0001173313

true

0001173313

2022-08-22

2022-08-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported): August

9, 2023 (August 22, 2022)

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

333-91436 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing

Rule or Standard; Transfer of Listing.

As disclosed on the initial Current Report on Form

8-K filed on August 22, 2022, ABVC BioPharma, Inc. (the “Company”) received a deficiency letter from the Nasdaq Listing

Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) notifying the

Company that, for the last 30 consecutive business days, the closing bid price for the Company’s common stock was below the minimum

$1.00 per share required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (“Rule

5550(a)(2)”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company was initially given until February 14, 2023

to regain compliance with Rule 5550(a)(2). Since the Company did not regain compliance by such date, it requested and received an additional

180 days, until August 14, 2023, to comply with Rule 5550(a)(2).

On August 8, 2023, the Company received a notification

letter (the “Notification Letter”) from Nasdaq notifying the Company that the Staff has determined that for 10 consecutive

business days, from July 25, 2023 to August 7, 2023, the closing bid price of the Company’s common stock has been at least $1.00

per share or greater. Accordingly, the Staff has determined that the Company has regained compliance with Listing Rule 5550(a)(2)

and has indicated that the matter is now closed.

On August 10, 2023, the Company shall issue a press

release announcing that the Company received the Notification Letter and regained compliance with Nasdaq’s minimum bid price requirement.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

The following

exhibits are furnished with this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities and

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| August 9, 2023 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

Exhibit 99.1

ABVC

BioPharma Regains Compliance with Nasdaq's Minimum Bid Price Requirement

Fremont, CA (August 10, 2023) –

ABVC BioPharma, Inc. (NASDAQ: ABVC) ("Company"), a clinical-stage biopharmaceutical company developing therapeutic solutions

in ophthalmology, neurology, and oncology/hematology, announced today that on August 08, 2023, it received a letter from the Nasdaq Listing

Qualifications Department notifying the Company that it had regained compliance with the minimum bid price requirement.

On August 19, 2022, the Company received a notification

that its common stock failed to maintain a minimum bid price of $1.00 over the previous 30 consecutive business days, as required by Nasdaq

Listing Rules of The Nasdaq Stock Market. The closing bid price of the Company's common stock was at $1.00 per share or greater from July

25 to August 7, 2023. Accordingly, the Company has regained compliance with Nasdaq Capital Market Minimum Bid Price Requirement per Listing

Rule 5550(a)(2) and this matter is now closed.

About ABVC BioPharma & Its Industry

ABVC BioPharma is a clinical-stage biopharmaceutical

company with an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under development. For its drug

products, the Company utilizes in-licensed technology from its network of world-renowned research institutions to conduct proof-of-concept

trials through Phase II of clinical development. The Company's network of research institutions includes Stanford University, University

of California at San Francisco, and Cedars-Sinai Medical Center. For Vitargus®, the Company intends to conduct global clinical

trials through Phase III.

We believe the Company's pipeline products have

great market potential. As per the Future Market Insights report, the MDD market was valued at $11.51 billion in 2022 and is expected

to reach $14.96 billion by 2032 with a CAGR of 2.8% over the forecast period.[1] According to the Polaris market research report,

the global ADHD treatment market was valued at $16.13 billion in 2022 and is expected to reach $32.14 billion by 2030 with a CAGR of 7.1%

over the forecast period.[2] According to iHealthcare Analyst, Inc., the global market for retinal surgery devices is expected

to reach $3.7 billion by 2027, driven by the rising geriatric population worldwide.[3]

Forward-Looking Statements

This press release contains "forward-looking

statements." Such statements may be preceded by the words "intends," "may," "will," "plans,"

"expects," "anticipates," "projects," "predicts," "estimates," "aims," "believes,"

"hopes," "potential," or similar words. Forward-looking statements are not guarantees of future performance, are based

on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company's control,

and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such

forward-looking statements. None of the outcomes expressed herein are guaranteed. Such risks and uncertainties include, without limitation,

risks and uncertainties associated with (i) our inability to manufacture our product candidates on a commercial scale on our own, or in

collaboration with third parties; (ii) difficulties in obtaining financing on commercially reasonable terms; (iii) changes in the size

and nature of our competition; (iv) loss of one or more key executives or scientists; and (v) difficulties in securing regulatory approval

to proceed to the next level of the clinical trials or to market our product candidates. More detailed information about the Company and

the risk factors that may affect the realization of forward-looking statements is set forth in the Company's filings with the Securities

and Exchange Commission (SEC), including the Company's Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors are

urged to read these documents free of charge on the SEC's website at http://www.sec.gov. The Company assumes no obligation to publicly

update or revise its forward-looking statements as a result of new information, future events or otherwise.

This press release does not constitute an offer

to sell, or the solicitation of an offer to buy any of the Company's securities, nor shall such securities be offered or sold in the United

States absent registration or an applicable exemption from registration, nor shall there be any offer, solicitation or sale of any of

the Company's securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction.

Contact:

Tom Masterson

Email: tmasterson@allelecomms.com

[1] https://www.futuremarketinsights.com/reports/major-depressive-disorder-treatment-market#:~:text=The%20major%20depressive%20disorder%20(MDD,US%24%2011.51%20billion%20in%202022

[2] https://www.prnewswire.com/news-releases/global-attention-deficit-hyperactivity-disorder-adhd-market-size-projected-to-reach-usd-32-14-billion-by-2032--with-cagr-of-7-1-study-by-polaris-market-research-301729196.html#:~:text=According%20to%20the%20research%20report

[3] https://www.ihealthcareanalyst.com/technological-advancement-ophthalmic-surgery-retinal-surgery-devices-market/

v3.23.2

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

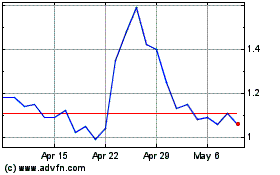

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

From Apr 2024 to May 2024

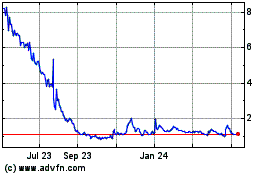

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

From May 2023 to May 2024