TIDMBZT

RNS Number : 0527O

Bezant Resources PLC

29 September 2023

29 September 2023

Bezant Resources Plc

("Bezant" or the "Company")

Interim Results for the Six Months Ended 30 June 2023

Bezant (AIM: BZT), the copper-gold exploration and development

company, announces its unaudited interim results for the six months

ended 30 June 2023.

Chairman's Statement

Dear Shareholder,

The focus of the first half of 2023 continues to be Southern

Africa.

Financial highlights:

GBP463K loss after tax (2022: GBP348K)

Approximately GBP365K cash at bank at the period end (31

December 2022: GBP57K).

Operational and corporate events in six months to 30 June 2023

:

In Namibia at our Hope & Gorob project we await the issue of

a mining licence and in the meantime have been working on technical

and other studies targeting a 8,000, tonnes contained copper p.a.

open pit copper / gold mining operation in 2024, obtaining

non-equity financing for the mining operation and the finalization

of an updated mineral resource estimate.

In Botswana at our Kanye project we have focused on

metallurgical work to test that manganese can be extracted from the

deposit to produce leach solutions with high manganese concentrate

via standard leaching processing technologies.

Eureka Project Argentina: We maintain our Eureka Project in good

standing and during the period we had an updated Environmental

Impact Assessment approved which provides for environmental

monitoring and a drill program encompassing 9 drill holes of

200-300 metres each. The Company will engage an environmental

consultant to conduct the environmental monitoring in 2H 2023 and

we are seeking a joint venture partner for the exploration of the

Eureka Project. In 2021 and into 2022 this was hampered by COVID

restrictions in Argentina, but we have in the period received

expressions of interest in the project and our focus remains to

joint venture or monetise this unique red bed copper

occurrence.

Investment in Mankayan Project in Philippines: On 27 March 2023

the Company announced the completion of its share swap sale of its

investment in IDM Mankayan Pty Ltd for shares in IDM International

Ltd. Our investment in IDM International Ltd (see note 7.1) is held

at fair value of GBP2.2m. At the time of writing we hold a 24.2%

investment in IDM International Limited. We are looking for this

investment to be monetised either by direct trade sale or flotation

on an individual or combined project basis. IDM International

Limited and Crescent Mining Development Corporation the licence

holder are actively progressing the project, whilst pursuing the

various avenues to secure and advance what is a very large project

in a copper hungry world.

Funding : On 15 June 2023, the Company announced, that it had

agreed with Sanderson Capital Partners Limited ("Sanderson") a

long-term shareholder in the Company to extend the repayment date

for the GBP700,000 drawn down under the unsecured convertible loan

funding facility entered into with Sanderson on 22 November 2021

until 23 December 2024 which is now convertible by Sanderson at the

fixed price of 0.08 pence per share.

Issue of Equity: During the period we announced, on the dates

indicated below, the following issues of new ordinary shares

("Shares") to raise funds and settle accrued fees to conserve the

Company's working capital:

a) On 9 January 2023 the issue of 7,926,024 new Shares to settle GBP6,000 of consultancy fees;

b) On 12 April 2023 a fundraising of GBP750,000 from existing

shareholders and investors for 1,875,000,000 Shares which included

GBP40,000 from directors, the issue of 218,700,942 Shares to

Directors and a PDMR at a premium to the share price and the

fundraising price to settle GBP174,961 of accrued fees for the

period March 2022 to March 2023 and the issue of 246,808,068 Shares

to settle GBP101,250 of consultancy fees at the fundraising price

to conserve the Company's working capital:

c) On 5 May 2023 the issue of 104,875,000 Shares to settle professional fees of GBP41,950; and

d) On 15 June 2023, the issue of 87,500,000 Shares to settle

fees of GBP70,000 due in relation to the extension of the Sanderson

unsecured convertible loan funding facility equivalent to 6.67% per

year at a premium to the share price and the issue of 437,500,000

warrants over Shares exercisable at 0.12 pence per Share

exercisable for two years.

Operational and corporate post period end events:

On 24 July 2023 and 6 September 2023 we announced the results of

the metallurgical test work at the Kanye project which in essence

verify that manganese can be extracted from the deposit to produce

leach solutions with high manganese concentrate via standard

leaching processing technologies with extremely high

recoveries.

A revised mineral resource statement in relation to the Hope

& Gorob project is being finalised by Addison Mining Services

which will incorporate recent metallurgical test work and the

Company expects to announce this in October 2023.

Outlook: During the period the copper price has continued to be

volatile, but the consensus remains that there is an impending

shortage of copper supplies. We believe we have an above average

copper project portfolio, and we continue to have several

discussions regarding finance and resource collaboration for their

advancement. At the time of writing, we are still in discussions

and negotiations regarding portfolio advancement.

I would like to thank my fellow directors and management for

their untiring efforts to maintain and advance our projects to a

point where our portfolio is well understood by the trade and

therefore financeable going forward.

Colin Bird

Executive Chairman

29 September 2023

For further information, please contact:

Bezant Resources Plc

Colin Bird Executive Chairman +44 (0)20 3416 3695

------------------------------------------ ----------------------

Beaumont Cornish (Nominated Adviser)

Roland Cornish / Asia Szusciak +44 (0) 20 7628 3396

------------------------------------------ ----------------------

Novum Securities Limited (Joint Broker)

Jon Belliss +44 (0) 20 7399 9400

------------------------------------------ ----------------------

Shard Capital Partners LLP (Joint Broker)

Damon Heath +44 (0) 20 7186 9952

------------------------------------------ ----------------------

or visit http://www.bezantresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law pursuant to the Market Abuse (Amendment) (EU Exit)

regulations (SI 2019/310).

Group Statement of Profit and Loss

For the six months ended 30 June 2023

Notes Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

GBP'000 GBP'000

CONTINUING OPERATIONS

Group revenue - -

Cost of sales - -

------------ ------------

Gross profit - -

Operating expenses (463) (319)

Share based payments 4 - (29)

------------ ------------

Group operating loss (463) (348)

Interest income - -

Loss before taxation (463) (348)

Taxation - -

------------ ------------

Loss for the period (463) (348)

============ ============

Loss per share (pence)

Basic and diluted from continuing operations 4 (0.01) (0.01)

======= =======

Group Statement of Other Comprehensive Income

For the six months ended 30 June 2023

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

GBP'000 GBP'000

Other comprehensive income :

Loss for the period (463) (348)

Items that may be reclassified to profit

or loss:

Foreign currency reserve movement (179) 9

------------ ------------

Total comprehensive loss for the period (642) (339)

============ ============

Group S tatement of Changes in Equity

For the six months ended 30 June 2023

Share Share Other Retained Non-Controlling Total

Capital Premium Reserves(1) Losses interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Unaudited - six months

ended 30 June 2023

Balance at 1 January

2023 2,079 39,507 3,672 (35,551) - 9,707

Current period loss - - - (463) - (463)

Foreign currency reserve - - (179) - - (179)

Total comprehensive

loss for the period - - (179) (463) - (642)

--------- --------- ------------- --------- ---------------- ---------

Proceeds from shares

issued 37 713 - - - 750

Share issue costs - (81) 21 - - (60)

Shares issued - in

lieu of fees 14 422 - - - 436

Equity component of

borrowings - - 272 - - 272

--------- --------- ------------- --------- ---------------- ---------

Balance at 30 June

2023 2,130 40,561 3,786 (36,014) - 10,463

========= ========= ============= ========= ================ =========

Share Share Other Retained Non-Controlling Total

Capital Premium Reserves(1) Losses interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Unaudited - six months

ended 30 June 2022

Balance at 1 January

2022 2,076 39,303 3,781 (36,952) (12) 8,196

Current period loss - - - (348) - (348)

Foreign currency reserve - - 9 - - 9

Total comprehensive

loss for the period - - - (348) - (339)

--------- --------- ------------- --------- ---------------- ---------

Proceeds from shares -

issued - - - - -

Shares issued - in

lieu of fees 2 147 - - - 149

Warrants exercised - 18 - 44 - 62

Share options granted - - - - -

--------- --------- ------------- --------- ---------------- ---------

Balance at 30 June

2022 2,078 39,468 3,790 (37,256) (12) 8,068

========= ========= ============= ========= ================ =========

(1) Other reserves is made up of the share-based payment and

foreign exchange reserve.

Group Balance Sheet

As at 30 June 2023

Unaudited Audited

30 31

June December

2023 2022

Notes GBP'000 GBP'000

ASSETS

Non-current assets

Plant and equipment 6 2 2

Investments 7 2,260 2,260

Exploration and evaluation assets 8 8,435 8,398

---------- ----------

Total non-current assets 10,697 10,660

---------- ----------

Current assets

Trade and other receivables 56 76

Cash and cash equivalents 365 57

---------- ----------

Total current assets 421 133

----------

TOTAL ASSETS 11,118 10,793

----------

LIABILITIES

Current liabilities

Trade and other payables 220 463

Borrowings 9 435 623

---------- ----------

Total current liabilities 655 1,086

---------- ----------

NET ASSETS 10,463 9,707

========== ==========

EQUITY

Share capital 10 2,130 2,079

Share premium 10 40,561 39,507

Share-based payment reserve 1,201 1,181

Foreign exchange reserve 328 506

Merger reserve 1,831 1,831

Other reserves 426 154

Retained losses (36,014) (35,551)

---------- ----------

TOTAL EQUITY 10,463 9,707

========== ==========

Group Statement of Cash Flows

For the six months ended 30 June 2023

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

Notes GBP'000 GBP'000

Net cash outflow from operating activities 11 (246) (238)

----------- -----------

Cash flows from/(used) in investing activities

Deferred exploration expenditure (149) (474)

(149) (474)

----------- -----------

Cash flows from financing activities

Proceeds from issuance of ordinary shares 703 19

Borrowings - 250

----------- -----------

703 269

----------- -----------

Increase/(decrease) in cash 308 (443)

Cash and cash equivalents at beginning

of period 57 728

Foreign exchange movement - 4

----------- -----------

Cash and cash equivalents at end of period 365 289

=========== ===========

Notes to the interim financial information

For the six months ended 30 June 2023

1. Basis of preparation

The unaudited interim financial information set out above,

which incorporates the financial information of the Company

and its subsidiary undertakings (the "Group"), has been prepared

using the historical cost convention and in accordance with

International Financial Reporting Standards ("IFRS"), including

IFRS 6 'Exploration for and Evaluation of Mineral Resources',

as adopted by the European Union ("EU") and with those parts

of the Companies Act 2006 applicable to companies reporting

under IFRS.

These interim results for the six months ended 30 June 2023

are unaudited and do not constitute statutory accounts as

defined in section 434 of the Companies Act 2006. The financial

statements for the year ended 31 December 2022 have been delivered

to the Registrar of Companies and the auditors' report on

those financial statements was unqualified and contained a

material uncertainty pertaining to going concern.

Going concern basis of accounting

The Group made a loss from all operations for the six months

ended 30 June 2023 after tax of GBP0.5 million (2022: GBP0.4

million), had negative cash flows from operations and is currently

not generating revenues. Cash and cash equivalents were GBP365,000

as at 30 June 2023.

On 12 April 2023 the Company announced a GBP750,000 fundraising

from directors, existing shareholders and investors to advance

the Hope Copper-Gold Project in Namibia whilst the Company

awaits the award of a mining licence ahead of facilitating

copper gold mining operations, for the metallurgical test

work on the Kanye manganese project in Botswana and for the

Company's other projects as well as working capital. The Company

also issued shares to Directors and PDMR at a premium to the

share price to settle GBP174,961 of accrued fees ("Conversion

Shares") and the settling of GBP101,250 of consultancy fees

by the issue of shares to consultants ("Consultant Shares")

to conserve the Company's working capital.

On 15 June 2023, the Company announced, that it had agreed

with Sanderson Capital Partners Limited ("Sanderson") a long-term

shareholder in the Company to extend the repayment date for

the GBP700,000 drawn down under the unsecured convertible

loan funding facility entered into with Sanderson on 22 November

2021 until 23 December 2024 which is now convertible by Sanderson

at the fixed price of 0.08 pence per share.

An operating loss is expected in the year subsequent to the

date of these accounts and as a result the Company will need

to raise funding to provide additional working capital to

finance its ongoing activities. Management has successfully

raised money in the past, but there is no guarantee that adequate

funds will be available when needed in the future.

Based on the Board's assessment that the Company will be able

to raise additional funds, as and when required, to meet its

working capital and capital expenditure requirements, the

Board have concluded that they have a reasonable expectation

that the Group can continue in operational existence for the

foreseeable future. For these reasons the Group continues

to adopt the going concern basis in preparing the annual report

and financial statements.

There is a material uncertainty related to the conditions

above that may cast significant doubt on the Group's ability

to continue as a going concern and therefore the Group may

be unable to realize its assets and discharge its liabilities

in the normal course of business.

The financial report does not include any adjustments relating

to the recoverability and classification of recorded asset

amounts or liabilities that might be necessary should the

entity not continue as a going concern.

2 Significant accounting judgments, estimates and assumptions

The carrying amounts of certain assets and liabilities are

often determined based on estimates and assumptions of future

events. The key estimates and assumptions that have a significant

risk of causing a material adjustment to the carrying amounts

of certain assets and liabilities within the next annual reporting

year are:

Share-based payment transactions:

The Group measures the cost of equity-settled transactions

with directors, consultants and employees by reference to

the fair value of the equity instruments at the date at which

they are granted. The fair value is determined by using a

Black and Scholes model which takes into account expected

share volatility, strike price, term of the option and the

dividend policy.

Impairment of investments, options and deferred exploration

expenditure:

The Group determines whether investments (including those

acquired during the period), options and deferred exploration

expenditure are impaired when indicators, based on facts and

circumstances, suggest that the carrying amount may exceed

its recoverable amount. Such indicators include the point

at which a determination is made as to whether or not commercial

mining reserves exist in the subsidiary or associate in which

the investment is held or whether exploration expenditure

capitalised is recoverable by way of future exploitation or

sale, obviously pending completion of the exploration activities

associated with any specific project in each segment.

Fair value of assets and liabilities acquired on acquisition

of subsidiaries

The Group determines the fair value of assets and liabilities

acquired on acquisition of subsidiaries by reference to the

carrying value at the date of acquisition and by reference

to exploration activities undertaken and/or information that

the Directors become aware of post acquisition (note 8).

Investments at fair value through profit and loss ('Equity

investments')

Equity investments are initially measured at cost, including

transaction costs. At each reporting date, the fair value

is assessed and any resultant gains and losses are included

directly in the Consolidated Statement of Profit and Loss

under IFRS 9.

Valuation of Equity Instruments Convertible Loan (Borrowings)

Convertible instruments can be complex, containing a number

of features which can have a significant impact on the accounting

under IFRS 9 Financial Instruments and IAS 32 Presentation

of Financial Instruments. The Company determined that the

GBP700,000 convertible note whose terms was modified during

the period (note 9) was substantially different as the discounted

present value of the cash flows under the new terms including

any fees paid net of any fees received discounted using the

original effective interest rate was more than 10% different

from the discounted present value of the remaining cash flows

of the original financial liability. Therefore, the original

GBP700,000 convertible note ("Original 2022 Convertible Loan")

was treated as being repaid on 14 June 2023 and a new GBP700,000

convertible note loan taken out on 14 June 2023 under the

new the modified terms ("Modified 2023 Convertible Loan").

The Company determined that the Modified 2023 Convertible

Loan was an equity instrument as the conversion feature results

in the conversion of a fixed amount of stated principal into

a fixed number of shares, it satisfies the 'fixed for fixed'

criterion and, therefore, it is classified as an equity instrument

which requires the valuation of the liability component and

the equity conversion component. The fair value of the liability

component, included in current borrowings, at inception was

calculated using a market interest rate for an equivalent

instrument without conversion option. The discount rate applied

was 25%.

Segment reporting

3. For the purposes of segmental information, the operations of

the Group are focused in geographical segments, namely the UK,

Argentina, Namibia, and Botswana, and comprise one class of business:

the exploration, evaluation and development of mineral resources.

The UK is used for the administration of the Group and includes

equity investments in non-group companies.

The Group's loss before tax arose from its operations in the

UK, Argentina Namibia and Botswana.

For the six months

ended 30 June 2023

- unaudited

UK Argentina Namibia Botswana Total

GBP'000 GBP'000 GBP'000

Consolidated loss

before tax (418) (45) - - (463)

-------- ---------- -------- --------- --------

Included in the consolidated

loss before tax are

the following income/(expense)

items:

Foreign currency gain - - - - -

Total Assets 2,663 4,867 2,536 1,052 11,118

Total Liabilities (601) (54) - - (655)

-------- ---------- -------- --------- --------

For the six months

ended 30 June 2022

- unaudited

UK Argentina Namibia Botswana Total

GBP'000 GBP'000 GBP'000

Consolidated loss

before tax (288) (59) (1) - (348)

-------- ---------- -------- --------- --------

Included in the consolidated

loss before tax are

the following income/(expense)

items:

Foreign currency gain - - - -

Total Assets 361 5,338 2,418 885 9,002

Total Liabilities (892) (42) - - (934)

-------- ---------- -------- --------- --------

4. Share based payments

6 months 6 months

ended 30 ended 30

June 2023 June 2022

GBP'000 GBP'000

Share option expense - Directors - 18

Share option expense - Management - 11

- 29

===================================================== ===========

5. Loss per share

The basic and diluted loss per share have been calculated

using the loss attributable to equity holders of the Company

for the six months ended 30 June 2023 of GBP463,000 (2022:

GBP348,000). The basic loss per share was calculated using

a weighted average number of shares in issue of 6,139,789,530

(2022: 5,025,497,800).

The weighted average number of shares in issue and to be

issued if calculating the diluted loss per share would amount

to 7,200,975,826 (2022: 6,355,967,563).

The diluted loss per share and the basic loss per share

are recorded as the same amount, as conversion of share

options decreases the basic loss per share, thus being anti-dilutive.

6. Plant and equipment

Unaudited Audited

30 June 31

2023 December

2022

GBP'000 GBP'000

6.1 Cost

Balance at beginning of period 67 67

Exchange differences - -

---------- ----------

At end of period 67 67

---------- ----------

6.2 Depreciation

Balance at beginning of period 65 65

Charge for the period - -

At end of period 65 65

---------- ----------

Net book value at end of period 2 2

========== ==========

7. Investments

Unaudited Audited

30 31

June December

2023 2022

GBP'000 GBP'000

Investments under fair value through

profit and loss (note 7.1) 2,182 2,182

Debt instruments under fair value through

profit and loss (note 7.2) 78 78

2,260 2,260

========== ==========

7.1 Investments

On 13 September 2021 the Company, entered into a conditional

agreement with IDM Mankayan Pty Ltd ("IDM Mankayan"), a company

incorporated in Australia, to take the Mankayan Project in

the Philippines forward (the "IDM Mankayan Agreement"). The

IDM Mankayan Agreement completed on 20 October 2021 and the

Company paid A$90,000 (GBP49K)_to IDM Mankayan and owns 44

IDM Mankayan shares (the "IDM Mankayan Investment") of the

160 shares issued by IDM Mankayan but has no management control

over or right to appoint directors of IDM Mankayan which is

why the IDM Mankayan Investment is held as an equity investment

under IFRS 9. The Mankayan project's MPSA was originally issued

for a standard 25 year period, which expired on 11 November

2021, and as announced by the Company on 18 March 2022 has

been renewed for a second 25 year term with effect from 12

November 2021.

On 26 October 2022 the Company entered into a conditional share

purchase agreement with IDM International Ltd ("IDM International")

the parent company of IDM Mankayan to sell the IDM Mankayan

Investment for 19,381,054 fully paid ordinary shares of IDM

International (the "IDM International SPA"). The IDM International

SPA was conditional on approval of the IDM International SPA

by the shareholders of IDM International and completed during

the period on 27 March 2023.

7.2 On 26 October 2022 the Company entered into a convertible loan

note agreement with IDM International to invest A$137,500 (GBP

78K) in IDM International to acquire 137,500 notes (the "IDM

International Convertible Loan Note Investment"). The Company

has the right to convert the whole but not part of the face

value of each Note into IDM International Shares at A$0.20

at any time (and as many times) prior to the Maturity Date

which is 11 November 2026. As at 30 June 2023, the fair value

of the debt instrument was GBP78k and no unrealised gain/loss

was recognised.

Unaudited Audited

30 June 2023 31 December

2022

GBP'000 GBP'000

Investments under fair value

through profit and loss

Unquoted investments 1 January

2023 2,182 49

Increase in fair value during

year(1) - 2,133

------------- ------------

Unquoted investments at 30

June 2023 2,182 2,182

============= ============

(1) 19,381,054 shares valued at AUD$0.20 (GBP0.112) being

the share subscription price at which at which third parties

subscribed for shares in IDM International on 4 April 2023.

Investments are initially valued at cost. At each reporting

date these investments are measured at fair value with any

gains or losses recognised through the Consolidated Statement

of Profit and Loss. In 2023, the Group and Company had unrealised

gains of GBP2,133,000.

This along with other valuations are estimates based on the

Directors' assessment of the performance of the underlying

investment and reliable information such as recent fundraising.

There is however inherent uncertainty when valuing private

companies such as these in the natural resources sector.

8. Exploration and evaluation assets

Unaudited Audited

30 31

June December

2023 2022

GBP'000 GBP'000

Balance at beginning of period 8,398 7,692

Acquisitions during period

Exploration expenditure 37 934

Write back of liability in relation to joint

venture expenditure (note 8.1) - (228)

Carried forward at end of period 8,435 8,398

========== ==========

8.1 Exploration Assets

Argentina

The amount of capitalised exploration and evaluation expenditure

relates to 12 licences comprising the Eureka Project and are

located in north-west Jujuy near to the Argentine border with

Bolivia and are formally known as Mina Eureka, Mina Eureka

II, Mina Gino I, Mina Gino II, Mina Mason I, Mina Mason II,

Mina Julio I, Mina Julio II, Mina Paul I, Mina Paul II, Mina

Sur Eureka and Mina Cabereria Sur, covering, in aggregate,

an area in excess of approximately 5,500 hectares and accessible

via a series of gravel roads. All licences remain valid.

A new Environmental Impact Assessment (EIA) was presented in

2021 and approved in February 2023 in respect of Mina Eureka,

Mina Gino I, Mina Gino II, Mina Mason I, Mina Mason II, Mina

Julio I, Mina Julio II, Mina Paul I, Mina Paul II, being the

9 northern most licences which are the intended focus of a

future exploration programme. The new EIA approval covers environmental

monitoring and a drill program encompassing 9 drill holes of

200-300 metres each. The Company will engage an environmental

consultant to conduct the environmental monitoring in 2H 2023

and is seeking a joint venture partner to work with in relation

to an exploration drilling programme.

Notwithstanding the absence of new exploration activities on-site

during the period the directors, given their intention post

COVID-19 in Argentina to focus on finding a joint venture partner

for the project have assessed the value of the intangible asset

having considered any indicators of impairment, and in their

opinion, based on a review of the expiry dates of licences,

future expected availability of funds to develop the Eureka

Project and the intention to continue exploration and evaluation,

no impairment is necessary. The capitalised cost at 30 June

2023 was GBP4,847,000.

8.2 Namibia

On 14 August 2020 the Company completed the acquisition of

100% of Virgo Resources Ltd and its interests in the Hope Copper-Gold

Project in Namibia which comprise i) 70% of Hope and Gorob

Mining Pty Ltd incorporated in Namibia which owns EPL5796,

and ii) 80% of Hope Namibia Mineral Exploration Pty Ltd Incorporated

in Namibia which owns EPL6605 and iEPL7170. The balance of

the project is held by local Namibian partners.

JORC Resource: The Hope project area on EPL5796 contains a

combined gross mineral resource within three closely-spaced

deposits (namely Hope, Gorob-Vendome and Anomaly) of 10.18Mt

at 1.89% Cu and 0.3 g/t Au at 0.7% Cu cut-off reported in accordance

with the JORC code (2012), with 192kt of contained Cu and 3,190kg

of contained Au. Approximately 30% of the Mineral Resource

tonnage is classified in the Indicated Mineral Resource category

with the balance in the Inferred Mineral Resource category

and was based on 339 drill holes for a total of 63,855 metres.

The Hope deposit itself has an Indicated Mineral Resource of

3.09Mt @ 2.53% Cu and 0.84g/t Au at a 0.7% Cu cut-off. Historic

drill intersections include 23.31m @ 1.59% Cu & 0.23g/t Au

from 464.09m, including 9.68m @ 3.18% Cu & 0.42g/t Au from

477.17m (hole HDD82) and 10.12m @ 5.72% Cu & 0.56g/t Au from

525.57m (hole HDD91).

During 2022 on 7 February 2022, 15 March 2022, 14 June 2022

and 9 August 2022 the Company announced positive results in

relation to exploration activities undertaken post acquisition

which support the Company's confidence in the Hope Copper-Gold

Project. The 9 August 2022 announcement highlighted that; the

Company has submitted a mining licence application for the

Hope-Gorob copper-gold project area on EPL5796 to the Namibian

authorities; the Mining Licence application is based on an

updated Scoping Study completed in May 2022 by external consultants

incorporating historic mineral resource estimates which did

not yet include additional near-surface copper-gold resources

generated by the Company's shallow drill programme completed

in early 2022; the Scoping Study indicated that the potential

for the development of a surface and underground copper mine

exists at the Hope and Gorob deposits and recommended completion

of the additional work required for optimisation of mine development

plans including the work necessary to obtain granting of environmental

permits and also recommended that further exploration work

continues to fully define resource potential at these deposits;

the shallow drilling completed in 2022 has continued to extend

the strike and up-dip extension of mineralisation at both the

Hope and Vendome prospects. The 2022 drillholes have added

more than 1.5km to the mineralised strike length, with the

potential to add significantly to the previously estimated

mineral resource; and continuous copper and gold mineralisation

has been intersected in drill intercepts over substantial downhole

widths of up to 29.74m.

Reported downhole assay peak intercepts from the shallow drill

programme on EPL5796 include:

o 4.6% Cu, 2.80g/t Au over 3.81m from 39.32m depth in hole

VED001

o 2.4% Cu, 0.36g/t Au over 14.28m from 25.2m depth in hole

HPD003

o 1.90% Cu, 0.36g/t Au over 9.30m from 33.80m depth in hole

HPD005

o 1.49% Cu, 0.23g/t Au over 16.97m from 15.50m depth in hole

HPD004

It was also noted that gold values typically return grades

of approximately 0.3g/t Au providing a significant potential

by-product value addition; and the drill programme was successful

in confirming the presence of shallow mineralisation at three

prospects to date. Results are sufficiently encouraging to

warrant further drilling along strike to evaluate an estimated

additional linear 10km or more of projected mineralisation

never previously tested.

A renewal application has been made for EPL6605 to be renewed

to 25 September 2024 which the Company anticipates will be

granted once the Ministry of Mines and Energy review has been

completed.

Post acquisition there have been no indications that any impairment

provisions are required in relation to the carrying value of

the Hope Copper-Gold Project. The capitalised cost at 30 June

2023 was GBP2,536,000.

8.3 Botswana

On 12 February 2021 the Company further to its announcement

on 22 December 2020 announced the completion of the acquisition

of 100% of Metrock Resources Ltd ("Metrock") and its manganese

mineral exploration licences in Southern Botswana comprising

the Kanye Manganese Project (the "Kanye Manganese Project").

The Kanye Manganese Project i) comprises a 1,668 sq. km land

package with 125 km of potential on trend manganese mineralisation

across the licences ii) has historical trenching results have

yielded in the case on one prospect of between 53% and 74%

manganese oxide ("MnO"), and iii) project area is near the

ground of a TSX listed public company that has a preliminary

economic assessment showing high rates of return based on a

MnO grade of 27.3.

The Kanye Manganese Project comprises collection of five prospecting

licenses, namely PLs 129/2019 , 421/2018, 423/2018, 424/2018,

and PL 425/2018 (the "Project Licences"), located in south-central

Botswana south of the town of Jwaneng and west of the town

of Kanye and 150 km by road from the capital Gaborone. The

licenses cover a total area of 1,668 sq. km and provide the

holder with the right to prospect for Metals. Four licenses

are held by Cypress Sources Pty Ltd, a 100% owned subsidiary

of Coastal Resources Pty Ltd which in turn is 100% owned by

Metrock Resources Limited. The fifth licence PL 129/2019 is

held by Coastal Minerals Pty Ltd which is 100% owned by Coastal

Resources Pty Ltd.

Reconnaissance mapping, prospecting and sampling work on the

Kanye property since acquisition in February 2021 (through

October 2022) has been focussed on PL 129/2019 has highlighted

the following; in relation to PL 129/2019 up to four historic

manganese occurrences were successfully located and sampled

in the field within an 8km-belt; 40 grab samples were obtained

which assayed from traces up to high-grade results of 67.18%

MnO occurring at the Moshaneng borrow pit and 68.01% MnO at

the Mheelo prospect; geological mapping indicates that the

target horizon hosting high-grade manganese may extend continuously

for at least 4km between the Loltware and Moshaneng prospects

on the Bezant ground; laboratory assays from trench sampling

by Bezant at the Loltware manganese prospect (announced on

22 March 2022) returned in-situ chip/grab sample peak results

of 41.4% MnO, 49.23% MnO and 40.83% MnO from one metre wide

zones of siliceous manganese mineralisation within a continuously

mineralised zone of 40m @ 11.53% MnO; At the Moshaneng Borrow

Pit, excavation of shallow clays by a local contractor for

road fill has exposed further manganese-rich pods over a width

of approximately 12-15m and a strike length of about 300m within

a continuous 2km long soil anomaly.

Maiden drill testing for both the Moshaneng and Loltware targets

commenced in October 2022 and comprised 11 mainly shallow,

angled RC holes totaling 682m at Moshaneng prospect as well

as one short diamond drill hole at Loltware prospect the results

of which were announced on 9 February2023 and highlighted;

Moshaneng drilling intersected a zone of flat-lying detrital,

supergene manganese-iron mineralisation which appears to infill

an irregular karst surface over a minimum strike length of

400m; p otential for at least another 100m of strike extension

to the southeast of holes MS-RC-07 and MS-RC-012 would extend

the total strike length to a minimum of 500m ; l ess than 25%

of the more than 2km potential extent of the target defined

by soil geochemistry has been drill tested ; g rades compare

favourably with reported grades on neighbouring more advanced

manganese projects and therefore the Kanye project warrants

detailed evaluation and drilling with a view to establishing

the mineral resource potential; drilling at Loltware encountered

encouraging manganese enhancement in core, warranting further

investigation.

The Moshaneng drill results included the following assay intervals:

* 6m @ 28.64% MnO from 6m depth in hole MS-RC-12

* Including 4m @ 35.38% MnO from 8m depth

* 3m @ 21.85% MnO from 4m depth in hole MS-RC-06

3m @ 21.20% MnO from 2m depth in hole MS-RC-07

Post the period end on 24 July 2023 and 6 September 2023 the

Company announced the results of metallurgical test work at

the Kanye project which in essence verify that manganese can

be extracted from the deposit to produce leach solutions with

high manganese concentrate via standard leaching processing

technologies with extremely high recoveries.

Post-acquisition there have been no indications that any impairment

provisions are required in relation to the carrying value of

the Kanye Manganese Project.

The capitalised cost at 30 June 2023 was GBP1,052,000.

9. Borrowings

Borrowings Original 2022 Convertible Loan - Note (i)

Consolidated

Unaudited Audited

30 June 2023 31 December

2022

GBP'000 GBP'000

Balance at beginning of year 623 -

Convertible loan receipts - 700

Equity allocation - (154)

Finance charge accrued 77 77

Refinanced by Modified 2023 Convertible

Loan (700)

- 623

===================== ===================

Borrowings Modified 2023 Convertible Loan - Note (ii)

Consolidated

Unaudited Audited

30 June 2023 31 December

2022

GBP'000 GBP'000

Balance at beginning of year - -

Original 2022 Convertible loan refinanced 700 -

Equity allocation (272) -

Finance charge accrued 7 -

435 -

======================= ===================

Note (i) As announced on 30 June 2022 the Company further to its

announcement of 23 November 2021 confirmed that it had issued two

drawdown notices of GBP350,000 each (" Tranche 1 " and " Tranche 2

") for a total amount of GBP700,000 (the " Original 2022

Convertible Loan ") under its GBP1,000,000 interest free unsecured

convertible loan funding facility with Sanderson Capital Partners

Ltd (the " Lender"), a long-term shareholder in the Company (the "

Facility "). The amount drawdown was interest free and repayable in

12 months or can be converted at any time at the Lender's option

into Bezant shares at fixed prices for Tranche 1 of GBP350,000, at

0.19 pence per share and for Tranche 2 of GBP350,000 at 0.225 pence

per share. As the conversion feature results in the conversion of a

fixed amount of stated principal into a fixed number of shares, it

satisfies the 'fixed for fixed' criterion and, therefore, it is

classified as an equity instrument. The value of the liability

component of GBP546,000 and the equity conversion component of

GBP154,000 were determined at the date of the drawdowns. The fair

value of the liability component, included in current borrowings,

at inception was calculated using a market interest rate for an

equivalent instrument without conversion option. The discount rate

applied was 25%.

Under the terms of the Facility the Lender is due;

a) a drawdown fee of GBP14,000 being 2% of the amount drawdown

which was settled by the issue of 12,522,361 new ordinary shares of

GBP0.00002 each ("Shares") credited as fully paid at 0.1118 pence

per share being the five-day VWAP on 28 June 2022 (the "Drawdown

Fee Shares"); and

b) GBP350,000 of three year warrants over Shares (the

"Warrants"). The exercise price for the Warrants are as

follows:

-- GBP175,000 at 0.25 pence per share for the drawdown of Tranche 1; and

-- GBP175,000 at 0.30 pence per share for the drawdown of Tranche 2.

Note (ii) On 15 June 2023 the Company announced that it had

agreed with the Lender to extend the repayment date for the

GBP700,000 under the Original 2022 Convertible Loan so the

GBP700,000 drawdown is now repayable by 23 December 2024 and

convertible by the Lender at the fixed price of 0.08 pence per

share (the "New Conversion Price") and to the loan extension fees

detailed below (the "Modified 2023 Convertible Loan"). No further

amounts can be drawn down under the Facility.

As the conversion feature of the Modified 2023 Convertible Loan

results in the conversion of a fixed amount of stated principal

into a fixed number of shares, it satisfies the 'fixed for fixed'

criterion and, therefore, it is classified as an equity instrument.

The value of the liability component of GBP427,674 and the equity

conversion component of GBP272,326 were determined at the date of

the Modified Terms. The fair value of the liability component,

included in current borrowings, at the date of the Modified 2023

Convertible Loan was calculated using a market interest rate for an

equivalent instrument without conversion option. The discount rate

applied was 25%.

Under IFRS 9, the terms of a modified financial liability at

amortised cost are substantially different if the discounted

present value of the cash flows under the new terms including any

fees paid net of any fees received discounted using the original

effective interest rate is at least 10% different from the

discounted present value of the remaining cash flows of the

original financial liability. Therefore the Original 2022

Convertible Loan is treated as repaid on 14 June 2023 and the

Modified 2023 Convertible Loan as a new loan taken out on 14 June

2023.

The Company as a loan extension fee in relation to the Modified

2023 Convertible Loan i) paid the Lender a GBP 70,000 facility

extension and documentation fee equivalent to 6.67% per year which

was settled by the issue of 87,500,000 new ordinary shares of

0.002p each ("Shares") at the New Conversion Price ("Facility

Extension Fee Shares"); and ii) issued the Lender 437,500,000

warrants over Shares exercisable at 0.12 pence per Share (the

"Warrant Exercise Price") exercisable for two years from 14 June

2023 (the "Facility Extension Fees"). The Company has an option to

convert all or part of the GBP700,000 drawdown if the Company's

share price exceeds 0.14 pence for 10 or more business days.

The New Conversion Price was at a 113% premium to the closing

price of 0.0375 pence per share on 14 June 2023 and a 100% premium

to the placing price in relation to the Company's GBP750,000

fundraising announced on 12 April 2023. The Warrant Exercise Price

is at a 220% premium to the closing price on 14 June 2023.

10. Share capital

Unaudited Audited

30 31

June December

2023 2022

GBP'000 GBP'000

Number

Authorised

6,000,000,000 ordinary shares of 0.002p

each (1) 120 100

5,000,000,000 deferred shares of 0.198p

each (2) 9,900 9,900

---------- ----------

10,000 10,000

========== ==========

Allotted ordinary shares, called up and

fully paid

As at beginning of the year 101 98

Share subscription 37 -

Shares issued in lieu of directors and management

fees 4 1

Shares issued on exercise of warrants - 1

Shares issued to settle third party fees 10 1

Total ordinary shares at end of year 152 101

------ ------

Allotted deferred shares, called up and

fully paid (2)

As at beginning of the period 1,978 1,978

Total deferred shares at end of period 1,978 1,978

Ordinary and deferred as at end of period 2,130 2,079

====== ======

Number of

Number of shares 31

shares 30 December

June 2023 2022

Ordinary share capital is summarised below:

As at beginning of the period 5,081,399,113 4,913,028,538

Share subscription 1,875,000,000 -

Shares issued in lieu of directors and management

fees 218,700,942 100,000,000

Shares issued on exercise of warrants - 41,562,500

Shares issued to settle third party fees 462,872,981 26,808,075

As at end of period 7,637,973,036 5,081,399,113

=============== ==============

Deferred share capital is summarised below:

As at beginning of the year (1) 998,773,038 998,773,038

As at end of period 998,773,038 998,773,038

=============== ==============

(1) This is the number of ordinary shares which the directors

were authorised to issue at the AGM on 23 August 2022. This authority

was increased to 7,500,000,000 shares at the AGM on 28 July 2023.

(2) The Deferred Shares have very limited rights and are effectively

valueless as they have no voting rights and have no rights as

to dividends and only very limited rights on a return of capital.

The Deferred Shares are not admitted to trading or listed on

any stock exchange and are not freely transferable.

Unaudited Audited

30 31

June December

2023 2022

GBP'000 GBP'000

The share premium was as follows:

As at beginning of year 39,507 39,303

Share subscription 713 -

Shares issued to settle third party fees 251 34

Shares issued in lieu of directors and management

fees 171 128

Share issue costs (81) -

Warrants exercised - 42

As at end of year 40,561 39,507

========== ==========

Each fully paid ordinary share carries the right to one vote

at a meeting of the Company. Holders of ordinary shares also

have the right to receive dividends and to participate in the

proceeds from sale of all surplus assets in proportion to the

total shares issued in the event of the Company winding up.

11. Reconciliation of operating loss to net

cash outflow from operating activities

Unaudited Unaudited

Six Six

months months

ended 30 ended

June 30 June

2023 2022

GBP'000 GBP'000

Operating loss from all operations (463) (348)

Share option expense - 29

Shares issued - Directors fees 43

Share issued - Consultants 19

Shares issued - Legal/finance fees 70 -

(Increase)/decrease in receivables 20 (52)

Increase/(decrease) in payables 65 133

---------- ----------

Net cash outflow from operating activities (246) (238)

========== ==========

12. Subsequent events

No significant events have occurred subsequent to the reporting

date that would have a material impact on the consolidated financial

statements.

13. Availability of Interim Report

A copy of these interim results will be available from the Company's

registered office during normal business hours on any weekday

at Floor 6, Quadrant House, 4 Thomas More Square, London E1W

1YW and can also be downloaded from the Company's website at

www.bezantresources.com . Bezant Resources Plc is registered

in England and Wales with company number 02918391.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDCBBDDGXI

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

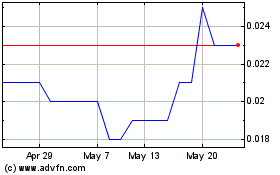

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025