Spire Healthcare Group PLC Post-close Trading Update (9875T)

12 January 2017 - 6:00PM

UK Regulatory

TIDMSPI

RNS Number : 9875T

Spire Healthcare Group PLC

12 January 2017

Spire Healthcare Group plc

Post-close Trading Update

12 January 2017

Spire Healthcare Group plc (LSE: SPI), the major UK independent

hospital group, provides the following update for Financial Year

2016 and preliminary guidance for Financial Year 2017.

Overview of expected outturn for Financial Year 2016

Management expect Group revenues for the Financial Year ended 31

December 2016 of approximately GBP925m (2015: GBP885m) and Group

EBITDA of approximately GBP162m (2015: GBP160m).

While the overall results for Financial Year 2016 were adversely

impacted by recent trading performance at St Anthony's hospital,

the Group's underlying performance (excluding St Anthony's) is

expected to be towards the top end of the revenue and EBITDA

guidance for 2016 (which guided to a range for revenue growth of

between 3% and 5% over Financial Year 2015 at a circa 18%

margin).

In addition, cash flow has remained strong throughout the year

and the Group expects year-end net debt leverage of circa 2.7 times

EBITDA, against guidance of 3.0 times EBITDA.

Redevelopment of Spire St Anthony's hospital

St Anthony's is currently undergoing a redevelopment and

reconfiguration process which is expected to take longer than

initially anticipated by management. Although much of the building

programme to establish a new 6 surgical theatre complex was

successfully completed on time in the second half of 2016, the work

to reconfigure staffing levels, clinical processes and competencies

to take full advantage of this additional capacity is still ongoing

and is not now expected to be completed until the second half of

2017.

Because of this delay St Anthony's is expected to report an

EBITDA loss of approximately GBP1.5m for Financial Year 2016 (2015:

GBP5m EBITDA profit) on revenues of approximately GBP30m (2015:

GBP32m), with the majority of the expected EBITDA loss accumulating

over the last 2 months of 2016. However, management believes it has

fully identified the further requirements at St Anthony's and

remains confident of the delivery of the investment case over the

medium term.

NHS tariff

NHS Improvement has recently finalised its consultation on NHS

tariff for the fiscal year commencing 1 April 2017. The impact of

these changes to prices for the weighted basket of services

currently delivered to the NHS by Spire Healthcare is an overall

reduction of circa 3.9%, which for the Financial Year ending 31

December 2017 has an adverse 9 months revenue impact of GBP7m

(based on an adverse annualised revenue impact of GBP11m). As in

previous years, management will pursue strategies to mitigate these

pricing pressures over the medium term.

Outlook for Financial Year 2017

Management will provide detailed guidance for the Financial Year

ending 31 December 2017 at the Financial Year 2016 results

presentation on 2 March 2017. This guidance will take account of

the continuing strength of the trading performance in Spire

Healthcare's underlying business, the impact of the recovery plan

for St Anthony's, the start- up effects of our two new hospitals in

Manchester and Nottingham (on track to open in January 2017 and

April 2017 respectively) and the impact of the NHS tariff changes,

net of efficiency savings.

Management expect the net effect of these factors to result in

an EBITDA outcome for 2017 in line with 2016, before the Group

returns to mid to high single digit EBITDA growth from Financial

Year 2018 onwards.

Chairman's statement

Garry Watts, Executive Chairman, said:

"While it is disappointing that St Anthony's return to

profitability has been delayed, we are nevertheless pleased with

the robust underlying performance of our established hospitals and

remain very positive about the prospects for Spire's business

overall. Spire's fundamental business proposition is solid and we

continue to be well placed to benefit from opportunities arising

from constrained NHS funding and capacity."

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

For further information please contact:

Spire Healthcare:

Antony Mannion, Investor

Relations Director +44 (0)20 7427 9160

Simon Gordon, Chief Financial

Officer +44 (0)20 7427 9004

Maitland:

Tom Eckersley +44 (0)20 7379 5151

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTQLLBFDFFZBBK

(END) Dow Jones Newswires

January 12, 2017 02:00 ET (07:00 GMT)

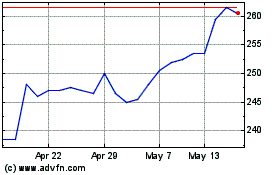

Spire Healthcare (LSE:SPI)

Historical Stock Chart

From Apr 2024 to May 2024

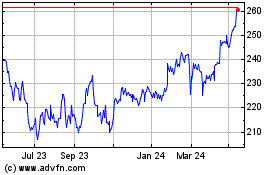

Spire Healthcare (LSE:SPI)

Historical Stock Chart

From May 2023 to May 2024