NZ Dollar Rises Amid Risk-on Mood

21 February 2025 - 1:48PM

RTTF2

The New Zealand dollar strengthened against other major

currencies in the Asian session on Friday amid risk appetite, as

traders seemed cautious and await clarity on U.S. President Donald

Trump's trade policies and the outcome of Ukraine peace talks.

Trump's harsh criticism of Ukrainian President Zelenskyy

heightened tensions in the ongoing conflict. Trump called Zelensky

a "dictator" after the latter said the U.S. president was "living

in a disinformation space" governed by Moscow.

Crude oil prices settled higher on Thursday, as supply

disruptions in Russia and drop in gasoline and distillate fuel

stocks supported oil prices. West Texas Intermediate Crude oil

futures closed higher by $32 or 0.44 percent at $72.57 a

barrel.

In the Asian trading today, the NZ dollar rose to a 2-day high

of 86.90 against the yen, from yesterday's closing value of 86.90.

The kiwi is likely to find resistance around the 90.00 region.

Against the U.S. and the Australian dollars, the kiwi advanced

to more than a 2-month high of 0.5772 and a 3-day high of 1.1088

from Thursday's closing quotes of 0.5765 and 1.1107, respectively.

If the kiwi extends its uptrend, it is likely to find resistance

around 0.59 against the greenback and 1.09 against the aussie.

The kiwi edged up to 1.8191 against the Australian dollar, from

yesterday's closing value of 1.8216. On the upside, 1.79 is seen as

the next resistance around the 1.79 region.

Looking ahead, PMI reports from various European economies and

U.K. for January are set to be published in the European

session.

In the New York session, Canada retail sales data for December,

U.S. S&P Global PMI data for February, U.S. existing home sales

data for January, U.S. University of Michigan's consumer sentiment

for February and U.S. Baker Hughes oil rig count data are slated

for release.

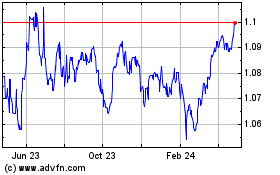

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Jan 2025 to Feb 2025

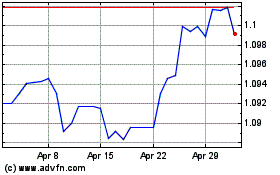

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Feb 2024 to Feb 2025