Do You Need A Floating Rate Bond ETF? - Top Yielding ETFs

19 December 2011 - 10:01PM

Zacks

With the rapid expansion of the ETF industry, products have

cropped up in a variety of sectors that can give investors exposure

to new asset classes. One such space that has seen a great deal of

interest from some is in the bond space with floating rate

securities. These funds track bonds that do not pay out a set rate

to investors but instead have variable rates that are often tied to

an underlying index such as LIBOR. As a result, bonds that employ

this approach can have different yield rates than their fixed rate

cousins, potentially giving them a unique risk/reward than their

more ubiquitous counterparts (see Top Three High Yield Bond

ETFs).

This could be important given the state of interest rates and

the direction that they will have to go in years ahead. With the

benchmark rate at 0.25% in the U.S., many feel that a normalization

of interest rates will have to take place in the near future,

potentially crushing the long-term bull market in bonds in the

process. However, for investors who have floating rate securities,

the blow is likely to be much less severe. This is because floating

rate securities have a far lower interest rate sensitivity than

their fixed rate brethren, making them ideal choices in rising

interest environments.

Downsides of floating rate bond ETFs

While there may be several positives for this corner of the

market, investors should realize that ‘floaters’ aren’t the be all

end all in the bond space. First, it is important to remember that

we are still in a low interest rate environment and that higher

rates may not be coming down the pike for several years. This could

keep bonds that pay out a variable rate depressed in yield terms

when compared to their fixed rate counterparts for the foreseeable

future, taking away one of the key selling points for the product

class. Furthermore, because floaters have less of a demand from the

general investing public, there are less of these bonds in the

market place suggesting that any fund tracking a basket of these

securities will only have but a handful of different companies. If

that wasn’t bad enough, most securities that issue this type of

bonds are financials, meaning that the product will likely see

heavy concentrations in that particular sector over the long haul

(Can You Fight Inflation With This Real Return ETF?).

Yet despite these short-term negatives, a case for floating rate

bonds over the long term can still be made. Most investors are

intensely concentrated in U.S. government debt and with yields at

historic lows, a reversal seems poised to strike the market at some

point in the future. So while in the near-term floating rate bonds

may underperform similar fixed securities, they could make for a

nice compliment to fixed rate-heavy portfolios for investors with

more than a few years until retirement. For these investors, any of

the following three ETFs could make for excellent choices:

iShares Floating Rate Note Fund (FLOT)

This relatively new fund tracks the Barclays Capital US Floating

Rate Note Less Than Five Years Index which gives investors exposure

to a basket of bond securities that have floating rates. The total

portfolio consists of 133 securities but close to 53% of the assets

go towards financials. The fund does have a pretty low expense

ratio, charging investors 20 basis points a year, a figure that is

more than made up for by the fund’s 1.7% 30 Day SEC Yield. In terms

of performance, the product has lost about 2.3% since inception

although it has stabilized in recent weeks (read Go Local With

Emerging Market Bond ETFs).

Market Vectors Investment Grade Floating Rate Bond Fund

(FLTR)

The oldest product in the floating rate ETF space is this fund

from Van Eck. The fund seeks to replicate the Market Vectors

Investment Grade Floating Rate Index which is a benchmark that

consists of U.S. dollar-denominated floating rate notes issued by

corporate issuers and rated investment grade by at least one of the

three major rating agencies. In terms of holdings, the fund has

just 23 securities in its basket putting close to one-fourth of the

total in bonds from Credit Suisse and Citigroup. While the product

does beat out FLOT in terms of expenses by a basis point, its yield

is far worse coming in at 1.1% when measured by the 30 Day SEC

yield metric. The product has also underperformed on the capital

appreciation front as well as this floating rate ETF has lost about

7% in the past six months (see Australia Bond ETF

Showdown).

Barclays Capital Investment Grade Floating Rate SPDR

(FLRN)

The newest fund on the list, FLRN debuted at the end of November

giving investors a very short window into its performance history.

Yet, with that being said, FLRN does track a similar index to FLOT

suggesting that the performance could be near what that security

has produced. Investors should note, however, that there are a few

key differences between the two. First, FLRN only holds about 50

securities in its basket while charging an expense ratio of just

0.15% a year, putting it lower than FLOT for both. Fortunately,

FLRN does beat out FLOT in terms of yield, as the fund pays out

close to 2% a year, thanks to its heavier focus on securities that

are a few years away from maturity and (as opposed to the other

products which have a slightly greater tilt towards short-terms

bonds).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

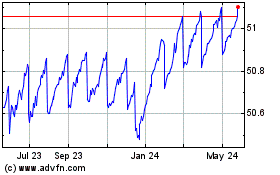

iShares Floating Rate Bo... (AMEX:FLOT)

Historical Stock Chart

From Jan 2025 to Feb 2025

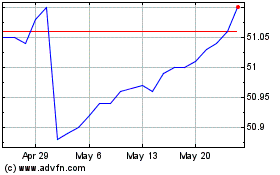

iShares Floating Rate Bo... (AMEX:FLOT)

Historical Stock Chart

From Feb 2024 to Feb 2025