UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number 001-38628

SilverCrest Metals Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

570 Granville Street, Suite 501

Vancouver, British Columbia V6C 3P1

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form

40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

SILVERCREST METALS INC. |

|

| |

|

|

|

| Date: January 13, 2025 |

By: |

/s/ Sean Deissner |

|

| |

Name: |

Sean Deissner |

|

| |

Title: |

VP, Financial Reporting |

|

INDEX TO EXHIBITS

EXHIBIT 99.1

NOTICE OF SPECIAL MEETING OF SECURITYHOLDERS

To be held on February 6,

2025

NOTICE IS HEREBY GIVEN that a special meeting (the “Meeting”)

of the holders (the “Shareholders”) of common shares (the “SilverCrest Shares”) of SilverCrest Metals

Inc. (“SilverCrest” or the “Company”) and the holders of stock options of the Company (the “Optionholders”,

and collectively with the Shareholders, the “Securityholders”) will be held at the offices of Cassels Brock & Blackwell

LLP at Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia and via live webcast, at 10:00 a.m. (Vancouver time)

on February 6, 2025 for the following purposes:

| 1. | to consider, in accordance with the interim order of the Supreme Court

of British Columbia dated January 8, 2025 (the “Interim Order”), and,

if deemed acceptable, to pass, with or without variation, a special resolution (the “Arrangement Resolution”) approving

a statutory plan of arrangement (the “Plan of Arrangement”) under Division 5 of Part 9 of the Business Corporations

Act (British Columbia) (“BCBCA”) pursuant to which Coeur Mining, Inc. (“Coeur”) will indirectly,

among other things, acquire all of the issued and outstanding SilverCrest Shares, the full text of which is set forth in Appendix A to

the accompanying management information circular (“Circular”); and |

| 2. | to transact such other business as may properly come before the Meeting

or any adjournments or postponements thereof. |

The board of directors of the Company unanimously recommends that

the Securityholders vote FOR the Arrangement Resolution.

In addition to in-person attendance, the Meeting can also be accessed

via live webcast at meetnow.global/MHZWLAD. Any Securityholder attending the Meeting via the live webcast will not be able to vote during

the Meeting. Only Securityholders or their duly appointed proxyholders who are present in person at the Meeting are able to vote during

the Meeting. Accordingly, in order that as many SilverCrest Shares and stock options as possible are represented at the Meeting, Securityholders

are encouraged to vote their SilverCrest Shares and/or stock options via proxy prior to the proxy cut-off time as further described below.

Pursuant to the Interim Order, the record date is December 19, 2024

(the “Record Date”) for determining Securityholders who are entitled to receive notice of and to vote at the Meeting.

Only registered Shareholders (“Registered Shareholders”) and Optionholders as of the Record Date are entitled to receive

notice of the Meeting (“Notice of Meeting”) and to vote at the Meeting. This Notice of Meeting is accompanied by the

Circular, an applicable form of proxy and a letter of transmittal for Registered Shareholders (the “Letter of Transmittal”).

Each SilverCrest

Share and SilverCrest Option entitled to be voted at the Meeting will entitle the holder thereof to one vote at the Meeting for each SilverCrest

Share and SilverCrest Option, respectively. In order to become effective, the Arrangement Resolution must be approved by at least (i) 66⅔%

of the votes cast by Shareholders present in person or represented by proxy and entitled to vote at the Meeting; (ii) 66⅔%

of the votes cast by Securityholders, voting together as a single class, present in person or represented by proxy and entitled to vote

at the Meeting, with Shareholders and Optionholders being entitled to one vote for each SilverCrest Share and SilverCrest Option, respectively;

and (iii) a simple majority of the votes cast by Shareholders present in person or represented by proxy and entitled to vote at the

Meeting, excluding certain SilverCrest Shares required to be excluded in accordance with Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions.

Registered Shareholders and Optionholders are requested

to read the enclosed Circular and are requested to date and sign the enclosed proxy form promptly, as applicable, and return it in the

self-addressed envelope enclosed for that purpose or by any of the other methods indicated in the proxy form. Registered Shareholders

and Optionholders may also vote online instead of by mail. Pursuant to the Interim Order, proxies, to be used at the Meeting, must be

received by Computershare Investor Services Inc. by no later than 10:00 a.m. (Vancouver time) on February 4, 2025 (or,

if the Meeting is adjourned or postponed, by the time that is 48 hours prior to the Meeting, excluding Saturdays, Sundays and holidays).

To vote online at www.investorvote.com, you will need to enter your 15-digit control number (located on the bottom left corner

of the first page of the form of proxy) to identify yourself as a Registered Shareholder or Optionholder on the voting website.

Alternatively, a proxy can be submitted to

Computershare Investor Services Inc. either by mail or courier, to 100 University Avenue, 8th Floor Toronto, Ontario M5J 2Y1.

If a Registered Shareholder or Optionholder receives more than one proxy form because such Registered Shareholder or Optionholder owns

securities of the Company registered in different names or addresses, each proxy form needs to be completed and returned or voted online.

If your SilverCrest Shares are not registered in your name but are

held through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary, please complete and return the

request for voting instructions in accordance with the instructions provided to you by your broker or such other intermediary. Failure

to do so may result in such securities not being voted at the Meeting.

If you wish that a person other than

the management nominees identified on the form of proxy or voting instruction form (“VIF”) attend and vote at the Meeting

as your proxy and vote your securities, including if you are not a Registered Shareholder and wish to appoint yourself as proxyholder

to attend, attend and vote at the Meeting, you MUST submit your form of proxy (or proxies) or VIF, as applicable, in accordance with the

instructions set out in the Circular. If submitting a proxy or VIF, appointing a person other than the management nominees identified,

you must return your proxy or VIF in accordance with the instructions set out in the Circular by 10:00 a.m. (Vancouver

time) on February 4, 2025 (or, if the Meeting is adjourned

or postponed, by the time that is 48 hours prior to the Meeting, excluding Saturdays, Sundays and holidays).

If you are a Registered Shareholder who is not a Dissenting Shareholder

(as defined in the Circular), please complete the Letter of Transmittal in accordance with the instructions included therein, sign, date

and return it to the depositary, Computershare Investor Services Inc. (the “Depositary”), in the envelope provided,

together with the certificates or the direct registration system advices (“DRS Advices”) representing your SilverCrest

Shares and any other required documents. If you are sending certificates, it is recommended that you send them by registered mail. The

Letter of Transmittal contains complete instructions on how to exchange your SilverCrest Shares for the Consideration under the Arrangement.

You will not receive your Consideration until after the Arrangement is completed and you have returned your properly completed documents,

including each applicable Letter of Transmittal, and the certificate(s) or DRS Advice(s) representing your SilverCrest Shares to the Depositary.

Beneficial Shareholders do not need to complete a Letter of Transmittal

and will receive the consideration to which they are entitled under the Arrangement through the intermediary.

Pursuant to the Interim Order, Registered Shareholders as at the close

of business on the Record Date have the right to dissent with respect to the Arrangement Resolution and, if the Arrangement becomes effective,

to be paid the fair value of their SilverCrest Shares in accordance with the provisions of Sections 237 to 247 of the BCBCA, as modified

by the Interim Order and the Plan of Arrangement. A Registered Shareholder as at the close of business on the Record Date wishing to exercise

rights of dissent with respect to the Arrangement must send to the Company a written objection to the Arrangement Resolution, which written

objection must be sent to the Company c/o Cassels Brock & Blackwell LLP, Suite 2200, RBC Place, 885 West Georgia Street, Vancouver,

BC V6C 3E8, Attention: Rajit Mittal, by no later than 4:00 p.m. (Vancouver time) on February 4,

2025 (or by 4:00 p.m. (Vancouver time) on the second business day immediately preceding the date that any adjourned or postponed Meeting

is reconvened), and must otherwise strictly comply with the dissent procedures set forth in Sections 237 to 247 of the BCBCA, as modified

by the Interim Order and the Plan of Arrangement, and described in the Circular. The Registered Shareholders’ right to dissent is

more particularly described in the Circular. Copies of the Plan of Arrangement, the Interim Order and the text of Sections 237 to 247

of the BCBCA are set forth in Appendix B, Appendix C and Appendix K, respectively, of the Circular. Anyone who is a beneficial owner of

SilverCrest Shares and who wishes to exercise a right of dissent should be aware that only Registered Shareholders as at the close of

business on the Record Date are entitled to exercise a right of dissent. Accordingly, a beneficial (non-registered) Shareholder who desires

to exercise a right of dissent must make arrangements for the SilverCrest Shares beneficially owned by such holder to be registered in

the name of such holder prior to the Record Date or, alternatively, make arrangements for the Registered Shareholder of such SilverCrest

Shares to exercise the right of dissent on behalf of such beneficial Shareholder. Optionholders are not entitled to exercise dissent rights.

A Registered Shareholder as at the close of business on the Record Date wishing to exercise a right of dissent may only exercise such

rights with respect to all SilverCrest Shares registered in the name of such Shareholder. It is recommended that you seek independent

legal advice if you wish to exercise a right of dissent. Failure to strictly comply with the requirements set forth in Sections 237

to 247 of the BCBCA, as modified by the Interim Order and the Plan of Arrangement, may result in the loss of any right of dissent.

The Circular provides additional information relating to the matters

to be dealt with at the Meeting and is deemed to form part of this Notice of Meeting. Any adjourned or postponed meeting resulting from

an adjournment or postponement of the Meeting will be held at a time and place to be specified either by the Company before the Meeting

or by the Chair at the Meeting.

Dated at Vancouver, British Columbia as of

January 8, 2025.

BY ORDER OF THE BOARD

/s/ “N. Eric Fier”

N. Eric Fier

Chief Executive Officer and Director

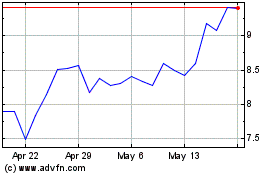

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Dec 2024 to Jan 2025

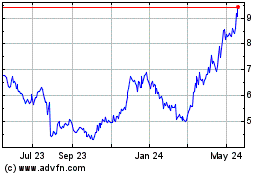

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Jan 2024 to Jan 2025