HBAR Prices Crashes 35% As BlackRock Denies Any Ties To Hedera

26 April 2024 - 12:00AM

NEWSBTC

HBAR, Hedera’s native token, saw a sharp correction following

clarification that the world’s largest asset manager, BlackRock,

was not directly involved in the tokenization of its ICS Treasury

Fund on the Hedera network. HBAR Token Crashes By Almost 35%

Data from CoinGecko shows that the HBAR token has declined by

almost 35% since its price rose by over 100% on the back of the

announcement, which many misinterpreted to mean that BlackRock

tokenized its fund on the Hedera network. On April 24, the Hedera

Foundation shared that Blockchain trading firm Archax and

Infrastructure firm Ownera had collaborated to tokenize BlackRock’s

ICS US Treasury money market fund (MMF) on Hedera. Related Reading:

XRP Price Ready For 70% Breakout As Long-Term Consolidation Nears

Its End Members of the crypto community, including influencers like

CrediBULL Crypto and Mason Versluis, misconstrued this as meaning

that BlackRock had tokenized its fund on Hedera. This assumption

immediately created a bullish narrative for the ecosystem, leading

to HBAR’s price rallying by over 100% and peaking at

$0.176. However, the crypto token has since been on a

downtrend, with BlackRock denying any involvement with Hedera.

Specifically, a BlackRock spokesperson told Cointelegraph that the

world’s largest asset manager “has no commercial relationship with

Hedera nor has BlackRock selected Hedera to tokenize any BlackRock

funds.” Meanwhile, Archax’s co-founder had also clarified on his X

(formerly Twitter) platform that BlackRock wasn’t directly involved

in the whole move. He claimed that tokenization of the fund can

usually be done without the permission of the asset manager.

However, he revealed that BlackRock knew they were tokenizing on

the network. Why The News Is Still Bullish For The Hedera Ecosystem

Despite BlackRock not being directly involved in this development,

crypto analyst CrediBULL Crypto offered some perspective on why

this news is still bullish for Hedera and its HBAR token. He

revealed that BlackRock is the fourth largest shareholder of ABRDN,

a firm that is a primary investor in Archax. Related Reading: Brace

For Impact: Worldcoin Team Plans To Sell 1.5 Million WLD Tokens

Every Week For 6 Months Therefore, the crypto analyst believes that

BlackRock must have signed off on this move, something he considers

a “de-facto endorsement of the product.” Meanwhile, he also alluded

to an interview that revealed that BlackRock chose Hedera, although

ABRDN introduced them to the network. CrediBULL Crypto noted

that even if BlackRock wasn’t building on the network, it is clear

that “major enterprises are using Hedera.” They are “actively

involved with building on the network and are constantly pushing to

move it forward behind the scenes,” he added. He suggested that

this puts Hedera above 99% of networks that can’t boast of such

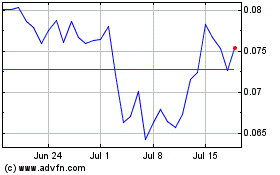

achievements. HBAR price crashes 35% from highs | Source:

HBARUSDT on Tradingview.com Featured image from Vecteezy, chart

from Tradingview.com

Hedera Hashgraph (COIN:HBARUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hedera Hashgraph (COIN:HBARUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025