Bouygues: Nine-month 2024 results

NINE-MONTH 2024 RESULTS

- Group

outlook for 2024 confirmed: sales and current operating profit from

activities (COPA) expected to be slightly up on 2023

-

Construction businesses: backlog at a very high level,

providing visibility on future activity

- Equans:

year-on-year increase in sales, COPA, margin from activities and

net cash, reflecting the continued successful execution of the

strategic Perform plan

- Bouygues

Telecom: strong performance in Fixed, and still a competitive

market environment in Mobile. Launch of the new B.iG brand and the

new B&YOU Pure fibre offer on the B2C market. Completion of the

La Poste Telecom transaction expected before the end of the

year

- Net debt

at €8.5bn at end-September 2024, improving versus end-September

2023

The Board of Directors, chaired by Martin

Bouygues, met on 4 November 2024 to close off the financial

statements for the first nine months of 2024.

KEY FIGURES

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Sales |

41,492 |

|

40,888 |

|

+1% |

a |

|

Current operating profit/(loss) from

activities |

1,719 |

|

1,623 |

|

+96 |

|

|

Margin from activities |

4.1% |

|

4.0% |

|

+0.1 pts |

|

|

Current operating profit/(loss) ᵇ |

1,651 |

|

1,546 |

|

+105 |

|

|

Operating profit/(loss) ᶜ |

1,474 |

|

1,400 |

|

+74 |

|

|

Financial result |

(287) |

|

(316) |

|

+29 |

|

|

Net profit/(loss) attributable to the Group |

687 |

d |

665 |

|

+22 |

|

(a) Up 2% like-for-like and at constant exchange

rates.

(b) Includes PPA amortisation of €68m in 9M 2024 and of €77m in 9M

2023.

(c) Includes net non-current charges of €177m in 9M 2024 and of

€146m in 9M 2023.

(d) Excluding the future increase in the tax rate for 2024 which

would result from the new French Finance Act.

|

(€ million) |

End-Sept 2024 |

|

End-Dec 2023 |

|

End-Sept 2023 |

|

|

|

|

|

|

|

|

|

|

Net surplus cash (+)/net debt (-) |

(8,474) |

|

(6,251) |

|

(10,238) |

|

-

Nine-month 2024 sales were €41.5 billion, up

1% versus nine-month 2023, driven mainly by Equans and Bouygues

Construction. Like-for-like and at constant exchange rates, sales

increased 2% year-on-year.

-

Current operating profit from activities (COPA)

was €1,719 million, up €96 million year-on-year, driven

mainly by Equans, where COPA increased €97 million

year-on-year, and to a lesser extent by Bouygues Construction and

Bouygues Telecom. COPA declined €50 million year-on-year at

Bouygues Immobilier, resulting in a current operating loss from

activities of €49 million, in particular due to a sharp

decline in its business activity. The adaptation measures put in

place are expected to begin producing results in fourth-quarter

2024.

- Net profit attributable to

the Group was €687 million1, up

€22 million year-on-year. This includes:

- amortisation and impairment of

intangible assets recognised in acquisitions (PPA) of

€68 million (of which €40 million at Bouygues SA related

to the acquisition of Equans), versus €77 million in

nine-month 2023;

- net non-current charges2

of €177 million, which do not reflect the operational

performance of the business segments. This mainly includes the

Management Incentive Plan at Equans, which was recognised this year

over the first nine months whereas it was not implemented until the

second quarter in 2023, the impact on Bouygues Construction of a

regulatory change in the UK, and the cost of adaptation measures at

Bouygues Immobilier. TF1 and Bouygues Telecom recognised lower

amounts of net non-current charges;

- financial result of

-€287 million, compared with -€316 million in nine-month

2023. This improvement was mainly due to the combined effect of a

higher level of net cash and the return on net cash, given that

debt is at fixed rates;

- income tax expense of

€392 million, versus €363 million in the first nine

months of 2023.

- Net debt was

€8.5 billion at end-September 2024, improving versus

end-September 2023. Net gearing3 was 61% at

end-September 2024 (versus 74% at end-September 2023).

OUTLOOK FOR 2024 CONFIRMED

The outlook below is based on information

known to date.

Outlook for the Group

In 2024, Equans will continue to improve its

results in line with its strategic Perform plan. Bouygues

Immobilier will continue to face a challenging market environment,

with low visibility on the timetable for recovery.

In an uncertain economic and geopolitical environment, and after a

year of strong growth, Bouygues is targeting sales and current

operating profit from activities (COPA) for 2024 that are slightly

up on 2023.

Outlook for Equans

In 2024, Equans will continue to roll out its

strategic plan. It will remain focused on improving performance in

a supportive environment and will continue to prioritise margins

over volume growth. The 2024 sales figure will be close to, yet

slightly above, that of 2023. It will factor in both the effects of

growth in Equans’ markets and the scope effect related to the

asset-based activity disposals at end-2023, and the selective

approach to contracts strategy.

As a reminder, Equans is aiming for:

- Sales: from 2025 onwards, an

acceleration in organic sales growth to align with that of market

peers

- Margin:

- In 2025, a current operating margin

from activities (COPA margin) close to 4%

- In 2027, a current operating margin

from activities (COPA margin) of 5%

- Cash: a cash conversion rate

(COPA-to-cash flow4) before working capital requirements

(WCR) of between 80% and 100%

Outlook for the TF1 group

The TF1 group maintains its outlook for 2024,

despite a more challenging economic environment for the rest of the

year:

- keep growing in digital, building

on the promising launch of TF1+;

- maintain a broadly stable current

operating margin from activities, close to that of 2023;

- continue to generate solid cash

flow, enabling the TF1 group to aim for a growing dividend policy

over the next few years.

Outlook for Bouygues

Telecom

In 2024, Bouygues Telecom confirms it is aiming

for:

- an increase in sales billed to

customers;

- EBITDA after Leases of above

€2 billion;

- Gross capital expenditure at around

€1.5 billion (excluding frequencies).

DETAILED ANALYSIS BY SECTOR OF

ACTIVITY

CONSTRUCTION BUSINESSES

At end-September 2024, the backlog in the

construction businesses (Bouygues Construction,

Colas and Bouygues Immobilier) reached the very high level of

€31.8 billion, up 7% year-on-year (up 8% at constant exchange

rates and excluding principal disposals and acquisitions), and

provides visibility on future activity. The international backlog

increased 6% year-on-year, driven notably by the award of major

contracts at Bouygues Construction, reflecting good momentum in

Civil Works. The backlog for France was up 9% year-on-year, driven

by both Bouygues Construction and Colas.

In the first nine months of 2024, Bouygues

Construction’s order intake was €10.1 billion,

supported by good momentum in the normal course of business

(contracts of less than €100 million), representing 47% of

total order intake in the first nine months of 2024. Order intake

was also driven by major contract awards, such as, in the third

quarter, contracts to build the Torrens to Darlington highway

tunnel (for over €2 billion), and redevelop Ryde Hospital (for

around €250 million) in Australia, to build a hotel complex in

the Dominican Republic (for around €120 million) and a

residential building in Florida (for around €100 million).

Bouygues Construction’s backlog stood at €17.9 billion at

end-September 2024, up 18% year-on-year (up 19% at constant

exchange rates and excluding principal disposals and acquisitions).

This growth was driven by Civil Works, where the backlog increased

43% year-on-year, while the Building backlog was broadly stable

year-on-year (up 1%).

Colas recorded an order intake of

€9.8 billion in the first nine months of 2024. In Roads, the

order intake increased slightly in France and was down

internationally year-on-year, related notably to the completion of

major projects and some delayed projects in North America, as well

as the geographic repositioning of activities in certain countries.

In Rail, the order intake was lower year-on-year, but is not

representative of business activity due to an unfavourable

comparison basis, and the disposal of Colas Rail Italy (which had

an order intake and backlog of around €0.4 billion). Colas’

backlog totalled €12.8 billion, almost stable at constant

exchange rates and excluding principal disposals and acquisitions.

The backlog as published was down 4% year-on-year, with Roads down

5% and Rail down 2% year-on-year5. The Rail backlog for

Colas at end-September 2024 had yet to include the renovation

contract for Line 1 of the Cairo metro.

Bouygues Immobilier still has to contend with a

challenging market environment. In France, Residential property

unit reservations showed some improvement. Commercial property

activity remains at a standstill. The backlog was 18% lower than at

end-September 2023.

The construction businesses reported sales of

€20.2 billion in the first nine months of 2024, up 1%

year-on-year, driven by Bouygues Construction. Like-for-like and at

constant exchange rates, sales also increased 1%. Bouygues

Construction’s sales rose 5% year-on-year. Sales rose slightly for

Civil Works (up 2% year-on-year). Sales for International Building

increased very sharply (up 17% year-on-year) while decreasing

slightly for France Building (down 3% year-on-year). Sales at Colas

were stable year-on-year, driven by Rail (up 5% year-on-year),

while Roads was stable year-on-year, as slightly higher sales in

France were offset by a slight decrease internationally. Bouygues

Immobilier’s sales declined 13%6 versus the first nine

months of 2023, reflecting the challenging market environment.

Sales from Residential property were down 11% year-on-year and

sales from Commercial property were very low.

The COPA in the construction businesses was

€476 million in the first nine months of 2024, down

€23 million year-on-year, and the COPA margin in the

construction businesses decreased slightly (down 0.1 point) over

the period to 2.4%.

Bouygues Construction’s COPA increased €29 million to

€219 million at end-September 2024 and its margin from

activities was 2.9%, improving by 0.3 points year-on-year. At

Colas, COPA was €306 million, almost stable year-on-year, and

its margin from activities was 2.6%, stable year-on-year. As a

reminder, COPA in third-quarter 2023 at Colas included a

significant gain on a land sale in the United States. COPA declined

€50 million year-on-year at Bouygues Immobilier, resulting in

a current operating loss from activities of €49 million,

notably due to a sharp decline in its business activity.

EQUANS

Equans posted an order intake of

€14.1 billion in the first nine months of 2024, up both in

France and internationally. Significant orders were booked in the

third quarter, including notably an electrical and mechanical works

contract for the healthcare sector in Canada and a contract to fit

out and install equipment in a UK data centre. Each contract is

worth approximately €140 million. Order intake also reflected

good momentum in recurrent maintenance contracts and in the normal

course of business. The underlying margin of the order intake

continued improving. Equans’ backlog was €25.8 billion at

end-September 2024, rising by 4% versus end-December 2023 but down

slightly year-on-year. This reflects the selective approach to

contracts strategy and the gradual exit from the new-build business

in the UK (building of new homes, notably social housing) due to

unfavourable market conditions.

Equans posted a 3% year-on-year increase in sales to

€14.1 billion for the first nine months of 2024, lifted by

overall solid momentum in France and abroad. This was despite the

divestment of activities in late 2023 and the gradual exit from the

new-build business in the UK. Sales were also driven by the major

growth posted by the speciality activities, particularly solar

power, data centres and smart factories. Current operating profit

from activities was €474 million, an increase of

€97 million versus the first nine months of 2023. The margin

from activities was therefore 3.4%, up 0.6 points versus the first

nine months of 2023, reflecting the continued successful roll-out

of the Perform plan in all of Equans’ operating units.

TF1

TF1 group’s audience ratings remained at a high

level for the first nine months of 2024, with an audience share of

33% in the WPDM 507 category and of 30% among

individuals aged 25-49.

TF1 group reported sales of €1.6 billion in the first nine

months of 2024, representing a 3% increase year-on-year (up 2%

like-for-like and at constant exchange rates):

- Media sales rose by 4%

year-on-year, with advertising revenue up 5% year-on-year, driven

notably by digital, namely the performance of TF1+, where

advertising revenue increased 40% year-on-year, confirming the

platform’s appeal to advertisers. In linear TV, advertising revenue

rose 2% year-on-year;

- Sales at Newen Studios totalled

€192 million, down 3% versus the first nine months of 2023.

Johnson Production Group (JPG), a TV film production and

distribution company acquired in late July, added €8 million

to third-quarter sales. As previously announced, Newen’s business

will be concentrated on the fourth quarter, with the delivery of

flagship shows such as the second seasons of

Marie-Antoinette and Memento Mori.

Current operating profit from activities (COPA)

was €198 million, close to the nine-month 2023 figure,

reflecting a €43 million year-on-year increase in the

programming costs, exceptional expenditure related to the launch of

TF1+ and the positive impact of a brand licence divestment in the

third quarter. The margin from activities was 12.4%, a decrease of

0.7 points year-on-year.

BOUYGUES TELECOM

In Fixed, FTTH customers totalled

four million at end-September 2024, thanks to 408,000 new adds

in the first nine months of 2024, of which 159,000 in the third

quarter. The Fixed customer base was 5.1 million, of which

82,000 new adds in the third quarter. The share of Fixed customers

subscribing to a FTTH plan continued to increase, reaching 79%

versus 71% one year earlier. Bouygues Telecom continued extending

its geographical reach, with national coverage at around 90% and

with 37.5 million FTTH premises marketed to date. Bouygues

Telecom is targeting around 40 million by the end of 2026.

Year-on-year, Fixed ABPU increased €2.3 to €33.2 per customer

per month.

Mobile plan customers excluding MtoM totalled

15.8 million, thanks to 246,000 new adds in the first nine

months of the year (of which 170,000 in the third quarter),

compared with new adds of 217,000 in the first nine months of 2023

(of which 108,000 in the third quarter of 2023). As expected, ABPU

Mobile decreased €0.2 year-on-year to €19.6 per customer per month,

due to sustained competition in the low-end segment and the rising

cost of living, which has been leading some customers to migrate to

cheaper plans.

Sales billed to customers reached €4.6 billion, up 5% versus

the first nine months of 2023. Sales from services rose 4%

year-on-year. In total, Bouygues Telecom’s sales were stable

year-on-year, impacted by the decline in Other sales (down 13%

year-on-year), which mainly consist of Handset, Accessories and

Built-to-suit sales.

EBITDA after Leases came to €1,506 million

in the first nine months of 2024, rising by €55 million

year-on-year. This was driven by higher sales billed to customers

combined with sustained efforts to control costs amid the rising

operating expenses associated with the sharp growth in the FTTH

customer base. EBITDA after Leases margin was 32.5%, almost

unchanged versus end-September 2023.

Current operating profit from activities (COPA) was

€603 million, up €18 million year-on-year. The increase

in EBITDA after Leases was partially offset by the increase in

depreciation and amortisation over the period. A review of some

depreciation periods for certain assets has nonetheless led to a

one-off positive effect on COPA in third-quarter 2024. Operating

profit was €571 million and included net non-current charges

of €14 million.

Gross capital expenditure excluding frequencies amounted to

€1,084 million at end-September 2024, in line with full-year

outlook.

Acquisition of La Poste

Telecom

In its press release dated 29 May 2024, Bouygues

Telecom stated that it had been informed by SFR and La Poste of

divergences between them concerning the terms and conditions of the

transaction provided for in the exclusivity agreement signed by

Bouygues Telecom with the La Poste group for the acquisition of La

Poste Telecom.

Bouygues Telecom was informed that these

divergences have been resolved on 4 November 2024.

In addition, as the necessary administrative

authorisations have been obtained and SFR has waived its

pre-emption right, the parties have agreed to complete the

transaction before the end of the year.

Bouygues Telecom will adapt its guidance to

factor in the acquisition of La Poste Telecom in the months

following completion of the transaction at the latest.

FINANCIAL SITUATION

At €13.9 billion, the Group maintained a

very high level of liquidity, which comprised €2.7 billion in

cash and equivalents, supplemented by €11.2 billion in undrawn

medium- and long-term credit facilities.

Net debt at end-September 2024 was

€8.5 billion, versus €6.3 billion at end-December 2023

and €10.2 billion at end-September 2023. The change between

end-December 2023 and end-September 2024 reflected mainly:

- payment of dividends for

-€813 million;

- acquisitions and disposals for

-€214 million; and

- net cash used in operating

activities, which amounted to -€1.1 billion.

In the first nine months of 2024, the change in

working capital requirements (WCR) related to operating activities

and other was a negative €2.0 billion, representing an

improvement relative to the prior-year period, in which this change

was a negative €2.2 billion.

Net gearing8 was 61%, an improvement

versus end-September 2023 (74%). Net gearing at end-December 2023

was 44%.

At end-September 2024, the average maturity of

the Group’s bonds was 7.6 years, and the average coupon was

3.01% (average effective rate of 2.25%). The debt maturity schedule

is well spread over time, and the next bond redemption will be in

October 2026.

The long-term credit ratings assigned to the

Group by Moody’s and Standard & Poor’s are: A3, stable outlook,

and A-, negative outlook, respectively.

FINANCIAL CALENDAR

6 March 2025: Full-year 2024 results (7.30am

CET)

The financial statements have been subject to a limited review

by the statutory auditors and the corresponding report has

been issued.

You can find the full financial statements and

notes to the financial statements on www.bouygues.com/results.

The results presentation conference call for analysts will start at

9.00am (CET) on 5 November 2024.

Details on how to connect are available on www.bouygues.com.

The results presentation will be available before

the conference call starts

on www.bouygues.com/results.

ABOUT BOUYGUES

Bouygues is a diversified services group operating in over 80

countries with 201,500 employees all working to make life better

every day. Its business activities in construction

(Bouygues Construction, Bouygues Immobilier, Colas);

energies & services (Equans);

media (TF1) and telecoms

(Bouygues Telecom) are able to drive growth since they all satisfy

constantly changing and essential needs.

INVESTORS AND ANALYSTS

CONTACT:

investors@bouygues.com • Tel.: +33 (0)1 44 20 11 01

PRESS CONTACT:

presse@bouygues.com • Tel.: +33 (0)1 44 20 12 01

BOUYGUES SA • 32 avenue Hoche •

75378 Paris Cedex 08 • bouygues.com

NINE-MONTH 2024 BUSINESS

ACTIVITY

BACKLOG IN THE CONSTRUCTION

BUSINESSES

|

(€ million) |

End-Sept 2024 |

End-Sept 2023 |

Change |

|

|

|

|

|

|

|

|

Bouygues Construction |

17,924 |

15,147 |

+18% |

a |

|

Bouygues Immobilier |

1,005 |

1,226 |

-18% |

b |

|

Colas |

12,827 |

13,403 |

-4% |

c |

|

Total |

31,756 |

29,776 |

+7% |

d |

(a) Up 19% at constant exchange rates and

excluding principal disposals and acquisitions.

(b) Down 18% at constant exchange rates and

excluding principal disposals and acquisitions.

(c) Down 1% at constant exchange rates and

excluding principal disposals and acquisitions.

(d) Up 8% at constant exchange rates and

excluding principal disposals and acquisitions.

BOUYGUES CONSTRUCTION ORDER

INTAKE

|

(€ million) |

9M 2024 |

9M 2023 |

Change |

|

|

|

|

|

|

|

|

France |

3,011 |

2,722 |

+11% |

|

|

International |

7,054 |

5,418 |

+30% |

|

|

Total |

10,065 |

8,140 |

+24% |

|

BOUYGUES IMMOBILIER

RESERVATIONS

|

(€ million) |

9M 2024 |

9M 2023 |

Change |

|

|

|

|

|

|

|

|

Residential property |

1,024 |

878 |

+17% |

|

|

Commercial property |

7 |

30 |

-77% |

|

|

Total |

1,031 |

908 |

+14% |

|

COLAS BACKLOG

|

(€ million) |

End-Sept 2024 |

End-Sept 2023 |

Change |

|

|

|

|

|

|

|

|

Mainland France |

3,631 |

3,303 |

+10% |

|

|

International and French overseas territories |

9,196 |

10,100 |

-9% |

|

|

Total |

12,827 |

13,403 |

-4% |

|

EQUANS BACKLOG

|

(€ million) |

End-Sept 2024 |

End-Sept 2023 |

Change |

|

|

|

|

|

|

|

|

Total |

25,778 |

25,985 |

-1% |

|

TF1 AUDIENCE

SHARE a

|

(%) |

End-Sept 2024 |

End-Sept 2023 |

Change |

|

|

|

|

|

|

|

|

Total |

33.0% |

33.3% |

-0.3 pts |

|

(a) Source Médiamétrie – Women under 50 who are

purchasing decision-makers.

BOUYGUES TELECOM CUSTOMER BASE

|

(‘000) |

End-Sept 2024 |

End-Dec 2023 |

Change |

|

|

|

|

|

|

|

|

Mobile customer base excl. MtoM |

15,945 |

15,733 |

+212 |

|

|

Mobile plan base excl. MtoM |

15,756 |

15,510 |

+246 |

|

|

Total mobile customers |

24,196 |

23,451 |

+745 |

|

|

FTTH customers |

3,975 |

3,567 |

+408 |

|

|

Total fixed customers |

5,054 |

4,902 |

+152 |

|

NINE-MONTH 2024 FINANCIAL

PERFORMANCE

GROUP CONDENSED CONSOLIDATED INCOME

STATEMENT

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Sales |

41,492 |

|

40,888 |

|

+1% |

a |

|

Current operating profit/(loss) from

activities |

1,719 |

|

1,623 |

|

+96 |

|

|

Amortisation and impairment of intangible assets recognised in

acquisitions (PPA) ᵇ |

(68) |

|

(77) |

|

+9 |

|

|

Current operating profit/(loss) |

1,651 |

|

1,546 |

|

+105 |

|

|

Other operating income and expenses |

(177) |

c |

(146) |

d |

-31 |

|

|

Operating profit/(loss) |

1,474 |

|

1,400 |

|

+74 |

|

|

Cost of net debt |

(185) |

|

(231) |

|

+46 |

|

|

Interest expense on lease obligations |

(77) |

|

(59) |

|

-18 |

|

|

Other financial income and expenses |

(25) |

|

(26) |

|

+1 |

|

|

Income tax |

(392) |

|

(363) |

|

-29 |

|

|

Share of net profits/(losses) of joint ventures and associates |

5 |

|

50 |

|

-45 |

|

|

Net profit/(loss) from continuing operations |

800 |

|

771 |

|

+29 |

|

|

Net profit/(loss) attributable to non-controlling interests |

(113) |

|

(106) |

|

-7 |

|

|

Net profit/(loss) attributable to the Group |

687 |

|

665 |

|

+22 |

|

(a) Up 2% like-for-like and at constant exchange

rates.

(b) Purchase Price Allocation.

(c) Includes net non-current charges of €33m at Bouygues

Construction, of €27m at Bouygues Immobilier, of €67m at Equans, of

€19m at TF1, of €14m at Bouygues Telecom and of €17m at

Bouygues SA.

(d) Includes net non-current charges of €60m at Bouygues

Construction, of €7m at Colas, of €47m at Equans, of €24m at TF1,

of €7m at Bouygues Telecom and of €1m at Bouygues SA.

GROUP SALES BY SECTOR OF

ACTIVITY

|

(€ million) |

9M 2024 |

9M 2023 |

Change |

Forex effect |

Scope effect |

Lfl &

constant fx ᶜ |

|

|

|

|

|

|

|

|

|

Construction businesses ᵃ |

20,187 |

19,996 |

+1% |

0% |

0% |

+1% |

|

o/w Bouygues Construction |

7,569 |

7,210 |

+5% |

0% |

+1% |

+5% |

|

o/w Bouygues Immobilier |

963 |

1,109 |

-13% |

0% |

0% |

-14% |

|

o/w Colas |

11,794 |

11,805 |

0% |

0% |

0% |

0% |

|

Equans |

14,084 |

13,726 |

+3% |

0% |

+1% |

+3% |

|

TF1 |

1,591 |

1,548 |

+3% |

0% |

-1% |

+2% |

|

Bouygues Telecom |

5,714 |

5,700 |

0% |

0% |

0% |

0% |

|

Bouygues SA and other |

163 |

176 |

nm |

- |

- |

nm |

Intra-Group

eliminations ᵇ |

(386) |

(386) |

nm |

- |

- |

nm |

|

Group sales |

41,492 |

40,888 |

+1% |

0% |

0% |

+2% |

|

o/w France |

20,099 |

19,987 |

+1% |

0% |

0% |

0% |

|

o/w international |

21,393 |

20,901 |

+2% |

0% |

+1% |

+3% |

(a) Total of the sales contributions (after

eliminations within the construction businesses).

(b) Including intra-Group eliminations of the construction

businesses.

(c) Like-for-like and at constant exchange rates.

CALCULATION OF GROUP EBITDA AFTER

LEASES a

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Group current operating profit/(loss) from

activities |

1,719 |

|

1,623 |

|

+96 |

|

|

Amortisation and impairment of intangible assets recognised in

acquisitions (PPA) |

(68) |

|

(77) |

|

+9 |

|

|

Interest expense on lease obligations |

(77) |

|

(59) |

|

-18 |

|

|

Net charges for depreciation, amortisation and impairment losses on

property, plant and equipment and intangible assets |

1,667 |

|

1,668 |

|

-1 |

|

Charges to provisions and other impairment losses,

net of reversals due to utilisation |

52 |

|

1 |

|

+51 |

|

|

Reversals of unutilised provisions and impairment losses and

other |

(220) |

|

(177) |

|

-43 |

|

|

Group EBITDA after Leases |

3,073 |

|

2,979 |

|

+94 |

|

(a) See glossary for definitions.

CONTRIBUTION TO GROUP EBITDA AFTER

LEASES a BY

SECTOR OF ACTIVITY

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

638 |

|

727 |

|

-89 |

|

|

o/w Bouygues Construction |

181 |

|

210 |

|

-29 |

|

|

o/w Bouygues Immobilier |

(38) |

|

(8) |

|

-30 |

|

|

o/w Colas |

495 |

|

525 |

|

-30 |

|

|

Equans |

555 |

|

442 |

|

+113 |

|

|

TF1 |

402 |

|

375 |

|

+27 |

|

|

Bouygues Telecom |

1,506 |

|

1,451 |

|

+55 |

|

|

Bouygues SA and other |

(28) |

|

(16) |

|

-12 |

|

|

Group EBITDA after Leases |

3,073 |

|

2,979 |

|

+94 |

|

(a) See glossary for definitions.

CONTRIBUTION TO GROUP CURRENT OPERATING

PROFIT FROM ACTIVITIES

(COPA) a BY

SECTOR OF ACTIVITY

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

476 |

|

499 |

|

-23 |

|

|

o/w Bouygues Construction |

219 |

|

190 |

|

+29 |

|

|

o/w Bouygues Immobilier |

(49) |

|

1 |

|

-50 |

|

|

o/w Colas |

306 |

|

308 |

|

-2 |

|

|

Equans |

474 |

|

377 |

|

+97 |

|

|

TF1 |

198 |

|

204 |

|

-6 |

|

|

Bouygues Telecom |

603 |

|

585 |

|

+18 |

|

|

Bouygues SA and other |

(32) |

|

(42) |

|

+10 |

|

|

Group current operating profit/(loss) from

activities |

1,719 |

|

1,623 |

|

+96 |

|

(a) See glossary for definitions.

RECONCILIATION OF CURRENT OPERATING PROFIT

FROM ACTIVITIES (COPA) TO CURRENT OPERATING PROFIT (COP) FOR THE

FIRST NINE MONTHS OF 2024

|

(€ million) |

COPA |

|

PPA amortisation ᵃ |

|

COP |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

476 |

|

-8 |

|

468 |

|

|

o/w Bouygues Construction |

219 |

|

-2 |

|

217 |

|

|

o/w Bouygues Immobilier |

(49) |

|

0 |

|

(49) |

|

|

o/w Colas |

306 |

|

-6 |

|

300 |

|

|

Equans |

474 |

|

0 |

|

474 |

|

|

TF1 |

198 |

|

-2 |

|

196 |

|

|

Bouygues Telecom |

603 |

|

-18 |

|

585 |

|

|

Bouygues SA and other |

(32) |

|

-40 |

|

(72) |

|

|

Total |

1,719 |

|

-68 |

|

1,651 |

|

(a) Amortisation and impairment of intangible

assets recognised in acquisitions.

RECONCILIATION OF CURRENT OPERATING PROFIT

FROM ACTIVITIES (COPA) TO CURRENT OPERATING PROFIT (COP) FOR THE

FIRST NINE MONTHS OF 2023

|

(€ million) |

COPA |

|

PPA amortisation ᵃ |

|

COP |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

499 |

|

-6 |

|

493 |

|

|

o/w Bouygues Construction |

190 |

|

0 |

|

190 |

|

|

o/w Bouygues Immobilier |

1 |

|

0 |

|

1 |

|

|

o/w Colas |

308 |

|

-6 |

|

302 |

|

|

Equans |

377 |

|

0 |

|

377 |

|

|

TF1 |

204 |

|

-3 |

|

201 |

|

|

Bouygues Telecom |

585 |

|

-22 |

|

563 |

|

|

Bouygues SA and other |

(42) |

|

-46 |

|

(88) |

|

|

Total |

1,623 |

|

-77 |

|

1,546 |

|

(a) Amortisation and impairment of intangible

assets recognised in acquisitions.

CONTRIBUTION TO GROUP CURRENT OPERATING

PROFIT (COP) BY SECTOR OF ACTIVITY

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

468 |

|

493 |

|

-25 |

|

|

o/w Bouygues Construction |

217 |

|

190 |

|

+27 |

|

|

o/w Bouygues Immobilier |

(49) |

|

1 |

|

-50 |

|

|

o/w Colas |

300 |

|

302 |

|

-2 |

|

|

Equans |

474 |

|

377 |

|

+97 |

|

|

TF1 |

196 |

|

201 |

|

-5 |

|

|

Bouygues Telecom |

585 |

|

563 |

|

+22 |

|

|

Bouygues SA and other |

(72) |

|

(88) |

|

+16 |

|

|

Group current operating profit/(loss) |

1,651 |

|

1,546 |

|

+105 |

|

CONTRIBUTION TO GROUP OPERATING PROFIT BY

SECTOR OF ACTIVITY

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

408 |

|

426 |

|

-18 |

|

|

o/w Bouygues Construction |

184 |

|

130 |

|

+54 |

|

|

o/w Bouygues Immobilier |

(76) |

|

1 |

|

-77 |

|

|

o/w Colas |

300 |

|

295 |

|

+5 |

|

|

Equans |

407 |

|

330 |

|

+77 |

|

|

TF1 |

178 |

|

177 |

|

+1 |

|

|

Bouygues Telecom |

571 |

|

556 |

|

+15 |

|

|

Bouygues SA and other |

(90) |

|

(89) |

|

-1 |

|

|

Group operating profit/(loss) |

1,474 |

a |

1,400 |

b |

+74 |

|

(a) Includes net non-current charges of €33m at

Bouygues Construction, of €27m at Bouygues Immobilier, of €67m at

Equans, of €19m at TF1, of €14m at Bouygues Telecom and of €17m at

Bouygues SA.

(b) Includes net non-current charges of €60m at Bouygues

Construction, of €7m at Colas, of €47m at Equans, of €24m at TF1,

of €7m at Bouygues Telecom and of €1m at Bouygues SA.

CONTRIBUTION TO NET PROFIT ATTRIBUTABLE TO

THE GROUP BY SECTOR OF ACTIVITY

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

235 |

|

288 |

|

-53 |

|

|

o/w Bouygues Construction |

157 |

|

130 |

|

+27 |

|

|

o/w Bouygues Immobilier |

(76) |

|

(2) |

|

-74 |

|

|

o/w Colas |

154 |

|

160 |

|

-6 |

|

|

Equans |

303 |

|

213 |

|

+90 |

|

|

TF1 |

67 |

|

63 |

|

+4 |

|

|

Bouygues Telecom |

263 |

|

279 |

|

-16 |

|

|

Bouygues SA and other |

(181) |

|

(178) |

|

-3 |

|

|

Net profit/(loss) attributable to the Group |

687 |

|

665 |

|

+22 |

|

NET SURPLUS CASH (+)/NET DEBT (-) BY

BUSINESS SEGMENT

|

(€ million) |

End-Sept 2024 |

|

End-Dec 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Bouygues Construction |

3,178 |

|

3,435 |

|

-257 |

|

|

Bouygues Immobilier |

(475) |

|

(150) |

|

-325 |

|

|

Colas |

(437) |

|

623 |

|

-1,060 |

|

|

Equans |

1,101 |

|

981 |

|

+120 |

|

|

TF1 |

364 |

|

505 |

|

-141 |

|

|

Bouygues Telecom |

(3,278) |

|

(2,625) |

|

-653 |

|

|

Bouygues SA and other |

(8,927) |

|

(9,020) |

|

+93 |

|

|

Net surplus cash (+)/net debt (-) |

(8,474) |

|

(6,251) |

|

-2,223 |

|

|

Current and non-current lease obligations |

(2,948) |

|

(3,017) |

|

+69 |

|

CONTRIBUTION TO GROUP NET CAPITAL

EXPENDITURE BY SECTOR OF ACTIVITY

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

215 |

|

128 |

|

+87 |

|

|

o/w Bouygues Construction |

84 |

|

31 |

|

+53 |

|

|

o/w Bouygues Immobilier |

1 |

|

3 |

|

-2 |

|

|

o/w Colas |

130 |

|

94 |

|

+36 |

|

|

Equans |

115 |

|

146 |

|

-31 |

|

|

TF1 |

183 |

|

184 |

|

-1 |

|

|

Bouygues Telecom |

1,079 |

|

1,103 |

|

-24 |

|

|

Bouygues SA and other |

3 |

|

46 |

|

-43 |

|

|

Group net capital expenditure – excluding

frequencies |

1,595 |

|

1,607 |

|

-12 |

|

|

Frequencies |

6 |

|

0 |

|

+6 |

|

|

Group net capital expenditure – including

frequencies |

1,601 |

|

1,607 |

|

-6 |

|

CONTRIBUTION TO GROUP FREE CASH FLOW BY

SECTOR OF ACTIVITY

|

(€ million) |

9M 2024 |

|

9M 2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

290 |

|

402 |

|

-112 |

|

|

o/w Bouygues Construction |

181 |

|

185 |

|

-4 |

|

|

o/w Bouygues Immobilier |

(75) |

|

(9) |

|

-66 |

|

|

o/w Colas |

184 |

|

226 |

|

-42 |

|

|

Equans |

363 |

|

221 |

|

+142 |

|

|

TF1 |

109 |

|

112 |

|

-3 |

|

|

Bouygues Telecom |

245 |

|

153 |

|

+92 |

|

|

Bouygues SA and other |

(82) |

|

(223) |

|

+141 |

|

|

Group free cash flow ᵃ – excluding

frequencies |

925 |

|

665 |

|

+260 |

|

|

Frequencies |

(6) |

|

0 |

|

-6 |

|

|

Group free cash flow ᵃ – including

frequencies |

919 |

|

665 |

|

+254 |

|

(a) See glossary for definitions.

GLOSSARY

ABPU (Average Billing Per

User):

- In the mobile segment, it is equal

to the total of mobile sales billed to customers (BtoC and BtoB)

divided by the average number of customers over the period. It

excludes MtoM SIM cards and free SIM cards.

- In the fixed segment, it is equal

to the total of fixed sales billed to customers (excluding BtoB)

divided by the average number of customers over the period.

Available cash: the aggregate

of cash and cash equivalents and the positive fair value of hedging

instruments.

BtoB (business to business):

when one business makes a commercial transaction with another.

Backlog:

- Bouygues Construction,

Colas, Equans: the amount of work still to be done on

projects for which a firm order has been taken, i.e. the contract

has been signed and has taken effect (after notice to proceed has

been issued and suspensory clauses have been lifted).

- Bouygues

Immobilier: sales outstanding from notarised sales plus

total sales from signed reservations that have still to be

notarised.

Under IFRS 11, Bouygues Immobilier’s backlog

does not include sales from reservations taken via companies

accounted for by the equity method (co-promotion companies where

there is joint control).

Business segment: designates

each one of the Bouygues group’s six main subsidiaries, namely

Bouygues Construction, Bouygues Immobilier, Colas, Equans, TF1 and

Bouygues Telecom.

Change in sales like-for-like and at

constant exchange rates:

- At constant exchange rates: change

after translating foreign-currency sales for the current period at

the exchange rates for the comparative period.

- On a like-for-like basis: change in

sales for the periods compared, adjusted as follows:

- For acquisitions, by deducting from

the current period those sales of the acquired entity that have no

equivalent during the comparative period.

- For divestments, by deducting from

the comparative period those sales of the divested entity that have

no equivalent during the current period.

Construction businesses:

Bouygues Construction, Bouygues Immobilier and Colas.

Current operating profit/(loss) from

activities (COPA): current operating profit from

activities equates to current operating profit before amortisation

and impairment of intangible assets recognised in acquisitions

(PPA).

EBITDA after Leases: current

operating profit after taking account of the interest expense on

lease obligations, before (i) net charges for depreciation,

amortisation and impairment losses on property, plant and equipment

and intangible assets, (ii) net charges to provisions and other

impairment losses and (iii) effects of losses of control. Those

effects relate to the impact of remeasuring retained interests.

EBITDA margin after Leases (Bouygues

Telecom): EBITDA after Leases as a proportion of sales

from services.

Energies & services:

Equans.

Free cash flow: net cash flow

(determined after (i) cost of net debt, (ii) interest expense on

lease obligations and (iii) income taxes paid), minus net capital

expenditure and repayments of lease obligations. It is calculated

before changes in working capital requirements (WCR) related to

operating activities and excluding frequencies.

FTTH (Fibre to the Home):

optical fibre from the central office (where the operator’s

transmission equipment is installed) all the way to homes or

business premises (Arcep definition).

FTTH premises secured: premises

for which the horizontal is deployed, being deployed or ordered up

to the concentration point.

FTTH premises marketed: the

connectable sockets, i.e. the horizontal and vertical deployed and

connected via the concentration point.

Group (or the Bouygues group):

designates Bouygues SA and all the entities that are controlled

directly or indirectly by Bouygues SA as defined in Article

L. 233-3 of the French Commercial Code.

Liquidity: the aggregate of

available cash, the fair value of hedging instruments and undrawn,

confirmed medium- and long-term credit facilities.

MtoM: machine to machine

communication. This refers to direct communication between machines

or smart devices or between smart devices and people via an

information system using mobile communications networks, generally

without human intervention.

Net surplus cash/(net debt):

the aggregate of cash and cash equivalents, overdrafts and

short-term bank borrowings, non-current and current debt, and the

fair value of financial instruments. Net surplus cash/(net debt)

does not include non-current and current lease obligations. A

positive figure represents net surplus cash and a negative figure

represents net debt. The main components of change in net debt are

presented in Note 7 to the consolidated financial statements

at 30 September 2024, available at bouygues.com.

Order intake (Bouygues Construction,

Colas, Equans): a project is included under order intake

when the contract has been signed and has taken effect (the notice

to proceed has been issued and all suspensory clauses have been

lifted) and the financing has been arranged. The amount recorded

corresponds to the sales the project will generate.

Reservations by value (Bouygues

Immobilier): the € amount of the value of properties

reserved over a given period.

- Residential properties: the sum of

the value of unit and block reservation contracts signed by

customers and approved by Bouygues Immobilier, minus registered

cancellations.

- Commercial properties: these are

registered as reservations on notarised sale.

For co-promotion companies:

- If Bouygues Immobilier has

exclusive control over the co-promotion company (full

consolidation), 100% of amounts are included in reservations.

- If joint control is exercised (the

company is accounted for by the equity method), commercial activity

is recorded according to the amount of the equity interest in the

co-promotion company.

Sales from services (Bouygues

Telecom) comprise:

- Sales billed to customers, which

include:

- In Mobile:

- For BtoC customers: sales from

outgoing call charges (voice, texts and data), connection fees, and

value-added services.

- For BtoB customers: sales from

outgoing call charges (voice, texts and data), connection fees, and

value-added services, plus sales from business services.

- Machine-To-Machine (MtoM)

sales.

- Visitor roaming sales.

- Sales generated with Mobile Virtual

Network Operators (MVNOs).

- In Fixed:

- For BtoC customers: sales from

outgoing call charges, fixed broadband services, TV services

(including Video on Demand and catch-up TV), and connection fees

and equipment hire.

- For BtoB customers: sales from

outgoing call charges, fixed broadband services, TV services

(including Video on Demand and catch-up TV), and connection fees

and equipment hire, plus sales from business services.

- Sales from bulk sales to other

fixed line operators.

- Sales from incoming

Voice and Texts.

- Spreading of handset subsidies over

the projected life of the customer account, required to comply with

IFRS 15.

- Capitalisation of connection fee

sales, which is then spread over the projected life of the customer

account.

Other sales (Bouygues Telecom):

difference between Bouygues Telecom’s total sales and sales from

services.

It comprises:

- Sales from handsets, accessories

and other.

- Roaming sales.

- Non-telecom services (construction

of sites or installation of FTTH lines).

- Co-financing of advertising.

Wholesale: wholesale market for

telecoms operators.

1 Excluding the future increase in the tax rate

for 2024 which would result from the new French Finance Act.

2 Includes non-current charges of €33m at Bouygues Construction, of

€27m at Bouygues Immobilier, of €67m at Equans, of €19m at TF1, of

€14m at Bouygues Telecom and of €17m at Bouygues SA.

3 Net debt/shareholders’ equity.

4 Free cash flow before cost of net debt, interest expense on lease

obligations and income taxes paid.

5 The Rail backlog was up 8% at constant exchange rates and

excluding principal disposals and acquisitions.

6 Excluding the share of co-promotions.

7 Women under 50 who are purchasing-decision makers.

8 Net debt/shareholders’ equity.

- PR_Bouygues_financial_results-9M-2024_EN

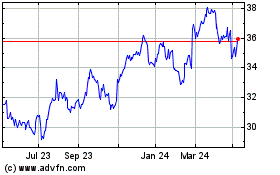

Bouygues (EU:EN)

Historical Stock Chart

From Jan 2025 to Feb 2025

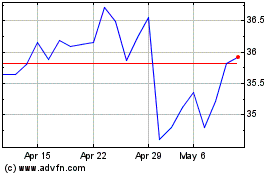

Bouygues (EU:EN)

Historical Stock Chart

From Feb 2024 to Feb 2025