Australian Dollar Rises As Trump Suggests New Trade Deal With China

20 February 2025 - 3:32PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Thursday, after optimistic

comments from U.S. President Donald Trump that trade deal with

China is "possible".

As markets continued to be cautious, Trump restated some of his

most important statements early on Thursday. Trump said he expects

Chinese President Xi Jinping to visit and that a new trade

agreement with China is feasible. He added that his administration

is thinking about imposing a 25% tariff on lumber and forest

products, and he referenced talks with China about TikTok.

The Australian dollar also appreciated following the release of

Australia's employment data and China's interest rate decision.

Data from the Australian Bureau of Statistics showed that the

Australian economy added 44,000 jobs last month to 14,634,300,

exceeding expectations for an increase of 19.400 jobs following the

increase of 56,300 jobs in the previous month.

Full-time employment increased by 54,100 to 10,092,800 people,

while part-time employment decreased by 10,100 to 4,541,500

people.

Meanwhile, the unemployment rate in Australia came in at a

seasonally adjusted 4.1 percent in January, in line with

expectations and up from 4.0 percent in December.

The People's Bank of China maintained its interest rates

unchanged for the fourth straight time. The PBoC left its one-year

loan prime rate unchanged at 3.10 percent. Likewise, the five-year

LPR, the benchmark for mortgage rates, was retained at 3.60

percent. The decision matched expectations.

The bank had reduced its both LPRs by 25 basis points each in

October 2024.

In the Asian trading today, the Australian dollar rose to nearly

a 2-1/2-month high of 1.6375 against the euro and more than a

2-week high of 0.9057 against the Canadian dollar, from yesterday's

closing quotes of 1.6435 and 0.9029, respectively. If the aussie

extends its uptrend, it is likely to find resistance around 1.60

against the euro and 0.92 against the loonie.

Against the U.S. dollar, the aussie advanced to a 3-day high of

0.6372 from an early 6-day low of 0.6328. On the upside, 0.65 is

seen as the next resistance level for the aussie.

The aussie edged up to 1.1136 against the NZ dollar, from

Wednesday's closing value of 1.1123. The next possible upside

target for the aussie is seen around the 1.13 region.

Looking ahead, Eurostat releases euro area construction output

data for December at 5:00 am ET in the European session.

At 6.00 am ET, the Confederation of British Industry publishes

Industrial Trends survey results for February. The order book

balance is forecast to rise to -30 in February from -34 in

January.

In the New York session, Canada new housing price index, PPI

data and raw material price index, all for January, U.S. weekly

jobless claims data, U.S. Philly Fed business conditions for

February, U.S. Consumer Board's leading index for January and U.S.

EIA crude oil data are slated for release.

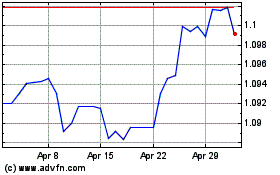

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Jan 2025 to Feb 2025

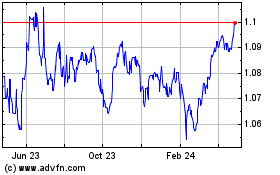

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Feb 2024 to Feb 2025