UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2025

Commission File No. 001-34184

SILVERCORP

METALS INC.

(Translation of registrant’s name into English)

Suite 1750 - 1066 West Hastings

Street

Vancouver, BC Canada V6E 3X1

(Address of principal executive office)

[Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ ] Form

40-F [ X ]

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

| Dated:

January 15, 2025 |

SILVERCORP METALS INC. |

| |

|

| |

/s/

Jonathan Hoyles |

| |

Jonathan

Hoyles |

| |

General

Counsel and Corporate Secretary |

EXHIBIT INDEX

| |

|

| EXHIBIT |

DESCRIPTION OF EXHIBIT |

Exhibit 99.1

Silvercorp Reports Operational Results and Financial

Results Release Date for the Third Quarter, Fiscal 2025

Trading Symbol: TSX/NYSE American: SVM

VANCOUVER, BC, Jan. 15, 2025 /CNW/ - Silvercorp Metals

Inc. ("Silvercorp" or the "Company") (TSX: SVM) (NYSE American: SVM) reports production and sales figures for the

third quarter of fiscal 2025 ended December 31, 2024 ("Q3 Fiscal 2025"). Silvercorp expects to release its Q3 Fiscal 2025 unaudited

financial results on Tuesday, February 11, 2025, after market close.

Q3 Fiscal 2025 Operational Results

- Record revenue of approximately

$83.6 million, an increase of 43% over the same quarter last year ("Q3 Fiscal 2024");

- Ore mined of 383,543 tonnes,

up 11% over Q3 Fiscal 2024;

- Ore milled of 361,810 tonnes,

up 16% over Q3 Fiscal 2024;

- Silver production of 1.9 million

ounces, an increase of 16% over Q3 Fiscal 2024; silver equivalent (only silver and gold)i production of approximately 2.1

million ounces, compared to 1.8 million ounces in Q3 Fiscal 2024;

- Lead production of approximately

17.1 million pounds, an increase of 2% over Q3 Fiscal 2024;

- Zinc production of approximately

6.7 million pounds, a decrease of 10% over Q3 Fiscal 2024; and

- Inventory stockpile ores at the

Ying Mining District of approximately 145 thousand tonnes will be processed during the Chinese New Year holidays in the fourth quarter.

Consolidated Operational Results for the Three

Months Ended December 31, 2024 and 2023

| |

Q3 Fiscal 2025 |

|

Q3 Fiscal 2024 |

| |

Ying Mining

District |

GC |

Consolidated |

|

Ying Mining

District |

GC |

Consolidated |

| Production Data |

|

|

|

|

|

|

|

| Ore Mined (tonnes) |

297,246 |

86,297 |

383,543 |

|

245,606 |

99,667 |

345,273 |

| Ore Milled (tonnes) |

|

|

|

|

|

|

|

| Gold ore |

21,912 |

— |

21,912 |

|

12,726 |

— |

12,726 |

| Silver ore |

255,783 |

84,115 |

339,898 |

|

201,475 |

98,299 |

299,774 |

| |

277,695 |

84,115 |

361,810 |

|

214,201 |

98,299 |

312,500 |

| Head Grades |

|

|

|

|

|

|

|

| Silver (grams/tonne) |

214 |

77 |

|

|

235 |

68 |

|

| Lead (%) |

2.7 |

1.1 |

|

|

3.5 |

1.1 |

|

| Zinc (%) |

0.5 |

2.7 |

|

|

0.7 |

2.7 |

|

| |

|

|

|

|

|

|

|

| Recovery Rates |

|

|

|

|

|

|

|

| Silver (%) |

94.7 |

82.8 |

|

|

94.9 |

80.3 |

|

| Lead (%) |

94.0 |

90.3 |

|

|

94.8 |

90.9 |

|

| Zinc (%) |

68.9 |

90.3 |

|

|

71.4 |

90.1 |

|

| |

|

|

|

|

|

|

|

| Metal Production |

|

|

|

|

|

|

|

| Gold (ounces) |

2,056 |

— |

2,056 |

|

1,342 |

— |

1,342 |

| Silver (in thousands of ounces) |

1,778 |

168 |

1,946 |

|

1,511 |

173 |

1,684 |

| Silver equivalent (in thousands of ounces) |

1,951 |

168 |

2,119 |

|

1,622 |

173 |

1,795 |

| Lead (in thousands of pounds) |

15,234 |

1,853 |

17,087 |

|

14,552 |

2,211 |

16,763 |

| Zinc (in thousands of pounds) |

2,250 |

4,418 |

6,668 |

|

2,153 |

5,251 |

7,404 |

| |

|

|

|

|

|

|

|

| Metals Sold |

|

|

|

|

|

|

|

| Gold (ounces) |

1,875 |

— |

1,875 |

|

1,342 |

— |

1,342 |

| Silver (in thousands of ounces) |

1,788 |

163 |

1,951 |

|

1,536 |

167 |

1,703 |

| Lead (in thousands of pounds) |

15,209 |

1,863 |

17,072 |

|

14,194 |

2,054 |

16,248 |

| Zinc (in thousands of pounds) |

2,203 |

4,402 |

6,605 |

|

2,215 |

5,105 |

7,320 |

At the Ying Mining District, a total of 297,246 tonnes

of ore were mined in Q3 Fiscal 2025, up 21% over Q3 Fiscal 2024, and 277,695 tonnes of ore were milled, up 30% over Q3 Fiscal 2024. Approximately

1.8 million ounces of silver, 2,056 ounces of gold, 2.0 million ounces of silver equivalent, 15.2 million pounds of lead, and 2.3 million

pounds of zinc were produced, representing production increases of 53%, 18%, 20%, 5%, and 5%, respectively, in gold, silver, silver equivalent,

lead and zinc over Q3 Fiscal 2024. Inventory stockpile ores at the Ying Mining District of approximately 145 thousand tonnes will be processed

during the Chinese New Year holidays in the fourth quarter as the 1,500 tonnes per day mill expansion has been in operation since November

2024.

At the GC Mine, 86,297 tonnes of ore were mined, down

13% over Q3 Fiscal 2024, and 84,115 tonnes of ore were milled, down 14% over Q3 Fiscal 2024. Approximately 168 thousand ounces of silver,

1.9 million pounds of lead, and 4.4 million pounds of zinc were produced, representing decreases of 3%, 16% and 16%, respectively, in

silver, lead and zinc over Q3 Fiscal 2024.

Consolidated Operational Results for the Nine

Months Ended December 31, 2024 and 2023

| |

Nine monthes ended December 31, 2024 |

|

Nine months ended December 31, 2023 |

| |

Ying Mining

District |

GC |

Consolidated |

|

Ying Mining

District |

GC |

Consolidated |

| Production Data |

|

|

|

|

|

|

|

| Ore Mined (tonnes) |

825,371 |

263,459 |

1,088,830 |

|

679,990 |

241,968 |

921,958 |

| Ore Milled (tonnes) |

|

|

|

|

|

|

|

| Gold ore |

47,463 |

— |

47,463 |

|

36,419 |

— |

36,419 |

| Silver ore |

661,972 |

257,276 |

919,248 |

|

599,459 |

232,824 |

832,283 |

| |

709,435 |

257,276 |

966,711 |

|

635,878 |

232,824 |

868,702 |

| Head Grades |

|

|

|

|

|

|

|

| Silver (grams/tonne) |

228 |

67 |

|

|

241 |

72 |

|

| Lead (%) |

2.9 |

0.9 |

|

|

3.5 |

1.2 |

|

| Zinc (%) |

0.6 |

2.5 |

|

|

0.7 |

2.7 |

|

| |

|

|

|

|

|

|

|

| Recovery Rates |

|

|

|

|

|

|

|

| Silver (%) |

94.8 |

83.0 |

|

|

95.0 |

81.8 |

|

| Lead (%) |

94.1 |

89.6 |

|

|

95.1 |

90.7 |

|

| Zinc (%) |

70.6 |

90.3 |

|

|

70.7 |

90.2 |

|

| |

|

|

|

|

|

|

|

| Metal Production |

|

|

|

|

|

|

|

| Gold (ounces) |

4,385 |

— |

4,385 |

|

5,352 |

— |

5,352 |

| Silver (in thousands of ounces) |

4,868 |

450 |

5,318 |

|

4,614 |

440 |

5,054 |

| Silver equivalent (in thousands of ounces) |

5,222 |

450 |

5,672 |

|

5,080 |

440 |

5,520 |

| Lead (in thousands of pounds) |

41,284 |

4,624 |

45,908 |

|

44,952 |

5,692 |

50,644 |

| Zinc (in thousands of pounds) |

6,513 |

12,400 |

18,913 |

|

6,463 |

12,363 |

18,826 |

| |

|

|

|

|

|

|

|

| Metals Sold |

|

|

|

|

|

|

|

| Gold (ounces) |

4,112 |

— |

4,112 |

|

5,352 |

— |

5,352 |

| Silver (in thousands of ounces) |

4,883 |

448 |

5,331 |

|

4,665 |

431 |

5,096 |

| Lead (in thousands of pounds) |

41,308 |

4,685 |

45,993 |

|

43,471 |

5,282 |

48,753 |

| Zinc (in thousands of pounds) |

6,514 |

12,467 |

18,981 |

|

6,510 |

12,308 |

18,818 |

| |

|

|

|

|

|

|

|

About Silvercorp

Silvercorp is a Canadian mining company producing

silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company's strategy is to create shareholder

value by 1) focusing on generating free cash flow from long life mines; 2) organic growth through extensive drilling for discovery; 3)

ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG. For more information,

please visit our website at www.silvercorpmetals.com.

For further information

Silvercorp Metals Inc.

Lon Shaver

President

Phone: (604) 669-9397

Toll Free 1(888) 224-1881

Email: investor@silvercorp.ca

Website: www.silvercorpmetals.com

CAUTIONARY DISCLAIMER - FORWARD-LOOKING STATEMENTS

This news release includes "forward-looking statements"

within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within

the meaning of applicable securities laws relating to, among other things statements regarding the processing of ore stockpiles and timing

of release the Company's Q3 Fiscal 2025 unaudited financial results. By their very nature, forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different

from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking information

may in some cases be identified by words such as "will", "anticipates", "expects", "intends" and

similar expressions suggesting future events or future performance.

We caution that all forward-looking information is

inherently subject to change and uncertainty and that actual results may differ materially from those expressed or implied by the forward-looking

information. A number of risks, uncertainties and other factors, including fluctuating commodity prices; recent market events and

condition; estimation of mineral resources, mineral reserves and mineralization and metal recovery; interpretations and assumptions of

mineral resource and mineral reserve estimates; exploration and development programs; climate change; economic factors affecting the Company;

timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions

into existing operations; permits and licences for mining and exploration in China; title to properties; non-controlling interest shareholders;

acquisition of commercially mineable mineral rights; financing; competition; operations and political conditions; regulatory environment

in China; regulatory environment and political climate in Bolivia and Ecuador; integration and operations of Adventus; environmental risks;

natural disasters; dependence on management and key personnel; foreign exchange rate fluctuations; insurance; risks and hazards of mining

operations; conflicts of interest; internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act; outcome

of current or future litigation or regulatory actions; bringing actions and enforcing judgments under U.S. securities laws; cyber-security

risks; public health crises; the Company's investment in New Pacific Metals Corp. and Tincorp Metals Inc.; and the other risk factors

described in the Company's Annual Information Form and other filings with Canadian and U.S. regulators on www.sedarplus.ca and www.sec.gov;

could cause actual results and events to differ materially from those expressed or implied in the forward-looking information or could

cause our current objectives, strategies and intentions to change. Accordingly, we warn investors to exercise caution when considering

statements containing forward-looking information and that it would be unreasonable to rely on such statements as creating legal rights

regarding our future results or plans. We cannot guarantee that any forward-looking information will materialize and you are cautioned

not to place undue reliance on this forward-looking information. Any forward-looking information contained in this news release represent

expectations as of the date of this news release and are subject to change after such date. However, we are under no obligation (and we

expressly disclaim any such obligation) to update or alter any statements containing forward-looking information, the factors or assumptions

underlying them, whether as a result of new information, future events or otherwise, except as required by law. All of the forward-looking

information in this news release is qualified by the cautionary statements herein. A comprehensive discussion of other risks that impact

Silvercorp can also be found in our public reports and filings which are available under its profile at www.sedarplus.ca.

i Silver equivalent is calculated by converting

the gold metal quantity to its silver equivalent using the ratio between the net realized selling prices of gold and silver achieved,

and then adding the converted amount expressed in silver ounces to the ounces of silver.

View original content to download multimedia:https://www.prnewswire.com/news-releases/silvercorp-reports-operational-results-and-financial-results-release-date-for-the-third-quarter-fiscal-2025-302351316.html

SOURCE Silvercorp Metals Inc

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2025/15/c8213.html

%CIK: 0001340677

CO: Silvercorp Metals Inc

CNW 08:00e 15-JAN-25

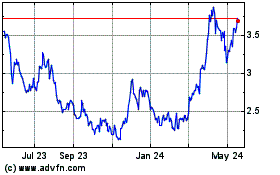

Silvercorp Metals (AMEX:SVM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Silvercorp Metals (AMEX:SVM)

Historical Stock Chart

From Jan 2024 to Jan 2025