Solana ‘In Serious Danger’ If $137 Support Breaks – Analyst Shares Targets

05 October 2024 - 1:30AM

NEWSBTC

Solana is trading above a crucial support level at $137 after

experiencing a 17% correction from local highs around $160. This

recent dip has left analysts and investors on edge, awaiting

confirmation of the next price direction. Just last week,

sentiment was strongly bullish, but the current market atmosphere

is filled with fear and uncertainty. One notable analyst, Carl

Runefelt, has shared a chart highlighting the risk of Solana losing

its key support level, which could lead to further downside.

Related Reading: Can SUI Break Past $2 Resistance? On-Chain Metrics

Reveal Growing Demand The entire crypto market is grappling with

high volatility, amplifying uncertainty. This has led to growing

fear among investors, many concerned about the potential for deeper

corrections. While Solana showed strong momentum recently, the

present market conditions have dampened optimism, leaving traders

anxious for a clear signal that could reignite confidence. As

Solana continues to hover near this critical support level, the

coming days will be pivotal in determining whether it can regain

its bullish momentum or if further declines are on the horizon.

Solana Testing Crucial Demand Levels Solana is at a critical

juncture, as its price action has shifted from bullish to bearish

in just a few days. Bulls are now proceeding with caution,

especially below the $140 mark, which represents a key structural

level. The $137 support level is crucial, as it could be

Solana’s last defense against a further drop. Top crypto analyst

Carl Runefelt recently shared a technical analysis on X,

highlighting the precarious situation Solana finds itself in.

According to Runefelt, Solana could see a sharp drop to $128 if

this support level breaks, extending the current consolidation

phase. In addition to the risk of a breakdown, Runefelt also

pointed to key resistance levels that bulls need to target if

Solana is to regain its upward momentum. The most important levels

to watch are the $150 and $160 supply zones. A break above

these zones would be necessary to confirm a reversal into a bullish

trend. Until then, the price action remains uncertain, and

investors are closely monitoring these critical support and

resistance levels. Related Reading: Ethereum At Risk Of Further

Decline: Top Investor Sets $2,150 Target If Support Breaks The

current market volatility and the threat of further declines are

causing hesitation among traders. Solana’s ability to hold its

support or break through resistance will determine its next move.

SOL Technical Analysis: Prices To Watch Solana (SOL) is trading at

$139 after a correction from local highs that haven’t been broken

since July. The price faces significant resistance as it struggles

to reclaim the 4-hour 200 moving average (MA) at $139.9, a critical

strength indicator. For bulls to regain momentum, holding above

this level is essential. Additionally, the price must reclaim the

4-hour 200 exponential moving average (EMA) at $144.3 to confirm a

bullish reversal and signal a potential recovery. However, the

market may see further downside pressure if Solana fails to surpass

these crucial technical levels. A deeper correction could lower the

price to $120, a key demand zone that could serve as a new level of

support. This would extend the current consolidation phase and put

more downward pressure on Solana’s price. Related Reading: Cardano

(ADA) Faces Risk Of 30% Drop – On-Chain Metrics Confirm A Slow

Demand Investors are watching closely as SOL navigates this

critical range, with both bulls and bears waiting for a decisive

move in either direction. Featured image from Dall-E, chart from

TradingView

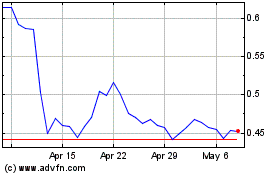

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024