false

0001011509

0001011509

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

Current Report

Pursuant to

Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2024

GOLDEN MINERALS COMPANY

(Exact name of registrant as specified in its

charter)

| delaware |

1-13627 |

26-4413382 |

(State or other jurisdiction of

incorporation or

organization) |

(Commission

File Number) |

(I.R.S. Employer

Identification Number) |

350 Indiana Street, Suite 650

Golden,

Colorado 80401

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: (303) 839-5060

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

AUMN |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On August 14, 2024, Golden

Minerals Company issued a press release reporting financial results for the second quarter of 2024. A copy of the press release is attached

to this report as Exhibit 99.1.

The information in this Current

Report on Form 8-K, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: August 16, 2024

| |

Golden Minerals Company |

| |

|

| |

By: |

/s/ Joseph G. Dwyer |

| |

|

Name: |

Joseph G. Dwyer |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

Golden Minerals

Reports Second Quarter 2024 Financial Results

GOLDEN, CO - /BUSINESS

WIRE/ - August 14, 2024 – Golden Minerals Company (“Golden Minerals,” “Golden” or the “Company”)

(NYSE-A: AUMN and TSX: AUMN) has today released financial results for the quarter ending June 30, 2024. (All figures are in approximate

U.S. dollars.)

Second Quarter

Financial Summary

| · | Cash

and equivalents balance was $1.4 million as of June 30, 2024, compared to $3.8 million

as of December 31, 2023. |

| · | Current

liabilities were $4.8 million as of June 30, 2024, compared to $5.7 million as of December 31,

2023. |

| · | Zero

debt as of June 30, 2024, unchanged from December 31, 2023. |

| · | Net

loss was $2.7 million or $0.19 per share in the second quarter 2024, compared to a net loss

of $1.5 million or $0.21 per share in the second quarter 2023. |

Cash Inflows

and Expenditures

Cash expenditures

during the six months ended June 30, 2024 totaled $8.3 million and included:

| · | $5.1

million from the loss on discontinued Velardeña operations, which includes, $4.1 million

of loss from operations and $1.0 million of severance payments to employees who were terminated

during the six months ended June 30, 2024; |

| · | $2.1

million in general and administrative expenses; |

| · | $0.8

million in exploration expenditures; and |

| · | $0.3

million in care and maintenance costs at the El Quevar project, net of zero reimbursements

from Barrick Gold Corporation (“Barrick”) pursuant to the Earn-in Agreement between

the Company and Barrick. |

The above

expenditures were partially offset by cash inflows of $5.9 million from the following:

| · | $2.6

million from the collection of VAT receivables from the Mexican Government; |

| · | $2.5

million of proceeds received from the sale of the Velardeña Property assets; and |

| · | $0.8

million of other working capital changes. |

Liquidity and

Capital Resources

The Company does

not currently have sufficient resources to meet its expected cash needs during the twelve months ended June 30, 2025. At June 30,

2024, the Company had current assets of approximately $2.5 million, including cash and cash equivalents of approximately $1.4 million.

On the same date, it had accounts payable and other current liabilities of approximately $4.8 million. Because the Company has ceased

mining at the Velardeña mine, its only near-term opportunity to generate cash flow is from the sale of assets and equity or other

external financings. The Company is currently seeking buyers for its El Quevar and Yoquivo projects. As of August 9, 2024, the Company

has cash and cash equivalents of approximately $0.7 million. In the absence of additional cash inflows, the Company anticipates that

its cash resources will be exhausted in September 2024. The Company is considering bankruptcy filings for several of its Mexican

subsidiaries. If it is unable to obtain additional cash resources, the Company will be forced to cease operations and liquidate.

Page 1

of 3

GOLDEN MINERALS

COMPANY

350 Indiana Street

– Suite 650 – Golden, Colorado 80401 – Telephone (303) 839-5060

Golden Minerals

will need to secure additional sources of capital. In order to satisfy the Company’s projected general, administrative, exploration

and other expenses through June 30, 2025, it will need approximately $6.0 to $8.0 million in capital inflows. These capital inflows

may take the form of asset sales, equity or other external financing activities, collection of the outstanding amount due on the Velardeña

sale, or from other sources.

Golden has previously

announced the execution of certain asset purchase and sale agreements with a privately held Mexican company with regards to its Velardeña

Properties. Pursuant to the terms of the sale agreements, Golden agreed to sell certain mining concessions, equipment, land parcels and

other assets in exchange for an aggregate purchase price of $5.5 million in cash, plus VAT. There are four separate sales agreements.

The first three sales agreements, which include the combined sales of the Velardeña and Chicago mines, the sulfide processing

plant and various related equipment, were completed on June 20, 2024 and the titles to the assets were transferred to the buyer.

The fourth agreement covers the oxide plant and water wells, and the buyer agreed to complete total payments of $3.0 million plus VAT

on July 1, 2024. The buyer has made payments of approximately $477,000 through August 7, 2024 and is currently in default.

The buyer has operational control of the plant, and Golden Minerals is no longer operating the oxide plant. The Company does not know

whether or when the buyer will make the remaining payments due on the oxide plant.

Quarterly Report

on Form 10-Q

The

Company’s consolidated financial statements and management’s discussion and analysis, as well as other important disclosures,

may be found in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. This Form 10-Q

is available on the Company’s website at Golden Minerals Company - SEC Filings. It

has also been filed with the U.S. Securities and Exchange Commission on EDGAR at www.sec.gov/edgar and with the Canadian securities

regulatory authorities on SEDAR at www.sedar.com.

Forward-Looking

Statements

This press release

contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, such as statements regarding (i) whether

the Buyer will make the remaining payments due on the oxide plant; (ii) the Company’s anticipated near-term capital needs,

and potential sources of capital; (iii) the anticipated timing of exhaustion of the Company’s cash resources in the absence

of additional cash inflows; (iv) the Company considering filing bankruptcy for several of its Mexican subsidiaries; (v) the

Company being forced to cease operations and liquidate if it is unable to obtain additional cash resources; and (vi) the Company’s

capital inflow needs to satisfy the Company’s projected general, administrative, exploration and other expenses through June 30,

2025. These statements are subject to risks and uncertainties, including the failure by the buyer of the Company’s assets in Mexico

to make the required payments due on the oxide plant; the inability of the Company to obtain sufficient capital to meet its obligations;

increases in costs and declines in general economic conditions; changes in political conditions, in tax, royalty, environmental and other

laws in the United States, Mexico or Argentina and other market conditions; and fluctuations in silver and gold prices. Golden Minerals

assumes no obligation to update this information. Additional risks relating to Golden Minerals may be found in the periodic and current

reports filed with the Securities & Exchange Commission by Golden Minerals, including the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023.

Follow us at www.linkedin.com/company/golden-minerals-company/ and https://twitter.com/Golden_Minerals.

Page 2

of 3

GOLDEN MINERALS

COMPANY

350 Indiana Street

– Suite 650 – Golden, Colorado 80401 – Telephone (303) 839-5060

For

additional information, please visit http://www.goldenminerals.com/ or contact:

Golden Minerals

Company

(303) 839-5060

SOURCE: Golden

Minerals Company

Page 3

of 3

GOLDEN MINERALS

COMPANY

350 Indiana Street

– Suite 650 – Golden, Colorado 80401 – Telephone (303) 839-5060

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

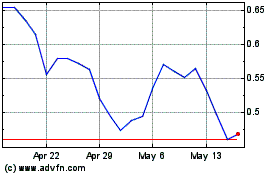

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Oct 2024 to Nov 2024

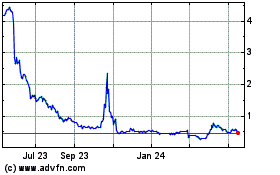

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Nov 2023 to Nov 2024