TIDMPOW

RNS Number : 8815G

Power Metal Resources PLC

24 July 2023

24 July 2023

Power Metal Resources PLC

("Power Metal" or the "Company")

Commercial Update

Power Metal Resources PLC (AIM:POW), the AIM listed metals

exploration and development company, is pleased to provide a

commercial update covering a number of corporate initiatives

currently underway and to also provide a financial update with the

latest available unaudited Gross Asset and Shareholders' Equity

position of the Company as at 30 June 2023.

Highlights:

-- Multiple corporate initiatives underway to optimise Power

Metal's positioning ahead of a resource sector recovery with work

advancing concurrently across various business interests.

-- Accelerated exploration underway across the Company's

Athabasca uranium interests in Saskatchewan, Canada and the Tati

Goldfields project in Botswana.

-- Intention to apply for OTC listing for easier trading of

Power Metal shares on market by US investors.

-- Appointment of Financial Adviser to Uranium Energy

Exploration for their planned listing, the Company's first uranium

project spin-out listing.

-- Significant increase in Gross Assets and Shareholders' Equity

since 30 September 2020 year end, in absolute terms and also per

issued share, demonstrating that Power Metal has been generating

value per share notwithstanding share dilution over the period.

Sean Wade, Chief Executive Officer of Power Metal Resources plc,

commented:

"I am very pleased to be able to update shareholders on these

important developments. We are well aware of the challenging market

conditions of late, and as such, it is important for us to

demonstrate to shareholders that significant steps are being taken

to position the Company in readiness for what we expect will be a

considerable recovery in the junior resource sector.

"The planned application for an OTC listing will give us the

opportunity to address a much wider international investor base and

therefore substantially improve liquidity in the shares. We want to

make it as easy as possible for people to invest and this is a

significant step forward in that regard.

"We see significant potential demand for a pure-play uranium

exploration vehicle and look forward to the planned listing of

Uranium Energy Exploration. We are also excited about the planned

listing of First Development Resources. Both events will, we

believe, deliver considerable Balance Sheet expansion.

"As far as the Balance Sheet is concerned more generally, I am

very pleased to update shareholders on where this stands as at 30

June 2023. We have continued to achieve excellent growth in

Shareholder Equity since the 30 September 2022 year end, reflecting

the successful IPO of Golden Metal Resources and other corporate

activities. Importantly our Shareholder Equity per share has grown

over recent years demonstrating that the financings undertaken have

fed through to increasing value for shareholders.

"During the summer and autumn period, the Company is looking to

finalise a number of value crystallisation events that we expect to

further bolster the balance sheet.

"Finally, it is important to note that Power Metal is focused on

achieving major metal discoveries across its portfolio of

interests. In that respect, we are similar to many exploration

companies. However, rather than expect our shareholders to bear the

costs of all exploration through repeated rounds of equity

financing, we are also focused on finding, through spin-out

listings, joint ventures and disposals (principally for acquirer

equity), multiple innovative financing structures for the costs of

project management and exploration. We will continue to offer

shareholders material exposure to the discovery upside through

large equity holdings in our investee companies."

Corporate Initiatives

Power Metal has undertaken three project disposals to date

leading to significant equity positions in Kavango Resources PLC

(LON:KAV), First Class Metals PLC (LON:FCM) and Golden Metal

Resources PLC (LON:GMET). Together these investments are currently

valued at GBP6.7 million and represent a small proportion of the

historic project interests previously held by the Company.

The Company is eager to build a more extensive portfolio of

investments through continuing disposals and recognises the

potential for the value of the portfolio to grow considerably

through this disposal activity and, as the junior resource sector

recovers, through an appreciation of the value of its underlying

investments.

At present, the Company is actively pursuing a number of

corporate initiatives in the following business interests as

summarised below. Shareholders should note, however, that there can

be no certainty that the current initiatives underway below will

lead to a successful conclusion.

Business Interest Commercial Work Underway

Silver Peak Project, Discussions underway to determine the optimal

Canada (30% POW) ownership structure and advancement of

the project.

------------------------------------------------

Athabasca Basin, Planned listing of Uranium Energy Exploration

Canada (100% POW) (see appointment of Financial Adviser below).

------------------------------------------------

ION Battery Resources Following completion of Authier project

Ltd, Canada (100% Earn-In announced recently, plans are being

POW) finalised for the next corporate steps,

seeking to maximise value for Power Metal.

------------------------------------------------

Tati Goldfields, Pursuing discussions to determine the optimal

Botswana (100% POW) ownership structure and advancement of

the project.

------------------------------------------------

Molopo Farms Complex, Pursuing multi-party discussions to secure

Botswana (87.71% project level financing or joint venture

POW) partner to enable accelerated exploration

across extensive nickel and platinum group

metal targets delineated from historical

exploration work.

------------------------------------------------

Haneti project, Tanzania Discussions continuing with joint venture

(30% POW) partner Katoro Gold PLC (LON:KAT) with

regard to future ownership and advancement

of the project.

------------------------------------------------

First Development Pursuing multi-party discussions on cornerstone

Resources PLC, Australia strategic investment in the IPO financing,

(58.59% POW) leading to completion of IPO financing

and listing in the London capital markets.

------------------------------------------------

New Horizon Metals Discussions advancing for the disposal

Pty Ltd, Australia of POW interest.

(20% POW)

------------------------------------------------

New Ballarat Gold Discussions continuing with joint venture

Corporation PLC, partner Red Rock Resources PLC (LON:RRR)

Australia (49.9% with regard to future ownership structure

POW) and advancement of the project.

------------------------------------------------

In addition, the Company is actively involved in discussions in

respect of exploration and development opportunities in Saudi

Arabia, which are plentiful and offer high impact potential for the

Company. Further information in respect of material developments

will be announced in due course.

Accelerated Exploration

Alongside the above corporate initiatives, the Company is

pursuing proactive exploration at a number of properties in and

surrounding the Athabasca Basin, targeting uranium discoveries; and

also, at the Tati Goldfields project in Botswana, targeting a

significant gold discovery.

Further exploration focused updates are expected as material

developments occur.

OTC Listing

The Company is pleased to announce that it is intending to apply

for a listing on the US OTC market. The application will be subject

to various regulatory approvals and an update on its progress will

be provided in due course.

If successful, this important step will provide easier trading

accessibility for US investors wishing to buy Power Metal shares on

market and will, in the Company's view, potentially increase the

liquidity of Power Metal share trading.

Appointment of Beaumont Cornish as Financial Adviser to Uranium

Energy Exploration ("UEE")

The Company is pleased to announce the appointment by UEE of

Beaumont Cornish Limited as Financial Adviser in respect to the

intended listing of UEE on a recognised London exchange. The

listing will be subject to the various regulatory approvals and an

update will be provided in due course.

The UEE transaction details are being finalised and a further

update to the market will be provided in due course. UEE will hold

the Reitenbach and E-12 uranium properties in Saskatchewan, Canada

currently 100 per cent owned by Power Metal. Additional selected

interests from the current portfolio and external assets may be

added to enhance the planned listing portfolio.

Financial Update

Power Metal is pleased to report that, on an unaudited basis,

the Company Shareholders' Equity as at 30 June 2023 was GBP15.5m vs

GBP10.2m, on an audited basis, as at 30 September 2022,

demonstrating growth of 52 per cent*.

The Company's Gross Assets total as at 30 June 2023 was GBP15.8m

vs GBP10.7m, on an audited basis, as at 30 September 2022,

demonstrating growth of 48 per cent*.

* The Consolidated Shareholders' Equity at 30 September 2022 was

GBP11.7m and the Consolidated Gross Assets GBP14.6m. The

Consolidation process is an accounting exercise that fully reflects

the value of subsidiary company net assets , however the

consolidation exercise is only conducted as part of the preparation

of `power metal's interim and full year financial statements.

The Gross Asset and Shareholder Equity figures are accounting

valuations based on cash, listed investments at market value on 30

June 2023 and the cost value of project acquisitions and project

operational expenditures (corporate and exploration costs).

The Company and Consolidated Gross Assets and Shareholder Equity

per issued ordinary share has been increasing each reporting period

end since 30 September 2020, demonstrating that Power Metal has

been generating value per share notwithstanding share dilution over

the period.

Since 30 September 2020, the Company (unconsolidated) Gross

Assets per issued POW share have grown by 89 per cent and Company

Shareholder Equity per share by 105 per cent to 30 June 2023.

The growth outlined above has been achieved despite extremely

challenging market conditions over recent years and without the

benefit of stronger listed asset valuations that would ordinarily

occur in more normalised or positive market conditions.

In addition, accounting valuations, other than for cash or

listed investments, Gross Assets and Shareholder Equity do not

reflect the full value of business interests at the reporting date,

many of which, in the Board's view, are now worth considerably more

than their accounting valuation at 30 June 2023. That value will be

more accurately reflected as disposals of project interests are

undertaken at market value.

For clarity, included within the above Gross Asset valuation at

30 June 2023 is cash and listed investments of c. GBP10.0m.

For further information please visit

https://www.powermetalresources.com/ or contact:

Power Metal Resources plc

Sean Wade (Chief Executive Officer) +44 (0) 20 3778 1396

SP Angel Corporate Finance (Nomad and Joint Broker)

Ewan Leggat/Charlie Bouverat +44 (0) 20 3470 0470

SI Capital Limited (Joint Broker)

Nick Emerson +44 (0) 1483 413 500

First Equity Limited (Joint Broker)

David Cockbill/Jason Robertson +44 (0) 20 7330 1883

BlytheRay (PR Advisors) +44 (0) 20 7138 3204

Tim Blythe

Megan Ray

NOTES TO EDITORS

Power Metal Resources plc - Background

Power Metal Resources plc (AIM:POW) is an AIM listed metals

exploration company which finances and manages global resource

projects.

The Company has a principal focus on opportunities offering

district scale potential across a global portfolio including

precious, base and strategic metal exploration in North America,

Africa and Australia.

Project interests range from early-stage greenfield exploration

to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through

strategic joint ventures until a project becomes ready for disposal

through outright sale or separate listing on a recognised stock

exchange, thereby crystallising the value generated from our

internal exploration and development work.

Value generated through disposals will be deployed internally to

grow the Company or may be returned to shareholders through share

buy backs, dividends or in-specie distributions of assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSEDEFDEDSESW

(END) Dow Jones Newswires

July 24, 2023 02:00 ET (06:00 GMT)

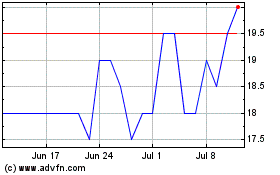

Power Metal Resources (AQSE:POW.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Power Metal Resources (AQSE:POW.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024