TIDMOSI

RNS Number : 1283H

Osirium Technologies PLC

22 November 2022

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

22 November 2022

Osirium Technologies plc

("Osirium" or the "Company" or, together with its subsidiary,

the "Group")

Proposed Placing and Subscription, Board Changes and Notice of

General Meeting

Osirium Technologies plc (AIM: OSI), a UK-based leading vendor

of cloud-based cybersecurity software, is pleased to announce that

it has conditionally raised GBP1.53 million before expenses by way

of:

-- a placing of 63,750,000 new ordinary shares of 1p each in the

capital of the Company (the "Placing Shares"), at a price of 2

pence per share (the "Issue Price") to raise GBP1,275,000 (the

"Placing"); and

-- an issue of 12,750,000 new ordinary shares of 1p each in the

capital of the Company (the "Subscription Shares") to certain

Directors of the Company and others at the Issue Price to raise

GBP255,000 (the "Subscription").

The Company also announces a number of Board changes that will

take effect on 1 January 2023, conditional on the completion of the

Placing and Subscription, including the appointment of Stuart

McGregor, current Sales Director, as Chief Executive Officer of the

Company.

Placing and Subscription highlights

-- Placing to raise GBP1,275,000 (before expenses), by way of a

proposed placing of 63,750,000 new Ordinary Shares with existing

and new institutional investors at the Issue Price. The Placing

will be carried out in two tranches:

-- 9,209,700 Placing Shares (the "First Placing Shares") will be

allotted and issued utilising the Company's existing share

allotment authorities granted at its 2022 annual general meeting

held on 7 June 2022 (the "2022 AGM"); and

-- 54,540,300 Placing Shares (the "Second Placing Shares") to be

allotted and issued conditional, inter alia, upon the passing of

the Resolution (the "Resolution") to grant authority to the

Directors to allot new ordinary share of 1p each in the capital of

the Company ("Ordinary Shares") otherwise than on a pre-emptive

basis at the Company's General Meeting expected to be held at 10:00

am on 12 December 2022 (the "General Meeting").

-- Subscription for an aggregate of 12,750,000 new Ordinary

Shares in the Company by certain Directors and others at the Issue

Price, to raise an additional GBP255,000, conditional on the

passing of the Resolution.

-- The Issue Price represents a discount of 50% to the closing

mid-market share price of an existing Ordinary Share on 21 November

2022, being the last business day prior to this announcement.

-- The Placing Shares and the Subscription Shares will in

aggregate represent approximately 62% of the Company's enlarged

share capital.

-- The net proceeds of the Placing and Subscription receivable

by the Company, which are expected to total approximately GBP1.36

million, will be used for general working capital purposes.

-- Allenby Capital Limited is acting as nominated adviser and

sole broker to the Company in respect of the Placing.

-- A Circular, containing further details of the Placing and

Subscription and a notice convening the General Meeting, will

shortly be made available to Shareholders and a copy will be

available on the Company's website, www.osirium.com .

Operational highlights

-- The Board's strategic focus is to reduce the timeframe to the

Company becoming cash flow break-even by maintaining the positive

growth achieved in the year to date, combined with a

rationalisation of the Group's cost base.

-- The Board has identified GBP1 million of annualised cost

savings, GBP650,000 of which have been implemented in the year to

date and the balance of which are expected to be implemented by the

start of 2023.

-- The following Board changes will be taking effect from 1

January 2023 conditional on completion of the Placing and

Subscription:

o Stuart McGregor, current Sales Director, will be appointed as

Chief Executive Officer

o David Guyatt, current Chief Executive Officer, will become

Executive Chairman in a part-time capacity

o Simon Lee, current Chairman, will be appointed as Senior

Independent Non-Executive Director and step down as Chairman

o Steve Purdham, Non-Executive Director, will step down from the

Board in order to pursue other business interests and Simon Hember

will be appointed chair of the Remuneration Committee.

David Guyatt, Chief Executive Officer, commented:

"We have made considerable strides against our financial and

strategic objectives over the course of the year, with our annual

recurring revenue indicating record growth for the year. Our

customer acquisition continues apace and, through the maturing of

our product suite, we are now in an even greater position to expand

our engagement with existing customers. Through the proposed

fundraise and the intended further rationalisation of our cost

base, we expect to accelerate the time to cash flow break-even and

fuel our long-term growth ambitions. I would like to thank all

shareholders for their support in helping us unlock the Group's

potential.

"With our initial product vision now established and gaining

market momentum, it is the right time to transition our leadership

team and see the Group through its next stage of growth. Stuart

McGregor possesses a deep knowledge of the Group's product suite

and customers, together with a wealth of experience in IT sales in

the UK and internationally, and represents an excellent fit for the

Group's strategic aims. At the same time, I would like to thank

Steve Purdham for his contribution to the Board over the past few

years. As Executive Chairman as of January 2023, I look forward to

continuing my active involvement on the Osirium Board, with a

strategic focus on scaling the market demand for Privileged

Security."

Background to and reasons for the Placing and Subscription

Osirium is a UK-based leading provider of cloud-based

cybersecurity and IT automation software to organisations in the UK

and internationally. The Group's complementary product portfolio

has been purposely built from the ground up to blend powerful

functionality with simple deployment - a key aspect of the Group's

differentiation. This is gaining increased brand value and

appreciation within the core mid-market space.

In 2022 year-to-date, the Company has made significant financial

and strategic progress, reporting bookings for the first nine

months of the year in excess of the total bookings achieved in any

prior year and delivering robust ARR SaaS growth. This is alongside

average contract values also increasing, reflecting the return to,

and increase in demand for, Osirium's products and the

stabilisation in its end markets.

This growth is underpinned by not only its Privileged Access

Management solution, but also its Privileged Process Automation and

its Privileged Endpoint Management solutions, which have emerged as

standalone products in 2022. As a result, its product suite can be

sold independently or as a bundled package. This offering enables

the Group to cross-sell and upsell to customers as part of its

stated 'Land, Expand and Renew' growth model. The Directors believe

this model is validated by the Group's rate of customer acquisition

throughout 2021 and in 2022 to date.

Current trading and prospects

As set out in its Q3 2022 trading update, announced on 1

November 2022, the Company achieved bookings for the nine months to

September 2022 of GBP2.52 million, which is in excess of the total

bookings recorded in any prior full year. The Company's annual

recurring revenue ("ARR") at September 2022 was GBP1.74 million, an

increase of 30.0% over the 12 months to 30 September 2022.

Managing costs remains one of the most important priorities for

the business, and the growth in revenues experienced during the

period is steadily bringing forward the Group's cash flow

break-even point. The Group has implemented measures which are

delivering material cost savings within the business without

affecting the Company's ability to continue to grow its business.

The Board has implemented GBP650,000 of annualised cost savings in

the business so far in 2022 and has identified a further GBP350,000

of annualised cost saving measures which will be taking effect from

1 January 2023 conditional on completion of the Placing and

Subscription. The Directors consider that this total GBP1 million

of annualised cost savings will contribute towards shortening the

timeframe by which the Company will become cash flow

break-even.

Notwithstanding the progress made in the year to date, as

announced at the time of the fundraise in February of this year,

the Company requires to raise additional working capital. The

Directors believe that the momentum seen in the past 12 months

demonstrates the market opportunity for the Group's suite of

products and therefore considers that it is appropriate to conduct

the Placing and Subscription in order to enable to the Company to

continue to pursue its growth strategy.

The Placing and Subscription

Further details of the Placing and Subscription are set out

below.

The first tranche of the Placing will not be conditional upon

the passing of the Resolution or the allotment and issue of the

Second Placing Shares and the Subscription Shares.

The second tranche of the Placing and the Subscription is

conditional, inter alia, upon the passing of the Resolution at the

General Meeting. Shareholders should be aware that if the

Resolution is not approved at the General Meeting, the second

tranche of the Placing and the Subscription will not proceed and

the Directors would immediately have to re-evaluate the strategy

and outlook of the Group. Shareholders are therefore urged to vote

in favour of the Resolution, which the Directors consider to be in

the best interests of Shareholders and the Company as a whole.

Use of Proceeds

The net proceeds of the Placing and the Subscription (being

approximately GBP1.36 million, assuming that all Placing Shares and

Subscription Shares are subscribed for) will be used for general

working capital purposes.

The Directors consider that the Placing and Subscription will

position the Group to capture the substantial market opportunity

available to deliver long term shareholder value.

Proposed Board Changes

In order to align the management team with the Group's strategy

of driving top line growth and conditional on the completion of the

Placing and Subscription, the Company has appointed Stuart McGregor

as Chief Executive Officer and as a member of the Board of

Directors. The appointment will take effect 1 January 2023 to

provide an orderly handover.

Stuart is a Sales leader with over 20 years in the IT industry.

Stuart has a breadth of experience in leading direct and channel

sales teams of SaaS and on premise solutions into mid-market and

enterprises across EMEA. As Sales Director for Privileged Access

Management vendor, Bomgar, where he established an EMEA operation

and led the UK and Northern Europe sales teams. Stuart saw local

revenues grow significantly and sales operations created in the UK,

Netherlands, Germany and France.

Stuart was also a member of Bomgar's Global Leadership team and

managed the integration of sales operations of the acquired

Lieberman, Avecto and BeyondTrust businesses. Stuart has also held

successful sales and consulting management positions at EMC, UK

start-up software company Thunderhead, BroadVision and Oracle.

Most recently he has spent over three years building and leading

the Group's sales teams as Osirium's Sales Director. During this

time he has worked closely with the executive team in implementing

the Group's go-to-market strategy, building key client

relationships and building new business pipeline.

Also effective 1 January 2023 (and conditional on the completion

of the Placing and Subscription), David Guyatt, the Company's

existing Chief Executive Officer will assume the position of

Executive Chairman in a part-time capacity. Simon Lee, the Group's

current Chairman, will stand down as Chairman and take on the role

of Senior Independent Non-Executive Director and current

Non-Executive Director, Steve Purdham will be stepping down from

the Board to pursue other business interests and Simon Hember will

be appointed chair of the Remuneration Committee. Steve was

principally involved in the Company's admission to AIM on the

London Stock Exchange in 2016 and has been with the Company since.

The Company takes this opportunity to thank him for his

contributions. Following these Board changes, the composition of

the Company's Board of Directors will be as follows:

-- Stuart McGregor, Chief Executive Officer

-- David Guyatt, Executive Chairman

-- Rupert Hutton, Chief Financial Officer

-- Simon Lee, Senior Independent Non-Executive Director

-- Simon Hember, Independent Non-Executive Director

The following information is provided pursuant to Rule 17 and

Schedule 2(g) of the AIM Rules: Stuart Lindsay McGregor, aged 54,

does not have any current directorships and has not held any

directorships in the past five years.

Further details of the Placing

Under the Placing, the Company has conditionally raised

GBP1,275,000 (before expenses) through a placing of 63,750,000

Ordinary Shares at 2pence per share with institutional and other

investors. The Company has entered into a Placing Agreement with

Allenby Capital under which Allenby Capital has agreed to use its

reasonable endeavours to procure Placees for the Placing Shares at

the Issue Price. The Placing has not been underwritten.

The Placing Shares will represent approximately 52% of the

enlarged share capital of the Company following completion of the

Placing and the Subscription.

The Company currently has limited authority to issue new

ordinary shares for cash on a non-pre-emptive basis. Accordingly,

the Placing is being conducted in two tranches.

The first tranche to raise a total of GBP184,194 by the issue of

9,209,700 Placing Shares (being the First Placing Shares) at the

Issue Price, has been carried out within the Company's existing

share allotment authorities granted at the 2022 AGM. The allotment

of the First Placing Shares is conditional, inter alia, upon

admission to AIM (First Admission) and the Placing Agreement

becoming unconditional in respect of the First Placing Shares and

not being terminated in accordance with its terms prior to First

Admission. Application has been made for the First Placing Shares

to be admitted to trading on AIM and it is expected that First

Admission will take place on 25 November 2022. The First Placing is

not conditional on completion of the second tranche of the Placing

or completion of the Subscription.

The second tranche of the Placing, to raise a total of GBP

1,090,806 by the issue of 54,540,300 Placing Shares (being the

Second Placing Shares) at the Issue Price , is conditional upon,

inter alia, the passing of the Resolution to be put to Shareholders

at the General Meeting (granting the Directors authority to allot

new ordinary shares otherwise than on a pre-emptive basis). In

addition, the allotment of the Second Placing Shares is

conditional, inter alia, on the Placing Agreement becoming

unconditional in respect of the Second Placing Shares and not being

terminated in accordance with its terms prior to admission to AIM (

Second Admission). It is expected that Second Admission will take

place on 14 December 2022.

The Placing is conditional, so far as concerns the Second

Placing Shares upon, inter alia, Second Admission occurring by no

later than 8.00 a.m. on 14 December 2022 (or such later time and/or

date as the Company and Allenby Capital may agree, not being later

than 8.00 a.m. on 30 December 2022). If such condition is not

satisfied or, if applicable, waived, the placing of the Second

Placing Shares will not proceed.

The Placing Shares will be issued credited as fully paid and

will rank pari passu in all respects with the Existing Ordinary

Shares, including the right to receive dividends and other

distributions declared on or after the date on which they are

issued.

It is expected that CREST accounts will be credited on the

relevant day of Admission and that share certificates (where

applicable) will be despatched within five working days of

Admission.

The Placing will entitle holders of the Company's GBP2,700,000

convertible unsecured 7.5% notes, due in 2024 and created by the

loan note instrument dated 21 October 2019 (the "Convertible Loan

Notes"), to elect to convert the principal amount of their loan

notes into fully paid Ordinary Shares ranking pari passu in all

respects with the Ordinary Shares of the Company in issue on the

date of conversion. Conversion will be at a rate equal to 6 pence

per share, being the placing price of the Company's last placing

announced on 11 February 2022. Notice of conversion may be given by

holders of the Convertible Loan Notes at any time within 20

business days of First Admission.

Further details of the Subscription and Director dealings

Concurrent with and conditional on the Placing, certain

Directors (including their families) and others have agreed to

subscribe for an aggregate of 12,750,000 new Ordinary Shares at the

Issue Price to raise an additional GBP255,000.

The following Directors and proposed Director of the Company

have subscribed for Subscription Shares pursuant to the

Subscription:

Director/proposed Existing number Number of Subscription Total number

Director of Ordinary Shares Shares of Ordinary Shares

following the

Subscription

Simon Lee 906,083 750,000 1,656,083

David Guyatt* 4,913,109 5,000,000 9,913,109

Rupert Hutton* 253,809 500,000 753,809

Stuart McGregor 146,523 750,000 896,523

*includes spouse

Further details of the Subscription by the Directors are set out

in the table below ( Notification and public disclosure of

transactions by persons discharging managerial responsibilities and

persons closely associated with them ) .

Related party transactions

The participation of certain Directors in the Subscription

constitutes a related party transaction pursuant to the AIM Rules

for Companies. The Directors (excluding Simon Lee, David Guyatt and

Rupert Hutton, each of whom has participated in the Subscription),

having consulted with the Company's nominated adviser, Allenby

Capital Limited, consider the terms of the Subscription to be fair

and reasonable insofar as the Company's shareholders are

concerned.

Admission to trading and total voting rights

Application has been made for the admission of the First Placing

Shares to trading on AIM ("First Admission"), which is expected to

occur on 25November 2022. Following First Admission, the number of

Ordinary Shares in issue and number of voting rights will be

55,258,318. The above figure may be used by shareholders as the

denominator for the calculations by which they will determine

whether they are required to notify their interest in, or a change

to their interest in, the Company under the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules

Posting of Circular and notice of General Meeting

The Company will shortly be making available to Shareholders a

circular (the "Circular") containing a notice of the General

Meeting, to be held at the Company's offices at Theale Court, 11-13

High Street, Theale, RG7 5AH at 10:00 a.m. on 12December 2022. A

copy of the Circular will be available on the Company's website,

www.osirium.com .

Expected timetable

2022

Posting of the Circular and the 22 November

Form of Proxy

Admission and commencement of dealings

in the First Placing Shares 08:00 a.m. on 25 November

Latest time and date for receipt

of completed Forms of Proxy or electronic

proxy appointment for use at the 10.00 a.m. on 8 December

General Meeting

General Meeting 10.00 a.m. on 12 December

Announcement of the results of the Before 2.00 p.m. on 12 December

General Meeting

Admission and commencement of dealings

in the Second Placing Shares and 08:00 a.m. on 14 December

the Subscription Shares

Words and expressions defined in the Circular have the same

meanings where used herein.

- Ends -

Contacts:

Osirium Technologies plc Tel: +44 (0)1183 242 444

David Guyatt, CEO

Rupert Hutton, CFO

Allenby Capital Limited (Nominated adviser and broker) Tel: +44 (0)20 3328 5656

James Reeve / George Payne (Corporate Finance)

Tony Quirke (Sales and Corporate Broking)

Alma PR (Financial PR adviser) Tel: +44 (0)20 3405 0205

Hilary Buchanan osirium@almapr.co.uk

Kieran Breheny

Will Ellis Hancock

About Osirium Technologies Plc

Osirium Technologies plc (AIM: OSI) is a leading UK-based

cybersecurity software vendor delivering Privileged Access

Management (PAM), Privileged Endpoint Management (PEM) and Osirium

Automation solutions that are uniquely simple to deploy and

maintain.

With privileged credentials involved in over 80% of security

breaches, customers rely on Osirium PAM's innovative technology to

secure their critical infrastructure by controlling 3(rd) party

access, protecting against insider threats, and demonstrating

rigorous compliance. Osirium Automation delivers time and cost

savings by automating complex, multi-system processes securely,

allowing them to be delegated to Help Desk engineers or end-users

and to free up specialist IT resources. The Osirium PEM solution

balances security and productivity by removing risky local

administrator rights from users, while at the same time allowing

escalated privileges for specific applications.

Founded in 2008 and with its headquarters in Reading, UK, the

Company's shares were admitted to trading on AIM in April 2016. For

further information please visit www.osirium.com .

Notice to Distributors

Solely for the purposes of the temporary product intervention

rules made under sections S137D and 138M of the Financial Services

and Markets Act 2000 and the FCA Product Intervention and Product

Governance Sourcebook (together, the "Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the Product Governance Requirements) may

otherwise have with respect thereto, the Placing Shares have been

subject to a product approval process, which has determined that

the Placing Shares are: (i) compatible with an end target market of

retail investors and investors who meet the criteria of

professional clients and eligible counterparties, as defined under

the FCA Conduct of Business Sourcebook COBS 3 Client

categorisation, and are eligible for distribution through all

distribution channels as are permitted by the FCA Product

Intervention and Product Governance Sourcebook (the "Target Market

Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Placing. Furthermore, it is noted that, notwithstanding the

Target Market Assessment, Allenby Capital Limited will only procure

investors who meet the criteria of professional clients and

eligible counterparties. For the avoidance of doubt, the Target

Market Assessment does not constitute: (a) an assessment of

suitability or appropriateness for the purposes of the FCA Conduct

of Business Sourcebook COBS 9A and 10A respectively; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase, or take any other action whatsoever with respect to

the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

1 Details of the person discharging managerial responsibilities

/ person closely associated (PCA)

a) Name

PDMRs: Simon Lee Chairman

David Guyatt CEO

----------------------

Rupert Hutton CFO

----------------------

Stuart McGregor Sales Director (PDMR)

----------------------

PCAs: Emma Hutton PCA with Rupert Hutton

-------------------------- ---------------------------------------------

2 Reason for the notification

-------------------------------------------------------------------------

a) Position/status See 1a) above

-------------------------- ---------------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- ---------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------

a) Name Osirium Technologies plc

-------------------------- ---------------------------------------------

b) LEI 213800CTPGYQ4POIC338

-------------------------- ---------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------------

a) Description of the Ordinary Shares of nominal value 1

financial instrument, pence each

type of instrument

Identification code GB00BZ58DH10

-------------------------- ---------------------------------------------

b) Nature of the transaction Placing for new ordinary shares

-------------------------- ---------------------------------------------

c) Price(s) and volume(s) Price: 2 pence

Volumes:

Simon Lee 750,000

David Guyatt 5,000,000

----------

Rupert Hutton 250,000

----------

Stuart McGregor 750,000

----------

Emma Hutton 250,000

----------

-------------------------- ---------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

-------------------------- ---------------------------------------------

e) Date of the transaction 21 November 2022 to be completed 14

December 2022

-------------------------- ---------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ---------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBBBPTMTATBBT

(END) Dow Jones Newswires

November 22, 2022 02:00 ET (07:00 GMT)

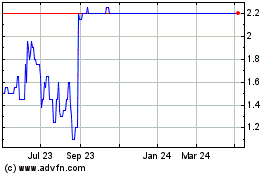

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Jan 2024 to Jan 2025