Bitcoin Derivatives Market Heating Up Again: Brace For Impact?

14 December 2024 - 3:30PM

NEWSBTC

Data shows that the indicators related to the Bitcoin derivatives

market have recently been heating up, which could lead to more

volatility in BTC’s price. Bitcoin Open Interest & Leverage

Ratio Have Shot Up As pointed out by CryptoQuant community analyst

Maartunn in a new post on X, the Bitcoin Open Interest has

registered a sharp increase alongside the asset’s return above the

$100,000 level. The “Open Interest” here refers to a metric that

keeps track of the total amount of derivatives positions related to

BTC that are currently open on all centralized exchanges. Related

Reading: Bitcoin Returns Above $100,000 As Monthly Inflows Hit $80

Billion Below is the chart shared by the analyst that shows the

trend in the percentage change of the Bitcoin Open Interest over

the past month: As displayed in the graph, the Bitcoin Open

Interest has witnessed a sharp positive change recently, which

implies a large number of positions have popped up on the market.

In the chart, Maartunn has highlighted the previous instances of

the indicator observing a large percentage increase. It would

appear that the price generally saw a cooldown when this pattern

formed during the past month. As for the reason behind this trend,

the answer is that more positions usually imply the presence of a

higher amount of leverage in the sector. A chaotic event known as a

squeeze can become more likely to occur in these circumstances.

During a squeeze, a large number of positions are liquidated at

once and provide fuel to the price move that caused them. The

elongated price move then unleashes a cascade of further

liquidations. A squeeze can be more probable to affect the side of

the market that has the more leveraged positions. The previous

increases in the Open Interest came alongside uptrends, so the new

positions were likely long ones. This may be why the market ended

up seeing a long squeeze to wipe out these excess positions. It’s

possible that the latest Open Interest increase could also lead to

a similar outcome for Bitcoin, since these fresh positions have

also come alongside a rally. It all depends, however, on whether

these positions are overleveraged or not. Unfortunately for the

cryptocurrency, this requirement also seems to be fulfilled, as

data for the Estimated Leverage Ratio shared by CryptoQuant author

IT Tech in an X post suggests. The Estimated Leverage Ratio tells

us, as its name implies, the average amount of leverage that the

users on the derivatives market are opting for. Given that this

metric has also spiked alongside the Open Interest increase, the

new positions that have appeared could be carrying significant

leverage. Related Reading: XRP Bull Flag Breakout Could Lead Price

To $4, Analyst Says It now remains to be seen how Bitcoin will

develop in the coming days, given the potential overheated

conditions that have developed in these derivatives indicators. BTC

Price At the time of writing, Bitcoin is floating around $100,400,

up more than 2% over the last seven days. Featured image from

Dall-E, CryptoQuant.com, chart from TradingView.com

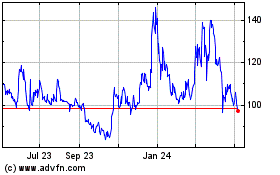

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

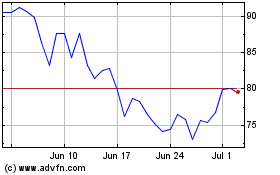

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024