India ETFs appear to be back on track after a year of sluggish

growth when its performance fell behind other emerging market

counterparts. Several government reforms and strong corporate

earnings boosted the price of Indian equities which eventually

resulted in the ETFs tracking the region to post strong gains

(India ETFs: Getting Back On Track?).

The Indian economy is largely dependent on foreign capital

inflow for growth and the government’s recent decision to allow

foreign direct investment in Indian retail led to a strengthening

of the economy.

Beyond this, the RBI, or the Reserve Bank of India, also played

its part in infusing more liquidity in the economy through interest

rate cuts. The bank has recently embarked on another rate cutting

campaign, slashing the rate for the first time in a while (A Trio

of Top Emerging Market ETFs for 2013).

The RBI slashed the policy repo rate by 25 basis points (bps) to

7.75% and also reduced the cash reserve ratio (CRR), the portion of

deposits banks need to maintain with the central bank, by 25 bps to

4.00%. This will result in an infusion of further 180 billion

rupees into the banking system.

The attempt by the bank is viewed as a measure to reinvigorate

growth in an economy that is seeing the slowest growth rate in a

decade. However, the bank also emphasized on the fact that further

reduction in interest rates is unlikely attributable to high levels

of fiscal and external deficits and inflation.

The central bank had last made a reduction of 50 bps in Apr

2012. Since then the central bank refused to make any cut in

interest rates despite the government’s continuous appeal in the

light of the high level of inflation.

This marks the second attempt by RBI to cut the CRR since the

third quarter of fiscal year 2012. Bad loans in Indian banks have

risen to a high level. In fact, the economy has recorded the

highest level of ratio of bad debt at banks in the last five years

(Does Your Portfolio Need An India ETF?).

Meanwhile the inflation rate was brought to a three-year low of

7.18% in December and the central bank expects inflation to remain

range bound around this level while heading into the 2013/2014

fiscal year starting April.

However, a fall in the expectation of GDP growth rate

disappointed the market as the RBI reduced its GDP growth forecast

for Asia's third-largest economy to 5.5% for the current fiscal

year, from 5.8% previously.

Indian banks make a healthy portion of ETFs tracking the economy

and the infusion of more liquidity in Indian banks should

positively impact the performance of these ETFs (Can India ETFs

Continue Their Solid Run?).

In fact with the RBI’s announcement on rate cut, Indian

ETFs jumped higher on Tuesday’s trading session. Below we are

highlighting three ETFs tracking the Indian economy in which

financials play a substantial role and which could see a continued

boost should the current trends continue:

iShares S&P India Nifty 50 ETF

(INDY)

Launched in November 2009, INDY is a Zacks top ranked ETF

tracking Indian securities (Zacks Top Ranked India ETF in Focus:

INDY). The product has amassed a net asset base of $419.6 million

and trades at a volume level of more than 300,000 shares a day.

Banks are the first preference of the fund among sector

allocation and make up a substantial portion of the basket with a

share of 12.15%. Other than banks, only computers software gets a

double-digit allocation in the fund with a share of 12.75%. Among

others, the fund does not invest more than 8.54%.

The fund’s asset base is spread across 51 Indian securities and

does little to reduce company specific risk as more than 55% of the

asset base go towards the top ten.

ITC Limited (8.54%), Reliance Industries Limited (7.72%)

and ICICI Bank Limited (7.19%) are the three top elements in the

basket, with a combined share of 23.45%. The ETF is extremely

pricey with an expense ratio of 92 basis points a year.

WisdomTree India Earnings Fund (EPI)

EPI is another Zacks top ranked ETF and manages an asset base of

$1,298.9 million. It is also the most liquid ETF among the three

trading at volume levels of more than 2.6 million shares a day

(Zacks Top Ranked India ETF: EPI).

The fund offers a broader play in Indian equities as it holds a

portfolio of 146 securities. The fund appears to be moderately

diversified in the top 10 stocks where it has invested 42.18% of

its assets.

From a sector perspective, the ETF relies heavily on its top

sectors. Financials, energy, information technology, materials and

industrials are the sectors with double-digit exposure. Healthcare,

consumer staples and telecommunication services are sectors with

least allocation, leaving a skew towards traditional sectors.

Among individual holdings, Reliance Industries, Oil and Natural

Gas Corporation and Infosys form the top line of the fund and

together account for almost 21.8% of the allocation. The fund

charges an expense ratio of 83 basis points on an annual basis.

PowerShares India Portfolio (PIN)

PowerShares’ PIN tracks the Indus India Index, providing

exposure to 50 Indian securities. The fund has built an asset base

of $402.6 million since its inception and trades at a volume level

of more than half a million shares a day.

These 50 securities are mainly from energy, financials and

information technology sectors in which the fund assigns more than

60% of the asset base in total. Among individual holdings, Infosys

(10.96%), Reliance Industries (10.13%) and Oil & Natural Gas

Corp (8.57%) occupy the top line of the fund.

The fund appears to be a bit reasonable than INDY, charging a

fee of 78 basis points from investors. It has returned 13.5% to

investors on an annual basis.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

ISHARS-SP INDIA (INDY): ETF Research Reports

PWRSH-INDIA POR (PIN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

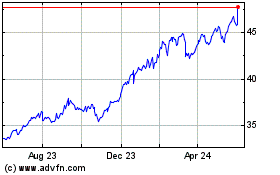

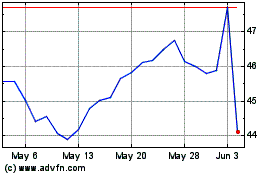

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Feb 2025 to Mar 2025

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Mar 2024 to Mar 2025