Bitcoin Price Is Trading In This Bearish Flag — What’s The Downside Target?

03 February 2025 - 5:00AM

NEWSBTC

The Bitcoin price has shown some level of resilience above $100,000

in the past few weeks, weathering the storm of uncertainty that

came with Donald Trump’s inauguration and the launch of the Chinese

AI platform DeepSeek. However, a prominent analyst on the social

media platform X has come forward with a worrying prediction for

the premier cryptocurrency. BTC Price Breaks Below Bear Flag

Pattern — $98,000 Next? In a February 1 post on X, popular crypto

pundit Ali Martinez shed light onto an interesting flag pattern the

Bitcoin price has been trading inside. According to the analyst,

the flagship cryptocurrency could see its value plunge below the

$100,000 mark over the coming days. Related Reading: Bitcoin

Outflows Signal Bullish Strength As Demand Remains High At $100K –

What This Means The rationale behind this bearish forecast is the

formation of a bear flag pattern on the 30-minute Bitcoin price

chart. A bear flag is a pattern used in technical price analysis

characterized by an almost vertical price drop (flagpole) followed

by a brief consolidation period. This technical analysis is an

inverse of the more popular bull flag pattern, which typically

suggests a continuation of an upward trend. A bear flag, on the

other hand, indicates that a price downtrend is likely to persist.

Typically, the upper and lower boundaries of the consolidation

range in the flag pattern act as resistance and support,

respectively. Hence, it is essential to wait for a successful break

beneath the consolidation for the confirmation of the bearish

signal. As shown in the chart above, the Bitcoin price has broken

beneath the lower boundary and could be on its way to $98,200.

According to Martinez, this bearish setup could be invalidated if

the premier cryptocurrency jumps towards $102,800. While dropping

to 98,200 doesn’t do well for the bullish case of Bitcoin, the

market leader still stands a chance at recovery from this level.

However, investors might need to watch out for the $97,190 zone

just beneath it. Martinez noted in another post on X that the

$97,190 region is one of the most important support levels for

Bitcoin price based on investors’ cost basis. With over 1.45

million addresses purchasing 1.36 million BTC at this level,

holding above $97,190 could prove pivotal to sustaining the bull

market. Bitcoin Price At A Glance As of this writing, the price of

BTC sits just beneath the $100,000, reflecting an almost 2% decline

in the past 24 hours. According to data from CoinGecko, the

flagship cryptocurrency is down by over 4% on the weekly timeframe.

Related Reading: Bitcoin Price In Trouble? Bearish Divergence That

Led To Market Crash Last Cycle Returns Featured image created by

Dall-E, chart from TradingView

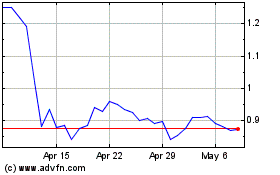

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025