TIDMWINK

RNS Number : 6572W

M Winkworth Plc

19 April 2023

M Winkworth Plc

Audited final results for the year to 31 December 2022

M Winkworth plc ("Winkworth" or the "Company"), the leading

franchisor of real estate agencies, is pleased to announce its

results for the year ended 31 December 2022.

Highlights for the year:

Financial performance in 2022 in line with management

expectations but below the exceptional 2021 level. Revenues and

pre-tax profits both markedly higher than 2019.

-- Franchised office network revenue down 3% to GBP63.1 million

(2021: GBP64.8 million).

-- Sales revenues 54% of total revenues (2021: 60%).

-- Revenues of GBP9.31 million in line with 2021 (2021 GBP9.45 million).

-- Profit before taxation down 23% to GBP2.47 million (2021: GBP3.21 million).

-- Clean Balance Sheet: Year-end cash balance of GBP5.25 million

(2021: GBP5.02 million) - no debt.

-- Two new offices opened in the year (2021: 6).

-- Ordinary dividends of 11.0p per ordinary share declared

(2021: 9.3p per ordinary share excluding Special Dividends).

Dominic Agace, CEO of the Company, commented: "After an

exceptionally strong performance in sales in 2021, we continued to

make good progress across the business in 2022, in lettings and

management in particular, and have delivered a set of results which

we consider to be very satisfactory against a background that was

at times challenging. Many of our key metrics for 2022 are up by

some 50% on 2019, the pre-pandemic year."

"While the outcome for the current year is shrouded, now that

mortgages rates having fallen from their peak and are settling at

more historic norms of around 4%, we see a rebased market emerging.

Rental prices are showing greater stability and we expect a further

healthy contribution from our lettings and management business in

2023."

Investor presentation

Dominic Agace, CEO of the Company, and Andrew Nicol, CFO of the

Company, will present the final audited results for the year to 31

December 2022 via the Investor Meet Company platform on 20 April

2023 at 3.00pm BST.

The presentation is open to all existing and potential

shareholders who can sign up and register to participate for free

at:

https://www.investormeetcompany.com/m-winkworth-plc/register-investor

Investors who already follow Winkworth on the Investor Meet

Company platform will automatically be invited.

For further information please contact:

M Winkworth Plc Tel : 020 7355 0206

Dominic Agace (Chief Executive Officer)

Andrew Nicol (Chief Financial Officer)

Milbourne (Public Relations) Tel : 07903 802545

Tim Draper

Shore Capital (NOMAD and Broker) Tel : 020 7408 4090

Robert Finlay

David Coaten

Henry Willcocks

About Winkworth

Winkworth is the leading London franchisor of residential real

estate agencies with a pre-eminent position in the mid to upper

segments of the sales and lettings markets. The franchise model

allows entrepreneurial real estate professionals to provide the

highest standards of service under the banner of a long-established

brand name and to benefit from the support and promotion that

Winkworth offers.

Winkworth is admitted to trading on the AIM Market of the London

Stock Exchange.

For further information please visit: www.winkworthplc.com

Chairman's Statement

I am pleased to report that Winkworth traded well in 2022, with

growth on all fronts compared to pre-pandemic levels of business.

There has been substantial growth in the business since 2019, which

we are pleased has been reflected in increased dividends.

I congratulate the franchisees on maintaining their staff and

their relationships with local communities, which led to an

excellent performance. Completed sales instructions hit an

exceptionally high level which, allowing for normal withdrawals due

to outside issues, is remarkable. I believe that in recent years

the Company has taken a stride forward as key offices in the

country markets have matured, adding to the long-established London

core and the ongoing progress being made by our new partner

businesses.

I enjoy my non-executive role but, of course, I was an estate

agent on the 'shop floor' for over 50 years through some of the

most interesting times in the property market and in more recent

years, I have influenced the business to maintain our personal

touch and the quality of the business. We believe that our

customers should have freedom of access to our agents and directors

or partners and we welcome discussion and casual calls on any

subject related to property. In this way, franchisees are able not

only to gather useful background information but also to exercise

their expertise and judgement on the market at all times. We do not

have our own legal offering or financial services business, but we

encourage our franchisees to use their market connections to help

our clients with their transaction requirements.

While we have continued to upgrade our digital, online and other

systems, as we consistently invest to support the needs of our

franchisees and customers, Winkworth's greatest asset is its

people. Our technology is there to enable them to use their skills

to create better outcomes for clients, not to reduce headcount to

the detriment of client care.

We are well-placed to interpret the large number of often

disparate judgements being made on the property market and to

establish why certain reports on trends may be more accurate than

others. For instance, a report on site registrations of properties

for sale, in a changing market where some agents may still be

pitching over-optimistic prices, can distort the real picture.

Equally misleading can be analysis based on land registry prices

which, as it takes six months for the data to be published, are

always out of date. Likewise, building societies using their own

data may only be lending to a section of the market.

Local knowledge is vital for estimating realistic pricing,

whereas blatant over-pricing is a danger to the client and

subsequently lowers the agent's percentage of sales completed from

instructions. This, not the largest number of properties to sell,

is the best gauge of success. Winkworth is not trying to be the

highest volume agent for property listings but instead aims to

achieve a high level of completed transactions at the best price

for the client.

In lettings and management, we continue to build the number of

landlords and tenants with whom the Company has a close

relationship. We have always found that proprietor-led management

and lettings brings tenants and landlords closer to decision-taking

and guidance on their property. Our experience is that landlords

like to connect with a local individual rather than a centralised,

often remote team, so our relationship between landlords and the

manager of the office is, in our opinion, a long-term win.

When we listed on the London Stock Exchange in 2009, we raised

capital to grow outside of London, to maintain our London business

and to develop our brand, and we have made considerable strides in

this direction since then. Our managers have done a tremendous job

in diversifying our profit centres, whilst being committed to

building and backing substantial businesses alongside our core

London offices, such as we have done in Bristol, Bath, Exeter,

Norwich, Brighton, Reading etc. Besides our focus on both

residential sales and lettings, we now also have a growing

commercial business.

We also committed to maintain a strong balance sheet in order to

develop the Company without debt. This policy has enabled us not

only to grow the business, but also to pay progressive dividends to

shareholders under all but the most extreme market conditions. With

uncertain times ahead, where economically viable we will continue

to prioritise dividend payments, while retaining sufficient cash to

be able to expand.

Simon Agace

Non-Executive Chairman

18 April 2023

CEO's Statement

In a year of fiscal tightening, the property market remained

remarkably resilient until the mini budget in October 2022, when

confidence was upset by the sharp rise in interest rates. Our

results for 2022, while below those recorded by an exceptionally

strong performance in 2021, were very satisfactory. It is worth

noting that in 2022 our revenues, profit before tax and net cash

position were all some 50% higher than the pre-pandemic levels

achieved in 2019. Our ordinary dividends declared for 2022 showed

an increase of 18% over the prior year and were 41% above those

declared in 2019.

Despite the upwards drift in the cost of finance, prices peaked

at record levels in August 2022, but after the budget we saw

pricing being tested and a predictable slowdown in activity, with

early signs being for a soft landing rather than significant

weakness.

The ongoing reversal of the Covid-induced race for space, with a

reversion to office working and city life returning to business as

usual, translated into gross revenues of the franchised network in

London being down by only 1% year-on-year, compared to a fall of 9%

in the country markets. As expected, Central London benefitted from

the return of international travel, with income 11% ahead of

2021.

Over the course of the year, we retained our position as the

second agency by number of properties exchanged in inner

London(1).

The rental market remained incredibly strong across all regions,

with price increases of over 10% in many areas due to a shortage of

supply following the sell-off of many buy-to-let properties by

landlords facing the higher tax and regulatory changes that have

reduced the viability of this activity in recent years. This,

combined with a significant movement of people to and from the

country driven by pandemic-related factors, led to notable price

movements. Increased market share and higher rents resulted in our

network revenue growing by 11%, led by central London where the

additional factor of the return of international travel boosted

growth to 16%.

In 2022, gross revenues of the franchised network of GBP63.1m

were down by 3% year-on-year (2021: GBP64.8m). Sales income was

down by 12% at GBP34.3m (2021: GBP39.0m) while Lettings and

Management increased by 11% to GBP28.7m (2021: GBP25.8), producing

a 54:46 revenue split between these two activities, compared to a

60:40 ratio in 2021, as the sales market eased in the second half

of 2022 and lettings revenue continued to grow.

Winkworth's revenues declined by 1% to GBP9.31m (2021: GBP9.45m)

and profit before taxation fell by 23% at GBP2.46m (2021:

GBP3.21m). The Group's cash position at year end increased to

GBP5.25m (2021: GBP5.02m). Dividends of 11.0p per share were

declared for the year (2021: 9.3p per share).

We continued to grow our franchise base, opening two new offices

and developing regional networks by backing existing successful

franchisees. Our Exeter franchisee opened a new office in Crediton

and our Bath franchisee opened in Bristol through acquisition. We

successfully resold our leading office in Shepherds Bush to a new

generation franchisee to take it on to the next level. While some

openings expected to complete in the second half were delayed, our

pipeline remains healthy with five new offices in new markets

expected. We continue to see opportunities to support both key

talent in the network and outstanding candidates in the industry to

acquire new businesses and expand the Winkworth brand.

Our owned offices in Tooting and Crystal Palace, and our

Development and Commercial Investment ("DCI") business showed

significant progress over 2021 in terms of their combined

contribution to both revenues and profit before taxation.

Tooting retained its position as number one for 'Sold Subject to

Contract' in its area and Crystal Palace continued to grow its

revenue and improve its market share, rising from 7th to 4th in its

area and growing its revenue by 30% over 2021. DCI revenues more

than doubled in 2022.

Overall, our partnered businesses revenue grew by 27% from

GBP2.2m to GBP2.8m. We will seek to grow the revenues and

profitability of our partnered businesses and plan to launch a new

homes operation within our DCI venture as part of its

evolution.

OUTLOOK

The sales market continues to be supported by the shortage and

high cost of rental property, pent-up savings post-pandemic, a

strong employment market, and private sector wage inflation. After

a positive start to the year, we expect the property market to

perform towards the higher end of expectations, albeit at

transaction levels more closely aligned to historic averages than

the boom levels of the last two years, with the increased cost of

finance leading to prices drifting down by 5%.

A severe shortage of supply continues to underpin rental prices,

particularly in London where the return to city living is driving

demand and buy-to-let landlords have sold down portfolios in

response to the increased costs of finance and management.

Affordability ceilings are, however, now being reached and, as

financing costs fall from peak levels, some landlords may now be

tempted back into the market.

With mortgages rates having fallen from the peak levels seen

after the mini budget and now settling at more historic norms of

around 4%, we see a rebased market emerging, with UK transactions

reverting closer to the long-term average of around 1m per annum.

As such we see opportunities to invest in the right talented people

in the industry, supporting their entrepreneurial ambition to own a

business, and in existing franchisees seeking to grow the revenue

of their existing offices or open new ones.

Note(1): based on postcodes where Winkworth has listed a

property - Source: twentyea

Dominic Agace

Chief Executive Officer

18 April 2023

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE YEARED 31 DECEMBER 2022

Notes 2022 2021

GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue 9,307 9,451

Cost of sales (1,594) (1,294)

--------- ---------------

GROSS PROFIT 7,713 8,157

1 18

Administrative expenses (5,246) (4,941)

Negative goodwill - -

--------- ---------------

OPERATING PROFIT 2,468 3,234

Finance costs (38) (52)

Finance income 39 32

--------- ---------------

PROFIT BEFORE TAXATION 2,469 3,214

Tax 4 (488) (606)

--------- ---------------

PROFIT AND TOTAL COMPREHENSIVE INCOME

FOR THE YEAR 1,981 2,608

========= ===============

Profit and total comprehensive income attributable

to: 1,951 2,519

Owners of the parent 30 89

Non-controlling interests

--------- ---------------

Earnings per share expressed in pence per Notes 1,981 2,608

share: 6 ====== ======

2022 2021

GBP GBP

Basic 15.32 19.78

Diluted 15.18 19.48

--------- ---------------

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31 DECEMBER 2022

Notes 2022 2021

GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Intangible assets 906 925

Property, plant and equipment 666 944

Prepaid assisted acquisitions support 503 279

Investments 41 71

Trade and other receivables 385 334

--------- ---------

2,501 2,553

--------- ---------

CURRENT ASSETS

Trade and other receivables 1,146 1,301

Cash and cash equivalents 5,251 5,019

--------- ---------

6,397 6,320

--------- ---------

TOTAL ASSETS 8,898 8,873

========= =========

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 64 64

Share based payment reserve 8 51 51

Retained earnings 6,212 6,145

--------- ---------

6,327 6,260

Non-controlling interests 102 72

--------- ---------

TOTAL EQUITY 6,429 6,332

--------- ---------

LIABILITIES

NON-CURRENT LIABILITIES

Trade and other payables 433 632

Deferred tax 91 97

--------- ---------

CURRENT LIABILITIES 524 729

Trade and other payables 1,575 1,412

Corporation tax payable 370 400

--------- ---------

1,945 1,812

TOTAL LIABILITIES 2,469 2,541

--------- ---------

TOTAL EQUITY AND LIABILITIES 8,898 8,873

========= =========

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF CHANGES

IN EQUITY

FOR THE YEARED 31 DECEMBER

2022

Called

up

share Retained Share Other Non-controlling Total

capital earnings premium reserves Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January 2021 64 5,147 - 51 5,262 165 5,427

Changes in equity

NCI on acquisition of shares - 45 - - 45 (182) (137)

Dividends - (1,566) - - (1,566) - (1,566)

Total comprehensive income - 2,519 - - 2,519 89 2,608

------- -------- ------- -------- ------- --------------- -------

Balance at 31 December 2021 64 6,145 - 51 6,260 72 6,332

------- -------- ------- -------- ------- --------------- -------

Changes in equity

Dividends - (1,884) - - (1,884) - (1,884)

Total comprehensive income - 1,951 - - 1,951 30 1,981

------- -------- ------- -------- ------- --------------- -------

Balance at 31 December 2022 64 6,212 - 51 6,327 102 6,429

======= ======== ======= ======== ======= =============== =======

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2022

Notes 2022 2021

GBP'000 GBP'000

Cash flows from operating activities 2,469 3,214

Profit before tax 531 509

Depreciation and amortisation charges 30 -

Impairment of fixed asset investments 38 52

Finance costs (39) (32)

Finance income 3,029 3,744

Increase in trade and other receivables 106 (411)

Increase/(decrease) in trade and other

payables 198 (375)

--------- ---------

Cash generated from operations 3,333 2,958

Interest paid - (1)

Tax paid (521) (382)

--------- ---------

Net cash from operating activities 2,812 2,575

--------- ---------

Cash flows from investing activities

Purchase of intangible fixed assets (123) (180)

Purchase of tangible fixed assets (19) (46)

Purchase of tangible fixed assets 1 -

Assisted acquisitions support (316) (50)

Interest received 39 32

--------- ---------

Net cash used in investing activities (418) (244)

--------- ---------

Cash flows from financing activities

Payments of lease liabilities (240) (219)

Interest paid on lease liabilities (38) (51)

Acquisition of non-controlling interest - (137)

Equity dividends paid (1,884) (1,566)

--------- ---------

Net cash used in financing activities (2,162) (1,973)

========= =========

Increase/(decrease) in cash and cash equivalents 232 358

Cash and cash equivalents at beginning

of year 5,019 4,661

--------- ---------

Cash and cash equivalents at end of year 5,251 5,019

========= =========

WINKWORTH PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2022

1. STATUTORY INFORMATION

M Winkworth Plc is a public company, registered in England and

Wales and quoted on AIM. The Company's registered number and

registered office address can be found on the Company Information

page of the Annual Report.

2. ACCOUNTING POLICIES

Basis of preparation

The financial statements have been prepared under the historical

cost convention, with the exception of financial instruments as set

out below, and in accordance with International Financial Reporting

Standards adopted by the European Union ("IFRS"). The financial

statements are presented in pound sterling, which is also the

company's functional currency. The following principal accounting

policies have been applied consistently in dealing with items which

are considered material in relation to the financial

statements.

Going concern

The Directors have, at the time of approving the financial

statements, a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future.

The Group has a strong cash base and no borrowings, with a high

level of discretionary expenditure, which can be cut at short

notice. Income would need to fall substantially for a prolonged

period, beyond six months, before a cash shortfall arose, at which

point stronger measures would be taken to cut costs. Thus, the

Directors continue to adopt the going concern basis of accounting

in preparing the accounts.

Revenue

Revenue represents the value of commissions and subscriptions

due to the Group under franchise agreements, together with the

value of fees earned by its subsidiary lettings business. Revenue

in respect of commissions due on house sales is recognised at the

point of the relevant property sale having been completed by the

franchisee. Revenue in respect of commissions due on lettings,

property management and administration services is recognised in

the period to which the services relate. The Group earns a straight

8% by value on all sales and lettings income generated by the

franchisees.

3. SEGMENTAL REPORTING

The board of directors, as the chief operating decision making

body, review financial information and make decisions about the

Group's business and have identified a single operating segment,

that of estate agency and related services and the franchising

thereof.

The directors believe that there are two material revenue

streams relevant to estate agency franchising.

2022 2021

GBP'000 GBP'000

Revenue

Estate agency and lettings business 2,781 2,231

Commissions and subscriptions due to the group under

franchise agreement 6,526 7,220

------- -------

9,307 9,451

4. TAXATION

Analysis of tax expense

2022 2021

GBP'000 GBP'000

Current tax:

Taxation 496 599

Adjustment re previous years (2) -

------- -------

Total current tax 494 299

Deferred tax (6) 7

------- -------

Total tax expense in consolidated statement of profit

or loss and other comprehensive

Income 488 606

======= =======

Factors affecting the tax expense

The tax assessed for the year is higher than the standard rate

of corporation tax in the UK. The difference is explained

below:

2022 2021

GBP'000 GBP'000

Profit before income tax 2,469 3,214

------- -------

Profit multiplied by the standard rate of corporation

tax in the UK of 19% (2021 - 19%) 469 611

Effects of:

Expense (income) not deductible (taxable) for tax

purposes 9 (18)

Adjustment in respect of prior periods (2) -

Depreciation in excess of capital allowances 18 12

Other movements (6) 1

------- -------

Tax expense 488 606

======= =======

5. DIVIDENDS

2022 2021

GBP'000 GBP'000

Ordinary shares of 0.5p each 1,884 1,566

======= =======

6. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

2022

Earnings Weighted Per-share

average amount

number of

shares

GBP'000 '000 pence

Basic EPS

Earnings attributable to ordinary shareholders 1,951 12,733 15.32

Effect of dilutive securities - 122 -

--------- ----------- ----------

Diluted EPS

Diluted earnings 1,951 12,855 15.18

========= =========== ==========

2021

Earnings Weighted Per-share

average amount

number of

shares

GBP'000 '000 pence

Basic EPS

Earnings attributable to ordinary

shareholders 2,519 12,733 19.78

Effect of dilutive securities - 195 -

--------- -------------------- ----------

Diluted EPS

Diluted earnings 2,519 12,928 19.48

========= ==================== ==========

7. CALLED UP SHARE CAPITAL

2022 2021

Authorised: GBP'000 GBP'000

20,000,000 Ordinary shares of 0.5p 100 100

========= ==========

2022 2021

Issued and f GBP'000 GBP'000

u lly paid:

12,733,238 Ordinary shares of 0.5p 64 64

========= ==========

8. RESERVES

Retained earnings are earnings retained by the Company not paid

out in dividends.

Share premium is the premium paid on shares purchased in the

Company.

Other reserves are the fair value equity components recognised

over the vesting period of share based payments.

9. POST BALANCE SHEET EVENTS

On 13 January 2023, M Winkworth Plc declared dividends of 2.9p

per or the fourth quarter of 2022.

After the reporting date the Directors became aware that

aggregate dividends totalling GBP713,000 paid in the period and

shortly after the end of the period had been made otherwise than in

accordance with the Companies Act 2006 as unaudited interim

accounts had not been filed at Companies House prior to the

dividend payment. A resolution has been proposed at the General

Meeting to be held on 6 June 2023 to authorise the appropriation of

distributable profits to the payment of the relevant dividends and

waive the entitlement of the Company to pursue shareholders and

Directors for repayment. This will constitute a related party

transaction under IAS24 'Related party disclosures', the effect of

which will be to return all parties, so far as possible, to the

position they would have been in had the relevant dividends been

made in full compliance with the Companies Act 2006.

10. FINANCIAL INFORMATION

The financial information contained within this announcement for

the year ended 31 December 2022 is derived from but does not

comprise statutory financial statements within the meaning of

section 434 of the Companies Act 2006. Statutory accounts for the

year ended 31 December 2021 have been filed with the Registrar of

Companies and those for the year ended 31 December 2022 will be

filed following the Company's annual general meeting. The auditors'

reports on the statutory accounts for the years ended 31 December

2022 and 31 December 2021 are unqualified, do not draw attention to

any matters by way of emphasis, and do not contain any statements

under section 498 of the Companies Act 2006.

11. ANNUAL REPORT AND ACCOUNTS

Copies of the annual report and accounts for the year ended 31

December 2022 together with the notice of the Annual General

Meeting to be held at the offices of M Winkworth Plc, 13 Charles II

Street, St James's, London SW1Y 4QU on 6 June 2023 at 10.30am, will

be posted to shareholders shortly and will be available to view and

download from the Company's website at www.winkworthplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GPUMCCUPWGQR

(END) Dow Jones Newswires

April 19, 2023 02:00 ET (06:00 GMT)

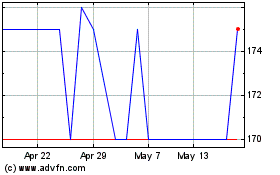

M Winkworth (LSE:WINK)

Historical Stock Chart

From Nov 2024 to Dec 2024

M Winkworth (LSE:WINK)

Historical Stock Chart

From Dec 2023 to Dec 2024