Ring Energy, Inc. (NYSE American: REI) (“Ring” or the

“Company”) today announced it has entered into an agreement to

acquire the Central Basin Platform (“CBP”) assets of Lime Rock

Resources IV, LP (“Lime Rock”) for $100 million, subject to

customary closing adjustments. The purchase price is comprised of

$80 million of upfront cash consideration, a $10 million deferred

cash payment due nine months after closing, and up to 7.4 million

shares of Ring common stock. The transaction has an effective date

of October 1, 2024, and is expected to close by the end of the

first quarter of 2025.

Lime Rock’s CBP acreage is in Andrews County,

Texas, where the majority of the acreage directly offsets Ring’s

core Shafter Lake operations, and the remaining acreage is

prospective for multiple horizontal targets and exposes the Company

to new active plays. The transaction represents another opportunity

for the Company to seamlessly integrate strategic, high-quality

assets with Ring’s existing operations and create shareholder value

through improved operations and synergy capture. The Lime Rock

position has been a key target for Ring as the Company has

historically sought to consolidate producing assets in core

counties on the CBP defined by shallow declines, high margin

production and undeveloped inventory that immediately competes for

capital. Additionally, these assets add significant near-term

opportunities for field level optimization and cost savings that

are core competencies of Ring’s operating team.

Transaction Highlights

- Highly

Accretive CBP Acquisition: Accretive to key Ring per share

financial and operating metrics, and attractively valued at less

than 85% of Proved Developed (“PD”) PV-101,2;

-

Increased Scale and Operational Synergies: Expands

legacy CBP footprint with seamless integration and identified cost

reduction opportunities;

-

Meaningful Adjusted Free Cash Flow (“AFCF”)1

Generation: Higher AFCF, shallow decline and

reduced reinvestment rate accelerates debt reduction;

-

Strengthens High-Return Inventory Portfolio:

Improves inventory of proven drilling locations with superior

economics in active development areas; and

- Creates

a Stronger and More Resilient Company: Solidifies position

as a leading conventional Permian consolidator while strengthening

the operational and financial base.

Mr. Paul D. McKinney, Chairman of the Board and

Chief Executive Officer, commented, “This is a unique opportunity

to capture high-quality, oil-weighted assets that generate

significant free cash flow in a privately negotiated transaction.

Today’s announcement is another example of our proven strategy to

create value for our shareholders through accretive M&A. This

acquisition not only increases our scale, but it also enhances our

portfolio of high-return drilling locations and accelerates the

Company’s ability to pay down debt. We look forward to quickly

integrating the assets into our existing operations and applying

our extensive expertise to optimally develop the inventory of

horizontal targets afforded by the transaction.”

Mr. McKinney continued, “For the Lime Rock

transaction, we expect to run the same playbook as our highly

successful Founders’ acquisition announced in 2023, which has

outperformed nearly all our initial underwriting assumptions. Since

closing, Ring has increased the Founders’ production base by

greater than 40%, lowered the Founders’ per Boe lifting costs by

approximately 20%, and reduced our Company’s debt balance through

free cash flow generation to more than cover the cash purchase

price. We plan to achieve similar success on the Lime Rock assets.

Our team has a proven M&A track record as Lime Rock will mark

Ring’s fourth acquisition since 2019, totaling approximately $940

million of assets. We believe the benefits of consolidation are

compelling when structured appropriately, and we strongly view this

as a value-enhancing transaction for Ring shareholders that will

better position the Company for future opportunities and long-term

success.”

Asset Highlights

- ~17,700

net acres (100% HBP) contiguous to Ring’s existing

footprint;

- 2,300

boe/d (>80% Oil) of low-decline average Q3 2024 net

production from ~101 gross wells;

- $120

million of oil-weighted PD PV-101,2 based on February 19,

2025 NYMEX strip pricing;

- >40

gross locations that immediately compete for capital;

and

- $34

million of 2025E Adjusted EBITDA1 implies an attractive

valuation for shareholders.

Transaction Consideration

The purchase price of the acquisition is $100

million, subject to customary closing adjustments. Consideration

consists of cash and up to 7.4 million shares of Ring common stock

based on Ring’s 10-day volume weighted average stock price of

$1.3534 per common share as of February 24, 2025. The upfront cash

consideration is expected to be funded with cash on hand and

borrowings under Ring’s existing credit facility.

Advisors

Greenhill, a Mizuho affiliate, acted as sole

financial advisor to Ring in connection with the acquisition and

Jones & Keller, P.C. served as legal counsel. Truist Securities

served as financial advisor to Lime Rock Resources and Kirkland

& Ellis LLP served as legal counsel.

Q4 and FY 2024 Earnings Conference Call

Information

Ring plans to issue its fourth quarter and full

year 2024 earnings release after the close of trading on Wednesday,

March 5, 2025. The Company has scheduled a conference call on

Thursday, March 6, 2025, at 11:00 a.m. ET (10:00 a.m. CT) to

discuss its fourth quarter and full year 2024 operational and

financial results, the Lime Rock transaction, and its outlook for

2025. To participate, interested parties should dial 833-953-2433

at least five minutes before the call is to begin. Please reference

the “Ring Energy Earnings Conference Call”. International callers

may participate by dialing 412-317-5762. The call will also be

webcast and available on Ring’s website at www.ringenergy.com under

“Investors” on the “News & Events” page. An audio replay will

also be available on the Company’s website following the call.

About Ring Energy, Inc.

Ring Energy, Inc. is an oil and gas exploration,

development, and production company with current operations focused

on the development of its Permian Basin assets. For additional

information, please visit www.ringenergy.com.

Non-GAAP Information

Certain financial information utilized by the

Company are not measures of financial performance recognized by

accounting principles generally accepted in the United States

(“GAAP”).

The Company defines “Adjusted EBITDA” as net

income (loss) plus net interest expense (including interest income

and expense), unrealized loss (gain) on change in fair value of

derivatives, ceiling test impairment, income tax (benefit) expense,

depreciation, depletion and amortization, asset retirement

obligation accretion, transaction costs for executed acquisitions

and divestitures (A&D), share-based compensation, loss (gain)

on disposal of assets, and backing out the effect of other income.

Company management believes Adjusted EBITDA is relevant and useful

because it helps investors understand Ring’s operating performance

and makes it easier to compare its results with those of other

companies that have different financing, capital and tax

structures. Adjusted EBITDA should not be considered in isolation

from or as a substitute for net income, as an indication of

operating performance or cash flows from operating activities or as

a measure of liquidity. Adjusted EBITDA, as Ring calculates it, may

not be comparable to Adjusted EBITDA measures reported by other

companies. In addition, Adjusted EBITDA does not represent funds

available for discretionary use. The Company cannot provide a

reconciliation of 2025E Adjusted EBITDA without unreasonable

efforts because it is unable to predict with reasonable certainty

the ultimate outcome of certain significant items required for

reconciliation. These items are uncertain, depend on various

factors and could have a material impact on GAAP reported

results.

The Company defines “Adjusted Free Cash Flow” or

“AFCF” as Net Cash Provided by Operating Activities less changes in

operating assets and liabilities (as reflected on our Condensed

Statement of Cash Flows), plus transaction costs for executed

acquisitions and divestitures (A&D), current income tax expense

(benefit), proceeds from divestitures of equipment for oil and

natural gas properties, loss (gain) on disposal of assets, and less

capital expenditures, bad debt expense, and other income. For this

purpose, our definition of capital expenditures includes costs

incurred related to oil and natural gas properties (such as

drilling and infrastructure costs and lease maintenance costs) but

excludes acquisition costs of oil and gas properties from third

parties that are not included in our capital expenditures guidance

provided to investors. Our management believes that Adjusted Free

Cash Flow is an important financial performance measure for use in

evaluating the performance and efficiency of our current operating

activities after the impact of capital expenditures and net

interest expense (including interest income and expense, excluding

amortization of deferred financing costs) and without being

impacted by items such as changes associated with working capital,

which can vary substantially from one period to another. Other

companies may use different definitions of Adjusted Free Cash

Flow.

PV-10 is a non-GAAP financial measure that

differs from a financial measure under GAAP known as “standardized

measure of discounted future net cash flows” in that PV-10 is

calculated without including future income taxes. The Company

believes the presentation of PV-10 provides useful information

because it is widely used by investors in evaluating oil and

natural gas companies without regard to specific income tax

characteristics of such entities. PV-10 is not intended to

represent the current market value of the Company’s estimated

proved reserves. PV-10 should not be considered in isolation or as

a substitute for the standardized measure as defined under GAAP.

The Company also presents PV-10 at strip pricing, which is PV-10

adjusted for price sensitivities. Since GAAP does not prescribe a

comparable GAAP measure for PV-10 of reserves adjusted for pricing

sensitivities, it is not practicable for the Company to reconcile

PV-10 at strip pricing to a standardized measure or any other GAAP

measure.

Safe Harbor Statement

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements involve a wide variety of risks

and uncertainties, and include, without limitation, statements with

respect to the Company’s strategy and prospects. The

forward-looking statements include statements about the expected

benefits to the Company and its shareholders from the proposed

acquisition of oil and gas properties (the “Lime Rock Acquisition”)

from Lime Rock; the anticipated completion of the Lime Rock

Acquisition or the timing thereof; the Company’s future reserves,

production, financial position, business strategy, revenues,

earnings, costs, capital expenditures and debt levels of the

Company, and plans and objectives of management for future

operations. Forward-looking statements are based on current

expectations and subject to numerous assumptions and analyses made

by Ring and its management considering their experience and

perception of historical trends, current conditions and expected

future developments, as well as other factors appropriate under the

circumstances. However, whether actual results and developments

will conform to expectations is subject to a number of material

risks and uncertainties, including but not limited to: the

Company’s ability to successfully integrate the oil and gas

properties to be acquired in the Lime Rock Acquisition and achieve

the anticipated benefits from them; risks relating to unforeseen

liabilities of Ring or the assets acquired in the Lime Rock

Acquisition; declines in oil, natural gas liquids or natural gas

prices; the level of success in exploration, development and

production activities; adverse weather conditions that may

negatively impact development or production activities particularly

in the winter; the timing of exploration and development

expenditures; inaccuracies of reserve estimates or assumptions

underlying them; revisions to reserve estimates as a result of

changes in commodity prices; impacts to financial statements as a

result of impairment write-downs; risks related to the level of

indebtedness and periodic redeterminations of the borrowing base

and interest rates under the Company’s credit facility; Ring’s

ability to generate sufficient cash flows from operations to meet

the internally funded portion of its capital expenditures budget;

the impacts of hedging on results of operations; the effects of

future regulatory or legislative actions; cost and availability of

transportation and storage capacity as a result of oversupply,

government regulation or other factors; and Ring’s ability to

replace oil and natural gas reserves. Such statements are subject

to certain risks and uncertainties which are disclosed in the

Company’s reports filed with the Securities and Exchange Commission

(“SEC”), including its Form 10-K for the fiscal year ended December

31, 2023, and its other SEC filings. Ring undertakes no obligation

to revise or update publicly any forward-looking statements, except

as required by law.

Contact Information

Al Petrie Advisors

Al Petrie, Senior Partner

Phone: 281-975-2146

Email: apetrie@ringenergy.com

1 Represents a non-GAAP financial measure that should not be

considered a substitute for any GAAP measure. See section in this

release titled “Non-GAAP Information” for a more detailed

discussion.2 Proved reserves determined by internal management

estimates based on NYMEX strip pricing as of February 19, 2025.

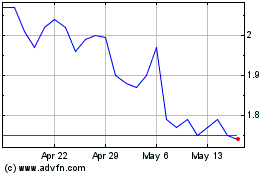

Ring Energy (AMEX:REI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ring Energy (AMEX:REI)

Historical Stock Chart

From Mar 2024 to Mar 2025