- Year-over-year revenue grows 9%, operating

profit up 12%, non-GAAP operating profit up 16%

Note: A webcast of ResMed’s conference call will be available at

4:30 p.m. ET today at http://investor.resmed.com

ResMed Inc. (NYSE: RMD, ASX: RMD), a world-leading digital

health company, today announced results for its quarter ended

December 31, 2020.

Second Quarter 2021 Highlights

All comparisons are to the prior year period

- Revenue increased 9% to $800.0 million; up 7% on a constant

currency basis

- GAAP gross margin of 57.8%; non-GAAP gross margin expanded 20

bps to 59.9%

- Net operating profit increased 12%; non-GAAP operating profit

up 16%

- GAAP diluted earnings per share of $1.23; non-GAAP diluted

earnings per share of $1.41

“Our second-quarter results reflect continued solid performance

and positive trends across our business resulting in top-line

growth as well as double-digit improvement in operating income and

earnings per share,” said Mick Farrell, ResMed CEO. “In our core

markets of sleep apnea, COPD, and asthma, we are seeing continued

sequential improvement in new patient volume and ongoing adoption

of our mask and accessories resupply programs. Our global teams

have managed SG&A investments judiciously as we navigate

through the global pandemic. We have seen great adoption of digital

health and an increase in the importance of out-of-hospital

healthcare these last 12 months, and that will only expand

throughout 2021 as vaccines become more widely available, and our

communities open up worldwide. We have continued to invest in

focused R&D programs in digital health and core medtech

innovation, to help accelerate our ResMed growth strategy:

improving 250 million lives in out-of-hospital healthcare in

2025.”

Financial Results and Operating

Metrics

Unaudited; $ in millions, except for per

share amounts

Three Months Ended

December 31, 2020

December 31, 2019

% Change

Constant Currency (A)

Revenue

$

800.0

$

736.2

9

%

7

%

Gross margin (B)

57.8

%

58.0

%

(0

)

Non-GAAP gross margin (B)

59.9

%

59.7

%

0

Selling, general, and administrative

expenses

169.5

171.4

(1

)

(3

)

Research and development expenses

54.9

49.9

10

7

Income from operations

221.7

197.8

12

Non-GAAP income from operations (B)

254.5

218.5

16

Net income

179.5

160.6

12

Non-GAAP net income (B)

206.4

176.3

17

Diluted earnings per share

$

1.23

$

1.10

12

Non-GAAP diluted earnings per share

(B)

$

1.41

$

1.21

17

Six Months Ended

December 31, 2020

December 31, 2019

% Change

Constant Currency (A)

Revenue

$

1,552.0

$

1,417.2

10

%

8

%

Gross margin (B)

58.1

%

57.8

%

1

Non-GAAP gross margin (B)

59.9

%

59.6

%

1

Selling, general, and administrative

expenses

328.5

338.9

(3

)

(5

)

Research and development expenses

109.5

98.0

12

9

Income from operations

438.6

368.9

19

Non-GAAP income from operations (B)

491.6

409.5

20

Net income

357.9

280.7

27

Non-GAAP net income (B)

391.8

311.7

26

Diluted earnings per share

$

2.45

$

1.93

27

Non-GAAP diluted earnings per share

(B)

$

2.68

$

2.14

25

(A)

In order to provide a framework

for assessing how our underlying businesses performed excluding the

effect of foreign currency fluctuations, we provide certain

financial information on a “constant currency” basis, which is in

addition to the actual financial information presented. In order to

calculate our constant currency information, we translate the

current period financial information using the foreign currency

exchange rates that were in effect during the previous comparable

period. However, constant currency measures should not be

considered in isolation or as an alternative to U.S. dollar

measures that reflect current period exchange rates, or to other

financial measures calculated and presented in accordance with U.S.

GAAP.

(B)

See the reconciliation of non-GAAP

financial measures in the table at the end of the press

release.

Discussion of Second Quarter Results

All comparisons are to the prior year period unless otherwise

noted

- Revenue in the U.S., Canada, and Latin America, excluding

Software as a Service, grew by 5 percent, driven by strong sales

across our mask product portfolio.

- Revenue in Europe, Asia, and other markets grew by 10 percent

on a constant currency basis, primarily driven by sales across our

device and mask product portfolio.

- Software as a Service revenue increased by 6 percent, due to

continued growth in resupply service offerings and stabilizing

patient flow in out-of-hospital care settings.

- Gross margin contracted by 20 basis points mainly due to

restructuring expenses associated with the cessation of our

portable oxygen concentrator business. Non-GAAP gross margin

expanded by 20 basis points, mainly due to benefits from

manufacturing efficiencies, product mix changes, and foreign

exchange rates, partially offset by declines in average selling

prices.

- Selling, general, and administrative expenses decreased by 3

percent on a constant currency basis. SG&A expenses improved to

21.2 percent of revenue in the quarter, compared with 23.3 percent

in the same period of the prior year. These changes in SG&A

expenses were mainly due to savings in travel and other cost

management as a result of the COVID-19 pandemic.

- Income from operations increased by 12 percent and non-GAAP

income from operations increased by 16 percent.

- Net income grew by 12 percent and diluted earnings per share

grew by 12 percent. Non-GAAP net income grew by 17 percent and

non-GAAP diluted earnings per share grew by 17 percent,

predominantly attributable to strong sales and controlled operating

costs.

- Cash flow from operations for the quarter was $169.9 million,

compared to net income in the current quarter of $179.5 million.

During the quarter we paid $56.7 million in dividends.

Dividend program

The ResMed board of directors today declared a quarterly cash

dividend of $0.39 per share. The dividend will have a record date

of February 11, 2021, payable on March 18, 2021. The dividend will

be paid in U.S. currency to holders of ResMed’s common stock

trading on the New York Stock Exchange. Holders of CHESS Depositary

Interests (“CDIs”) trading on the Australian Securities Exchange

will receive an equivalent amount in Australian currency, based on

the exchange rate on the record date, and reflecting the 10:1 ratio

between CDIs and NYSE shares. The ex-dividend date will be February

10, 2021, for common stockholders and for CDI holders. ResMed has

received a waiver from the ASX’s settlement operating rules, which

will allow ResMed to defer processing conversions between its

common stock and CDI registers from February 10, 2021, through

February 11, 2021, inclusive.

Webcast details

ResMed will discuss its second quarter fiscal year 2021 results

on its webcast at 1:30 p.m. U.S. Pacific Time today. The live

webcast of the call can be accessed on ResMed’s Investor Relations

website at investor.resmed.com. Please go to this section of the

website and click on the icon for the “Q2 2021 Earnings Webcast” to

register and listen to the live webcast. A replay of the earnings

webcast will be accessible on the website and available

approximately two hours after the live webcast. In addition, a

telephone replay of the conference call will be available

approximately two hours after the webcast by dialing +1

800-585-8367 (U.S.) or +1 416-621-4642 (outside U.S.) and entering

the passcode 4291663. The telephone replay will be available until

February 11, 2021.

About ResMed

At ResMed (NYSE: RMD, ASX: RMD) we pioneer innovative solutions

that treat and keep people out of the hospital, empowering them to

live healthier, higher-quality lives. Our digital health

technologies and cloud-connected medical devices transform care for

people with sleep apnea, COPD, and other chronic diseases. Our

comprehensive out-of-hospital software platforms support the

professionals and caregivers who help people stay healthy in the

home or care setting of their choice. By enabling better care, we

improve quality of life, reduce the impact of chronic disease, and

lower costs for consumers and healthcare systems in more than 140

countries. To learn more, visit ResMed.com and follow @ResMed.

Safe harbor statement

Statements contained in this release that are not historical

facts are “forward-looking” statements as contemplated by the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements – including statements regarding

ResMed’s projections of future revenue or earnings, expenses, new

product development, new product launches, new markets for its

products, the integration of acquisitions, litigation, and tax

outlook – are subject to risks and uncertainties, which could cause

actual results to materially differ from those projected or implied

in the forward-looking statements. Additional risks and

uncertainties are discussed in ResMed’s periodic reports on file

with the U.S. Securities & Exchange Commission. ResMed does not

undertake to update its forward-looking statements.

RESMED INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Income

(Unaudited; $ in thousands,

except for per share amounts)

Three Months Ended

Six Months Ended

December 31, 2020

December 31, 2019

December 31, 2020

December 31, 2019

Net revenue

$

800,011

$

736,157

$

1,551,955

$

1,417,213

Cost of sales

321,132

296,975

622,436

572,976

Amortization of acquired intangibles

(1)

11,164

12,052

23,143

25,488

Restructuring - cost of sales (1)

5,232

-

5,232

-

Total cost of sales

$

337,528

$

309,027

$

650,811

$

598,464

Gross profit

$

462,483

$

427,130

$

901,144

$

818,749

Selling, general, and administrative

169,470

171,422

328,459

338,862

Research and development

54,935

49,943

109,468

97,976

Amortization of acquired intangibles

(1)

7,689

8,556

15,932

13,599

Restructuring - operating expenses (1)

8,673

-

8,673

-

Litigation settlement expenses (1)

-

(600

)

-

(600

)

Total operating expenses

$

240,767

$

229,321

$

462,532

$

449,837

Income from operations

221,716

197,809

438,612

368,912

Other income (expenses), net:

Interest income (expense), net

$

(5,792

)

$

(10,018

)

$

(12,517

)

$

(20,562

)

Loss attributable to equity method

investments

(2,640

)

(6,924

)

(4,928

)

(13,786

)

Other, net

(2,692

)

(2,115

)

5,279

(5,225

)

Total other income (expenses), net

(11,124

)

(19,057

)

(12,166

)

(39,573

)

Income before income taxes

$

210,592

$

178,752

$

426,446

$

329,339

Income taxes

31,078

18,198

68,560

48,637

Net income

$

179,514

$

160,554

$

357,886

$

280,702

Basic earnings per share

$

1.24

$

1.11

$

2.47

$

1.95

Diluted earnings per share

$

1.23

$

1.10

$

2.45

$

1.93

Non-GAAP diluted earnings per share

(1)

$

1.41

$

1.21

$

2.68

$

2.14

Basic shares outstanding

145,246

144,212

145,053

143,966

Diluted shares outstanding

146,421

145,575

146,350

145,479

(1) See the reconciliation of non-GAAP financial measures in the

table at the end of the press release.

RESMED INC. AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(Unaudited; $ in thousands)

December 31, 2020

June 30, 2020

ASSETS

Current assets:

Cash and cash equivalents

$

255,865

$

463,156

Accounts receivable, net

509,364

474,643

Inventories

474,821

416,915

Prepayments and other current assets

211,435

168,745

Total current assets

$

1,451,485

$

1,523,459

Non-current assets:

Property, plant, and equipment, net

$

459,472

$

417,335

Operating lease right-of-use assets

131,291

118,348

Goodwill and other intangibles, net

2,323,490

2,338,492

Deferred income taxes and other

non-current assets

207,118

189,742

Total non-current assets

$

3,121,371

$

3,063,917

Total assets

$

4,572,856

$

4,587,376

LIABILITIES AND STOCKHOLDERS’

EQUITY:

Current liabilities:

Accounts payable

$

122,166

$

135,786

Accrued expenses

280,332

270,353

Operating lease liabilities, current

22,445

21,263

Deferred revenue

105,238

98,617

Income taxes payable

35,166

64,755

Short-term debt

11,988

11,987

Total current liabilities

$

577,335

$

602,761

Non-current liabilities:

Deferred revenue

$

86,899

$

87,307

Deferred income taxes

12,733

13,011

Operating lease liabilities,

non-current

117,641

101,880

Other long term liabilities

9,481

8,347

Long-term debt

813,732

1,164,133

Long-term income taxes payable

90,051

112,910

Total non-current liabilities

$

1,130,537

$

1,487,588

Total liabilities

$

1,707,872

$

2,090,349

STOCKHOLDERS’ EQUITY:

Common stock

$

582

$

580

Additional paid-in capital

1,574,240

1,570,694

Retained earnings

3,076,569

2,832,991

Treasury stock

(1,623,256

)

(1,623,256

)

Accumulated other comprehensive income

(163,151

)

(283,982

)

Total stockholders’ equity

$

2,864,984

$

2,497,027

Total liabilities and stockholders'

equity

$

4,572,856

$

4,587,376

RESMED INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Cash Flows

(Unaudited; $ in thousands)

Six Months Ended

December 31, 2020

December 31, 2019

Cash flows from operating

activities:

Net income

$

357,886

$

280,702

Adjustment to reconcile net income to cash

provided by operating activities:

Depreciation and amortization

80,046

77,077

Amortization of right-of-use assets

17,911

12,323

Stock-based compensation costs

31,441

27,309

Loss attributable to equity method

investments

4,928

13,786

(Gain) loss on equity investment

(4,776

)

5,419

Restructuring expenses

8,673

-

Changes in fair value of business

combination contingent consideration

500

(7

)

Changes in operating assets and

liabilities:

Accounts receivable, net

(19,259

)

(275

)

Inventories, net

(34,212

)

(28,294

)

Prepaid expenses, net deferred income

taxes, and other current assets

(29,875

)

(66,818

)

Accounts payable, accrued expenses, and

other

(99,348

)

(88,927

)

Net cash provided by operating

activities

$

313,915

$

232,295

Cash flows from investing

activities:

Purchases of property, plant, and

equipment

(48,443

)

(47,771

)

Patent registration costs

(8,367

)

(4,871

)

Business acquisitions, net of cash

acquired

(437

)

(3,423

)

Purchases of investments

(14,446

)

(21,841

)

Proceeds / (Payments) on maturity of

foreign currency contracts

19,922

1,064

Net cash used in investing activities

$

(51,771

)

$

(76,842

)

Cash flows from financing

activities:

Proceeds from issuance of common stock,

net

18,614

24,297

Taxes paid related to net share settlement

of equity awards

(46,507

)

(41,091

)

Payment of business combination contingent

consideration

-

(302

)

Proceeds from borrowings, net of borrowing

costs

55,000

730,000

Repayment of borrowings

(406,000

)

(700,012

)

Dividends paid

(113,165

)

(112,202

)

Net cash used in financing activities

$

(492,058

)

$

(99,310

)

Effect of exchange rate changes on

cash

$

22,623

$

824

Net increase / (decrease) in cash and cash

equivalents

(207,291

)

56,967

Cash and cash equivalents at beginning of

period

463,156

147,128

Cash and cash equivalents at end of

period

$

255,865

$

204,095

RESMED INC. AND

SUBSIDIARIES

Reconciliation of Non-GAAP Financial

Measures

(Unaudited; $ in thousands, except for per

share amounts)

The measures “non-GAAP gross profit” and

“non-GAAP gross margin” excludes amortization expense from acquired

intangibles related to cost of sales and are reconciled below:

Three Months Ended

Six Months Ended

December 31, 2020

December 31, 2019

December 31, 2020

December 31, 2019

Revenue

$

800,011

$

736,157

$

1,551,955

$

1,417,213

Add back: Deferred revenue fair value

adjustment (A)

-

657

-

2,102

Non-GAAP Revenue

$

800,011

$

736,814

$

1,551,955

$

1,419,315

GAAP Cost of sales

$

337,528

$

309,027

$

650,811

$

598,464

Less: Amortization of acquired intangibles

(A)

(11,164

)

(12,052

)

(23,143

)

(25,488

)

Less: Restructuring - cost of sales

(A)

(5,232

)

-

(5,232

)

-

Non-GAAP cost of sales

$

321,132

$

296,975

$

622,436

$

572,976

GAAP gross profit

$

462,483

$

427,130

$

901,144

$

818,749

GAAP gross margin

57.8

%

58.0

%

58.1

%

57.8

%

Non-GAAP gross profit

$

478,879

$

439,839

$

929,519

$

846,339

Non-GAAP gross margin

59.9

%

59.7

%

59.9

%

59.6

%

The measure “non-GAAP income from operations” is reconciled with

GAAP income from operations below:

Three Months Ended

Six Months Ended

December 31, 2020

December 31, 2019

December 31, 2020

December 31, 2019

GAAP income from operations

$

221,716

$

197,809

$

438,612

$

368,912

Amortization of acquired intangibles -

cost of sales (A)

11,164

12,052

23,143

25,488

Amortization of acquired intangibles -

operating expenses (A)

7,689

8,556

15,932

13,599

Restructuring - cost of sales (A)

5,232

-

5,232

-

Restructuring - operating expenses (A)

8,673

-

8,673

-

Deferred revenue fair value adjustment

(A)

-

657

-

2,102

Litigation settlement expenses (A)

-

(600

)

-

(600

)

Non-GAAP income from operations

$

254,474

$

218,474

$

491,592

$

409,501

RESMED INC. AND

SUBSIDIARIES

Reconciliation of Non-GAAP Financial

Measures

(Unaudited; $ in thousands, except for per

share amounts)

The measures "non-GAAP net income" and

“non-GAAP diluted earnings per share” are reconciled with GAAP net

income and GAAP diluted earnings per share in the table below:

Three Months Ended

Six Months Ended

December 31, 2020

December 31, 2019

December 31, 2020

December 31, 2019

GAAP net income

$

179,514

$

160,554

$

357,886

$

280,702

Amortization of acquired intangibles -

cost of sales, net of tax (A)

8,566

9,210

17,742

19,478

Amortization of acquired intangibles -

operating expenses, net of tax (A)

5,900

6,538

12,214

10,392

Restructuring - cost of sales, net of tax

(A)

4,663

-

4,663

-

Restructuring - operating expenses, net of

tax (A)

7,730

-

7,730

-

Deferred revenue fair value adjustment,

net of tax (A)

-

503

-

1,610

Litigation settlement expenses, net of tax

(A)

-

(528

)

-

(528

)

(Gain) loss on equity investments (A)

-

-

(8,476

)

-

Non-GAAP net income (A)

$

206,373

$

176,277

$

391,759

$

311,654

Diluted shares outstanding

146,421

145,575

146,350

145,479

GAAP diluted earnings per share

$

1.23

$

1.10

$

2.45

$

1.93

Non-GAAP diluted earnings per share

(A)

$

1.41

$

1.21

$

2.68

$

2.14

(A)

ResMed adjusts for the impact of the

amortization of acquired intangibles, restructuring expenses,

deferred revenue fair value adjustment, litigation settlement

expenses, and the (gain) loss on equity investments from their

evaluation of ongoing operations, and believes that investors

benefit from adjusting these items to facilitate a more meaningful

evaluation of current operating performance.

ResMed believes that non-GAAP diluted

earnings per share is an additional measure of performance that

investors can use to compare operating results between reporting

periods. ResMed uses non-GAAP information internally in planning,

forecasting, and evaluating the results of operations in the

current period and in comparing it to past periods. ResMed believes

this information provides investors better insight when evaluating

ResMed’s performance from core operations and provides consistent

financial reporting. The use of non-GAAP measures is intended to

supplement, and not to replace, the presentation of net income and

other GAAP measures. Like all non-GAAP measures, non-GAAP earnings

are subject to inherent limitations because they do not include all

the expenses that must be included under GAAP.

RESMED INC. AND

SUBSIDIARIES

Revenue by Product and Region

(Unaudited; $ in millions, except for per

share amounts)

Three Months Ended

December 31, 2020 (A)

December 31, 2019 (A)

% Change

Constant Currency (B)

U.S., Canada, and Latin America

Devices

$

205.0

$

203.5

1

%

Masks and other

221.8

204.5

8

Total Sleep and Respiratory Care

$

426.8

$

408.0

5

Software as a Service

91.8

86.7

6

Total

$

518.6

$

494.7

5

Combined Europe, Asia, and other

markets

Devices

$

188.0

$

162.3

16

%

10

%

Masks and other

93.4

79.2

18

12

Total Sleep and Respiratory Care

$

281.4

$

241.5

17

10

Global revenue

Devices

$

393.0

$

365.8

7

%

5

%

Masks and other

315.2

283.7

11

9

Total Sleep and Respiratory Care

$

708.2

$

649.5

9

7

Software as a Service

91.8

86.7

6

6

Total

$

800.0

$

736.2

9

7

Six Months Ended

December 31, 2020 (A)

December 31, 2019 (A)

% Change

Constant Currency (B)

U.S., Canada, and Latin America

Devices

$

402.4

$

390.4

3

%

Masks and other

427.5

387.8

10

Total Sleep and Respiratory Care

$

829.9

$

778.2

7

Software as a Service

184.0

173.6

6

Total

$

1,013.9

$

951.8

7

Combined Europe, Asia, and other

markets

Devices

$

364.0

$

314.2

16

%

11

%

Masks and other

174.0

151.2

15

10

Total Sleep and Respiratory Care

$

538.1

$

465.4

16

10

Global revenue

Devices

$

766.4

$

704.6

9

%

6

%

Masks and other

601.6

539.0

12

10

Total Sleep and Respiratory Care

$

1,368.0

$

1,243.6

10

8

Software as a Service

184.0

173.6

6

6

Total

$

1,552.0

$

1,417.2

10

8

(A)

Totals and subtotals may not add due to

rounding.

(B)

In order to provide a framework for

assessing how our underlying businesses performed excluding the

effect of foreign currency fluctuations, we provide certain

financial information on a “constant currency basis,” which is in

addition to the actual financial information presented. In order to

calculate our constant currency information, we translate the

current period financial information using the foreign currency

exchange rates that were in effect during the previous comparable

period. However, constant currency measures should not be

considered in isolation or as an alternative to U.S. dollar

measures that reflect current period exchange rates, or to other

financial measures calculated and presented in accordance with U.S.

GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210128005352/en/

For investors Amy Wakeham +1 858-836-5000

investorrelations@resmed.com

For media Jayme Rubenstein +1 858-836-6798

news@resmed.com

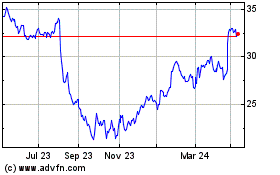

Resmed (ASX:RMD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Resmed (ASX:RMD)

Historical Stock Chart

From Jan 2024 to Jan 2025