Altcoins Season: Recent Crypto Dip Shows Decline May Be Over And Bulls Are Taking Charge

09 February 2025 - 2:30PM

NEWSBTC

Altcoins are showing signs of strength as the cryptocurrency market

begins to recover from a significant correction in February. This

rebound has pushed the total crypto market cap upward after

bouncing off the $3 trillion mark on February 2. Related Reading:

Bitcoin Dominance 2021 Vs. 2025: Why Striking Similarities May Show

If An Altcoin Season Is Possible Notwithstanding, this correction

saw the altcoin market cap dip massively after a rejection at $425

billion. However, a key observation from crypto analyst Rekt

Capital noted that despite the rejection from this significant

resistance level, the pullback in altcoin market capitalization is

much shallower than in previous downturns. This observation shows

that the bulls might be slowly taking charge among altcoins.

Altcoins: Market Cap Faces Rejection At $425 Billion, But Altcoins

Gain Strength Rekt Capital’s technical analysis underscores the

importance of the $425 billion resistance level for the altcoin

market, particularly focusing on the total market capitalization of

altcoins outside the top 10. This analysis comes amid a broader

downturn in the altcoin sector over the past week, which is a

continuation of a longer correction that began in early January

when the market cap peaked at a multi-year high of approximately

$440 billion. Despite facing strong rejection at this key level,

the depth of the latest retracement remains notably shallower than

previous corrections. The current pullback measures around 50% from

the $425 billion resistance, whereas the last two significant

downturns saw steeper declines of 69% and 85%. This milder

retracement is a change that could influence the trajectory of the

altcoin market. A key takeaway from this trend is the apparent

weakening of resistance at $425 billion, which indicates that

bearish momentum after the retracement across the altcoin market

isn’t as strong as it was in the previous cycles. Unlike previous

cycles, where heavy selling led to deeper drawdowns, the current

price action signals growing market resilience. What Does This Mean

For An Altcoin Season? Rekt Capital’s analysis aligns with the

expectations of investors eagerly anticipating the arrival of the

altcoin season. The relatively shallow pullback from the $425

billion resistance level strengthens the argument that this altcoin

season could unfold better than in the past two cycles. Crypto

analysts like Rekt Capital are fervently anticipating an altcoin

season to roll into action, where profits in Bitcoin starts rolling

into altcoins and the altcoin market outperforms Bitcoin. In

another analysis, Rekt Capital noted a recent rejection of the

Bitcoin dominance around 64%. However, he did note that history

shows that rejections around 64% are mostly momentarily, and the

real rejection is around 71%. When the Bitcoin dominance reaches

here, a repeat of history could see it reject very harshly into a

cycle-defining altseason. Related Reading: Final Dip?

Dogecoin Correction Could Precede A Record Surge—Analyst For now,

Bitcoin dominance remains strong, and a full-fledged altcoin season

has yet to materialize. Analysts like Benjamin Cowen suggest that

the anticipated altcoin rally may be on pause, with Bitcoin

continuing to absorb the majority of market liquidity. Until

dominance shows a clearer reversal, altcoin investors may have to

wait a little longer. Featured image from Pexels, chart from

TradingView

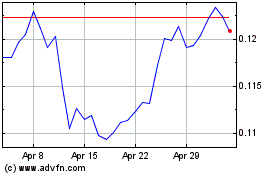

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025