TIDMTND

RNS Number : 2843E

Tandem Group PLC

29 June 2023

Tandem Group plc

(the 'Group' or 'Company')

AGM Trading Statement

Tandem Group plc (AIM: TND), designers, developers, distributors

and retailers of sports, leisure and mobility equipment, announces

that at the Annual General Meeting of the Company to be held today,

the Company's Chairman, Steve Grant, will make the following

statement, with the Board maintaining its expectations that the

Group will achieve market expectations of performance for the full

year and particularly encouraging strong growth in the Group's

emobility division .

Trading

As previously announced in our Final Results Outlook Statement,

trading commenced slowly at the beginning of the year, presenting

challenges that persisted throughout the subsequent months. The

cautious buying behaviour observed among national retailers,

coupled with a delayed Chinese New Year, contributed to the initial

difficulties. These circumstances were not unforeseen, as we had

previously communicated our expectations. Trading conditions to 23

June 2023 have remained persistently challenging, however, we were

pleased with performance in the second quarter particularly in

bicycles and eMobility. The prevailing economic landscape,

exacerbated by high interest rates and the impact of the ongoing

cost of living crisis on the retail sector, has further compounded

the obstacles we face.

We have also experienced a shift in the buying habits of

national retailers who are transitioning from Free On Board (FOB)

purchases to Direct Delivery (DD). This change naturally alters the

pattern of our sales, aligning them more closely with the end

customer's buying behaviour and therefore the timing difference in

sales is to be expected to be weighted in favour of later in the

year compared to prior periods.

Overall, our sales have experienced a 26% decrease compared to

the prior year. Notably, our Toys, Sports, and Leisure division has

been particularly affected, with a 46% decline. However, it is

important to highlight that along with the move away from FOB, part

of this decline can be attributed to customer overstocks from the

previous year that have yet to be cleared, due to the impact of the

cost of living crisis and adverse weather conditions experienced

thus far in the current year. We therefore remain cautiously

optimistic as the year progresses, anticipating a recovery in this

segment.

In our Bicycles division, although sales are behind last year

overall by 20%, results in Q2 are significantly ahead of the

equivalent period in the prior year as we continue to release new

products.

Sales in our emobility sector have experienced a significant

growth of 51% compared to the prior year. Sales of electric bikes

in particular have experienced remarkable success in the first part

of 2023. In comparison to the prior year, electric bike sales have

more than tripled, reflecting a strong consumer demand and growing

interest in electric-powered transportation options. This upward

trend in electric bike sales highlights the effectiveness of our

strategy in capturing market opportunities.

The sale of electric bikes was positively impacted by the growth

in new Independent Bike Dealers and national retailer accounts and

our Electric Life shop, an innovative retail concept which, coupled

with the Electric Life website, has played an important role in

driving awareness, accessibility, and enthusiasm for electric bikes

among consumers.

We continue to support legislation that will determine the

legality and regulations surrounding electric scooters, and are

both well positioned and poised to seize opportunities as soon as

clarity emerges.

The Home and Garden division has experienced an overall decline

in turnover of approximately 30% compared to the same period in the

prior year. This decline is in line with the challenges faced from

poor weather conditions in Q1 and the prevailing cost of living

crisis continuing to impact non-essential spending.

We were pleased that the decline slowed significantly in Q2

compared to Q1, therefore despite the difficulties we have

outlined, we remain optimistic about the potential within the Home

and Garden sector.

In a strategic move to enhance our sales and marketing efforts,

we have expanded our Jack Stonehouse website as a platform to

promote products from other areas of our business. This approach

allows us to cross-promote and showcase the diverse range of

offerings available across different divisions. By leveraging this

untapped potential, we aim to maximise visibility, capture new

customers, and drive overall sales growth.

Outlook

Looking ahead, we anticipate that the remainder of 2023 will

continue to present challenges for the industry and for the Group.

The current market conditions show no signs of abatement, and we

anticipate further obstacles as increasing interest rates place

additional pressure on the disposable income of households. Despite

this, the positive trend we are seeing in sales now is expected to

continue throughout the rest of the year.

We are optimistic about the recently released and upcoming movie

releases applicable to our licences in 2023 and the positive impact

they will have on our popular brands such as Barbie, Paw Patrol,

and Spider-Man. These beloved franchises have captivated audiences

for years, and with new cinematic adventures on the horizon, we

anticipate an increase in demand for branded goods associated with

these blockbuster movies.

Our strategic focus on driving new national and independent

accounts has yielded positive results. These new partnerships hold

great potential as customers work through their previous overstocks

with their old suppliers. These new accounts will continue to

contribute to our sales as we build strong relationships and

establish ourselves as a reliable supplier in the market.

The changing landscape of the bike industry, has given us

further opportunity to gain market share alongside the launch of

new and exciting products.

We have invested considerable time and expertise into developing

designs that embody the quality, craftsmanship, and reliability

that our Dawes and Claud Butler brands are renowned for. The

significant pre-orders of our highly anticipated new electric bike

models are very encouraging. We continue to make strong progress

with our strategy of growing the eMobility sector.

Furthermore, we have made significant progress in building our

Group and brand awareness. Our proactive approach includes

publishing articles in appropriate media outlets, providing us with

increased exposure across the industries in which we operate. This

heightened visibility has been further enhanced by the recognition

we have received through several prestigious awards. These

accolades not only validate our commitment to excellence but also

serve as a powerful tool to attract new customers and enhance brand

authority.

In Home and Garden, we expect sales to perform relatively in

line with 2022 by the year-end. We have recently launched new

ranges of products, capitalising on market trends and consumer

preferences. These new offerings, coupled with improved weather

conditions, are anticipated to bolster sales in the Home and Garden

division.

Despite all of the current challenges, the Board remain

confident in the Group's ability to continue building and gaining

market share. We remain committed to evolving our strategies,

nurturing customer relationships, and leveraging our growing brand

presence to drive further growth and success in the market, and we

therefore maintain our view of achieving market expectations of our

performance for the full year.

Dividend

We announced on 27 March 2023 that following the results in 2022

it was the Board's view that it was our intention to pay a final

dividend of 6.57 pence per ordinary share. A resolution to that

effect will be proposed at the AGM today. Subject to this

resolution being passed, the dividend will be paid on or around 6

July 2023 to shareholders on the register on 12 May 2023

(ex-dividend date 11 May 2023).

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

Enquiries:

Tandem Group plc

Peter Kimberley, Chief Executive

David Rock, Company Secretary

Telephone 0121 748 8075

Nominated Adviser

Cenkos Securities plc

Ben Jeynes / Dan Hodkinson - Corporate Finance

Russell Kerr / Michael Johnson - Sales

Telephone 020 7397 8900

29 June 2023

Forward-Looking Statements

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and other factors, some

of which are beyond the Company's control, are difficult to

predict, and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

The Company cautions security holders and prospective security

holders not to place undue reliance on these forward-looking

statements, which reflect the view of the Company only as of the

date of this announcement. The forward-looking statements made in

this announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMDZGZVKRNGFZM

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

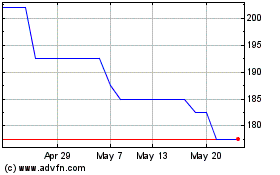

Tandem (LSE:TND)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tandem (LSE:TND)

Historical Stock Chart

From Nov 2023 to Nov 2024