Asian Shares Rise on Strong U.S. Lead

06 October 2016 - 3:00PM

Dow Jones News

Asian shares were broadly higher on Thursday, tracking a strong

close in the U.S. equity market and solid U.S. economic data that

saw the yen weaken.

The Nikkei Stock Average was up 0.7%, as the yen softened

against the U.S. dollar, supporting local exporters. Meanwhile, the

S&P ASX 200 was up 0.3%, the Hang Seng Index was 0.5% higher

and Korea's Kospi rose 0.3%. Markets in China are closed for the

Golden Week holiday.

At the start of Tokyo share trading, the yen weakened about 0.1%

against the dollar. It is now about flat to the greenback.

Late Wednesday, the Institute for Supply Management released its

September survey of demand seen by managers of U.S. service-sector

firms. The survey reading jumped to 57.1, hitting an 11-month high

and well above market consensus of 53. The dollar strengthened as a

result, and the WSJ Dollar Index was recently up 0.1% against a

basket of currencies.

"It is very much at the moment all about the U.S. dollar," said

Gavin Parry, managing director at brokerage Parry International

Trading in Hong Kong. "It is impacting the rest of the [Asian]

region."

The weaker Japanese yen supported local exporters, with auto

makers rising: Mazda Motor climbed 3.7%, Toyota Motor rose 1.4% and

Nissan was 0.7% higher.

The share prices of Japanese banks also improved as fears about

Deutsche Bank's health continued to subside. The Topix bank

subsection extended gains for the fourth session in a row and was

last up 2%.

Overnight, U.S. crude-oil prices surged more than 2% after data

showed that U.S. crude stockpiles fell for the fifth consecutive

week. Shares in energy companies led the S&P 500 higher, which

rose 0.4% on Wednesday. WTI slipped back 27 cents in Asian trade,

but was still hovering just below $50 a barrel. Japanese oil

explorer Inpex rose 3.8% and Japan Petroleum Exploration was 3.5%

higher.

Weaker-than-expected U.S. ADP employment data—a survey of

payroll figures—suggested that the U.S. jobs market was softer than

thought.

Companies across America added 154,000 workers to their ranks in

September, while economists surveyed by The Wall Street Journal

expected an increase of 173,000.

This has dampened expectations for a U.S. rate increase by

year-end. According to CME Group's FedWatch tool, the likelihood of

a rate rise in December has slipped to 59.8% from 63.4% a day

earlier.

In the short-term, investors will look to the U.S. initial

jobless claims later on Thursday and nonfarm payrolls on Friday,

which should shed more light on the Federal Reserve's rate

stance.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

October 05, 2016 23:45 ET (03:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

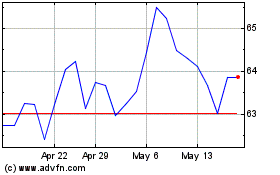

ASX (ASX:ASX)

Historical Stock Chart

From Dec 2024 to Jan 2025

ASX (ASX:ASX)

Historical Stock Chart

From Jan 2024 to Jan 2025