Rexel: Q4 sales & FY 2024 results

|

|

Q4 sales & FY 2024 results

Sales & Ebita margin in line with revised guidance

2024; FCF conversion exceeding objective

Positive North America momentum balancing softer

environment in Europe

Transformation actions gaining momentum throughout 2024 –

to be further amplified in 2025 |

→ FY 24 sales at €19,285.1m, up

+0.7% on a reported basis

- Same-day

sales down (2.4)% in FY 2024; improving trends quarter after

quarter

- Q4 sales of

€4,893.1m, down (0.5)% on a same-day basis (up +1.0% on an

actual-day basis) thanks to positive momentum in North

America, up +3.6%

- Continued

market share gains boosted by

best-in-class services which includes

digitalization

- Active

acquisitions strategy contributing for +2.9% to FY 24 sales

growth

→ FY 24 current adjusted EBITA margin at 5.9%,

demonstrating resilience in a difficult macro

environment

- Structural cost

actions combined with rapid cost adaptation (FTE down (2.7)% versus

volume down (1.5)% yoy), to mitigate impact of sales decline on our

profitability

→ Digital sales penetration at

32% of sales in Q4 24, up +232bps

- Digital sales now

above €6bn in 2024, making Rexel one of the largest digital BtB

players

- Digital sales

growth contributed to outperformance and productivity gains

→ FY 24 operating income of €845.9 million (vs

€1,216.6 million in FY 23), including exceptional items (French

Competition Authority fine for €124m against which Rexel has lodged

an appeal, Goodwill impairment, acquisitions costs); net income of

€341.0 million

→ Free cash flow conversion well above

guidance at 76%, confirming our cash-generative model

→ Attractive return to shareholders: proposed

dividend for 2024 of 1.20€ per share, for a 54%

payout ratio, based on recurring net income of €662.3 million in

2024 (vs €823.3 million in 2023)

→ Executing our capital allocation strategy with

a healthy balance sheet: indebtedness ratio at 1.83x

- Share

buyback: €100m shares repurchased in 2024; €300m since

mid-2022

- M&A:

more than €500m of value creative acquisitions completed

in 2024

- Portfolio

management: disposal of Rexel business in New Zealand, signed on

February 1st, as a

result of the continuous strategic review of our

portfolio

→ 2025 outlook: Stable to

slightly positive same-day sales growth, current adjusted EBITA

margin at c. 6% and free cash flow conversion at c. 65% (excluding

the €124m fine from the French Competition Authority to be paid in

2025)

→ Confirmation of Rexel's medium-term ambitions,

driven by solid electrification trends, market outperformance,

further transformation of the business model and acceleration of

savings programs

Guillaume TEXIER, Chief Executive Officer,

said:

“In softer 2024 conditions than anticipated, especially in

Europe, the Rexel teams seized the opportunity to demonstrate how

the transformation of the last few years could positively impact

the business by deploying advanced services, digital penetration

and value solutions to customers, resulting in market share gains

in several countries.

We leveraged our increased presence in North America, a region

with solid prospects in which we have expanded through organic

growth and active M&A with 9 acquisitions completed since 2021.

We quickly adapted our cost base across the Group, allowing us to

deliver resilient profitability and record high free cash flow

conversion.

We are entering 2025 with good momentum on three aspects:

market share gains, strong exposure to the positive North American

market, and optimization projects. This acceleration of our

transformation allows us to be confident that we are on track to

reach our medium-term ambitions.” |

|

Financial review for the period ended December 31,

2024 |

- This press

release presents Rexel's consolidated financial statements for the

year ended December 31, 2024. The audit procedures by the Statutory

Auditors are in progress and their report on the consolidated

financial statements for the year ended December 31, 2024 will be

issued on February 14, 2025

- Full year 2024

financial report was authorized for issue by the Board of Directors

on February 12, 2025

- The

following terms are defined in the Glossary section of this

document: Current EBITA; Current adjusted EBITA, EBITDA; EBITDAaL;

Recurring net income; Free Cash Flow and Net Debt

-

Unless otherwise stated, all comments are on a constant and

adjusted basis and, for sales, at same number of working

days

| Key

figures1 (€m) -

Actual |

FY 2024 |

YoY change |

| Sales on

a reported basis |

19,285.1 |

+0.7% |

| On a constant

and actual-day basis |

|

(1.9) % |

|

On a constant and same-day basis |

|

(2.4) % |

|

Current adjusted

EBITA2,4 |

1,131.7 |

(16.0) % |

|

As a percentage of sales |

5.9 % |

-98 bps |

|

Current EBITA4 |

1,139.3 |

(11.4) % |

|

Operating income |

845.9 |

(30.5) % |

|

Net income |

341.0 |

(56.0) % |

|

Recurring net income |

662.3 |

(19.6) % |

|

FCF before interest and tax |

916.5 |

(8.0) % |

|

FCF conversion3 |

76 % |

|

|

Net debt at end of period |

2,483.9 |

€522m increase |

1 See definition in the Glossary

section of this document 2 Change at comparable scope of

consolidation

3 EBITDAaL into FCF before interest and tax

4 In accordance to the AMF regulation, EBITA and

adjusted EBITA are renamed current EBITA and current adjusted

EBITA, with no change in the calculation methodology

SALES

Q4 sales up +3.6% year-on-year on a

reported basis and down (0.5)% on a constant and same-day

basis

| Key

figures (€m) |

Q4 2024 |

YoY change |

FY 2024 |

YoY change |

| Sales on

a reported basis |

4,893.1 |

+3.6% |

19,285.1 |

+0.7% |

|

On a constant and actual-day basis |

|

+1.0% |

|

(1.9) % |

|

On a constant and same-day basis |

|

(0.5) % |

|

(2.4) % |

In Q4 2024, Rexel posted sales of €4,893.1m, up

+3.6% on a reported basis. They include:

- Constant

and same-day sales evolution of (0.5)%, including a (0.4)%

contribution from volume as well as a negative selling-price effect

of (0.7)% on non-cable products and +0.6% on cable products

- A positive calendar

effect of +1.5%, translating into a +1.0% actual-day sales growth

in the quarter

- A positive net

scope effect of +2.1%, mainly resulting from the acquisitions of

Talley and Electrical Supplies Inc in the US, completed

respectively in June and July 2024 as well as Itesa in France,

completed in October 2024

- A positive currency

effect of +0.4%, mainly due to the appreciation of the US dollar

and the British Pound against the euro

| (in

contrib.) |

% mix 2024 |

SD sales growth |

ow price |

ow volume |

| Core

ED1 |

79 % |

+1.4% |

+0.3% |

+1.1% |

|

Electrification |

21 % |

(1.9) % |

(0.4) % |

(1.5) % |

|

Total |

100 % |

(0.5) % |

(0.1) % |

(0.4) % |

1 Including cable

Sales were down (0.5)% on a constant and

same-day basis or up +1.0% on a constant and actual-day basis. More

specifically:

- The

improvement compared to Q3 24 is mainly driven by US and Canada,

offsetting the still muted situation in Europe notably in

electrification

- North America was

up +3.6%, still driven by backlog execution of diversified

projects

- Europe was

unchanged compared to Q3 24, with contrasting trends between

countries

- Asia-Pacific was

slightly negative in the majority of countries excluding India; a

similar performance to Q3

- The four

electrification product categories (Solar, Electric Vehicle

charging infrastructure, HVAC and Industrial Automation),

represented 21% of sales and decreased by (8.2)% in Q4

(contribution:-190bps)

- Pricing for

non-cable products was down (0.7)% and remains explained by

deflation in solar across geographies and piping in North

America

- The Q4 cable price

contribution was positive at +0.6%, benefiting from more supportive

copper prices for the second consecutive quarter

- Rexel posted

further growth in digitalization, with digital now representing 32%

of sales in Q4 2024, up +232bps compared to Q4 2023. Europe was at

43% of digital sales, up +357bps, North America was at 22%, a

slight increase of +29bps and Asia-Pacific was at 22% (vs 9% in Q4

23) thanks to the adoption of Email to EDI in China

FY sales up +0.7% year-on-year on a

reported basis, down (2.4)% on a constant and same-day

basis

In FY 2024, Rexel posted sales of €19,285.1m, up

+0.7% on a reported basis, supported by the positive

contribution of our M&A strategy. They include:

- Constant

and same-day sales evolution of (2.4)%, including a (1.5)%

contribution from volume and a negative selling price of (0.7)% on

non-cable products and (0.2)% on cable products

- A positive calendar

effect of +0.5%

- A positive net

scope effect of +2.7%, mainly resulting from +2.9% from

acquisitions of Wasco and Itesa in Europe as well as Talley and

Electrical Supplies Inc in North America, and remaining effect from

disposal of Norway

- A neutral currency

effect

Europe (49% of Group sales): Down (3.8)%

in Q4 and (4.9)% in FY on a constant and same-day

basis

In the fourth-quarter, sales in Europe declined

by (2.2)% on a reported basis, including:

- Constant and

same-day sales evolution of (3.8)%. This includes a negative volume

and price contribution of respectively (3.6)% and (0.2)% (non-cable

products for (0.8)% and +0.6% on cable products)

- A slightly positive

calendar effect of +0.3%

- A positive net

scope effect of +0.8%, resulting from the acquisition of Itesa in

France

- A positive currency

effect of +0.5%, mainly due to the appreciation of the British

pound and the Swiss Franc against the euro

| Key

figures (€m) |

% of the region's sales |

Q4 2024 |

YoY change |

FY 2024 |

YoY change |

|

Europe |

|

2,390.3 |

(3.8) % |

9,550.6 |

(4.9) % |

|

ow France |

39% |

935.7 |

(1.3) % |

3,654.3 |

(1.3) % |

|

DACH1 |

23% |

546.5 |

(4.2) % |

2,258.0 |

(5.9) % |

|

Benelux |

17% |

403.1 |

(7.9) % |

1,561.2 |

(10.2) % |

|

Nordics |

9% |

210.9 |

(1.4) % |

830.0 |

(6.7) % |

|

UK |

8% |

179.5 |

(10.5) % |

788.1 |

(6.8) % |

1 Germany, Switzerland & Austria

More specifically:

- Electrification

categories, especially solar, contributed negatively (down (8.3)%

for a -170bps contribution)

- Core ED business,

including cable, was down (2.1)% in contribution, broadly similar

to Q3 24.

By country and cluster:

- Same-day

sales in France decreased slightly by (1.3)%,

outperforming the declining market. The positive momentum in

non-residential mitigated lower demand in other end markets

including residential and industry.

- Same day

sales in the DACH region (Germany, Austria and

Switzerland) were down (4.2)% in the quarter but improved vs Q3 24.

Overall demand remained muted in the region and notably in Germany

and Austria, in a challenging macroeconomic context and in the

absence of recovery in Solar demand.

-

Benelux declined by (7.9)%, with market

outperformance in Belux. This performance is similar to the last

two quarters, and is explained by the demand normalization in

Solar.

- Same-day

sales in the Nordics (Sweden and Finland) were

down (1.4)% in Q4 due to residential and non-residential

activities. Overall, demand in residential showed signs of

improvement in H2 compared to H1 24.

- In

the UK, sales were down (10.5)%, due to weak

demand in all three markets as well as the closure of 24 branches

completed towards the end of 2024.

North America (45% of Group sales):

Strong sales growth at +3.6% in Q4 and +0.5% in FY on a constant

and same-day basis

In the fourth-quarter, sales in North America

were up +11.3% on a reported basis:

- Constant

and same-day sales growth of +3.6%, driven by volume contribution

of +3.6% and a stable price effect

- A positive calendar

effect of +3.1%

- A positive +4.1%

net scope effect, mainly resulting from the acquisitions of Talley

and Electrical Supplies Inc in the US

- A slightly positive

currency effect of +0.2%, mainly due to the appreciation of the US

dollar against the euro

| Key

figures (€m) |

% of the region's sales |

Q4 2024 |

YoY change |

FY 2024 |

YoY change |

|

North America |

|

2,187.7 |

+3.6% |

8,461.8 |

+0.5% |

|

ow United States |

83% |

1,814.4 |

+3.4% |

6,975.0 |

+0.5% |

|

Canada |

17% |

373.3 |

+4.4% |

1,486.8 |

+0.2% |

In North America:

- The

overall good performance was driven once again by our backlog

execution

- Core ED business,

including cables, contributed to growth for +5.5% with positive

volume

-

Electrification categories were down (9.0)% (contributing for

-200bps), from lower demand in Industrial automation both in the US

and in Canada as well as in Solar, mostly in California.

Specifically, in our two countries:

- In

the US, same-day sales were up +3.4% in Q4 2024

- By

business: Project activity continued to be driven by strong backlog

execution, with project business up in double digits. Quotation

activity remained healthy, with backlog still representing 2.5

months of sales, above pre-pandemic levels

- By

market: Growth was positive in all three end-markets. While

residential (7% of sales) was up for a third consecutive quarters,

growth in both non-residential and industry projects segments have

accelerated sequentially, notably driven by datacenters, Oil &

Gas, automotive and logistics. More specifically, the positive

demand in electrical products in industry now more than offset the

still negative evolution in industrial automation activity.

- By

region: Favorable momentum was confirmed in Gulf Central driven by

Oil&Gas, in Southeast region (incl. Mayer) boosted by

datacenters and new manufacturing plants, and in the Northwest,

driven by residential activity

- Very

positive momentum at Talley. The integration is progressing well

with very good top line momentum, exceeding initial plan

- In

Canada, sales were up +4.4% on a same-day basis,

with strong acceleration driven by project activity, showing

double-digit increases in both non-residential and industrial

segments. More specifically, growth in the quarter was driven by

mining and manufacturing. Prices also contributed positively. The

backlog overall was up 1% compared to the end of Q3 24

Asia-Pacific (6% of Group sales): (2.0)% in Q4 and

(1.5)% in FY on a constant and same-day basis

In the fourth-quarter, sales in Asia-Pacific

were stable on a reported basis, including:

- Constant and

same-day sales change of (2.0)%, including negative volume and

price contribution of (1.7)% and (0.4)%

- A positive calendar

effect of +1.0%

- A positive currency

effect of +1.0%, mainly due to the appreciation of the Australian

dollar and the Yuan Renminbi against the euro

| Key

figures (€m) |

% of the region's sales |

Q4 2024 |

YoY change |

FY 2024 |

YoY change |

|

Asia-Pacific |

|

315.1 |

(2.0) % |

1,272.7 |

(1.5) % |

|

ow Australia |

47% |

148.7 |

(0.3) % |

596.3 |

+1.9% |

|

China |

38% |

120.4 |

(6.3) % |

492.4 |

(4.7) % |

In Asia-Pacific, sales decreased by (2.0)% on a

constant and same-day basis:

- In

Australia, sales were broadly stable at (0.3)%,

supported by industrial markets, notably mining, as well as

electrification activity (Solar and HVAC)

- In

China, sales decreased by (6.3)%, in a context of

low industrial demand. Inventories in the value chain have

normalized, as reflected in prices, which improved sequentially. Q4

was also marked by customers acquisitions among OEM's, and a strong

boost in digital, now at 31% of sales (vs 4% in Q4 23)

- In

India, sales jumped by +22.3% in Q4 24 boosted by

customer acquisitions in a favorable context.

PROFITABILITY

Current adjusted EBITA margin at 5.9% in

2024, down -98 bps compared to 2023

For the graph, please open the pdf file by

clicking on the link at the end of the press release.

In a declining environment reflected by a (1.9)%

actual-day sales evolution in 2024 with volume and selling prices

both negative, profitability was resilient, as reflected by the

current adjusted EBITA margin of 5.9%, compared to 6.8% in

2023.

More specifically :

- Gross

margin stood at 24.8%, down -68 bps versus 2023, of which:

- -25bps

from the effects of selling price deflation and negative customer

mix in North America (sales growth driven by projects

activity)

- -43bps

from the more competitive commercial environment specifically in

Europe

-

Opex/sales stood at (19.0)%, deteriorating by -30 bps versus 2023

and explained by:

- -32bps

from operating deleveraging driven by the actual-day sales decline

of (1.9)% in 2024

- +2bps

from active cost actions offsetting opex inflation:

- Opex

inflation stood at +2.4% (+3.6% from wage increases and +1.7% from

other opex), impacting profitability by -45bps

- Internal

action plans resulted in +47bps from cost savings and productivity

initiatives

Compared to the previous cycles, Rexel

demonstrated its capacity to adapt its cost base in a declining

sales environment. This was notably achieved through productivity

initiatives, with headcount reduction accelerating in the course of

2024 to reach (2.7)% at end-December 24 (vs end-December 23),

exceeding the volume decline of (1.5)%. Overall, opex declined by

1.1% (excluding depreciation) despite an opex inflation of

2.4%.

| FY 2024

(€m) |

Europe |

North America |

Asia Pacific |

Group |

|

Sales |

9,551 |

8,462 |

1,273 |

19,285 |

| On a constant

and actual-day basis |

(4.5) % |

1.0 % |

(1.2) % |

(1.9) % |

|

On a constant and same-day basis |

(4.9) % |

0.5 % |

(1.5) % |

(2.4) % |

|

Current adj. EBITA |

553 |

594 |

20 |

1,132* |

| % of

sales |

5.8% |

7.0% |

1.6% |

5.9% |

|

Change in bps as a % of sales |

-151 bps |

-42 bps |

-136 bps |

-98 bps |

*Including €(35)m for corporate costs in

2024

By geography, the change in current adjusted

EBITA margin in 2024 can be explained as follows:

-

Europe was down -151 bps at 5.8% of sales,

resulting from negative operating leverage combined with pricing

pressure, notably on Solar activity, and increased a more

competitive environment, partly mitigated by cost adaptation and

accelerated strategic transformation action plans.

-

North America was down a limited -42 bps at 7.0%

of sales, thanks to improved sales momentum in H2 and strict opex

discipline.

-

Asia-Pacific was down -136 bps at 1.6% of sales,

notably reflecting a more competitive environment in the region and

deflation in China

As a result, current adjusted EBITA stood at

€1,131.7m (vs. €1,347.2m in 2023 on a comparable base) and current

EBITA stood at €1,139.3m (including a positive one-off copper

effect of €7.6 million).

Focus on the bridge from reported EBITDA to

current EBITA :

- EBITDA margin was

down 60bps at 7.9%

- Depreciation of

Right of Use stood at €(258.3) million vs. €(233.3) million in

2023, mainly resulting from acquisitions

- Other depreciation

and amortization stood at €(117.9) million, implying 0.6% of

sales

| Reported

basis (€m) |

FY 2023 |

FY 2024 |

YoY change |

|

EBITDA |

1,633.0 |

1,515.6 |

(7.2) % |

| % EBITDA

margin |

8.5% |

7.9% |

|

| Depreciation

Right of Use (IFRS 16) |

(233.3) |

(258.3) |

|

| Other

depreciation and amortization |

(113.8) |

(117.9) |

|

|

Current EBITA |

1,285.9 |

1,139.3 |

(11.4) % |

NET INCOME

Net income of €341.0 million in 2024;

recurring net income of €662.3

million

Operating income in the year stood at €845.9m

(vs €1,216.6m in 2023).

- Amortization of

intangible assets resulting from purchase price allocation amounted

to €(35.7) (vs. €(24.3)m in 2023)

- Other income and

expenses amounted to a net charge of €(257.7)m (vs. a net charge of

€(45.1)m in 2023) and notably included:

- €(124.0)m related

to the fine imposed by the French Competition Authority, against

which Rexel has lodged an appeal, to be paid in 2025

- €(54.8)m in

goodwill & intangible assets impairment notably in Germany and

UK

- €(33.1)m in

restructuring mostly in Europe and integration costs

- €(22.0)m of asset

impairment following the classification of New Zealand as an asset

held for sale (disposal completed on February 1st, 2025)

- €(14.3)m in fair

value adjustment for earn-out on Talley

- €(9.8)m in

acquisition costs

Net financial expenses in the year amounted to

€(207.7)m (vs. €(167.7)m in 2023), and can be broken down as

follows:

- €(141.5) million

from financial costs compared to €(112.0) million in 2023,

reflecting higher interest rates and gross debt. The effective

interest rate increased to 4.35% in 2024 from 3.66% in 2023

- €(66.2)

million from interest on lease liabilities in 2024 vs €(55.6)

million in 2023

Income tax in the year represented a charge of

€(297.2)m (vs. €(274.2) in 2023)

- The tax rate stood

at 46.6% in 2024, due to non-deductible other expenses (including

the competition authority fine in France and goodwill impairment)

and deferred tax assets write-offs.

- The normative tax rate stood at

26.2% in 2024, excluding one-offs

As a result, net income in the year stood at

€341.0 million (vs. €774.7 million in 2023) and recurring net

income amounted to €662.3 million in 2024 (vs €823.3 million in

2023) - see appendix 3

FINANCIAL STRUCTURE

Free cash-flow before interest and tax

of €916.5 million in 2024

Indebtedness ratio of 1.83x at December

31, 2024

In 2024, free cash flow before interest and tax

reached €916.5 million (vs. €996.4 million in 2023),

representing a free cash flow conversion rate (EBITDAaL

into FCF before interest and taxes) of

76%. It included:

- EBITDAaL

of €1,204.3 million including €(311.3) million of lease payments in

2024

-

Operating cash flow stood at €1,008.0 million notably including

€(173.0) million of other operating revenue and costs, of which

€(124)m fine from the French Competition Authority to be paid in

2025

- An

outflow of €(55.8) million from the change in pensions obligations

(vs €(21.3) million in 2023) due to an accelerated contribution to

the UK pension funds of €36m (GBP30m)

- An

inflow of €34.3 million from change in working capital (compared to

an outflow of €(187.1) million in 2023)

- The

change in trade working capital was an outflow of €(15.5) million.

On a constant basis, trade WCR stood at 14.2% of sales in 2024,

stable compared to the prior year (14.1% in 2023)

- The

change in non-trade working capital was an inflow of €49.8 million,

including €124m for the fine received from the French competition

authority to be paid in 2025

- A lower level of

net capital expenditure (i.e. €(125.8) million vs. €(153.3) million

in 2023). Gross capex represented 0.7% of sales, a similar level to

that of 2023, with continued investment in automated supply chain

solutions and digital.

Below FCF before interest and tax, the cash flow

statement took into account:

- €(129.6) million in

net interest paid in 2024 (vs €(101.3) million paid in 2023);

- €(281.0) million in

income tax paid in the year, compared to €(327.4) million paid in

2023;

- €(550.1) million in

financial investment including earn-out;

- €(357.2) million in

dividends paid in 2024 based on 2023 earnings (€1.20 per

share);

- €(99.8) million in

share buybacks;

- €(19.0) million in

currency effects during the year (vs €10.4 million in 2023).

At December 31, 2024:

- Net financial

debt increased by €522.3 million year-on-year to €2,483.9 million

(vs €1,961.5 million at December 31, 2023), resulting from our

active capital allocation (notably M&A, dividend payment and

share buyback). It includes an estimation of the earn-out

negotiated on Itesa and Talley and a put option on Mavisun, based

on current development, for €123.8m

- The

indebtedness ratio (Net financial debt/EBITDAaL), as calculated

under the Senior Credit Agreement terms, stood at 1.83x

|

Proposed dividend for 2024 at 1.20€ per share |

Rexel will propose to Shareholders to maintain

the dividend at 1.20€ per share, to be paid fully in cash. This

represents a payout of 54% of the Group’s recurring net income, in

line with Rexel’s policy of paying out at least 40% of recurring

net income.

This dividend, payable in cash on May

16th, 2025 (detachment date on May 14th), is

subject to the approval of the Annual Shareholders’ Meeting to be

held in Paris on April 29, 2025.

|

Active portfolio management in 2024 with 3 acquisitions and

1 disposal |

In 2024, with the completion of 3 acquisitions,

Rexel confirmed its strong capability to integrate acquisitions and

rapidly create value, through bolt-on operations and acquisitions

of adjacent activities.

- In June, Rexel

acquired Talley, a leading distributor of wireless infrastructure

products and solutions in the United States, strongly reinforcing

its exposure to the fast-growing data usage trends (circa $360m of

sales, 300+ employees).

- Talley

delivered outstanding performance, well above expectation, during

the first year of integration

- Double-digit

sales growth and high-single digit current adjusted Ebita margin,

well above initial ambitions

- Synergies

expectations at c. 3% of acquired sales

- Rapid

geographical expansion into Rexel’s territories

- In July,

Rexel completed the acquisition of Electrical Supplies Inc in the

US, reinforcing its position in Florida (c. $60m of sales, three

branches and 93 FTE).

- In

October, Rexel closed the acquisition of Itesa, creating a leader

in the Security and Communication business, through a strong

presence in the alarm and video segments (15 branches, 2023

turnover of €78 million, 158 employees).

In addition, Rexel is accelerating the reshaping

of its portfolio in order to refocus operations and management time

on countries/businesses, having the potential to contribute to the

Group's mid-term goals.

- Rexel

sold its New Zealand operations on February 1 to Ten Oaks Group, an

American investment company. Rexel generated €95m in 2024 through a

network of 47 branches and 1 Distribution Center. Rexel does not

consider having the critical size in the country, where

profitability was below Group average.

|

ESG : Delivering on

CO² emisson reduction

- New Scope 3 ambition to consider the full product lifecycle

throughout the value chain |

In 2024, we have delivered on our CO²

reduction objectives on scope 1&2 and scope 3.

- Our scope 1&2

emissions were reduced by c. 8% in 2024, resulting notably from an

active reduction of our own emissions through electrification of

our facilities and renewable energy

- Well on

track to reach our 2030 ambition to reduce Scope 1&2 by 60%

(vs. 2016 base)

- Our scope 3

emissions were reduced by 8% in 2024.

- The

scope 3 objectives have been redefined, to better consider the full

environmental impact along the value chain vs a scope limited to

the use of products sold previously

- Our

scope 3 ambition, under the new definition, is to reduce emission

by 35% in 2030 and to keep our ambitious net zero target in 2050.

These objectives have been validated by the SBTi.

In 2025, we anticipate contrasted trends between

the different regions, more specifically:

- Accelerating growth

in North-America with

- Activity

potentially benefiting from increased industrial investment and

reshoring

- Favorable trends

from datacenter construction, especially in the US Southeast, as

well as from the recovery of residential construction, mostly in

the Northwest

- Continued soft

environment in Western Europe in H1 with pluses and minuses

- Positive market

share gains in most countries

- Residential and

non-residential construction benefiting from lower interest-rate

environment, with effects mostly in H2

- Lack of confidence

and political uncertainties in several countries

- Electrification

trends still weak short-term, but with easier comparison base

- Pricing environment

slightly supportive, with US tariffs impact still uncertain and not

included in the guidance

In this contrasted environment, the priority

will be to offset the cost inflation headwind and preserve our

profitability, notably thanks to

- The full-year

effect of 2024 cost-reduction action plans

- New 2025 savings

actions kicking in

In this context, Rexel's expectations for

full-year 2025 are as follows:

- Stable to slightly

positive same-day sales growth

- Current adjusted

EBITA margin1 at c. 6%

- Free cash flow

conversion2 at c. 65%, excluding the €124m fine from the

French Competition Authority, to be paid in 2025

Rexel’s medium-term ambitions remain unchanged

with the acceleration of self-help actions offsetting the temporary

market softness in Western Europe

- Sales growth

potential of between 5% and 8%, with targeted M&A representing

between 2% and 3%

- Current adjusted

EBITA margin above 7%

- High-single-digit

growth in Earnings Per Share (EPS)

- An average

conversion rate of 65% of EBITDAaL into Free Cash Flow before

interest and tax

1 Excluding

(i) amortization of PPA and (ii) the

non-recurring effect related to changes in copper-based cable

prices.

2 FCF Before interest and

tax/EBITDAaL

NB: The estimated impacts per quarter of (i)

calendar effects by geography, (ii) changes in the consolidation

scope and (iii) currency fluctuations (based on assumptions of

average rates over the rest of the year for the Group's main

currencies) are detailed in appendix 6

April 29, 2025 Q1

2025 sales

April 29, 2025

Annual

Shareholders' Meeting

May 14, 2025

Detachment date of

the dividend

May 16,

2025 Dividend

payment

July 28, 2025

(post-market) H1

2025 results

Full year 2024 financial report is available on

the Group’s website (www.rexel.com).

A slideshow of the fourth quarter sales and full

year 2024 results publication is also available on the Group’s

website.

Rexel, worldwide expert in the multichannel

professional distribution of products and services for the energy

world, addresses three main markets: residential, non-residential,

and industrial. The Group supports its residential,

non-residential, and industrial customers by providing a tailored

and scalable range of products and services in energy management

for construction, renovation, production, and maintenance. Rexel

operates through a network of more than 1,950 branches in 19

countries, with more than 27,000 employees. The Group’s sales were

€19.3 billion in 2024.

Rexel is listed on the Eurolist market of Euronext Paris

(compartment A, ticker RXL, ISIN code FR0010451203). It is included

in the following indices: MSCI World, CAC Next 20, SBF 120, CAC

Large 60, CAC 40 ESG, CAC SBT 1.5 NR, CAC AllTrade, CAC AllShares,

FTSE EuroMid, and STOXX600. Rexel is also part of the following SRI

indices: FTSE4Good, Dow Jones Sustainability Index Europe, Euronext

Vigeo Europe 120 and Eurozone 120, STOXX® Global ESG Environmental

Leaders, and S&P Global Sustainability Yearbook 2022, in

recognition of its performance in terms of Corporate Social

Responsibility (CSR).

For more information, visit www.rexel.com/en.

FINANCIAL ANALYSTS / INVESTORS

| Ludovic

DEBAILLEUX |

+33 1 42 85 76

12 |

ludovic.debailleux@rexel.com |

PRESS

| Brunswick: Laurence

FROST |

+33 6 31 65 57

06 |

lfrost@brunswickgroup.com |

CURRENT EBITA (Earnings Before

Interest, Taxes and Amortization) is defined as operating income

before amortization of intangible assets recognized upon purchase

price allocation and before other income and other expenses.

CURRENT ADJUSTED EBITA is

defined as current EBITA excluding the estimated non-recurring net

impact from changes in copper-based cable prices.

EBITDA (Earnings Before

Interest, Taxes, Depreciation and Amortization) is defined as

operating income before depreciation and amortization and before

other income and other expenses.

EBITDAaL is defined as EBITDA

after deduction of lease payment following the adoption of

IFRS16.

RECURRING NET INCOME is defined

as net income restated for non-recurring copper effect, other

expenses and income, non-recurring financial expenses, net of tax

effect associated with the above items.

FREE CASH FLOW is defined as

cash from operating activities minus net capital expenditure.

NET DEBT is defined as

financial debt less cash and cash equivalents. Net debt includes

debt hedge derivatives.

For appendix, please open the pdf file by

clicking on the link at the end of the press release.

The Group is exposed to fluctuations in

copper prices in connection with its distribution of cable

products. Cables accounted for approximately 16% of the Group's

sales and copper accounts for approximately 60% of the composition

of cables. This exposure is indirect since cable prices also

reflect copper suppliers' commercial policies and the competitive

environment in the Group's markets. Changes in copper prices have

an estimated so-called "recurring" effect and an estimated so

called "non-recurring" effect on the Group's performance assessed

as part of the monthly internal reporting process of the Rexel

Group: i) the recurring effect related to the change in

copper-based cable prices corresponds to the change in value of the

copper part included in the sales price of cables from one period

to another. This effect mainly relates to the Group’s sales; ii)

the non-recurring effect related to the change in copper-based

cable prices corresponds to the effect of copper price variations

on the sales price of cables between the time they are purchased

and the time they are sold, until all such inventory has been sold

(direct effect on gross profit). Practically, the non-recurring

effect on gross profit is determined by comparing the historical

purchase price for copper-based cable and the supplier price

effective at the date of the sale of the cables by the Rexel Group.

Additionally, the non-recurring effect on current EBITA corresponds

to the non-recurring effect on gross profit, which may be offset,

when appropriate, by the non-recurring portion of changes in the

distribution and administrative expenses.

The impact of these two effects is assessed for as much of the

Group’s total cable sales as possible, over each period. Group

procedures require that entities that do not have the information

systems capable of such exhaustive calculations to estimate these

effects based on a sample representing at least 70% of the sales in

the period. The results are then extrapolated to all cables sold

during the period for that entity. Considering the sales covered.

the Rexel Group considers such estimates of the impact of the two

effects to be reasonable.

This document may contain statements of future expectations and

other forward-looking statements. By their nature, they are subject

to numerous risks and uncertainties, including those described in

the Universal Registration Document registered with the French

Autorité des Marchés Financiers (AMF) on March 11, 2024 under

number D.24-0096. These forward-looking statements are not

guarantees of Rexel's future performance, Rexel's actual results of

operations, financial condition and liquidity as well as

development of the industry in which Rexel operates may differ

materially from those made in or suggested by the forward-looking

statements contained in this release. The forward-looking

statements contained in this communication speak only as of the

date of this communication and Rexel does not undertake, unless

required by law or regulation, to update any of the forward-looking

statements after this date to conform such statements to actual

results to reflect the occurrence of anticipated results or

otherwise.

The market and industry data and forecasts included in this

document were obtained from internal surveys, estimates, experts

and studies, where appropriate, as well as external market

research, publicly available information and industry publications.

Rexel, its affiliates, directors, officers, advisors and employees

have not independently verified the accuracy of any such market and

industry data and forecasts and make no representations or

warranties in relation thereto. Such data and forecasts are

included herein for information purposes only.

This document includes only summary information and must be

read in conjunction with Rexel’s Universal Registration Document

registered with the AMF on March 11, 2024 under number D.24-0096,

as well as the financial statements and consolidated result and

activity report for the 2023 fiscal year which may be obtained from

Rexel’s website (www.rexel.com).

- PR - Q4 sales & FY 2024 results

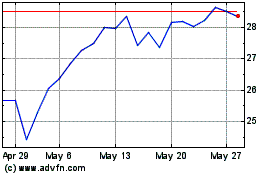

Rexel (EU:RXL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Rexel (EU:RXL)

Historical Stock Chart

From Feb 2024 to Feb 2025