Form 8-K - Current report

01 March 2025 - 12:00AM

Edgar (US Regulatory)

false

0000946644

0000946644

2025-02-26

2025-02-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported) February

26, 2025

AIM

IMMUNOTECH INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-27072 |

|

52-0845822 |

| (state

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 2117

SW Highway 484, Ocala

FL |

|

34473 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (352) 448-7797

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

AIM |

|

NYSE

American |

Item

8.01 Other Events

On

February 26, 2025, AIM ImmunoTech Inc. (the “Company”) received notice from the NYSE American (the “American”)

that the American has accepted the Company’s Plan to regain compliance with the minimum stockholders’ equity requirements

of Sections 1003(a)(ii) and 1003(a)(iii) of the American Company Guide.

For

more information, please see the February 26, 2025 press release which is attached to this Current Report on Form 8-K as Exhibit 99.1

and is incorporated by reference herein.

Cautionary

Statement Regarding Forward-Looking Statements

This

current report, including exhibit 99.1, contains forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 (the “PSLRA”). Words such as “may,” “will,” “expect,” “plan,”

“anticipate,” “continue,” “believe,” “potential,” “upcoming” and other variations

thereon and similar expressions (as well as other words or expressions referencing future events or circumstances) are intended to identify

forward-looking statements. Many of these forward-looking statements involve a number of risks and uncertainties. There can be no assurance

that the Company will be able to achieve compliance with the American’s continued listing standards within the required timeframe.

The Company urges investors to consider specifically the various risk factors identified in its most recent Form 10-K, and any risk factors

or cautionary statements included in any subsequent Form 10-Q or Form 8-K, filed with the U.S. Securities and Exchange Commission. You

are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this current report.

Among other things, for those statements, the Company claims the protection of the safe harbor for forward-looking statements contained

in the PSLRA. The Company does not undertake to update any of these forward-looking statements to reflect events or circumstances that

occur after the date hereof.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

The

following exhibits are filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AIM

ImmunoTech Inc. |

| |

|

|

| Date:

|

February

26, 2025 |

By |

/s/

Thomas K. Equels |

| |

|

Thomas

K. Equels, CEO |

Exhibit 99.1

AIM

ImmunoTech Announces NYSE American Acceptance of Plan to Regain Listing Compliance

OCALA,

Fla., February 26, 2025/ AIM ImmunoTech Inc. (NYSE American: AIM) (“AIM” or the “Company”) today announced

that it received notice from the NYSE American (the “American”) that the American has accepted the Company’s Plan to

regain compliance with the minimum stockholders’ equity requirements of Sections 1003(a)(ii) and 1003(a)(iii) of the American Company

Guide. AIM has until June 11, 2026 to regain compliance with the NYSE’s Continued Listings Standards.

AIM

CEO Thomas K. Equels stated: “We are pleased that the NYSE American has approved our plan and look forward to executing the strategy

over the coming months as we also continue to make advancements in our oncology and antiviral pipelines.”

About

AIM ImmunoTech Inc.

AIM

ImmunoTech Inc. is an immuno-pharma company focused on the research and development of therapeutics to treat multiple types of cancers,

immune disorders and viral diseases, including COVID-19. The Company’s lead product is a first-in-class investigational drug called

Ampligen® (rintatolimod), a dsRNA and highly selective TLR3 agonist immuno-modulator with broad spectrum activity in clinical trials

for globally important cancers, viral diseases and disorders of the immune system.

For

more information, please visit aimimmuno.com and connect with the Company on X, LinkedIn, and Facebook.

Cautionary

Statement

This

current report, including exhibit 99.1, contains forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 (the “PSLRA”). Words such as “may,” “will,” “expect,” “plan,”

“anticipate,” “continue,” “believe,” “potential,” “upcoming” and other variations

thereon and similar expressions (as well as other words or expressions referencing future events or circumstances) are intended to identify

forward-looking statements. Many of these forward-looking statements involve a number of risks and uncertainties. There can be no assurance

that the Company will be able to achieve compliance with the American’s continued listing standards within the required timeframe.

The Company urges investors to consider specifically the various risk factors identified in its most recent Form 10-K, and any risk factors

or cautionary statements included in any subsequent Form 10-Q or Form 8-K, filed with the U.S. Securities and Exchange Commission. You

are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this current report.

Among other things, for those statements, the Company claims the protection of the safe harbor for forward-looking statements contained

in the PSLRA. The Company does not undertake to update any of these forward-looking statements to reflect events or circumstances that

occur after the date hereof.

Investor

Contact:

JTC

Team, LLC

Jenene

Thomas

908.824.0775

AIM@jtcir.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

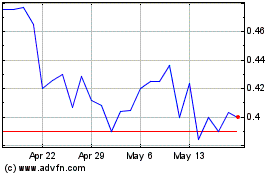

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Feb 2025 to Mar 2025

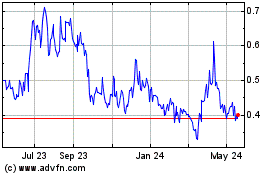

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Mar 2024 to Mar 2025