Can the Malaysia ETF Bounce Back in 2014? - ETF News And Commentary

20 December 2013 - 2:00AM

Zacks

The Malaysia ETF has gone through a rough patch in 2013. Political

uncertainty in the initial phase, and then the expected cease of

cheap dollars on the ‘Taper’ concern as well as slow-but-steady

growth in the U.S. against a relative slowdown in emerging markets

–played a big role in upsetting the country.

The World Bank also slashed its growth forecast for the Malaysian

economy in early October to 4.3% for 2013 and to 4.8% for

2014. Prior to this, the World Bank trimmed its Malaysian forecast

to 5.1% from 5.6% in late-July, citing current-account woes first

time since 1997.

However, the scenario seems to have taken a turn just before the

New Year. This is evident from the pretty decent economic scorecard

posted recently by the third largest Southeast Asian economy (read:

Malaysia ETF Surges on Election Result).

Export Boom Grabs Attention

Malaysia's exports jumped 9.6% year over year in October against a

forecast of 6.1% growth thanks to the recovery in its major trading

partners – China, ASEAN, Australia, the European Union, Hong Kong,

Korea and India. October numbers – representing a five successive

month of expansion – went up 6.1% sequentially.

Import growth (13.9%) in the month-under-review more than doubled

from the economists’ expectation. This was driven by increases in

imports of intermediate goods which should give another boost to

the exports in the final two months of the year.

Exports comprise more than half of Malaysia’s GDP thus becoming

instrumental in driving economic activity. The nation’s

FTSE Bursa Malaysia KLCI Index climbed to a record

high following the export data release.

The country’s trade surplus remains steady. Malaysia is one of the

only countries in Southeast Asia that has a decent current account

balance at present. Though many had expected the country to fall

into a deficit trap due to poor exports earlier this year, Malaysia

narrowly escaped that and is now comfortably in the surplus

zone.

GDP Picture ‘Not-So-Bad’

Malaysian GDP growth speeded up to 1.7% on a quarter-on-quarter

basis in Q3, up from 1.4% recorded in Q2. Improvement in private

investment coupled with the surge in net exports aided the economic

output.

This trend should continue even in the final quarter of the year as

the country fared better in terms of industrial production in

October, with 1.7% year-over-year and 0.7% sequential growth.

Notably, economists expected the industrial activity to slump 0.8%

quarter-on-quarter.

The government is also implementing a goods and services tax to

reduce the fiscal deficit. The country’s finance ministry issued

growth guidance in late October which assumes 4.5–5% economic

expansion this year and 5–5.5% in the next. No matter how the

economy is rolling, the GDP growth expectation is surely better

than many developed nations as well as developing ones in the

region too.

Decline in Debt-to-GDP Ratio

A much alarming component in the Malaysian economy was a high debt

to GDP ratio, be it on government (~50% in 2012) or household (~80%

in 2012). Some even believe that this sky-high credit level is

basically facilitating Malaysia’s economy to grow around 6% range

in the recent years.

However, the nation progressed on this front as well, though a

little bit. The rise of the household debt-to-GDP ratio fell to

2.5% in Q3 from 3.2% in the preceding period thanks to the central

bank’s measure. Also, as a relief, the amount of non-performing

loans remains low among household indebtedness (read: Time to Buy

the Top Ranked Malaysia ETF?).

Given these trends, a look to a Malaysian investment might be an

intriguing idea. Fortunately, investors have this with the

Malaysia ETF, which we have described in greater detail below:

iShares MSCI Malaysia ETF

(EWM) in Focus

The fund looks to track the performance of the Malaysian equity

market. The fund invests about $853 million in assets in 44

holdings. The fund is concentrated in the top 10 holdings which

account for as much as about half of the total.

The ETF charges a reasonable 49 bps in annual fees. The fund is

heavily exposed to financials that make up for about 30% of the

share in the basket followed by the industrials and utilities

sectors (see more in the Zacks ETF Center).

The most striking part is the fund’s return. EWM added about 11.2%

in the year-to-date frame (as of December 10) while the broader

emerging markets funds like

Vanguard FTSE Emerging Markets

ETF (VWO) and

iShares MSCI Emerging Markets Index Fund

(EEM) lost 1.15% and

0.43% respectively. EWM currently has a Zacks ETF Rank #3

(Hold).

Conclusion

While things are not yet fully over the hump, the country might be

an intriguing pick for investors planning a portfolio reshuffle

going into the New Year.

Yes, the taper issue is looming large, but we believe analysts have

already adjusted this much-hyped concern in their forecasts. And

even after the adjustment – which should take into account reduced

investment – forecasts look fairly encouraging compared to many

other emerging nations, suggesting that EWM might be a solid choice

for 2014.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MALAYSIA (EWM): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

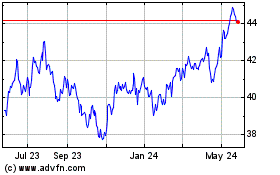

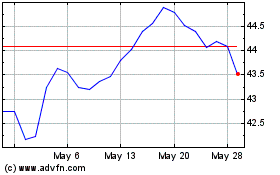

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Feb 2024 to Feb 2025