Australian Dollar Rises On Strong Consumer Inflation Data

24 April 2024 - 1:43PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Wednesday, following the release

of Australia's higher-than-expected consumer prices on quarter in

the first quarter of 2024.

Data from the Australian Bureau of Statistics showed that the

consumer prices in Australia were up a seasonally adjusted 1.0

percent on quarter in the first quarter of 2024. That exceeded

expectations for an increase of 0.8 percent and accelerated from

0.6 percent in the three months prior.

On a yearly basis, inflation climbed 3.6 percent - again topping

forecasts for 3.4 percent but slowing from 4.1 percent in the

previous three months.

The robust inflation data spurred expectations that the Reserve

Bank of Australia is unlikely for an early interest rate cut.

The Asian stock markets traded higher, as data showing a

slowdown in U.S. manufacturing activity in the month of April

raised hopes the U.S. Fed will start thinking of cutting interest

rates soon. Traders also continue to pick up stocks at relatively

reduced levels after the recent sell-off.

Traders now await more economic data later in the week,

including the release of first-quarter U.S. GDP data as well as the

core personal-consumption expenditures (PCE) price index, which is

the Fed's preferred measure of inflation. This ahead of the next

Federal Open Market Committee meeting on April 30-May 1.

The Australian dollar started trading higher against its major

rivals from April 19, 2024.

In the Asian trading today, the Australian dollar rose to nearly

a 10-year high of 101.07 against the yen and a 10-month high of

1.0983 against the NZ dollar, from yesterday's closing quotes of

100.42 and 1.0932, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 102.00 against the yen and

1.10 against the kiwi.

Against the U.S. dollar, the euro and the Canadian dollar, the

aussie advanced to near 2-week highs of 0.6530, 1.6408 and 0.8916

from Tuesday's closing quotes of 0.6485, 1.6490 and 0.8861,

respectively. The aussie may test resistance near 0.67 against the

greenback, 1.63 against the euro and 0.90 against the loonie.

The other antipodean currency or the NZ dollar also strengthened

against its most major rivals, amid risk appetite and following the

release of Australia's inflation data.

The NZ dollar rose to near 2-week highs of 0.5952 against the

U.S. dollar and 92.14 against the yen, from yesterday's closing

quotes of 0.5930 and 91.85, respectively. If the kiwi extends its

uptrend, it is likely to find resistance around 0.61 against the

greenback and 93.00 against the yen.

Against the euro, the kiwi edged up to 1.7997 from Tuesday's

closing value of 1.8033. The kiwi may test resistance near the 1.78

region.

Looking ahead, Germany Ifo business climate index for April and

U.K. Confederation of British Industry's industrial trends survey

results for April are due to be released in the European

session.

In the New York session, U.S. MBA mortgage approvals data,

Canada retail sales data for February, manufacturing sales data for

March, U.S. durable goods orders for March and U.S. EIA crude oil

data are slated for release.

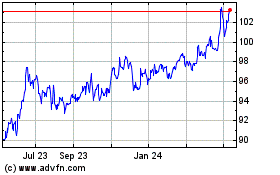

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2024 to May 2024

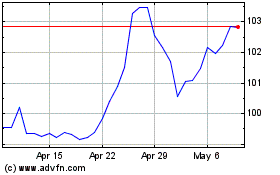

AUD vs Yen (FX:AUDJPY)

Forex Chart

From May 2023 to May 2024