Ethereum MVRV Score Signals Cooling Market Momentum – Time To Buy?

13 October 2024 - 6:00AM

NEWSBTC

In line with the general crypto market, Ethereum (ETH) produced a

positive price performance in the past day with a significant 4.50%

gain, according to data from CoinMarketCap. Following this price

rise, the altcoin moved its weekly profits to around 1.35% after

what has been a turbulent trading week. However, certain market

indicators signal the ETH market remains far from a bullish

breakout. Related Reading: Ethereum TD Setup: Why The ETH Price

Must Hold $2,250 Ethereum MVRV Far From Critical Bullish Level,

Analyst Says In an X post on Friday, crypto analyst Burak

Kesmeci shared an insight on the cyclical relationship between

Ethereum’s price and its Market Value to Realized Value (MVRV)

ratio, which he states can be used to identify buy and sell

signals. According to Kesmeci, the last two bull and bear

periods in the ETH market have revealed certain MVRV points i.e.

3.00 and 0.80 as vital to understanding price movement. The

analyst explains that an MVRV value above 3.00 usually results in

Ethereum entering an overbought zone, presenting investors with an

opportunity to sell in fear of a potential price fall.

Alternatively, historical data have shown ETH to be “relatively

cheap” and undervalued when the MVRV value falls below 0.80,

representing an opportunity for aggressive purchases by long-term

investors. However, In a more detailed analysis, Kesmeci

highlights 2.25 to be a critical MVRV level in a bullish Ethereum

market. The analyst states that significant price gains have been

recorded whenever ETH moved past this MVRV value in the last two

bull cycles. According to Kesmeci, Ethereum’s current MVRV stands

at 1.22 following a decrease from 1.95 over the last 120 days. A

continuous decline to below 0.80 would present a buy signal as

earlier stated. However, investors should only anticipate a

“serious rally” if the MVRV value moves upward and past 2.25.

Related Reading: Ethereum Could See a 53% Price Correction

If This Happens—Analyst Key Ethereum Support Zone Revealed In other

news, market analyst Ali Martinez has identified a key support

level for Ethereum. According to data from IntoTheBlock, 2.4

million wallet addresses acquired $52.6 million worth of ETH at the

$2,300 price mark. Therefore a price fall below this region

could trigger a panic market sale, resulting in a further price

loss. At the time of writing, ETH trades at $2,458 with a 4.51%

gain in the past 24 hours. However, the general market sentiment

towards the altcoin remains largely bearish. This is reflected in

the 13.21% decline in its daily trading volume currently valued at

$13.45 billion. With a market cap of $293.36 billion, Ethereum

remains the second-largest cryptocurrency after Bitcoin. Featured

image from The Guardian Nigeria, chart from Tradingview

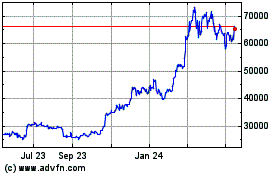

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

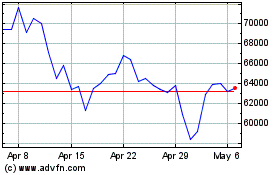

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024