing activities (956,330) (916,076) (1,874,365)

------------ ------------ ------------

Cashflows from financing activities

Share issue 1,000,000 2,174,996 2,174,999

Share issue costs (145,021) (249,316) (249,316)

Payment of lease liabilities (16,947) (33,135) (60,731)

Allocation of professional fees

on loan notes 7,374 7,374 14,746

------------ ------------ ------------

Net cash from financing activities 845,406 1,899,919 1,879,698

------------ ------------ ------------

Increase/(decrease) in cash

and cash equivalents (110,636) 254,847 (1,098,522)

Cash and cash equivalents at

beginning of period 383,854 1,482,376 1,482,376

------------ ------------ ------------

Cash and cash equivalents at

end of period 273,218 1,737,223 383,854

============ ============ ============

GENERAL INFORMATION

Osirium Technologies PLC was incorporated on 3 November 2015,

and registered and domiciled in England and Wales with its

registered office located at One Central Square, Cardiff CF10

1FS.

The principal activity of the Group in the periods under review

was that of the development, sale and licensing of security

software.

BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The Group financial information is presented in pounds sterling

which is the Group's presentational currency and all values are

rounded to the nearest whole pound.

The financial information does not comprise statutory accounts

within the meaning of section 435 of the Companies Act 2006. The

financial information together with the comparative information for

the six months ended 30 June 2021 are unaudited with the audited

information included for the 12 month period ended 31 December

2021. The audited information received an audit report which was

unqualified and did not include a statement under section 498(2) or

section 498(3) of the Companies Act 2006, but did contain a

material uncertainty paragraph on going concern.

The financial information was approved by the Board of Directors

on 21 September 2022 and authorised for issue on 22 September

2022.

Accounting Policies

The accounting policies used in the preparation of the financial

information for the six months ended 30 June 2022 are in accordance

with the recognition and measurement criteria of UK-adopted

international accounting standards and are consistent with those

which will be adopted in the annual financial statements for year

ended 31 December 2022.

These Interim Financial Statements have been prepared in

accordance with the accounting policies, methods of computation and

presentation adopted in the financial statements for the year ended

31 December 2021. As permitted, the Group has chosen not to adopt

IAS 34 'Interim Financial Reporting' in preparing these Interim

Financial Statements.

The Directors have considered all new, revised or amended

standards and interpretations which are mandatory for the first

time for the financial year ending 31 December 2022, and concluded

that none have had any significant impact on these interim

financial statements. New, revised or amended standards and

interpretations that are not yet effective have not been adopted

early.

Intangible assets

An internally-generated, development intangible asset arising

from Osirium's product development is recognised if, and only if,

Osirium can demonstrate all of the following:

- The technical feasibility of completing the intangible asset

so that is will be available for use of sale.

- Its intention to complete the intangible asset and use or sell it.

- Its ability to use or sell the intangible asset.

- How the intangible asset will generate probable future economic benefits. -

- The availability of adequate technical, financial and other

resources to complete the development and to use or sell the

intangible asset.

- Its ability to measure reliably the expenditure attributable

to the intangible asset during its development.

Internally-generated development intangible assets are amortised

on a straight-line basis over their useful lives. Amortisation

commences in the financial year of capitalisation. Where no

internally-generated intangible asset can be recognised,

development expenditure is recognised as an expense in the period

in which it is incurred.

Development costs 20% per annum, straight line.

Share based payments

Osirium issues equity-settled share-based payments to certain

employees and others under which Osirium receives services as

consideration for equity instruments (options) in Osirium.

Equity-settled share-based payments are measured at fair value at

the date of grant by reference to the fair value of the equity

instruments granted. The fair value determined at the grant date of

equity-settled share-based payments is recognised as an expense in

Osirium's Statement of Comprehensive Income over the vesting period

on a straight-line basis, based on Osirium's estimate of the number

instruments that will eventually vest with a corresponding

adjustment to equity. The expected life used in the valuation is

adjusted, based on management's best estimate, for the effect of

non-transferability, exercise restrictions, and behavioural

considerations.

Non-vesting and market vesting conditions are taken into account

when estimating the fair value of the options at grant date.

Service and non-market vesting conditions are taken into account by

adjusting the number of options expected to vest at each reporting

date. When the options are exercised Osirium issues new shares. The

proceeds received net of any directly attributable transaction

costs are credited to share capital (nominal value) and share

premium.

INTANGIBLE FIXED ASSETS

Development

Costs

GBP

Cost

At 1 January 2021 9,498,975

Additions to 30 June 2021 904,088

------------

Cost c/f as at 30 June

2021 10,403,063

============

At 1 January 2021 9,498,975

Additions to 31 December

2021 1,851,024

Cost c/f as at 31 December

2021 11,349,999

============

At 1 January 2022 11,349,999

Additions to 30 June 2022 945,808

------------

Cost c/f as at 30 June

2022 12,295,807

============

Amortisation

At 1 January 2021 6,163,520

Charge to 30 June 2021 717,701

------------

Amortisation c/f as at

30 June 2021 6,881,221

============

At 1 January 2021 6,163,520

Charge to 31 December 2021 1,629,169

------------

Amortisation c/f as at

31 December 2021 7,792,689

============

At January 2022 7,792,689

Charge to 30 June 2022 781,549

------------

Amortisation as at 30 June

2022 8,574,238

============

Carrying Amount:

At 30 June 2021 (unaudited) 3,521,842

============

At 31 December 2021 (audited) 3,557,310

============

At 30 June 2022 (unaudited) 3,721,569

============

All development costs are amortised over their estimated useful

lives, which is on average 5 years. Amortisation is charged in full

in the financial year of capitalisation.

All amortisation has been charged to administrative expenses in

the statement of comprehensive income.

RIGHT OF USE ASSETS

Leases

& Buildings

GBP

Cost

At 31 December

2020 159,455

Additions -

-------------

At 31 December

2021 159,455

Additions 222,735

At 30 June 2022 382,190

Depreciation

At 31 December

2020 98,126

Charge for year 49,063

-------------

At 31 December

2021 147,189

Charge for period 23,403

At 30 June 2022 170,592

Net Book Value

At 31 December

2021 12,266

=============

At 30 June 2022 211,598

=============

Additions to the right of use assets during the period were

GBP222,735 (year to 31 December 2021: GBPnil)

The group leases land and buildings for its office under an

agreement for 5 years running from 2022 to 2027.

LEASE LIABILITIES

Group

As at As at As at

30-Jun-22 30-Jun-21 31-Dec-21

GBP GBP

Current

Lease liability 19,125 40,276 15,765

========== ========== ==========

Non- current

Lease liability 212,084 - -

========== ========== ==========

RECONCILIATION OF LOSS BEFORE ANY INCOME TAX TO CASH GENERATED

FROM OPERATIONS

6 months 6 months Year

ended ended ended

30-Jun-22 30-Jun-21 31-Dec-21

(unaudited) (unaudited) (audited)

GBP GBP GBP

Loss before income tax (1,733,056) (1,611,418) (3,427,863)

Depreciation charges 44,729 45,982 97,291

Amortisation charges 781,549 717,701 1,615,249

Share option charge 6,994 6,994 13,988

Profit on disposal of fixed

assets - (167) (208)

Finance costs 107,395 91,863 197,030

Finance income - - -

------------- ------------- ------------

(792,388) (749,044) (1,504,513)

(Increase)/decrease in trade

and other receivables (22,036) (45,032) (260,689)

Increase /(decrease) in trade

and other payables 211,480 65,081 69,912

------------- ------------- ------------

Cash used in operations (602,944) (728,995) (1,695,291)

============= ============= ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KFLFLLKLXBBL

(END) Dow Jones Newswires

September 22, 2022 02:01 ET (06:01 GMT)

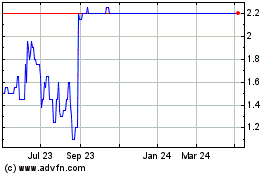

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Feb 2024 to Feb 2025