Asian Shares Flat as Markets in Pre-Brexit Stasis

22 June 2016 - 2:40PM

Dow Jones News

Shares in Japan and Hong Kong struggled while markets elsewhere

were subdued Wednesday, as investors were reluctant to make big

trades ahead of the U.K.'s vote on whether to leave the European

Union.

The Nikkei Stock Average was down 0.9% while the Hang Seng Index

fell 0.6%. The Shanghai Composite Index was up 0.2%, and

Australia's S&P ASX 200 was flat. South Korea's Kospi inched up

0.2%.

Shares in Asia have recovered this week as polls show Britain

tilting toward a decision to stay in the EU. But investors and

traders are mindful of surprises that could send shares tumbling

again.

"Large institutions aren't going to make a big bets on the vote

because it's a binary decision," said Andrew Sullivan, managing

director at Hong Kong-based brokerage Haitong International.

More polls on the referendum are expected before Thursday's

vote, the results of which are expected Friday morning Asia

time.

Regional markets have been quiet with trading volumes sluggish

in Hong Kong. Tuesday saw 54 billion Hong Kong dollars of shares

traded, compared with a 12-month daily average of 78.4 billion Hong

Kong dollars.

Last week, polls showing a preference to "exit" sent global

markets plunging and investors rushing for safe-haven assets.

Overnight in the U.S., Federal Reserve Chairwoman Janet Yellen

delivered her semiannual testimony to the Senate Banking Committee.

Ms. Yellen struck a slightly cautious note, with investors saying

her remarks were largely in line with what they had expected.

"The Federal Open Market Committee is unlikely to hike in July

while waiting for more data," said Bernard Aw, market strategist at

brokerage IG. "Solid [second quarter] GDP numbers and a bounce in

payrolls figures back around 200,000 levels would be nice. A 'stay'

vote in the U.K. referendum will certainly help," he added.

The Dow Jones Industrial Average inched up 0.1% overnight, while

the S&P 500 gained 0.3%.

In Japan, shares were pressured yet again by the stronger yen on

Wednesday. The yen, which has been trading close to a 22-month

high, was last up 0.4%, with the greenback at ¥ 104.41. A stronger

yen hurts the competitiveness of Japanese exporters.

In corporate news, shares of SoftBank Group were up 2.7% after

President Nikesh Arora announced an abrupt departure after just two

years with the firm. The split follows criticism in recent months

from investors who raised concerns about Mr. Arora's performance.

Some launched a campaign to oust him, questioning his record and

suggesting he faces a conflict of interest because he also advises

a private-equity firm.

Brent crude oil was last up 0.1% at $50.69 a barrel.

Alexander Martin contributed to this article.

Write to Chao Deng at Chao.Deng@wsj.com

(END) Dow Jones Newswires

June 22, 2016 00:25 ET (04:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

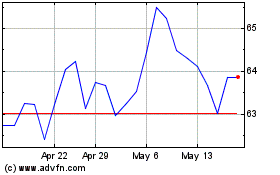

ASX (ASX:ASX)

Historical Stock Chart

From Dec 2024 to Jan 2025

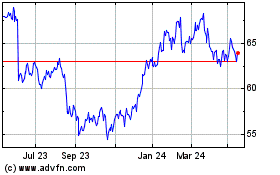

ASX (ASX:ASX)

Historical Stock Chart

From Jan 2024 to Jan 2025