Press Release: Sanofi announces buy back of shares from L’Oréal

03 February 2025 - 5:30PM

UK Regulatory

Press Release: Sanofi announces buy back of shares from L’Oréal

Sanofi announces buy back of shares from

L’Oréal

Paris, February 3, 2025. Sanofi

today announces the acquisition of 2.3% of its shares from

long-standing shareholder L’Oréal. This transaction is part of

Sanofi’s share buyback program announced on January 30, 2025. It is

fully aligned with Sanofi’s capital allocation policy and focus on

sustainable value creation for shareholders.

François Roger

Chief Financial Officer, Sanofi

“L’Oréal has been a trusted shareholder and partner for

decades, playing a key role in supporting Sanofi’s growth and

transformation. We are pleased to retain L’Oréal as one of our

largest shareholders. This transaction highlights Sanofi's

dedication to sustainable value creation while upholding our

strategic priorities and preserving the strength of our key

partnerships.”

The acquisition is structured as an off-market

block trade and is not subject to any specific conditions. The

acquisition is pursuant to an agreement approved by Sanofi’s Board

of Directors as a related-party agreement, in compliance with

article L.225-38 of the French Commercial Code, entered into on

February 2, 2025. It is expected to be completed in the coming

days. The transaction will involve the acquisition of 29,556,650

shares at a price of €101.50 per share, reflecting a discount of

2.8% to the closing price on January 31, 2025. The total

consideration of the transaction amounts to €3 billion. Shares

acquired from L’Oréal will be cancelled at the latest on April 29,

2025. The acquisition of these shares is expected to be accretive

to Sanofi's earnings per share, further enhancing shareholder

value.

After cancellation of the shares and excluding

treasury shares, L’Oréal will own 7.2% of Sanofi, with 13.1% of

voting rights1.

In accordance with the recommendation from the

Autorité des Marchés Financiers, and as recommended by an

ad-hoc committee comprised only of independent board

members, Sanofi’s board of directors appointed Finexsi, represented

by Olivier Peronnet and Olivier Courau, as an independent expert to

review the transaction. In its expert opinion Finexsi confirmed

that “Based on our work and as of the date of this report, the

price of the repurchased shares appears fair for Sanofi and its

shareholders. This transaction will not affect Sanofi’s financial

balances and will be accretive for Sanofi and its shareholders. It

is therefore carried out in the interest of the Company and will be

treated as a related-party transaction.”

About Sanofi

We are an innovative global healthcare company, driven by one

purpose: we chase the miracles of science to improve people’s

lives. Our team, across the world, is dedicated to transforming the

practice of medicine by working to turn the impossible into the

possible. We provide potentially life-changing treatment options

and life-saving vaccine protection to millions of people globally,

while putting sustainability and social responsibility at the

center of our ambitions. Sanofi is listed on EURONEXT: SAN and

NASDAQ: SNY

Media Relations

Sandrine Guendoul | + 33 6 25 09 14 25

| sandrine.guendoul@sanofi.com

Evan Berland | + 1 215 432 0234 |

evan.berland@sanofi.com

Léo Le Bourhis | + 33 6 75 06 43 81

| leo.lebourhis@sanofi.com

Nicolas Obrist | + 33 6 77 21 27 55

| nicolas.obrist@sanofi.com

Victor Rouault | + 33 6 70 93 71 40

| victor.rouault@sanofi.com

Timothy Gilbert | + 1 516 521 2929 |

timothy.gilbert@sanofi.com

Investor Relations

Thomas Kudsk Larsen |+ 44 7545 513 693 |

thomas.larsen@sanofi.com

Alizé Kaisserian | + 33 6 47 04 12 11 |

alize.kaisserian@sanofi.com

Felix Lauscher | + 1 908 612

7239 | felix.lauscher@sanofi.com

Keita Browne | + 1 781 249 1766 |

keita.browne@sanofi.com

Nathalie Pham | + 33 7 85 93 30 17 |

nathalie.pham@sanofi.com

Tarik Elgoutni | + 1 617 710 3587 |

tarik.elgoutni@sanofi.com

Thibaud Châtelet | + 33 6 80 80 89 90

| thibaud.chatelet@sanofi.com

Sanofi forward-looking

statements

This press release contains forward-looking statements as defined

in the Private Securities Litigation Reform Act of 1995, as

amended. Forward-looking statements are statements that are not

historical facts. These statements include projections and

estimates regarding the marketing and other potential of the

product, or regarding potential future revenues from the product.

Forward-looking statements are generally identified by the words

“expects”, “anticipates”, “believes”, “intends”, “estimates”,

“plans” and similar expressions. Although Sanofi’s management

believes that the expectations reflected in such forward-looking

statements are reasonable, investors are cautioned that

forward-looking information and statements are subject to various

risks and uncertainties, many of which are difficult to predict and

generally beyond the control of Sanofi, that could cause actual

results and developments to differ materially from those expressed

in, or implied or projected by, the forward-looking information and

statements. These risks and uncertainties include among other

things, unexpected regulatory actions or delays, or government

regulation generally, that could affect the availability or

commercial potential of the product, the fact that product may not

be commercially successful, the uncertainties inherent in research

and development, including future clinical data and analysis of

existing clinical data relating to the product, including post

marketing, unexpected safety, quality or manufacturing issues,

competition in general, risks associated with intellectual property

and any related future litigation and the ultimate outcome of such

litigation, and volatile economic and market conditions, and the

impact that pandemics or other global crises may have on us, our

customers, suppliers, vendors, and other business partners, and the

financial condition of any one of them, as well as on our employees

and on the global economy as a whole. The risks and uncertainties

also include the uncertainties discussed or identified in the

public filings with the SEC and the AMF made by Sanofi, including

those listed under “Risk Factors” and “Cautionary Statement

Regarding Forward-Looking Statements” in Sanofi’s annual report on

Form 20-F for the year ended December 31, 2023. Other than as

required by applicable law, Sanofi does not undertake any

obligation to update or revise any forward-looking information or

statements.

1 Number of actual voting rights

(excluding treasury shares) based on the total number of voting

rights as of December 31, 2024.

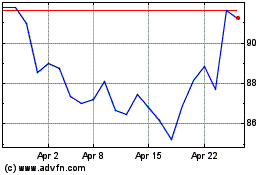

Sanofi (EU:SAN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sanofi (EU:SAN)

Historical Stock Chart

From Feb 2024 to Feb 2025