Petards Group PLC Half Yearly Report -3-

30 September 2013 - 4:02PM

UK Regulatory

Net cash from operating activities (1,029) 916 667

Cash flows from investing activities

Acquisition of property, plant and equipment (34) (70) (74)

Capitalised development expenditure (3) (156) (176)

Cash deposits held in escrow 77 - -

Net cash inflow/(outflow) from investing

activities 40 (226) (250)

Cash flows from financing activities

Proceeds from share issue - - 1,125

Expenses of share issue - - (151)

New short term borrowings 1,334 - -

Repayment of bank borrowings (42) (210) (505)

Net cash inflow/(outflow) from financing

activities 1,292 (210) 469

Net increase in cash and cash equivalents 303 480 886

Cash and cash equivalents at start of

period (47) (933) (933)

Effect of exchange rate fluctuations on

cash held - (1) -

Cash and cash equivalents at end of period 256 (454) (47)

Cash and cash equivalents comprise:

Cash and cash equivalents per balance

sheet 256 23 5

Secured overdraft - (477) (52)

256 (454) (47)

Notes

1 Basis of preparation

The interim financial information set out in this statement for

the six months ended 30 June 2013 and the comparative figures for

the six months ended 30 June 2012 are unaudited. This financial

information does not constitute statutory accounts as defined in

Section 435 of the Companies Act 2006.

The comparative figures for the financial year ended 31 December

2012 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the Company's

auditors and delivered to the Registrar of Companies. The report of

the auditors was (i) unqualified, (ii) did not contain an emphasis

of matter paragraph, and (iii) did not contain a statement under

section 498(2) or (3) of the Companies Act 2006.

This interim statement, which is neither audited nor reviewed,

has been prepared in accordance with the measurement and

recognition criteria of Adopted IFRSs. It does not include all the

information required for the full annual financial statements, and

should be read in conjunction with the financial statements of the

Group as at and for the year ended 31 December 2012. It does not

comply with IAS 34 'Interim Financial Reporting' as is permissible

under the rules of the AIM Market ("AIM").

The accounting policies applied in preparing these interim

financial statements are the same as those applied in the

preparation of the annual financial statements for the year ended

31 December 2012, as described in those financial statements other

than standards, amendments and interpretations which became

effective after 1 January 2013 and were adopted by the Group. These

have had no significant impact on the Group's profit for the period

or equity. The Board approved these interim financial statements on

27 September 2013.

Copies of this interim statement will be available on the

Company's website (www.petards.com) and from the Company's

registered office at 390 Princesway, Team Valley, Gateshead, Tyne

and Wear, NE11 0TU.

2 Taxation

No provision for taxation has been made in the Condensed

Consolidated Income Statement for the six months to 30 June 2013

based on the estimated tax provision required for the year ending

31 December 2012. No provision was required in the six months to 30

June 2012.

3 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to the shareholders by the weighted

average number of shares in issue. The calculation of diluted

earnings per share assumes conversion of all potentially dilutive

ordinary shares, all of which arise from share options.

The calculation of earnings per share is based on the profit for

the period and on the weighted average number of ordinary shares

outstanding in the period.

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

Earnings

(Loss)/profit for the period (GBP000) (338) 22 200

Number of shares

Weighted average number of ordinary shares

('000) 10,866 6,367 6,847

Diluted earnings per share is identical to the basic earnings

per share. None of the share options are dilutive as the exercise

prices are higher than the average market price of the shares.

4 Events occurring after the reporting period

On 1 July 2013 the Company announced an agreed offer to acquire

the entire share capital of Water Hall Group plc ("Water Hall") for

a consideration valued at GBP3.067 million. The consideration is

comprised of 10,954,854 new Petards ordinary shares of 1 pence each

and 1,752,775 new convertible redeemable loan notes of GBP1 each

with a coupon of 7% p.a. The loan notes have a five year term and

may be converted at any time into new Petards shares at a

subscription price of 8 pence per share.

Water Hall is an AIM traded investing company which at 30 June

2013 had a market capitalisation of approximately GBP1.5 million.

Its assets comprise a loan facility to Petards, cash, and a 29.99

per cent. shareholding in Petards together with a possible claim

for recovery of Aggregates Levy of GBP539,000 plus interest in a

class action against HM Revenue & Customs.

The Company's shareholders authorised the issue of the

consideration shares and convertible redeemable loan notes on 8

August 2013 and on 20 August 2013 the offer was declared

unconditional. The offer was declared wholly unconditional on 30

August 2013 and consequently application was made for the

cancellation of admission to trading of Water Hall shares on AIM

which is expected to be effective on 30 September 2013.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR VKLFLXKFLBBV

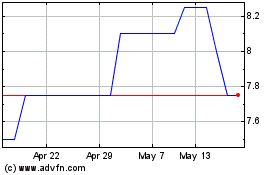

Petards (LSE:PEG)

Historical Stock Chart

From Sep 2024 to Oct 2024

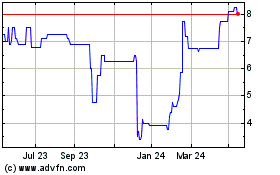

Petards (LSE:PEG)

Historical Stock Chart

From Oct 2023 to Oct 2024