Solana Holds Monthly Support As Network Activity Grows – Time For A Breakout?

20 December 2024 - 6:30PM

NEWSBTC

Solana faced heightened volatility yesterday, dropping 7% following

the Federal Reserve’s announcement of a 25 basis point rate cut and

fewer projected cuts for 2024. Despite the sell-off, Solana’s price

action remains resilient as it managed to hold above a critical

support level, reinforcing confidence in its ability to weather

macroeconomic shifts. Related Reading: Ethereum Whales Load Up:

Bullish Sign Or Bear Trap? While the market reacted to the Fed’s

cautious tone, Solana’s on-chain metrics tell a more optimistic

story. The number of daily transactions on the Solana network has

surged, nearing 67 million, reflecting growing adoption and

sustained network activity. This robust transaction volume

highlights Solana’s position as a leading blockchain platform, with

developers and users continuing to rely on its scalability and

efficiency. Analysts suggest that holding above its key support

level could position SOL for a strong rebound, particularly if

broader market conditions stabilize. The increased on-chain

activity adds to this bullish outlook, signaling that long-term

fundamentals remain intact. Solana Holding Key Demand Solana

demonstrates resilience in the face of market turbulence, holding

above key demand levels around $210 following yesterday’s sell-off

triggered by the Federal Reserve’s policy announcements. This

critical support level reinforces bullish sentiment for the asset,

with many analysts eyeing a breakout on the horizon. Top analyst

Jelle recently provided a compelling technical analysis on X,

noting that Solana successfully took out the lows, maintained its

position above monthly and weekly support levels, and continued to

trade within its falling wedge pattern. According to Jelle, this

setup suggests a breakout is imminent, with Solana targeting new

all-time highs soon. Supporting this optimistic outlook, on-chain

metrics paint a promising picture for Solana’s network activity.

Ali Martinez shared data showing the Solana network nearing 67

million daily transactions, underscoring strong adoption and user

engagement. This heightened network activity highlights Solana’s

utility and strengthens the foundation for sustained price growth.

Related Reading: XRP Consolidation Could End Once It Clears $2.60 –

Top Analyst Expects $4 Soon If Solana holds above the $210 level in

the coming days, it could trigger a significant rally as bullish

momentum builds. Traders and investors are closely watching the

asset’s price action for signs of a decisive move, with the

combination of strong technical and on-chain indicators pointing

toward a potential surge to new highs. Price Action: Liquidity

Resting Above Solana is trading at $210, a key level it has held

for several days despite broader market volatility. This price

point demonstrates solid demand, but holding this level alone won’t

ignite the next rally. A decisive push above $240 is critical for

Solana to regain bullish momentum. This move would signal renewed

strength and pave the way for higher price targets. A crucial

intermediate step lies at the $225 mark. If Solana can reclaim this

level with conviction, it would likely confirm a bullish trend and

set the stage for further upward momentum. This could attract

additional buying interest as traders and investors interpret the

move as a signal of strength. Related Reading: Ethereum Whales Load

Up: Bullish Sign Or Bear Trap? Failing to break above these

resistance levels, however, may keep Solana range-bound and limit

its ability to capitalize on the recent support it has established.

As market conditions continue to evolve, Solana’s ability to push

past these key thresholds will determine whether it transitions

into a stronger upward trajectory or remains stuck in

consolidation. Featured image from Dall-E, chart from

TradingView

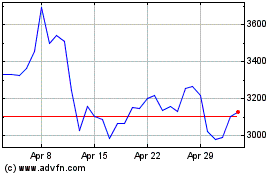

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024