TIDMLFT

RNS Number : 9162F

Lift Global Ventures PLC

10 November 2022

10 November 2022

Lift Global Ventures Plc

("Lift" or the "Company")

Final Audited Results to 30 June 2022

And

Notice of AGM

Lift Global Ventures Plc (AQSE:LFT), an enterprise company

formed to identify investment and acquisition opportunities within

the financial media and related technology industries, is pleased

to announce its Final Audited Results to 30 June 2022 (the

"Results").

Highlights

-- The Company successfully completes its admission to the AQSE

Growth Market raising GBP1,726,300 (before expenses).

-- The Company incurred a loss for the period of GBP474,578,

largely related to one-off costs in connection with the admission

to AQSE.

Post-Period Highlights

-- Shortly after the period end, the Company acquired Miriad

Limited, a successful financial PR and IR consulting company, for a

consideration of GBP366,667.

Notice of Annual General Meeting ('AGM')

The Company is also pleased to announce that its AGM will be

held on 5 December 2022 at 1pm (GMT) at the offices of Hill

Dickinson LLP at The Broadgate Tower, 20 Primrose Street, London,

EC2A 2EW.

Copies of the Notice of AGM, together with the Form of Proxy and

the Company's annual report and accounts to 30 June 2022, have been

posted to shareholders today and will be available to view on the

Company's website: www.liftgv.com .

The Directors of the Company accept responsibility for the

contents of this announcement.

- Ends -

Enquiries:

Lift Global Ventures Plc

Zak Mir, CEO

Tim Daniel, Executive Director +44 (0)203 745 1865

--------------------

Optiva Securities (AQSE Corporate

Adviser and Broker)

--------------------

Christian Dennis

Daniel Ingram +44 (0)203 411 1881

--------------------

For more information please visit: www.liftgv.com

Chairman's Statement

The period ended 30 June 2022 saw the Company successfully

complete its admission to the AQSE Growth Market ("AQSE") on 29

April 2022. In connection with the admission, the Company raised

GBP1,726,300 (before expenses). Including pre-IPO funds, the

Company raised a total of GBP2,066,300 during the period.

This milestone positioned the Company to begin executing its

strategy as detailed below.

Strategy & Outlook

The Company's investment strategy, as stated in its admission

document published on 25 April 2022, is to seek to operate as an

enterprise company seeking acquisition or investment opportunities

within the financial media and related technology industries.

Within these broad industries, areas of focus may include:

-- Financial news websites and other forms of "new media"

-- Investment research providers

-- Financial PR, IR, design and marketing agencies

-- Production studios and visual content providers

-- Technology platforms which facilitate capital raising and/or

lending

Indeed, the Company made its first acquisition soon after the

end of the period. Miriad Limited ("Miriad"), a successful

financial PR and IR consulting company run by well-known stock

market commentator (and Company Director) Zak Mir, was acquired on

5 September 2022 for a consideration of GBP366,667.

As stated in the Company's shareholder circular dated 8 August

2022, the acquisition of Miriad helps to achieve the Directors'

goal of covering Lift's fixed costs and providing, not just

stability during a time of market turmoil, but an ideal platform

from which to launch into the next phase of the Company's growth

strategy.

The Board looks forward to both growing the Miriad business and

continuing to seek complementary acquisition or investment

opportunities which help to cement the Company's central position

in the small/mid-cap arena.

The Company's strategy is further detailed in the Strategic

Report on Page 4.

Financial Summary

The Company incurred a loss for the period of GBP474,578. A

significant part of the Company's expenses during the period

related to one-off costs in connection with the admission to

AQSE.

With the post-period end acquisition of Miriad, the Directors

continue to focus on not just preserving but growing the Company's

assets.

The Board looks forward to providing further material updates to

the market in due course and thanks shareholders for their

continued support.

Paul Gazzard

Non-Executive Chairman

Statement Of Financial Position

As at 30 June 2022

As at 30

June

2022

GBP

Current Assets

Trade and other receivables 338,366

Cash and cash equivalents 1,322,305

Total current assets 1,660,671

Total Assets 1,660,671

Current Liabilities

Trade and other payables 64,235

Total Liabilities 64,235

Net Assets 1,596,436

Equity attributable to owners of

the Parent

Share capital 915,433

Share premium 1,097,757

Other reserves 57,824

Retained earnings (474,578)

Total Equity 1,596,436

Statement Of Comprehensive Income

For The Period Ended 30 June 2022

For the period

ended 30 June

2022

GBP

Administration expenses (286,280)

Listing fees - legal and professional services (188,298)

Operating Loss (474,578)

Loss before Taxation (474,578)

Corporation tax -

Loss for the period (474,578)

Earnings per share (pence) - Basic & Diluted (1.48)

The Company has no Other Comprehensive Income as at 30 June

2022.

Statement Of Changes In Equity

As at 30 June 2022

Attributable to Equity Shareholders

Share Share Other Retained Total

capital premium reserves earnings equity

GBP GBP GBP GBP GBP

On incorporation 50,000 - - - 50,000

Loss for the period - - - (474,578) (474,578)

Total Loss for the

period - - - (474,578) (474,578)

Transactions with owners

Issue of ordinary shares 865,433 1,150,867 - - 2,016,300

Cost of capital - (53,110) - - (53,110)

Options and warrants

granted - - 57,824 - 57,824

Total transactions

with owners 865,433 1,097,757 57,824 - 2,021,014

As at 30 June 2022 915,433 1,097,757 57,824 (474,578) 1,596,436

Statement Of Cash Flows

As at 30 June 2022

As at 30

June 2022

GBP

Cash flows from operating activities

Loss after taxation (474,578)

Adjustments for:

Share based payments 43,664

Increase in trade and other receivables (338,366)

Increase in trade and other payables 64,235

Net cash used in operating activities (705,045)

Cash flows from financing activity

Net proceeds from issue of shares 2,027,350

Net cash generated from financing

activity 2,027,350

Net increase in cash and cash equivalents 1,322,305

Cash and cash equivalents at 13 May -

2021

Cash and cash equivalents at end

of period 1,322,305

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXBKCBBNBDBADK

(END) Dow Jones Newswires

November 10, 2022 02:00 ET (07:00 GMT)

Lift Global Ventures (AQSE:LFT)

Historical Stock Chart

From Nov 2024 to Dec 2024

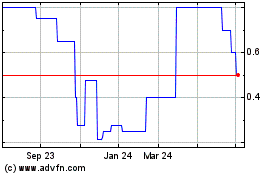

Lift Global Ventures (AQSE:LFT)

Historical Stock Chart

From Dec 2023 to Dec 2024