false

0000921114

0000921114

2024-07-22

2024-07-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 22, 2024

ARMATA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

| Washington |

|

001-37544 |

|

91-1549568 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 5005 McConnell Avenue, Los Angeles, California |

|

90066 |

| (Address of principal executive offices) |

|

(Zip Code) |

(310) 655-2928

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

ARMP |

|

NYSE American |

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(e)

On July 22,

2024, Mina Pastagia, M.D. (“Dr. Pastagia”) and Armata Pharmaceuticals, Inc. (the “Company”)

entered into an agreement (the “Amendment”), which amended certain terms of Dr. Pastagia’s Employment Agreement

with the Company, dated September 22, 2020 (the “Employment Agreement”). The Amendment updates the Employment

Agreement to reflect the fact that Dr. Pastagia has been serving as the Company’s Chief Medical Officer since January 1,

2023 and that her base salary has been $456,800 since her promotion. Additionally, commencing with the 2024 fiscal year, Dr. Pastagia

will have a target annual bonus opportunity equal to 50% of her annual base salary, with the actual bonus payable in respect of any fiscal

year dependent on actual performance as determined by the Company’s board of directors or compensation committee. Additionally,

Dr. Pastagia will be eligible for additional grants pursuant to the Company’s 2016 Equity Incentive Plan (or any successor

plan) commencing in 2025, with the actual size of any grant to be consistent with her position as the Company’s Chief Medical Officer

(with the current intent being for any such award to have a grant date fair value equal to $300,000), as determined by the Company’s

board of directors or compensation committee. In the event that Dr. Pastagia’s employment is terminated by the Company without

“cause” or if she resigns for “good reason” (in each case as defined in the Employment Agreement), then, subject

to her execution of a release and compliance with her post-termination restrictive covenants, she will be entitled to a continuation of

her base salary for 12 months following such termination.

The foregoing

description does not constitute a complete summary of the terms of the Amendment or the Employment Agreement and is qualified in its entirety

by reference to the full text of each of the Amendment and the Employment Agreement, copies of which are filed as Exhibit 10.1 and

Exhibit 10.2, respectively, to this report and incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

Exhibit

No. |

|

Description |

| 10.1 |

|

Amendment No. 1, dated as of July 22, 2024, to that certain Employment Letter Agreement by and between Mina Pastagia, M.D. and Armata Pharmaceuticals, Inc., dated as of September 22, 2020. |

| 10.2 |

|

Employment Letter Agreement by and between Mina Pastagia, M.D. and Armata Pharmaceuticals, Inc., dated as of September 22, 2020. |

| 104 |

|

Cover Page Interactive Data File (embedded within Inline XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date:

July 25, 2024 |

Armata

Pharmaceuticals, Inc. |

| |

|

| |

By: |

/s/

Richard Rychlik |

| |

Name: |

Richard Rychlik |

| |

Title: |

Principal Financial Officer and Corporate Controller |

Exhibit 10.1

AMENDMENT NO. 1

TO

EMPLOYMENT AGREEMENT

This Amendment No. 1 (this “ Amendment”)

to the Employment Agreement (as defined below) is entered into as of July 22, 2024, by and between Armata Pharmaceuticals, Inc. (the “Company”)

and Mina Pastagia, M.D. (the “Employee”).

WHEREAS, the Company and the Employee

are parties to that certain employment letter agreement, dated September 22, 2020 (the “Employment Agreement”), which

governs the terms of the Employee’s employment with the Company; and

WHEREAS, the Company and the Employee

now desire to amend the Employment Agreement to memorialize Employee’s title and compensation change effective as of January 1,

2023.

NOW, THEREFORE, in consideration of

the covenants and agreements herein contained, the parties hereto hereby agree as follows:

1.

Capitalized Terms. Capitalized terms that are not defined in this Amendment shall have the meanings ascribed thereto in

the Employment Agreement.

2.

Amendments to Employment Agreement.

(a)

The first two sentences of Section 1 of the Employment Agreement are hereby amended and restated in their entirety to read as follows:

“Effective as of January

1, 2023, you will serve as the Company’s Chief Medical Officer, reporting directly to the Company’s Chief Executive Officer,

and will have such duties and responsibilities commensurate with such title.”

(b) The first sentence of Section 2 of

the Employment Agreement is hereby amended and restated in its entirety to read as follows:

“Effective as of January

1, 2023, your base salary will be $456,800 per year, less applicable withholdings.”

(c) Section 3 of the Employment agreement

is hereby amended and restated in its entirety to read as follows:

“3. Bonus. You

will be eligible to earn an annual performance bonus based on achievement of Company performance objectives to be established by the

Board or its compensation committee and provided to you. Your annual target performance bonus for each fiscal year commencing with

the 2024 fiscal year will be equal to fifty percent (50%), although the amount of any payment will be dependent upon actual

performance as determined by the Board or its compensation committee. Generally, you must be employed by the Company through the

date on which bonuses are paid in order to be eligible to receive a bonus. Your annual performance bonus, if any, shall be paid to

you at the same time as annual bonuses are paid to other senior executives of the Company and, in all events, on or before March 15

of the year following the year to which it relates (or such earlier date as determined by the Board or its compensation committee in

the sole discretion). Your annual target performance bonus percentage is subject to increase, but not decrease, from time to time in

the discretion of the Board or its compensation committee (the “Compensation Committee”). For the

avoidance of doubt, the parties hereto acknowledge and agree that the Compensation Committee did not award any annual bonuses to

executive officers of the Company in respect of the 2023 fiscal year and that you have no entitlement to any bonus in respect of

employment during the 2023 fiscal year.”

(d) Section 4 of the Employment Agreement is hereby

amended and restated in its entirety to read as following:

“4. Equity Award. You will be

eligible to receive additional grants pursuant to the Company’s 2016 Equity Incentive Plan or any successor thereto (the “Plan”)

commencing in 2025. The actual size of your annual grant in respect of any fiscal year shall be consistent with your position as the Company’s

Chief Medical Officer, and the terms and conditions of any equity award granted in any fiscal year will be determined in the sole discretion

of the Board and/or the Compensation Committee. The parties hereto acknowledge and agree that the current intent of the Compensation Committee

is that provide you with an equity award each fiscal year (commencing in 2025) with a grant date fair value of approximately $300,000,

but nothing herein shall entitle you to any specific award or any specific terms or conditions in respect of any fiscal year. The parties

also acknowledge and agree that you were granted options and restricted stock units pursuant to the Plan in March 2024 and that you are

not entitled to any additional grant during the 2024 calendar year. Grants shall be made annually (commencing with the Company’s

2025 fiscal year) at the same time as grants of equity are made to other senior executives of the Company. Subject to your continued employment

with the Company, any equity awards granted pursuant to this paragraph in respect of any fiscal year shall vest on the same basis as equity

awards granted to other senior executives vest in respect of such fiscal year.”

(e) Section 8(a) of the Employment Agreement is

hereby amended and restated in its entirety to read as following:

“a. In the event (i) the Company

terminates your employment without Cause (as defined below and other than due to your death or disability), or (ii) you terminate your

employment for Good Reason (as defined below), and provided in either case of (i) or (ii) such termination or resignation constitutes

a “separation from service” (as defined under Treasury Regulation Section 1.409A-1(h), without regard to any alternative definition

thereunder, a “Separation from Service”) (such termination or resignation, an “Involuntary Termination”),

then, in addition to the Accrued Obligations, subject to your obligations below, you shall be entitled to receive an amount equal to twelve

(12) months of your then current base salary (ignoring any decrease in base salary that forms the basis for Good Reason), less all applicable

withholdings and deductions, paid on the schedule described below (the “Severance Pay”).”

3. Ratification and Confirmation. Except

as specifically amended by this Amendment, the Employment Agreement is hereby ratified and confirmed in all respects and remains valid

and in full force and effect. Whenever the Employment Agreement is referred to in this Amendment or in any other agreement, document or

instrument, such reference shall be deemed to be to the Employment Agreement, as amended by this Amendment, whether or not specific reference

is made to this Amendment.

4. Entire

Agreement. The Employment Agreement and this Amendment contain the entire understanding and agreement of the parties hereto

regarding the employment of the Employee and supersede all prior negotiations, discussions, correspondence, communications,

understandings and agreements between the parties relating to the subject matter hereof.

5.

Governing Law. This Amendment and the performance hereof shall be construed and governed in accordance with the laws of

the state of California.

6.

Controlling Document. In case of conflict between any of the terms and conditions of this Amendment and the Employment Agreement,

the terms and conditions of this Amendment shall control.

7.

Acknowledgment. The Employee acknowledges (i) that the Employee has consulted with or has had the opportunity to consult

with independent counsel of the Employee’s own choice concerning this Amendment, and has been advised to do so by the Company, and

(ii) that the Employee has read and understands this Amendment, is fully aware of its legal effect, and has entered into it freely based

on the Employee’s own judgment.

8.

Counterparts. This Amendment may be executed in multiple counterparts, each of which shall be deemed an original but all of which

together will constitute one and the same instrument. The execution of this Amendment may be by actual signature or by signature delivered

by facsimile or by e-mail as a portable document format (.pdf) file or image file attachment.

* * *

IN WITNESS WHEREOF, the parties have executed this Amendment as of

the date first set forth above.

| ARMATA PHARMACUETICALS, INC. |

|

EMPLOYEE |

| By: |

/s/ Deborah Birx |

|

/s/ Mina Pastagia |

| Name: |

Deborah Birx, M.D. |

|

Mina Pastagia, M.D. |

| Title: |

Chief Executive Officer |

|

|

[Signature Page to Amendment to M. Pastagia Employment

Agreement]

Exhibit 10.2

| 4503 Glencoe Avenue

Marina

del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

September 22, 2020

Ms. Mina Pastagia, MD

Dear Mina:

We are pleased to confirm our offer of employment with Armata

Pharmaceuticals, Inc. (the “Company”), in the position of Vice President, Clinical Development on the terms

set forth in this letter agreement (the “Agreement”).

1.

Position. As Vice President, Clinical Development, you will be responsible for managing the clinical research and development

and all clinical trial programs for the Company. You will report directly to the President and Chief Development Officer of the

Company. You agree to devote your full business time and attention to your work for the Company. Except upon the prior written

consent of the Board of Directors of the Company (the “Board”), you will not, during your employment with

the Company, (i) accept or maintain any other employment, or (ii) engage, directly or indirectly, in any other business activity

(whether or not pursued for pecuniary advantage) that might interfere with your duties and responsibilities as a Company employee or

create a conflict of interest with the Company.

2.

Salary. Your initial base salary will be $380,000 per year, less applicable withholdings. Your salary will be reviewed from time to

time by the Board or its compensation committee and may be adjusted in the sole discretion of the Board or its compensation committee.

3.

Bonus. You will be eligible to earn an annual performance bonus based on achievement of Company performance objectives to be established

by the Board or its compensation committee and provided to you. Your annual target performance bonus will initially be equal to thirty

five percent (35%), although the amount of any payment will be dependent upon actual performance as determined by the Board or its compensation

committee. Generally, you must be employed by the Company through the date on which bonuses are paid in order to be eligible to receive

a bonus. Your annual target performance bonus, if any, shall be paid to you on or before March 15 of the year following the year to which

it relates. Your annual target performance bonus percentage is subject to modification from time to time in the discretion of the Board

or its compensation committee. You will not be eligible for a cash bonus in calendar 2020.

4.

Equity Award. Upon commencement of employment with the Company (expected to be approximately October 15, 2020), you will receive

an Inducement award of 33,000 shares of the Company’s common shares (less applicable withholding). These shares will vest

immediately. You will also receive an additional Inducement award of 40,000 shares of the Company’s stock (less applicable

withholding), upon commencing employment. This Inducement award will vest six (6) months upon your start date, or on or about

approximately April 15, 2021. Finally, you will receive a third Inducement award of 30,000 shares (less applicable withholding upon

vesting) of the Company’s common stock which will cliff vest in their entirety upon the 3rd anniversary of your

start date (or approximately October 15, 2023). The shares will be issued outside of the Company’s 2016 Equity Incentive Plan

(the “Plan”). During your employment, depending upon your performance and the Company’s success, you

may also be granted options to purchase stock of the Company. The Options shall vest with respect to one-fourth of the total number

of shares on each anniversary of the stock option grant date and, subject to your continued services to the Company. The Options

shall be granted at the fair market value of the stock on the date of grant in accordance with the Plan and shall be subject to the

terms and conditions of the Plan, stock option grant notice and option agreement to be entered into between you and the Company.

| 4503 Glencoe Avenue

Marina del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

5.

Benefits. You will be eligible to participate in the benefits made generally available by the Company to its senior executives, in

accordance with the benefit plans established by the Company, and as may be amended from time to time in the Company’s sole discretion.

6.

At-Will Employment. The Company is an “at-will” employer. Accordingly, either you or the Company may terminate

the employment relationship at any time, with or without advance notice, and with or without cause.

7.

Termination. Upon any termination of your employment, you will be deemed to have resigned, and you hereby resign, from

all offices and directorships, if any, then held with the Company or any subsidiary. In the event of termination of your employment with

the Company, regardless of the reasons for such termination, the Company shall pay your base salary and accrued but unused vacation up

to and through the date of termination, less applicable payroll and tax withholdings (the “Accrued Obligations”).

8. Severance. You shall be eligible for the severance benefits described in this Section 8.

a. In the event

(i) the Company terminates your employment without Cause (as defined below and other than due to your death or disability), or (ii) you

terminate your employment for Good Reason (as defined below), and provided in either case of (i) or (ii) such termination or resignation

constitutes a “separation from service” (as defined under Treasury Regulation Section 1.409A-1(h), without regard to any alternative

definition thereunder, a “Separation from Service”) (such termination or resignation, an “Involuntary

Termination”), then, in addition to the Accrued Obligations, subject to your obligations below, you shall be entitled to

receive an amount equal to six (6) months of your then current base salary (ignoring any decrease in base salary that forms the basis

for Good Reason), less all applicable withholdings and deductions, paid on the schedule described below (the “Severance Pay”).

b. The

Severance Pay is conditional upon (i) your continuing to comply with your obligations under your PIIA (as defined in Section 11)

during the period of time in which you are receiving the Severance Pay; (ii) your delivering to the Company an executed separation

agreement and general release of claims in favor of the Company, in a form attached hereto as EXHIBIT A, within the time period set

forth therein, which becomes effective in accordance with its terms, which shall be no later than sixty (60) days following your

Separation from Service (the “Release”). The Severance Pay will be paid in equal installments on the

Company’s regular payroll schedule over the period outlined above following the date of your Separation from Service; provided,

however, that no payments will be made prior to the sixtieth (60th) day following your Separation from Service. On

the sixtieth (60th) day following your Separation from Service, the Company will pay you in a lump sum the amount of the

Severance Pay that you would have received on or prior to such date under the original schedule but for the delay while waiting for

the sixtieth (60th) day, with the balance of the Severance Pay being paid as originally scheduled.

| 4503 Glencoe Avenue

Marina del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

c.

“Cause” for purposes of your Severance Pay means (i) your gross negligence or willful failure substantially

to perform your duties and responsibilities to the Company or deliberate violation of a Company policy; (ii) your commission of any act

of fraud, embezzlement or dishonesty against the Company or any other willful misconduct that has caused or is reasonably expected to

result in material injury to the Company; (iii) your unauthorized use or disclosure of any proprietary information or trade secrets of

the Company or any other party to whom you owe an obligation of nondisclosure as a result of your relationship with the Company; or (iv)

your willful breach of any of your obligations under any written agreement or covenant with the Company, including without limitation

this Agreement and your PIIA.

d. “Good

Reason” for purposes of your Severance Pay means the occurrence at any time of any of the following without your prior written

consent: (i) a material reduction in your authority, duties or responsibilities (other than a mere change in title following any merger

or consolidation of the Company with another entity); (ii) a material reduction in your base salary; or (iii) any willful failure or willful

breach by the Company of any of its material obligations under this Agreement. For purposes of this subsection, no act, or failure to

act, on the Company’s part shall be deemed “willful” unless done, or omitted to be done, by the Company not in good

faith and without reasonable belief that the Company’s act, or failure to act, was in the best interest of the Company. In order

to terminate your employment under this Agreement for Good Reason, you must (1) provide written notice to the Company within ninety (90)

days of the first occurrence of the events described above, (2) allow the Company at least thirty (30) days from such receipt of such

written notice to cure such event, and (3) if such event is not reasonably cured within such period, resign from all position you then

hold with the Company effective not later than the one-hundred eightieth (180th) day after the initial occurrence of such event.

9.

Change in Control. If your Involuntary Termination occurs within one (1) month prior to, or twelve (12) months following a Change

in Control (as defined in the Plan), the vesting of all of your outstanding equity awards (including the Options) that are subject to

time-based vesting requirements shall accelerate in full such that all such equity awards shall be deemed fully vested as of the date

of such Involuntary Termination (or Change in Control, if later).

10.

Taxes: All amounts paid under this Agreement shall be paid less all applicable state and federal tax withholdings (if

any) and any other withholdings required by any applicable jurisdiction or authorized by you.

a. Section

409A. The Severance Pay provided in this Agreement is intended to qualify for an

exemption from application of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”)

and the regulations and other guidance thereunder and any state law of similar effect (collectively “Section 409A”)

or to comply with its requirements to the extent necessary to avoid adverse personal tax consequences under Section 409A, and any

ambiguities herein shall be interpreted accordingly. Each installment of Severance Pay is a separate “payment” for purposes

of Treasury Regulations Section 1.409A-2(b)(2)(i), and the Severance Pay is intended to satisfy the exemptions from application of Section

409A provided under Treasury Regulations Sections 1.409A-1(b)(4), 1.409A-1(b)(5) and 1.409A-1(b)(9). However, if such exemptions are

not available and you are, upon Separation from Service, a “specified employee” for purposes of Section 409A, then, solely

to the extent necessary to avoid adverse personal tax consequences under Section 409A, the timing of the Severance Pay shall be delayed

until the earlier of (i) six (6) months and one day after your Separation from Service, or (ii) your death. Except to the minimum extent

that payments must be delayed because you are a “specified employee”, all amounts of Severance Pay will be paid as soon as

practicable in accordance with the schedule provided herein and in accordance with the Company’s normal payroll practices.

| 4503 Glencoe Avenue

Marina del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

b.

Section 280G. If any payment or benefit you will or may receive from the Company

or otherwise (a “280G Payment”) would (i) constitute a “parachute payment” within the meaning

of Section 280G of the Code, and (ii) but for this sentence, be subject to the excise tax imposed by Section 4999 of the Code (the

“Excise Tax”), then any such 280G Payment pursuant to this Agreement or otherwise (a

“Payment”) shall be equal to the Reduced Amount. The “Reduced Amount” shall be

either (x) the largest portion of the Payment that would result in no portion of the Payment (after reduction) being subject to the

Excise Tax or (y) the largest portion, up to and including the total, of the Payment, whichever amount (i.e., the amount determined

by clause (x) or by clause (y)), after taking into account all applicable federal, state and local employment taxes, income taxes,

and the Excise Tax (all computed at the highest applicable marginal rate), results in your receipt, on an after-tax basis, of the

greater economic benefit notwithstanding that all or some portion of the Payment may be subject to the Excise Tax. If a reduction in

a Payment is required pursuant to the preceding sentence and the Reduced Amount is determined pursuant to clause (x) of the

preceding sentence, the reduction shall occur in the manner (the “Reduction Method”) that results in the

greatest economic benefit for you. If more than one method of reduction will result in the same economic benefit, the items so

reduced will be reduced pro rata (the “Pro Rata Reduction Method”).

Notwithstanding the

foregoing, if the Reduction Method or the Pro Rata Reduction Method would result in any portion of the Payment being subject to taxes

pursuant to Section 409A that would not otherwise be subject to taxes pursuant to Section 409A, then the Reduction Method and/or the Pro

Rata Reduction Method, as the case may be, shall be modified so as to avoid the imposition of taxes pursuant to Section 409A as follows:

(A) as a first priority, the modification shall preserve to the greatest extent possible, the greatest economic benefit for you as determined

on an after-tax basis; (B) as a second priority, Payments that are contingent on future events (e.g., being terminated without cause),

shall be reduced (or eliminated) before Payments that are not contingent on future events; and (C) as a third priority, Payments that

are “deferred compensation” within the meaning of Section 409A shall be reduced (or eliminated) before Payments that are not

deferred compensation within the meaning of Section 409A.

Unless you and the

Company agree on an alternative accounting firm, the accounting firm engaged by the Company for general tax compliance purposes as of

the day prior to the effective date of the change of control transaction triggering the Payment shall perform the foregoing calculations.

If the accounting firm so engaged by the Company is serving as accountant or auditor for the individual, entity or group effecting the

change of control transaction, the Company shall appoint a nationally recognized accounting firm to make the determinations required hereunder.

The Company shall bear all expenses with respect to the determinations by such accounting firm required to be made hereunder. The Company

shall use commercially reasonable efforts to cause the accounting firm engaged to make the determinations hereunder to provide its calculations,

together with detailed supporting documentation, to you and the Company within fifteen (15) calendar days after the date on which your

right to a 280G Payment becomes reasonably likely to occur (if requested at that time by you or the Company) or such other time as requested

by you or the Company.

If you receive

a Payment for which the Reduced Amount was determined pursuant to clause (x) of the first paragraph of this Section 10(b) and the

Internal Revenue Service determines thereafter that some portion of the Payment is subject to the Excise Tax, you shall promptly

return to the Company a sufficient amount of the Payment (after reduction pursuant to clause (x) of the first paragraph of this this

Section 10(b) so that no portion of the remaining Payment is subject to the Excise Tax. For the avoidance of doubt, if the Reduced

Amount was determined pursuant to clause (y) in the first paragraph of this this Section 10(b), you shall have no obligation to

return any portion of the Payment pursuant to the preceding sentence.

| 4503 Glencoe Avenue

Marina del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

11.

Other. As a condition of employment, you must read, sign and comply with the Company’s Proprietary Information and Invention

Assignment Agreement (“PIIA”), which (among other provisions) prohibits any unauthorized use or disclosure of

Company proprietary, confidential or trade secret information. As required by law, this offer is subject to satisfactory proof of your

identity and right to work in the United States. Further, if requested by the Company, this offer is contingent upon your successful completion

of a background check to the satisfaction of the Company. If the Company desires that you complete a background check, you will be required

to give your consent for the Company, through an outside firm, to complete a criminal background check and verification of information

provided on your employment application.

12.

Entire Agreement. Please let us know of your decision to join the Company by signing a copy of this Agreement and returning it

to us not later than October 15, 2020. This Agreement, together with your PIIA, sets forth our entire agreement and understanding regarding

the terms of your employment with the Company and supersedes any prior representations or agreements, whether written or oral. This Agreement

may not be modified in any way except in a writing signed by the Company’s Chief Executive Officer (or another duly authorized officer

of the Company) upon due authorization by the Board or its compensation committee and you. It shall be governed by California law, without

regard to principles of conflicts of laws.

Sincerely,

| /s/ Todd R. Patrick | |

| Todd R. Patrick | |

| Chief Executive Officer | |

| | |

| ACCEPTED AND AGREED: | |

| | |

| /s/ Mina Pastagia | |

| Mina Pastagia, MD | |

| | |

| Sep 22, 2020 | |

| Date | |

| 4503 Glencoe Avenue

Marina del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

EXHIBIT A

SEPARATION AGREEMENT AND RELEASE

I enter into this

Separation Agreement and Release (the “Release”) pursuant to Section 8 of the Offer Letter Agreement between

Armata Pharmaceuticals, Inc. (the “Employer”), and me dated September 22, 2020 (the “Agreement”).

I acknowledge that my timely execution and return and my non-revocation of this Release are conditions to the payments and benefits pursuant

to Section 8 of the Agreement. I therefore agree to the following terms:

1.

Release of Claims. I voluntarily release and forever

discharge the Employer, its affiliated and related entities, its and their respective predecessors, successors and assigns, its and

their respective employee benefit plans and fiduciaries of such plans, and the current and former officers, directors, stockholders,

members, employees, attorneys, accountants and agents of each of the foregoing in their official and personal capacities

(collectively referred to as the “Releasees”) generally from all claims, demands, debts, damages and

liabilities of every name and nature, known or unknown (“Claims”) that, as of the date when I sign this

Release, I have, ever had, now claim to have or ever claimed to have had against any or all of the Releasees. This release includes,

without limitation, all Claims:

| · | relating to my employment by the Employer and/or any affiliate of the Employer and

the termination of my employment; |

| · | of retaliation or discrimination under federal, state or local law (including, without limitation, Claims

of age discrimination or retaliation under the Age Discrimination in Employment Act, Claims of disability discrimination or retaliation

under the Americans with Disabilities Act, Claims of discrimination or retaliation under Title VII of the Civil Rights Act of 1964, Claims

of any form of discrimination or retaliation that is prohibited by the California Fair Employment and Housing Act; |

| · | under any other federal or state statute; |

| · | of defamation or other torts; |

| · | of violation of public policy; |

| · | for wages, bonuses, incentive compensation, stock, stock options, vacation pay or any other compensation

or benefits (except for such wages, bonuses, incentive compensation, stock, stock options, vacation pay or other compensation or benefits

otherwise due to me under the Agreement); and |

| · | for damages or other remedies of any sort, including, without limitation, compensatory

damages, punitive damages, injunctive relief and attorney’s fees; |

| 4503 Glencoe Avenue

Marina del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

I agree that the release set forth in

this section shall be and remain in effect in all respects as a complete general release as to the matters released. This release does

not extend to any obligations incurred under this Release, under any ongoing Company benefit plans or for indemnification under any indemnification

agreement, the Company’s Bylaws or applicable law. This release does not release claims that cannot be released as a matter of

law, including, but not limited to, my right to file a charge with or participate in a charge by the Equal Employment Opportunity Commission,

or any other local, state, or federal administrative body or government agency that is authorized to enforce or administer laws related

to employment, against the Company (with the understanding that any such filing or participation does not give me the right to recover

any monetary damages against the Company; my release of claims herein bars me from recovering such monetary relief from the Company).

I agree that I shall

not seek or accept damages of any nature, other equitable or legal remedies for my own benefit, attorney’s fees, or costs from any

of the Releasees with respect to any Claim released by this Release. I represent that I have not assigned to any third party and I have

not filed with any agency or court any Claim released by this Release.

2.

Ongoing Obligations. I reaffirm my ongoing obligations under the Agreement, including without limitation my obligations under Section

11 with respect to the Proprietary Information and Invention Assignment Agreement.

3.

No Assignment. I represent that I have not assigned to any other person or entity any Claims against any Releasee.

4. Right

to Consider and Revoke Release. I acknowledge that I have been given the opportunity to consider this Release for a period of

twenty-one (21) days from the date when it is tendered to me. In the event that I executed this Release within less than twenty-one

(21) days, I acknowledge that such decision was entirely voluntary and that I had the opportunity to consider this Release until the

end of the twenty-one (21) day period. To accept this Release, I shall deliver a signed Release to the Employer’s General

Counsel within such twenty-one (21) day period; provided that I acknowledge that the Employer may change the designated

recipient by notice. For a period of seven (7) days from the date when I execute this Release (the “Revocation

Period”), I shall retain the right to revoke this Release by written notice that is received by the Employer’s

General Counsel or other Employer-designated recipient on or before the last day of the Revocation Period. This Release shall take

effect only if it is executed within the twenty-one (21) day period as set forth above and if it is not revoked pursuant to the

preceding sentence. If those conditions are satisfied, this Release shall become effective and enforceable on the date immediately

following the last day of the Revocation Period (the

“Effective Date”).

5. California

Civil Code Section 1542. I acknowledge that I have been advised to consult with legal counsel and am familiar with the

provisions of California Civil Code Section 1542, a statute that otherwise prohibits the release of unknown claims, which provides

as follows:

| 4503 Glencoe Avenue

Marina del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

A GENERAL RELEASE DOES NOT EXTEND TO

CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN

BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

I, being aware of said code section, agree to expressly waive

any rights I may have thereunder, as well as under any other statute or common law principles of similar effect.

6. Other Terms.

(a) Legal Representation; Review of

Release. I acknowledge that I have been advised to discuss all aspects of this Release with my attorney, that I have carefully read

and fully understand all of the provisions of this Release and that I am voluntarily entering into this Release.

(b) Binding Nature of Release. This

Release shall be binding upon me and upon my heirs, administrators, representatives and executors.

(c) Amendment. This Release may be

amended only upon a written agreement executed by the Employer and me.

(d) Severability. In the event that

at any future time it is determined by an arbitrator or court of competent jurisdiction that any covenant, clause, provision or term of

this Release is illegal, invalid or unenforceable, the remaining provisions and terms of this Release shall not be affected thereby and

the illegal, invalid or unenforceable term or provision shall be severed from the remainder of this Release. In the event of such severance,

the remaining covenants shall be binding and enforceable.

(e) Governing Law and Interpretation.

This Release shall be deemed to be made and entered into in the State of California, and shall in all respects be interpreted, enforced

and governed under the laws of the State of California, without giving effect to the conflict of laws principles of such State. The language

of all parts of this Release shall in all cases be construed as a whole, according to its fair meaning, and not strictly for or against

either the Employer or me.

| 4503 Glencoe Avenue

Marina del Rey, CA 90292

Tel (310) 665-2928 · Fax (310) 665-2963

www.armatapharma.com |

(f) Entire Agreement; Absence of Reliance.

I acknowledge that I am not relying on any promises or representations by the Employer or any of its agents, representatives or attorneys

regarding any subject matter addressed in this Release.

So agreed.

| /s/

Mina Pastagia |

| Sep 22, 2020 |

| Mina Pastagia, MD |

| Date |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

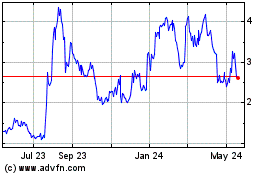

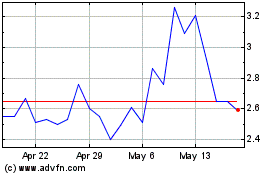

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Feb 2024 to Feb 2025