SSR Mining Inc. (Nasdaq/TSX: SSRM; ASX: SSR) (“SSR Mining” or

the “Company”) is pleased to announce the completion of the

previously announced acquisition (the “Transaction”) of the Cripple

Creek & Victor (“CC&V”) gold mine from Newmont Corporation

(“Newmont”) on February 28, 2025. As consideration for the

Transaction, SSR Mining made a $100 million cash payment to

Newmont, with up to $175 million in additional milestone-based

payments to be made in the future.

CC&V is expected to meaningfully increase SSR Mining’s

scale, free cash flow and portfolio diversification, and positions

the Company as the third largest gold producer in the U.S.A. As of

December 31, 2024, CC&V hosted 2.4 million ounces of gold

Mineral Reserves, an 85% year-over-year increase from the 1.3

million ounces of gold Mineral Reserves as of December 31, 2023.

Newmont also reported an additional 0.8 million ounces of Measured

and Indicated gold Mineral Resources and 0.9 million ounces of

Inferred gold Mineral Resources for CC&V as of December 31,

2024. SSR Mining expects to publish a technical report and life of

mine plan for CC&V within the next 12 months.

With the closing of the Transaction, production and free cash

flow from CC&V are attributable to SSR Mining effective March

1, 2025. The Company anticipates reporting consolidated full-year

2025 production and cost guidance, including attributable guidance

for CC&V, before the end of the first quarter.

Rod Antal, Executive Chairman of SSR Mining, said, “We are

thrilled to welcome CC&V and its team to SSR Mining. This

transaction adds another long-lived, free cash flow generative

asset to the portfolio, and we look forward to showcasing our

longer-term plans for the operation.”

About SSR Mining

SSR Mining is listed under the ticker symbol SSRM on the Nasdaq

and the TSX. The Company expects to remain listed on the ASX under

the ticker symbol SSR until market close on April 7, 2025.

For more information, please visit www.ssrmining.com.

Cautionary Note Regarding Forward-Looking Information

Except for statements of historical fact relating to us, certain

statements contained in this news release constitute

forward-looking information, future oriented financial information,

or financial outlooks (collectively “forward-looking information”)

within the meaning of applicable securities laws. Forward-looking

information may be contained in this document and our other public

filings. Forward-looking information relates to statements

concerning our outlook and anticipated events or results and, in

some cases, can be identified by terminology such as “may”, “will”,

“could”, “should”, “expect”, “plan”, “anticipate”, “believe”,

“intend”, “estimate”, “projects”, “predict”, “potential”,

“continue” or other similar expressions concerning matters that are

not historical facts.

Forward-looking information and statements in this news release

are based on certain key expectations and assumptions made by us.

Although we believe that the expectations and assumptions on which

such forward-looking information and statements are based are

reasonable, undue reliance should not be placed on the

forward-looking information and statements because we can give no

assurance that they will prove to be correct. Forward-looking

information and statements are subject to various risks and

uncertainties which could cause actual results and experience to

differ materially from the anticipated results or expectations

expressed in this news release.

Forward-looking information and statements in this news release

include any statements concerning, among other things: forecasts

and outlook relating to the Transaction, timing and realized value

and benefits of the development of the Cripple Creek & Victor

property, including timing of exploration, construction and

production, realization of Mineral Reserves, and the existence or

realization of Mineral Resource estimates; available liquidity

resulting from the Transaction, value and timing of compensation

relating to the milestone payments, the satisfaction of the

permitting related to the extension of the life of mine at

CC&V; and any and all other timing, exploration, development,

operational, financial, budgetary, economic, legal, social,

environmental, regulatory, and political matters that may influence

or be influenced by future events or conditions.

The above list is not exhaustive of the factors that may affect

any of the Company’s forward-looking information. You should not

place undue reliance on forward-looking information and statements.

Forward-looking information and statements are only predictions

based on our current expectations and our projections about future

events. Actual results may vary from such forward looking

information for a variety of reasons including, but not limited to,

risks and uncertainties disclosed in our filings on our website at

www.ssrmining.com, on SEDAR at www.sedarplus.ca, on EDGAR at

www.sec.gov and on the ASX at www.asx.com.au and other unforeseen

events or circumstances. Other than as required by law, we do not

intend, and undertake no obligation to update any forward-looking

information to reflect, among other things, new information or

future events. The information contained on, or that may be

accessed through, our website is not incorporated by reference

into, and is not a part of, this document.

Information Regarding CC&V

All information related to CC&V’s 2023 Mineral Reserves and

Mineral Resources is derived solely from Newmont Corporation’s

(“Newmont”) press release (“Newmont Announces 2023 Mineral Reserves

for Integrated Company of 136 Million Gold Ounces with Robust

Copper Optionality of 30 Billion Pounds”) dated February 22, 2024,

and all information related to CC&V’s 2024 Mineral Reserves and

Mineral Resources is derived from Newmont’s press release “Newmont

Reports 2024 Mineral Reserves of 134.1 Million Gold Ounces and 13.5

Million Tonnes of Copper”, dated February 20, 2025, and the Annual

Report on Form 10-K of Newmont, filed with the SEC on February 21,

2025 (collectively, the “Newmont Disclosures”). You should closely

review the Newmont Disclosures in their entirety to learn about the

risk, considerations and qualifications to which this information

is subject. We have not independently verified the information

derived from the Newmont Disclosures. These “historical estimates”

(as such term is defined in National Instrument 43-101 – Standards

of Disclosure for Mineral Properties (“NI 43-101”)) are provided

solely for information purposes and have not been independently

verified by SSR Mining. These historical estimates are based on

work completed and estimates prepared by Newmont, they are not

current and should not be treated as SSR Mining’s current estimates

of Mineral Reserves or Mineral Resources at CC&V.

Newmont’s Mineral Reserves and Mineral Resources for 2024 were

based on a gold price assumption of $1,700 per ounce for Mineral

Reserves and $2,000 per ounce for Mineral Resources. Newmont’s

Mineral Reserves and Mineral Resources for 2023 were based on a

gold price assumption of $1,400 per ounce for Mineral Reserves and

$1,600 per ounce for Mineral Resources.

Newmont has not prepared a technical report summary in

accordance with the requirements of Subpart 1300 under Regulation

SK of the Securities Act of 1933 and the Securities Exchange Act of

1934 or a technical report in accordance with the requirements of

NI 43-101, and Mineral Resources and Mineral Reserves have not been

calculated in accordance with NI 43-101. As a result, the

production estimates made by SSR Mining are based on the Newmont

Disclosure and have not been prepared, reviewed or verified by an

independent, third-party qualified person and no such qualified

person has done sufficient work to classify the Newmont Disclosures

as Mineral Resources or Mineral Reserves as prescribed by Subpart

1300 or NI 43-101 and SSR is not treating the historical estimate

as current Mineral Resources or Mineral Reserves for purposes of

Subpart 1300 or NI 43-101.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250228343106/en/

E-Mail: invest@ssrmining.com Phone: +1 (888) 338-0046

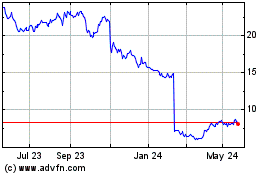

SSR Mining (ASX:SSR)

Historical Stock Chart

From Feb 2025 to Mar 2025

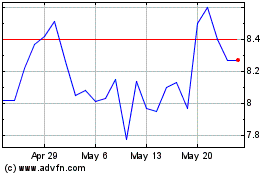

SSR Mining (ASX:SSR)

Historical Stock Chart

From Mar 2024 to Mar 2025