Crypto Market Stuck In A Rut? Here’s Why 2024 Bitcoin Breakout May Be Delayed

05 September 2024 - 4:00PM

NEWSBTC

The crypto market has been struggling with prolonged sideways

movement in recent months. Since March 2024, the market has failed

to make a successful breakout above previous peaks, leaving

investors frustrated. According to a recent report by CryptoQuant

analyst Crypto Dan, this continuous pattern of stagnation leads

many to wonder when the market might see a significant rebound.

While there are some short-term factors that may provide relief,

the overall sentiment in the crypto space remains cautious. Related

Reading: Bitcoin Eyes $68,000 In September: Could This Be The

Turning Point? Is The Crypto Market Stuck? One key observation made

by Crypto Dan is the emergence of a “Dead Cross” on the short-term

and long-term SOPR (Spent Output Profit Ratio) moving averages.

This is a bearish signal in technical analysis, indicating that

selling pressure is likely to outweigh buying pressure. It suggests

that traders may be locking in profits rather than betting on

further gains. The persistence of this trend as highlighted by Dan

raises questions about whether a meaningful recovery is on the

horizon, or if the market is headed for a longer period of

consolidation. Looking ahead, one potential catalyst Dan pointed

out for the market movement is the upcoming US Federal Reserve

meeting on September 18, where a base rate cut is anticipated.

Historically, rate cuts have tended to inject positive sentiment

into financial markets, including cryptocurrencies. A reduction in

interest rates could result in an influx of liquidity into riskier

assets like Bitcoin and altcoins, as investors seek higher returns.

This could trigger a short-term rally, offering some relief from

the stagnation observed in recent months. However, Dan warns that

while a short-term rebound might occur, it may not lead to a

sustained bullish trend unless there is a significant shift in

market conditions. When Will A Breakout Finally Happen? The

fundamental outlook for the crypto space remains mixed, with

macroeconomic factors such as inflation and recession concerns

still weighing heavily on investor sentiment. If these factors do

not improve, Dan noted that it is likely that frustrating,

low-volatility movements could persist well into 2024. In his

words: Due to the expected US base rate cut on September 18, a

short-term rebound due to positive market sentiment can be

expected, but if the market atmosphere is not significantly

reversed, it is highly likely that frustrating movements will

continue in 2024. Although actively monitoring the crypto market at

this current state may feel discouraging. However, Crypto Dan

emphasizes that “patience” will be key for long-term investors.

Related Reading: Bitcoin’s Breakout Blueprint: Analyst Reveals

Roadmap For Imminent Surge According to Dan, while the potential

for a short-term rally exists, broader market trends suggest

that a more meaningful and sustained uptrend may not

occur until 2025. Featured image created with DALL-E, Chart

from TradingView

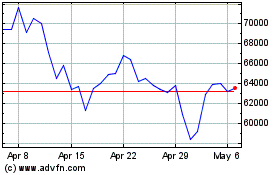

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

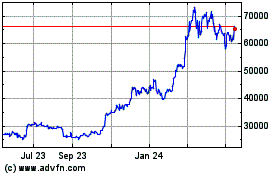

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024