XRP Slides After Failing To Reclaim $2.9, What’s Next For Bulls?

10 December 2024 - 1:30AM

NEWSBTC

XRP’s upward momentum has taken a hit after the price failed

to reclaim its previous high of $2.9, sparking a fresh decline that

has resulted in the price dropping toward previous support levels.

The rejection has raised questions about the strength of the bulls

and whether they can regain control to steer the price back to

higher levels. Bearish Build-Up On The 4-Hour Timeframe With

bearish pressure mounting, the focus now shifts to key support

zones and whether the bulls can hold firm against the downside

movement, preventing XRP from experiencing a much deeper

correction. Related Reading: XRP To Maintain Price Rally As Whales

Reload Amidst Price Dip- Details On the 4-hour chart, XRP exhibits

negative sentiment, attempting to drop below the 100-day Simple

Moving Average (SMA) as it trends downward toward the $1.9 support

level. Specifically, a continued descent to this support suggests

that selling pressure is intensifying, and if the support fails to

hold, the asset could experience more declines. Also, an analysis

of the 4-hour chart reveals that the Composite Trend Oscillator’s

trend line has fallen below the SMA line, signaling a potential

shift in momentum as it edges closer to the zero line. This

indicates a struggle to sustain upward movements and points to

moderate bearish pressure, leading to a cautious market sentiment.

If the signal line continues to drop, it may trigger heightened

selling activity. Price Set Up For XRP On The 1-Day Timeframe On

the daily chart, the crypto giant displays significant downward

movement, highlighted by a bearish candlestick after a failed

recovery attempt to surge toward its previous high of $2.9. The

inability to sustain an uptrend implies a lack of buyer confidence

and a prevailing pessimistic sentiment in the market. As XRP aims

at the $1.9 support level, the pressure from sellers could

intensify, raising concerns about the possibility of a breakdown.

Finally, the 1-day Composite Trend Oscillator signals growing

bearish momentum, with the indicator’s signal line dropping below

the SMA after lingering in the overbought zone. This development

suggests a possible shift in market dynamics as the overbought

conditions may give way to increased selling pressure. A crossover

of the signal line below the SMA is often interpreted as a bearish

signal, indicating that the upside momentum could be weakening.

Related Reading: XRP Price Steadies Above Support: Preparing for

the Next Move? Conclusively, as XRP faces renewed negative

pressure, key support levels become crucial in determining its next

move. Meanwhile, the first level to watch is $1.9, which could act

as an initial buffer against further declines. A sustained break

below this level might open the door for a deeper drop toward $1.7,

a region of significant historical activity. If bearish momentum

persists, the $1.3 mark could serve as the last line of defense

before a broader selloff ensues. Featured image from Adobe Stock,

chart from Tradingview.com

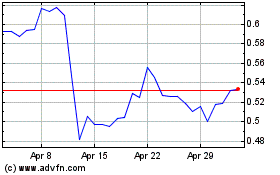

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024